Two share tips in ‘dying industry’ remain a buy

After previously backing these significant players, analyst Rodney Hobson believes both companies are still good value and there’s a reasonable dividend too. He also names a grossly overpriced stock to sell.

9th October 2024 08:57

by Rodney Hobson from interactive investor

Never in recorded history have 24 hours elapsed without a war waging somewhere on the globe. When the centre of conflict is the oil-rich Middle East, the price of crude oil will inevitably rise, and with it the shares of oil producers.

Initially, conflict in Gaza and even the spread of bombardments to Lebanon, though catastrophic in human terms, was not too great a worry for investors. Retaliation for Iranian missiles attacking Israel is a different matter.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Despite Western sanctions against Iran, that country is still a substantial producer of oil. Figures from the Organisation of Petroleum Exporting Countries (Opec) indicate that Iran exported 1.32 million barrels of oil a day last year. This year’s figure is unlikely to be any less, so the potential for Israeli missiles to disrupt production has been enough to send the price of crude higher.

Last week saw the biggest gain in crude prices for more than a year, with the international benchmark Brent approaching $80 a barrel and West Texas Intermediate, which monitors slightly lower quality, at $75.

Before Iran launched rockets at Israeli, tempting retaliation, oil had been slipping on reduced global demand, particularly from a slowing Chinese economy, and a belief that increased supply would more than offset the impact of the Middle East conflict.

Opec intends to restore some earlier production cuts, but it had delayed the process by two months until December. However, the extra production of 180,000 barrels a day is considerably less than forecasts that demand will be up by 2 million barrels a day.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- An election-year playbook for investors

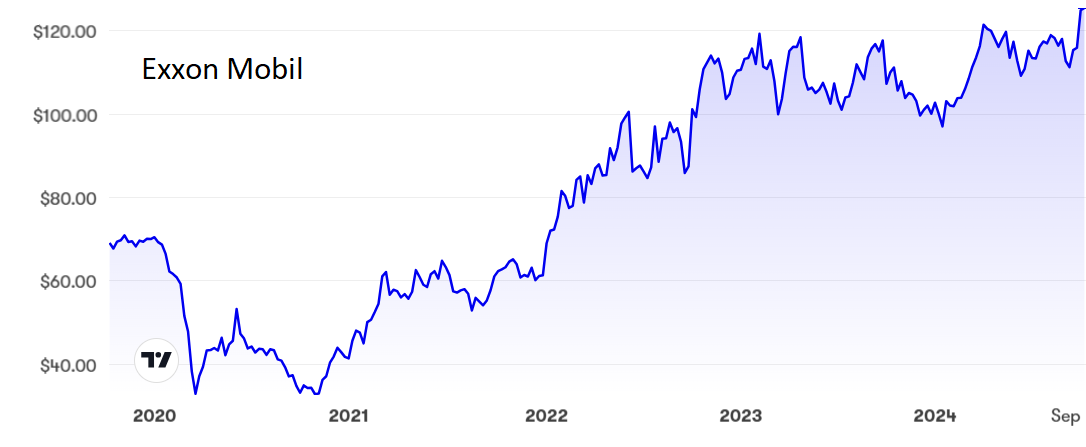

In fact, the weakness in crude prices during the third quarter, with Brent slipping below $70, had prompted Exxon Mobil Corp (NYSE:XOM) to warn that upstream earnings had been hit to the tune of at least $600 million and possibly as much as $1 billion.

Upstream earnings topped $7 billion in the second quarter, so that will be a sizeable hit, although it will still presumably leave the figure higher than the $5.66 billion recorded in the first three months of this year.

Exxon shares hit a five-year high at $125, yet at the current $122 the price/earnings (PE) ratio is still only around 15 while the yield is a touch above 3%, not bad for a company in what is supposed to be a dying industry.

Source: interactive investor. Past performance is not a guide to future performance.

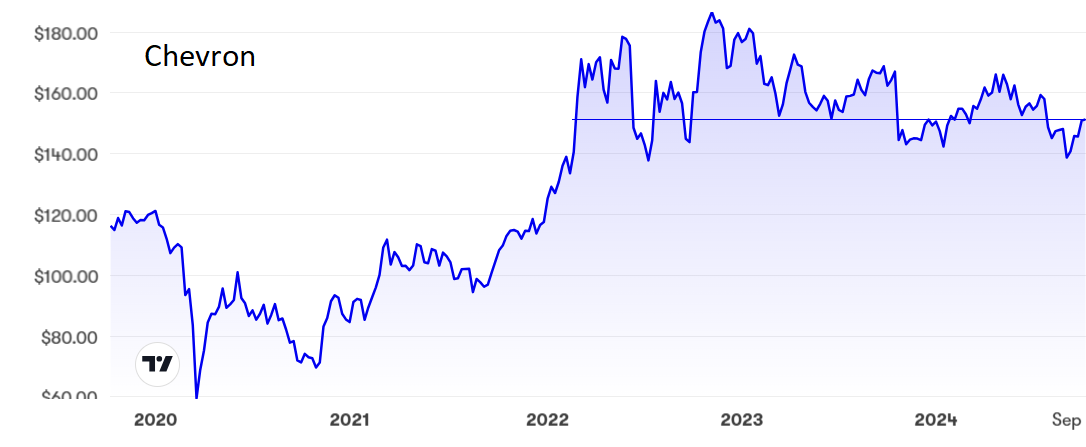

Chevron Corp (NYSE:CVX) in contrast has been moving sideways for the past two-and-a-half years and at just under $150 it is some way below its peak of $186 set in November 2022. The PE is similar to Exxon’s at 15 but the yield is much more tempting at 4.25%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Oil shares are naturally shunned by green investors, particularly those who shudder at the thought of profiting from human misery, but this column is about investment opportunities and individuals must make up their own minds. I recommended Exxon at just over $100 in February and those who followed that advice are well ahead, with dividends pocketed as well. My buy rating on Chevron at $150 is just about breaking even.

The case for buying Exxon at current higher levels looks risky but with all attempts at mediation in the Middle East falling on deaf ears, the shares must merit at least a hold. My feeling is that both companies remain worth buying, but with the proviso that investors should get out smartly in the unlikely event that sanity prevails over belligerence in the region.

- Global Economic Outlook: is this time different?

- Three investments that thrive after the Fed’s first rate cut

Update: A month-long strike that has shut down assembly plants for the 737 MAX and 777 aircraft is just another in a long string of disasters for Boeing Co (NYSE:BA), where industrial relations are at such a low ebb that an offer of a 30% pay rise and the restoration of an annual bonus caused increased resentment among the 33,000 employees affected. The shares have tumbled from $260 in December to $156 now. They are still grossly overpriced. It is not too late to sell.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.