Trusts to suit the new era of ‘higher for longer’ rates

Expecting the past decade’s winners to deliver again over the next 10 years is folly, warns Kepler Trust Intelligence as it highlights ideas for your watchlist.

3rd November 2023 14:03

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

The decade following the Global Financial Crisis turned out to be uncharacteristically easy for investors. Sure, the end of the first decade of the 21st century wasn’t much fun at the end, but if you didn’t cash up and head for the door, the following decade was easy. As it turned out, all you had to do was invest in equities or bonds — ideally passively — and ride the wave. Global technology stocks powered the way, but perhaps really it was just central banks progressively dishing out medicine.

As a concept, the prospect of quantitative easing (QE) and negative rates was (still is?) quite hard to get one’s head around in 2010. However, what it opened the door to was a huge expansion of public-sector debt, and arguably a public backstop for private-sector risk. Weak companies continued to live, bailed out by stock markets or cost-free debt. Recessions became a thing of the past, and inflation became a historic conceptual term.

At the start of the current decade, it seemed like something had to change. Nothing goes on forever, but it was far from obvious what might be the catalyst. Over 2022 things quickly changed. The catalyst was Russia’s sudden international isolation and the resultant impact on oil prices and worries about wheat prices with Ukraine embroiled in war. Central banks are well placed to deal with financial crises, but not necessarily political ones, especially when government balance sheets are already frayed. Their ability to deal with inflation is constrained by public debt levels never before witnessed outside wartime.

As we are experiencing in the UK, when presented with a slowdown or recession, many government’s ability to apply Keynesian fiscal stimulus is severely constrained by the ever-watchful bond market vigilantes. Rather than being a one-way street, central bankers have a tightrope to walk, with the potential for policy missteps significantly enhanced. As JPMorgan neatly summarised in their recently published 2024 Long-Term Capital Market Assumptions: “We are moving from a world of disinflation, ultra-easy monetary policy, and fiscal reticence to one with two-way inflation risk, conventional monetary policy, and greater use of fiscal tools.”

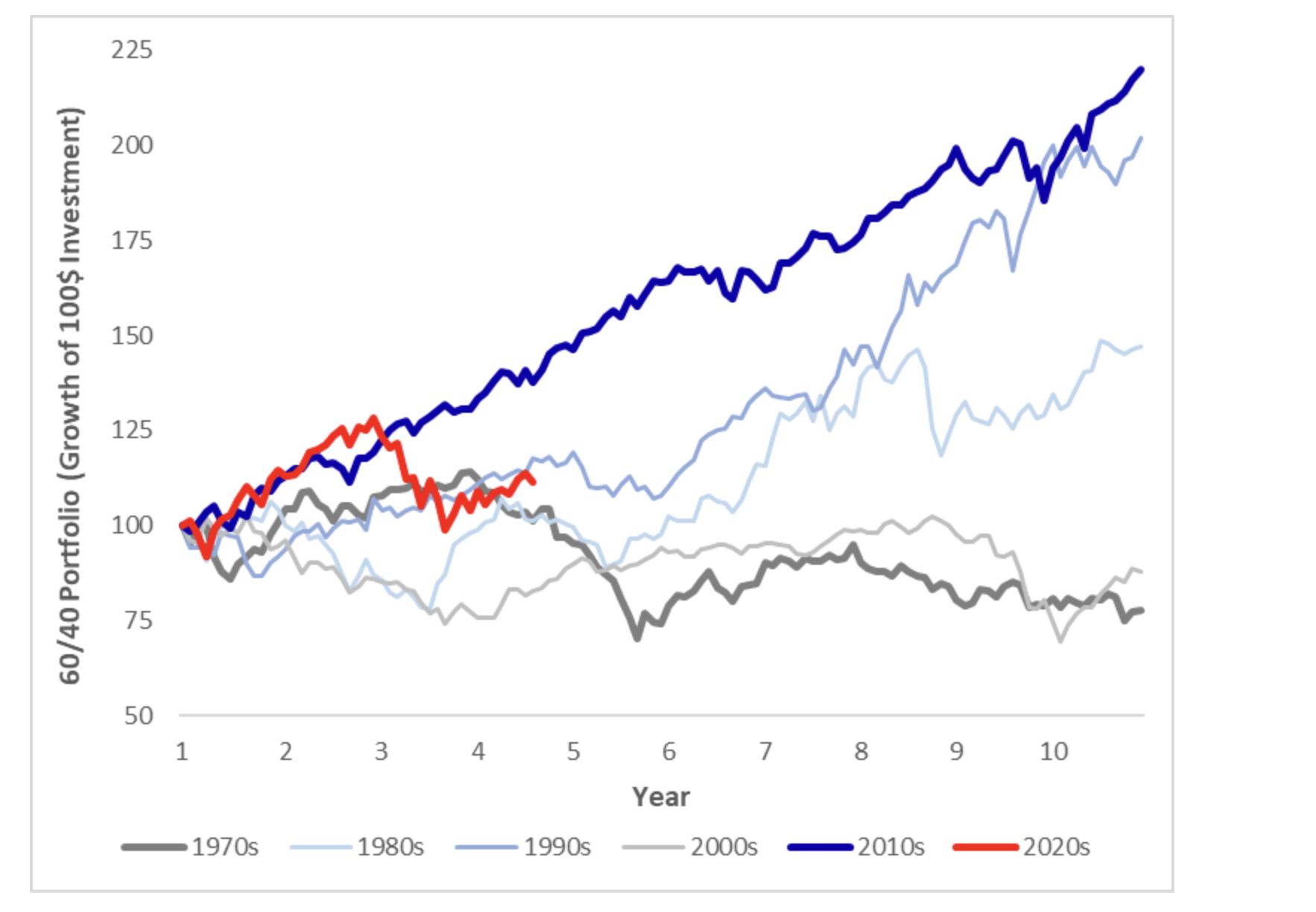

Not surprisingly then, in this context, the performance of a traditional 60/40 portfolio has been rather disappointing so far this decade. It is also very different to the last decade. We show this graphically below. In our view, this shows very clearly how different the last decade was. Many of the investment lessons of previous decades may, we suggest, have been forgotten (or never learnt by investors who have only experienced post-GFC markets). In our view, the new era is likely to be represented by active management being rewarded more — in an environment of weaker companies not surviving — but also the potential for policy mistakes by central banks.

60/40 GLOBAL PORTFOLIO PERFORMANCE BY DECADE

Source: Kepler Partners, Bloomberg. Past Performance is not a reliable indicator of future results

Past performance is clearly no guide to future returns. So whilst the graph above provides pictorial evidence that we are in a new era, the table below reinforces this. CEOs of quoted businesses face a very changed environment, and so it is not surprising that outside of AI-related hype, share prices have found it hard to make headway. Within the UK investment trust sphere, alternatives (such as property, infrastructure, and renewable energy) have shown they are interest rate sensitive. Certainly, they promise an element of inflation protection, but in terms of share prices, premiums have given way to discounts, offering no protection to investors. It is hard to argue that they provide strong diversification to equities (which might also rip higher if rates were to fall, and will potentially struggle in a high interest rate environment).

CHANGING ECONOMIC AND MARKET CONDITIONS

| PAST DECADE | TODAY | |

| Central bank behaviour | Highly stimulative | Tightening |

| Government behaviour | Austerity | Fiscal largesse |

| Credit window | Wide open | Constricted |

| Financing | Plentiful | Scarce |

| Inflation | Dormant | 40-year high |

| Interest rates | Lowest ever | More normal |

| Interest rates vol | Lowest ever | Elevated |

| Buyers | Eager | Hesitant |

| Holders | Complacent | Worried |

| Economic outlook | Positive | Recession likely |

| Likelihood of distress | Minimal | Rising |

Source: Oaktree Capital

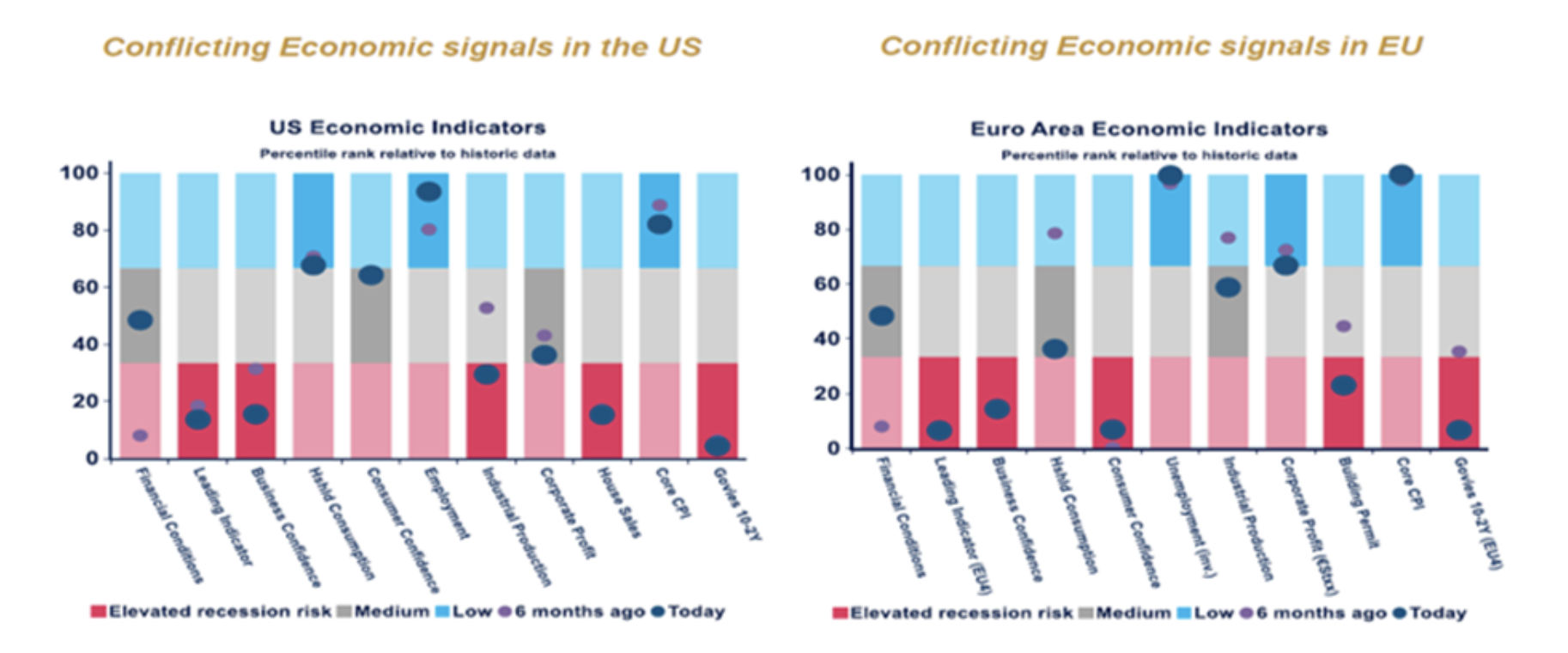

Things have certainly changed. But at the same time, it’s hard to know exactly where we are: economic indicators are all over the place. The graphic below shows that from the top down, conflicting signals are everywhere. Last calendar year (2022) gave investors a glimpse of what a ‘new normal’ could look like. With inflation proving sticky and many stock markets still standing at, or near, multi-year high valuations, we believe uncertainty should drive investors to seek out diversification within their portfolios. It’s possible that buying the ‘magnificent seven’ and ignoring everything else might work again. But surely there are only so many times that record can be played. Finding truly diversified and idiosyncratic risks in a portfolio seems the only sane thing to do in the current scenario. In the words of Harry Markowitz who died this year, diversification is the only free lunch in investing. Many investors may find that their portfolios over the last decade have become dangerously narrow, and what may seem diversified, is in fact not at all.

CONFLICTING ECONOMIC SIGNALS

Source: Macrobond, Bloomberg, Amundi Institute

In the current scenario we find ourselves in, we think two under-appreciated aspects of portfolio construction will come increasingly to the fore in the rest of the decade. Firstly, with an uncertain economic/market backdrop illustrated above, the potential for managers to add alpha is on the rise. Secondly, diversification of returns will become increasingly important, given the number of potential economic eventualities has expanded.

Alpha

With the rise of passives, stock market returns have been increasingly concentrated in those mega-cap, US names. Outperformance, matched by passive flows, has created a virtuous circle for these companies. Elsewhere, under-owned or unfashionable companies have the potential to deliver strong returns when the market tides turn. A recent example has been the outperformance of Energy-related stocks. Contrarian managers everywhere had the last laugh when, with P/Es at rock bottom thanks to ESG hand wringing, oil prices rose rapidly in 2022. We can’t help but think that under-owned sectors like mining may also have their time in the sun, not least because commodities tend to do well in times of high inflation. Higher interest rates mean capacity constraints everywhere, and no more so in capital-intensive industries such as mining. As the world attempts an energy transition on a global scale, demand for commodities is broadening out, away from China which historically has been akin to a monopsonist. The likes of BlackRock World Mining Trust (LSE:BRWM)provide an interesting and very different source of returns when compared to the magnificent seven. We think it interesting that BRWM’s NAV correlation to the MSCI ACWI over the last five years has been 0.77, showing it has some diversifying properties.

Elsewhere, smaller companies have endured a torrid time, underperforming globally. With recession fears abounding, perhaps this is understandable. A recent report from Goldman Sachs shows that indebted smaller companies will be modestly more highly impacted by higher interest rates than their large-cap cousins, having less sophisticated balance sheets. These certainly represent headwinds, but as is so often the case, smaller companies investing allows managers to sort the wheat from the chaff. Sure, there are weak, highly indebted companies that have been propped up by cheap money and good PR, heading rapidly downward. But there are also solid businesses, with secure balance sheets and intelligent management, whose share prices have been dragged lower by the small-cap malaise, fund outflows, and in the UK—a seeming indifference to anything quoted. A raft of trusts exists whose managers aim to seek the diamonds in the rough, particularly at the very smallest end of the market capitalisation spectrum. M&A activity seems to be picking up, at least within some manager’s portfolios. Rockwood Strategic (LSE:RKW) has now had three takeover bids within the portfolio in the year to date, the latest being Onthemarket.com. Elsewhere, and itself trading on a wide discount to NAV, is Downing Strategic Micro-Cap Inv. (LSE:DSM). Both trusts have relatively highly concentrated and high-conviction portfolios, which present opportunities as well as risks. On the other hand, Miton UK Microcap (LSE:MINI)offers a much more diversified exposure to the smallest companies in the UK market. We aren’t saying that these trusts offer a huge amount of diversification to portfolios, given that in a risk-off environment, NAVs and share prices will likely echo the wider market. However, what they do offer is the opportunity for idiosyncratic returns and the opportunity for managers to generate genuine alpha from their stock picking.

Diversifiers

The broad variety of economic statistics that we refer to above is potentially reflective of the highly unusual decade we have experienced since the GFC. With several economic eventualities seemingly of equal likelihood of occurring, the only way to navigate these unchartered waters safely is to look to diversification. The best, and most diversifying assets to add to portfolios are those that are uncorrelated. Academic research shows how adding just a few uncorrelated strategies to a portfolio can materially improve its risk/reward characteristics.

Where to find uncorrelated investments? As we mentioned above, many alternative trusts have proved to be highly correlated with interest rates. Hedge funds, or alternative strategies that specifically target uncorrelated returns, are not only uncorrelated but the evidence is that they also stand to benefit from higher interest rates. Hedge funds are a broad term which encompasses many strategies. We believe that they have the potential to offer investors uncorrelated sources of returns and targeted risk exposures, which help to diversify traditional exposures such as equities and bonds. Fundamentally, hedge funds utilise a wide array of trading strategies implemented across various instruments and asset classes, to isolate alternative risk premiums. They typically operate within strict risk management frameworks, and as a result, can be strongly diversifying.

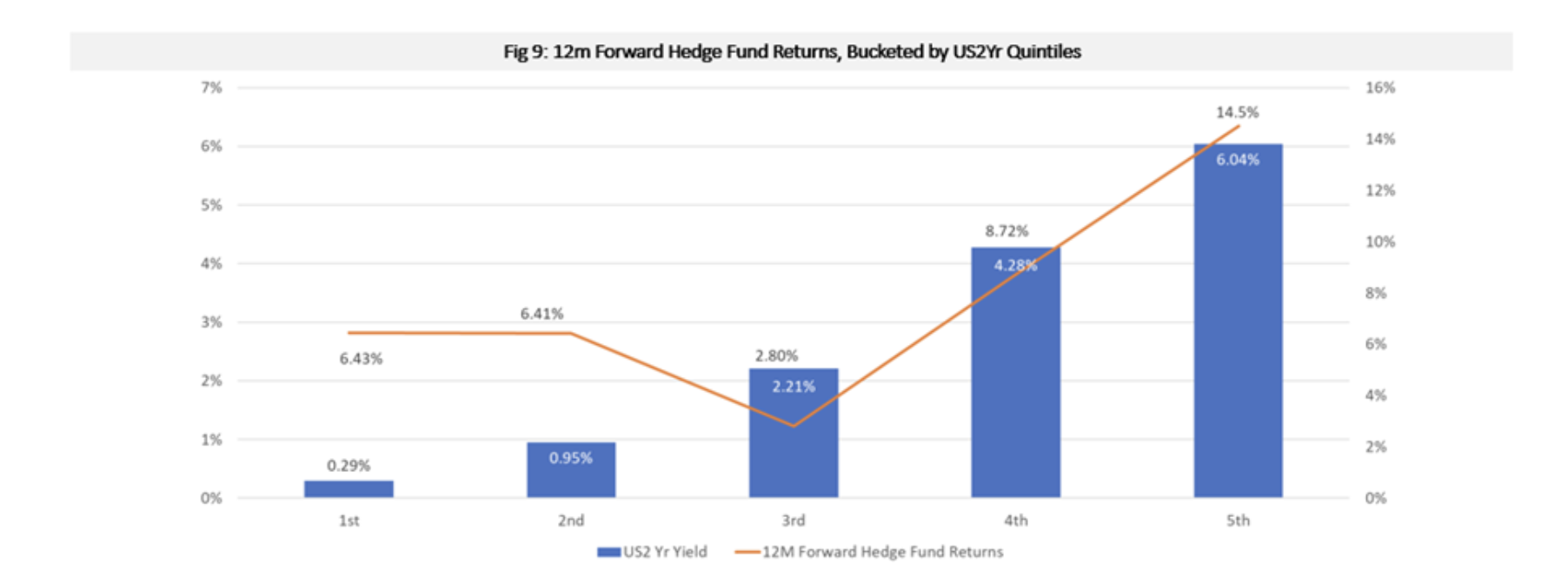

Fundamentally, hedge fund strategies rely on alpha. As we refer to above, the market uncertainty means that the dispersion of returns within asset classes is likely to be relatively high, producing a positive backdrop of alpha generation. Hedge funds are also structurally supported by higher short-term interest rates, as they typically invest in cash alongside their active positions. This is especially true for managed futures, macro, market neutral, and arbitrage approaches, where margin trades are prevalent. As such, higher short-term interest rates actually help hedge fund returns, not including the potential to add alpha through higher dispersion and less capital attracted to markets. This is borne out in research that our colleagues conducted, showing historical returns from the HFRI index (a well-known hedge fund index) in periods of different interest rate regimes. What it shows is that in periods of higher interest rates, hedge fund returns are correspondingly higher. Our colleagues attribute the lower hedge fund returns in the middle quintile of interest rates as being a symptom of these typically being in a transition phase for markets. When interest rates are slashed or raised, representing a regime change for financial markets, hedge fund returns in aggregate are lower during these periods. However, when rates are stable—either high or low—hedge funds can deliver an attractive and relatively consistent premium over cash. The same cannot be said of equities, which tend to generate narrower premiums over cash in higher-rate environments than they do in low-rate environments.

12M FORWARD HEDGE FUND RETURNS, BUCKETED BY US2YR INTEREST RATE QUINTILES

Source: Bloomberg, Kepler Partners. Past Performance is not a reliable indicator of future results

Hedge funds can also provide a dynamic correlation to bonds and equities. As such, following a decade of unorthodox monetary policy, which has led to dislocations in the pricing of assets and risk, the opportunity set for hedge funds looks to be turning for the better. True diversifiers may count more in a portfolio for the next decade than they have in the past where asset prices everywhere just went up.

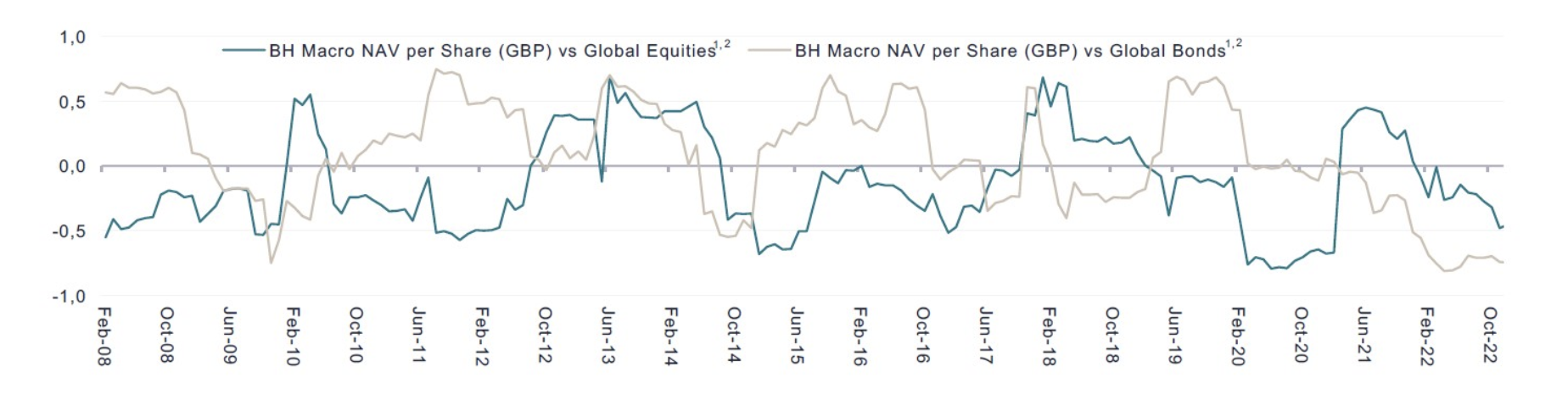

Within the investment trust universe, we would argue that the pre-eminent hedge fund strategy, that fits many of the descriptions above, is BH Macro GBP (LSE:BHMG). Brevan Howard’s flagship Master Fund (of which BHMG is a feeder fund) is one of the most successful hedge funds of all time in terms of the absolute amount of money returned to investors since the firm’s launch in 2002. BHMG was launched on the London Stock Exchange in 2007 and, since then, has achieved strong absolute returns with relatively low volatility. As a result, BHMG represents a high-quality investment proposition, having a manager with a pedigree of over 20 years and a track record as a listed fund of over 16 years, with an independent board. The Master Fund has exposure to a complementary combination of macro-directional and macro-relative value strategies, all overseen by a highly-resourced risk management team. The resulting return stream shows no discernible correlation with either equities or bonds, as we illustrate in the graph below. Correlation is dynamic, but historically, the strongest periods of NAV performance have come at times of stress for equities, such as in Q1 2020, and in bond markets, over 2022, for example. As well as providing strong diversification to a portfolio, BHMG’s NAV has beaten world equities over the last five years, with considerably less volatility and significantly lower drawdowns.

ROLLING ONE-YEAR CORRELATIONS OF MONTHLY RETURNS OF BH MACRO NAV WITH GLOBAL EQUITIES AND GLOBAL BONDS

Source: Brevan Howard. Past Performance is not a reliable indicator of future results

BHMG has time and again proved its worth as a portfolio diversifier, as well as having generated strong absolute returns. It is important to remember that this is not an investing strategy that requires Brevan Howard to accurately forecast the future better than anyone else. Instead, their strong risk-adjusted returns depend on the traders’ ability to evaluate and create asymmetric trades, the investment committee to allocate capital and maximise diversification, and the risk team to minimise drawdowns. March 2023 was a tough month for the strategy, in what was an unprecedented move in interest rate expectations. Rather than a negative, we see the experience as burnishing the risk team’s credentials, in that the drawdown was minimised. With the global macro landscape looking so uncertain, we believe Brevan Howard remains in a strong position to continue to deliver attractive risk-adjusted returns from the Master Fund. With the discount to NAV at historically wide levels, long-term investors may see these returns enhanced if the discount narrows.

Absolute return strategies such as those employed at Ruffer may also offer diversification benefits to portfolios. Ruffer Investment Company Ord (LSE:RICA) is a listed vehicle which invests in the highly flexible Ruffer investment strategy, which aims to generate positive returns in all market environments. Achieving this is most difficult when equities and bonds are losing money, and this is where RICA really stands out, with the adept use of various derivative strategies and non-conventional assets helping it to historically perform very well in falling markets and rarely lose money. That said, this calendar year has been uncharacteristically weak.

The core thesis of the management team remains that inflation will remain higher on average and be more volatile than markets currently expect and that this is the main threat to asset values and investors’ capital in the coming years. In recent years, RICA has made good money from being positioned for a more volatile investment environment. Whilst a period of high and volatile inflation remains a key scenario considered when allocating assets, the portfolio contains positions designed to perform in multiple other scenarios too, particularly in the shorter term. The success of the trust over the years has seen RICA trade at a premium for long periods. However, in 2023, as the trust has underperformed in a period of high inflation, a small discount has opened up. RICA has held positions protecting against credit spreads widening and equity markets falling, but markets are up and spreads narrower, despite gloomy economic mood music, so these positions have been a drag. Meanwhile, the trust had exposure to commodities and the China reopening trade, and both positions have disappointed. Overall, while inflation has fallen, US mega-cap tech has outperformed and the US and UK have avoided recession (so far). We would argue that RICA is intended to be held as a protection against such an environment collapsing—there are plenty of options for getting exposure to the largest and most liquid stocks in the world if that is where the action is. But if the looming recession does start to hit, RICA looks more likely to play its traditional role in a portfolio of protection.

Conclusion

Change for change’s sake is always worth resisting. However, we believe there is evidence mounting up that the current decade is going to shape out very differently than the last from an investment perspective. Expecting last decade’s winners to deliver this decade seems nonsensical, which is what passive investors are implicitly positioned for.

With discounts to NAV having widened across the investment trust sector, investors have a good opportunity to bulk up on the staples that will sustain them for the rest of their journey over the rest of the decade. We believe alpha-generating opportunities and diversification, both of which have delivered over the long run but didn’t help much in the last decade, should be on everyone’s acquisition lists.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.