Two cheap stocks with recovery potential

The outlook for this pair is much better than it was a year ago, and while you shouldn’t expect fireworks, overseas investing expert Rodney Hobson thinks they’re both worth owning now.

10th January 2024 08:48

by Rodney Hobson from interactive investor

Major motor manufacturers in the US suffered a lengthy strike in the autumn that has resulted in a crippling wage bill just as they were forced to concede lower prices to customers. Yet they enter the new year in good spirits and with better prospects than they did 12 months ago.

The six-week stoppage called by the United Auto Workers (UAW) hit all major vehicle manufacturers in the motor town of Detroit for the first time. It finished at the end of October with a clear victory for the union, winning a 25% pay rise, guaranteed adjustments to offset inflation and an extra uplift in wages for lower paid less experienced workers. There will also be a right to strike against any proposals by manufacturers to close factories.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Ford Motor Co (NYSE:F) alone reckons the new deal will cost $8.8 billion over the four-and-a-half year duration of the agreed new contract.

Previously, the UAW has picked on each manufacturer individually in turn. At least the total stoppage left all manufacturers on an equal footing. Although the agreed deal is tough on vehicle makers, putting margins under pressure, there is a positive side to it: the union made significant concessions during the economic crisis in 2008 and it was able to argue that “record profits mean record contracts” now.

The manufacturers and workers all realised that 2023 was a better year for the industry than expected and forecast sales for next year have been upgraded. Over the full year 15.5 million vehicles were sold in the US, an increase of 13% over 2022.

There are genuine hopes that, despite economic headwinds, car sales in the US will get back to the 17 million level enjoyed before the pandemic. A reasonable projection is 16 million over the next 12 months, especially as supply chains have improved.

Not so encouraging is that Americans are opting for less expensive models. General Motors Co (NYSE:GM), the top seller, admits that vehicles costing less than $50,000 sell on average in less than 30 days while more expensive models hang around for 47 days.

- US stock market outlook 2024: sectors to own in the year ahead

- The US stocks you were buying in 2023

- ii view: Tesla deliveries beat Wall Street forecasts

Ford itself reported higher sales of electric and hybrid cars in the fourth quarter, especially in the US, where hybrids were up 56% and all-electrics 28%. This was much higher growth than in the first nine months and took the full-year improvements to 25% and 18% respectively.

Admittedly, sales were boosted by special offers by manufacturers and dealers to attract customers hit by high interest rates and lingering inflation, but in the economic circumstances the performance was highly creditable.

Ford shares hit a short-lived unrealistic peak of $25 two years ago but have mostly been bubbling along around $12 since then, apart from when they dropped briefly below $10 while the strike was on. At the current level the price/earnings (PE) ratio is an undemanding 7.8 while the yield is attractive at 5%.

Source: interactive investor. Past performance is not a guide to future performance.

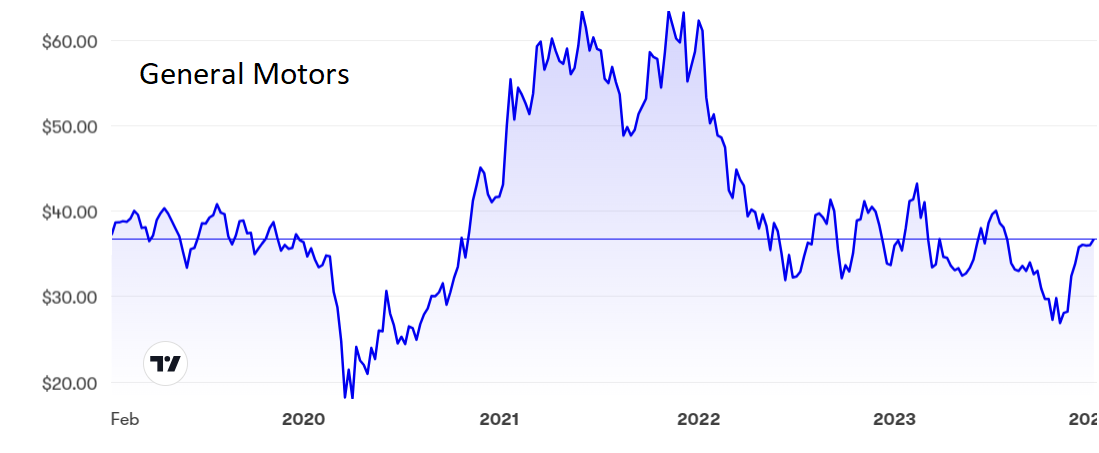

GM shares made several attempts to break above $60 during 2021 but have settled around the current level of $36.50, with $31 looking to be the floor if one ignores the temporary strike-induced dip to $27. The PE is even lower than Ford’s at 5.1 but the yield is only 1%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: Early last yearI marginally preferred GM, but the position is now reversed with the stock market rating on GM justifiably lower. At least there is a decent yield at Ford to compensate if the shares fail to hold up as well as I expect. However, both companies are worth considering as a ‘buy’ now that the outlook has brightened considerably. Just don’t expect shares in either company to soar dramatically during 2024.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.