Trusts to play a global smaller companies’ rally

With headwinds subsiding, small firms could enjoy a spell in the sun, argues Kepler Trust Intelligence.

31st May 2024 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

It may finally be happening. UK smaller companies might finally be on the charge. We have been saying the market may be an investment opportunity for a while now due to its very attractive valuations, and the past month has seen a sharp recovery in markets, with a UK smaller companies index up double-digits in just a few months. Smaller companies underperforming has not just been an issue in the UK though.

Below, we explore how smaller companies globally have struggled in the past couple of years for a variety of factors, and argue this period is coming to an end. Markets have rallied hard in the past couple of weeks, with smaller companies doing particularly well from mid-April onwards, but we believe this could be just the beginning of a long-term recovery. Valuations are still considerably below their long-term averages, and there are many factors that could drive a long-term recovery.

UK maybe OK…?!

There has been quite the remarkable change in the outlook for the UK in just the past month. Inflation is only slightly above its long-term target, potential interest rate cuts are on the horizon with just enough time to squeeze in an election in first. Meanwhile, the more domestically orientated FTSE 250 index is up circa 4.5% (over one month to 24/05/2024).

This improving outlook has been noted by HSBC, which has called the UK a “golden buying opportunity” due in part to valuations, noting a 23% discount to US peers in a note published in May. This followed an upgrade from UBS earlier in the month, where the investment bank moved UK equities from their least to most preferred asset. While these comments were directed at the broader UK market, the opportunities within smaller companies has not been lost on private equity which has been very active with M&A in the UK, primarily within small and mid-caps (SMID). The SMID-cap space has seen a flurry of activity in the past couple of years, with 2023 seeing an average bid premium of 51% of the prevailing share price, demonstrating the considerable value on offer.

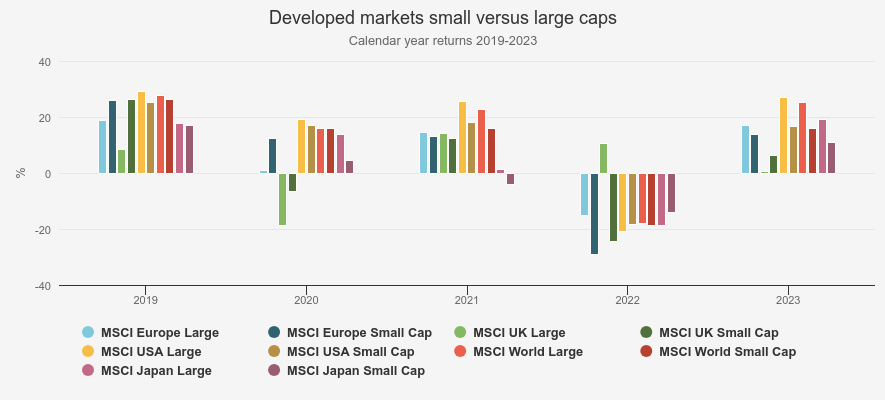

However, while the opportunity in UK small-caps has attracted bids, and the wider market beginning to capture the attention of institutional investors, it is not the only market where smaller companies have underperformed their larger peers. In fact, this is a trend that has been repeated across many developed markets such as Europe, Japan and the US. This can be seen in the chart below which shows performance of small caps versus large caps in these geographies plus a global aggregate over the past five years. In 2023, small-caps underperformed in all areas, except for the UK, although in this country the 2022 differential had been particularly wide, with smaller companies underperforming large caps by circa 35%. We have shown this in the chart below, where a negative figure represents a year of large-cap outperformance, and vice versa, across a series of developed markets.

SMALL VERSUS LARGE CAPS

Source: Morningstar. Past performance is not a reliable indicator of future results

This recent underperformance is particularly notable when considered in context of a longer time frame. Over the past 20 years, small caps have outperformed either in the majority or an equal number of years, in all regions with the exception of the US. The UK has led the way in this instance with 13 out of 20 years of small-cap outperformance. Furthermore, when small caps have had good years, they have delivered better relative performance than in the years when large caps have led the market. Europe has been being the standout in this regard with an average small-cap outperformance of 13.7% versus large-cap outperformance of 6.6%. Outperformance in the good years has not been so pronounced in Japan, though we think corporate governance reform has the potential to change this trend, as we discuss later.

AGGREGATE SMALL VS LARGE PERFORMANCE

| EUROPE | UK | US | GLOBAL | JAPAN | |

| Number of years Small Cap outperforms | 12 | 13 | 9 | 10 | 10 |

| Average Small Cap outperformance (%) | 13.66 | 15.29 | 7.32 | 6.49 | 6.69 |

| Average Large Cap outperformance (%) | 6.64 | 13.61 | 5.18 | 4.54 | 8.24 |

Source: Morningstar. Past performance is not a reliable indicator of future results.

As a result of these near-term challenges, valuations in smaller companies are now very depressed. According to data from Morningstar, the small-cap indices are all trading at valuations below their large-cap peers. This is even the case in the global index, with a small-cap PE ratio of 15.4x versus large caps of 21.8x despite small-caps traditionally offering better growth prospects. We would caution though that these figures are based off trailing 12-month earnings which will have been affected by the global slowdown in the past year which typically affects smaller companies more.

This is one of the primary reasons behind the recent small-cap underperformance. Smaller companies typically struggle in periods of weak economic environments due to their less diversified revenue streams and customer base, more limited access to finance and higher exposure to domestic consumers, amongst other reasons. As such, smaller companies tend to do worse in falling markets. However, this often reverses in market recoveries where smaller companies can capitalise on their better flexibility to capture the bounce-back.

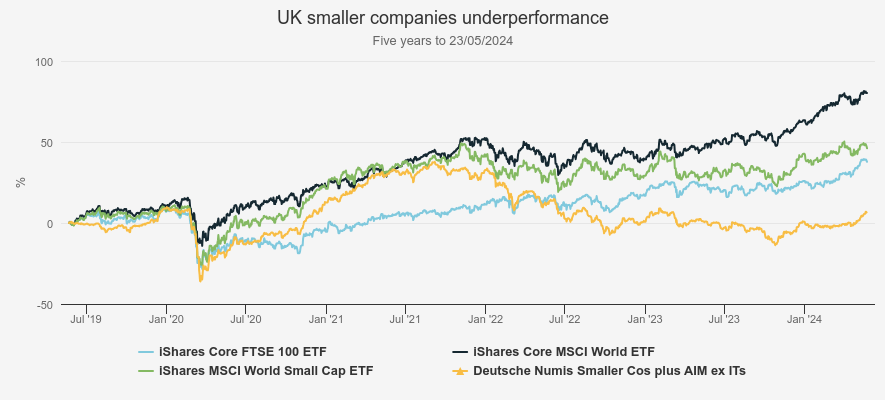

The roller coaster ride seen in UK smaller companies over the past five years is a good example of this. From the beginning of the period to the depths of the covid crisis in May 2020, the Deutsche Numis Smaller Companies plus AIM ex Investment Trust Index, a common benchmark for UK smaller companies trusts, fell circa 18%, while the large-cap FTSE 100 Index fell circa 13%. However, over the same period, the MSCI World Index was up cumulatively 4.7%, a 23-percentage point outperformance. From this nadir though, UK small caps then rose 57.9% over the following year, significantly beating its large-cap peer, the FTSE 100 index, and even returning more than double that of the MSCI World Index which rose 25.4%. This can be seen with the yellow line steadily closing in on the black line of the MSCI World ETF Index. A similar pattern can be seen in the World Small Cap ETF Index, where the cumulative performance gap to its large-cap peer has widened from early 2023 onwards.

ONE-YEAR PERFORMANCE

Source: Morningstar. Past performance is not a reliable indicator of future results.

UK smaller companies began underperforming again from mid-2021 onwards, as concerns over high inflation caused fears of a recession. As a result, UK small caps have ended the five-year period up only 6.5%, behind the FTSE 100 index’s return of circa 39%, the MSCI World Index’s return of 78.2% and the S&P 500 index's return of 97.1%. In the past few weeks, UK small caps have begun to recover sharply though which could arguably be the start of another long-term rally, should the economic outlook continue to improve.

The poor market from mid-2021 was particularly hard felt at the lowest end of the market cap spectrum. We wrote about the state of play in micro caps in our recent article, although Richard Staveley, manager of Rockwood Strategic (LSE:RKW)has managed to significantly outperform the market in his time running the trust. His highly concentrated portfolio, which he manages with an active approach, has delivered very strong returns. Richard is speaking at ourupcoming smaller companies eventwhere a host of managers will speak each day on the prospects for their area of the market.

Chris Berrier, manager of Brown Advisory US Smaller Companies (LSE:BASC) will be discussing the prospects for his trust also. The US has been one of the key drivers of global markets over the past few years, though this has been primarily centred around the so-called Magnificent Seven, which have provided the bulk of the index’s returns. In turn, this has contributed to large caps dominating inflows which led to small caps lagging their large-cap equivalents in 2023. However, over the long term, just like in the UK, US smaller companies tend to outperform their large-cap peers. Furthermore, they have historically performed well in absolute terms when interest rates and inflation cycles start to decline. With valuations very low, and the trust at a discount of circa 11%, this could prove an opportune entry point to BASC.

As we discussed earlier, the smaller companies story in Japan is a little different as they haven’t managed to beat their larger peers over the long term. However, AVI Japan Opportunity (LSE:AJOT), despite the management team’s small-cap focus, significantly outperformed both the smaller companies index and peers in 2023. The managers have been focusing on the corporate governance story since the trust’s inception in 2018 and focus on the small-cap end of the market in order to have the biggest impact from their activist approach. The year saw a resurgence of interest in the Japanese story, particularly surrounding corporate governance reforms. As early adopters of this successful approach, and the strong performance that has come with it, AJOT’s presentation will shine a light on the future potential for the sector.

One trust covering all of these geographies as well as Europe is managed by Nish Patel, the new manager of The Global Smaller Companies Trust (LSE:GSCT). GSCT offers investors access to a diversified portfolio of global equities that may help the volatility associated with smaller companies. Nish will continue to apply a valuation-focused approach which means the portfolio can often look different to peers. This has contributed to some strong periods of performance recently. Despite this, the trust remains at a wide discount versus its own history, along with the average of its sector. As such, we believe this could prove an attractive entry point to this diversified strategy and a more rounded way of accessing the potential of the asset class.

Conclusion

Smaller companies around the globe have faced a number of headwinds in the past couple of years, which has contributed to them falling to very attractive valuations. Much of this weakness has been linked to fears of a global economic slowdown as high interest rates, caused by high inflation, have worked their way through the economy and dampened demand.

However, these factors have arguably peaked. Inflation is back to near target levels in most major economies and the next move in interest rates is more likely to be a cut than a hike. It is in these recovering environments that smaller companies often do best, and often enjoy a strong and sustained recovery. As such, we believe there is potentially a lot to play for in smaller companies.

To hear a range of developed market managers discuss the nuances on their markets, Kepler will be hosting a smaller companies event later in June.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.