Turnaround time for struggling food giant

The proof of the pudding lies with a new CEO who could sell poor performers to invest on premium lines.

10th July 2019 10:04

by Rodney Hobson from interactive investor

The proof of the pudding lies with a new chief who looks set to sell off poor performers to boost spending on premium lines.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

A heavy burden lies on the shoulders of Miguel Patricio, who took over as chief executive officer of food and beverage giant Kraft Heinz (NASDAQ:KHC) last month. The reputation of famed investor Warren Buffett depends on him - as well as the immediate future of Kraft itself.

Patricio has form, having rescued the struggling Chinese business of brewer Anheuser-Busch InBev (NYSE:BUD), but he has his work cut out taking on Kraft's whole global range including condiments and sauces, cheese and dairy, meals, meat, refreshment beverages and other grocery products.

It's hard to believe that Kraft in its pomp made a brief if somewhat half-hearted attempt to take over Anglo-Dutch rival Unilever (LSE:ULVR) in 2017. Now it faces selling off some of its brands to finance the development of the ones with better prospects.

Since rival food groups H J Heinz and Kraft Food Group merged in 2015 to form the enlarged group with headquarters in Chicago and Pittsburgh, sales have struggled and margins have been squeezed. It has been affected to some extent by a trend towards foods perceived as healthier than tomato ketchup and baked beans; on the other hand there has been increased competition from cheaper alternatives.

Critics claim that the response of management was to cut costs rather than invest in existing products and widen the range, backed with corresponding advertising campaigns. As sales failed to improve, prices were slashed to boost revenue, but reduced margins meant there was no improvement to the bottom line.

Meanwhile, the combined headcount was reduced by more than a quarter, which cut duplicated costs but also caused uncertainty among key staff and is perhaps the reason why the company failed to make as much headway as shareholders hoped.

So far this year Kraft Heinz has become the subject of a US Securities and Exchange Commission investigation, has reduced in its dividend by a third to $1.60 and has written down the value of its Kraft and Oscar Meyer brands by $15.4 billion.

Patricio's main tactic at InBev's Chinese arm was to promote Budweiser, the flagship brand, and he could well repeat this tactic at Kraft Heinz by throwing extra marketing behind key products while improving their margins.

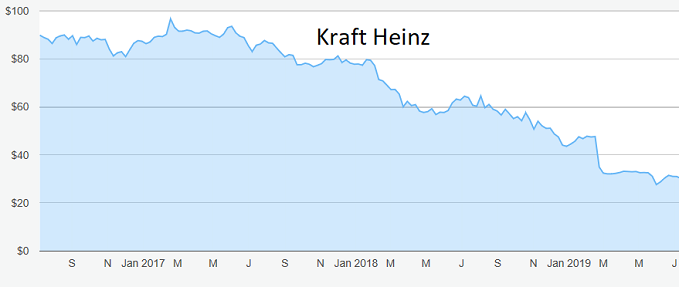

Source: TradingView Past performance is not a guide to future performance

Since Kraft's heavy debt pile, $30.8 billion at the end of last year, offset by only $1.1 billion cash, will act as a restraint, he is likely to sell off the poorer performers, hopefully without giving the impression of conducting a fire sale. Already the Canadian cheese business has been sold and other lines are being touted round. These sales could even help to finance selective acquisitions.

Watching developments will be Warren Buffet, chief executive officer of investment fund Berkshire Hathaway (NYSE:BRK.A), which now owns 26.7% of Kraft Heinz, its biggest equity investment. Berkshire and Brazilian private equity group 3G Capital acquired Kraft Foods Group in 2013 for $10 billion and Buffett has since said he paid too much, although he continued to feel that Kraft was "a wonderful business". Berkshire also bought Heinz for $23 billion, a price that with hindsight Buffett thought was fair.

Kraft Heinz shares peaked at $96.65 in February 2017 and have been sliding ever since to stand at just above $30 now. They hit a low of $26.96 in May but $30 seems to be a floor unless there is further bad news.

Analysts are cautious. Most rate the stock a hold but the consensus is that a rise of about $4 is all that shareholders can hope for over the next 12 months.

However, the price-earnings ratio is undemanding at 10 while, despite the dividend cut, the yield is a very attractive 5.3%.

Hobson's choice: Buy at up to $32, bearing in mind that this is a moderately risky investment.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.