The trusts offering a solution to declining company listings

The UK is not alone in seeing companies prefer to stay private, says a Kepler analyst, but investment trusts can capitalise on this global trend.

21st June 2024 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Raspberry Pi Holdings (LSE:RPI) brought much-needed relief to the UK stock market in June. In the tech company’s first week, its shares rose from an IPO price of 280p to 470p by close of business Friday in a rare success story for the UK’s embattled market.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Top Investment Trusts

While one berry does not a punnet make, a successful IPO demonstrates that fears over the UK’s decline may be a little overdone. However, it is true that over the long term, the stock market has seen a fall in the number of companies listed, and this has accelerated in the past couple of years.

Currently, the debate tends to view this as a British problem which can be addressed with a few tax and regulatory incentives. However, we think it is important to recognise that this ‘de-equitisation’ trend has been far from an exclusively UK issue and is actually part of a broader global trend of declining company listings on developed markets.

As we detail below, we believe there are a number of reasons behind this, with important investment implications. However, investment trusts might be particularly well-placed to offer solutions…

Staying private for longer

This de-equitisation trend is best evidenced through the falling number of listed companies on the major exchanges. The London Stock Exchange has seen its number of listed companies fall from circa 3,300 near the end of 2007 to circa 1,900 in 2023, a drop of almost 40% as we have shown in the chart below.

However, this is not just a UK phenomenon. The past few weeks have seen the issue addressed by the head of Germany’s Deutsche Börse, where the number of companies has fallen from a peak of 1,178 in 2007, to 583 in 2023. This trend has even affected the all-conquering US, where the number of listed companies has halved since 1996.

NUMBER OF LSE LISTED COMPANIES

Source: Statista

We believe one of the major factors influencing this is the desire of companies to stay private for longer. In the private space, companies can operate without burdens of higher scrutiny and regulatory challenges that public markets bring. The benefits of being listed have historically offered the opportunity to raise capital by offering a proportion of the company to the public where there are bigger sources of funds. However, the level of capital in the private equity (PE) space has grown incredibly, meaning companies are able to raise cash to fund their growth plans without needing public markets.

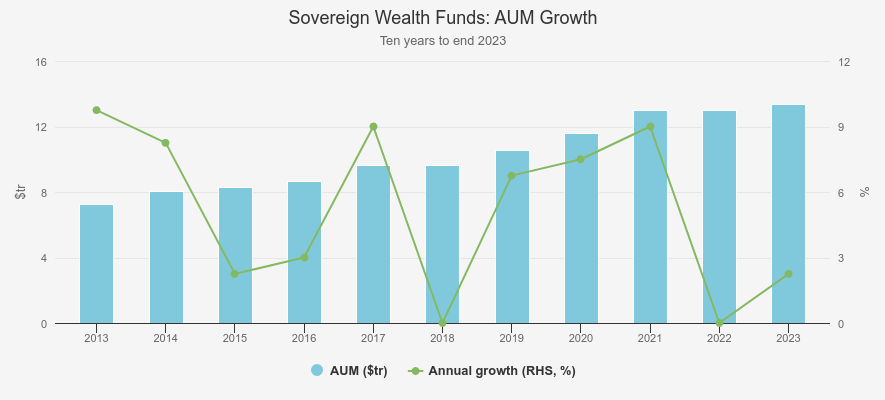

One of the main reasons PE assets have grown so much is the increasing prevalence of sovereign wealth funds (SWF) using the space. A number of national governments have established SWFs such as Norway’s Norges Bank, Qatar’s Investment Authority and Saudi Arabia’s Public Investment Fund. These have been created in order to make use of the enormous wealth they currently have and diversify it for the future to help support their economies when their primary funding source, typically hydrocarbon sales, eventually runs out.

The total assets of the SWF sector are estimated to have crossed over $10tr at the end of 2023. This is almost double the estimated $4.8tr from a decade prior. These funds are looking to diversify, and are able to do the extra research needed to invest privately. Their allocation to private equity has climbed to around 25% at the end of last year, up from just 7% in 2005. This has led to a considerable growth in the PE sector, with assets under management of $8.2tr in 2023 according to McKinsey. SWFs are estimated to make up about 14% of the sector and this has provided significant capital to allow companies to continue growing before needing to go to public markets, contributing to the de-equitisation effect. Additionally, there are more companies staying private but out of the hands of private equity managers, selling minority stakes to institutional investors, often with management retaining substantial control. This is a different model to the PE one, which sees managers take controlling positions and direct the management of the company with defined objectives and time frames in mind.

SWF AUM GROWTH

Source: State Street Global Advisors

Trust options

Fortunately, there are a number of investment trusts that offer exposure to unlisted equity. The structure allows managers to take illiquidity risk, as they are ‘permanent capital’ and not subject to outflows. The trend of companies staying private for longer has been a factor that Baillie Gifford has highlighted for a while, and it has allowed its managers to invest in private companies across its suite of trusts.

Baillie Gifford European Growth Ord (LSE:BGEU)is one example. Managers Stephen Paice and Chris Davies had their limit for private companies increased from 10% to 20% in early 2022. One of the portfolio’s largest holdings, Northvolt, is privately owned. It is Europe’s leader in electric vehicles battery manufacturing and offers the managers access to the exciting growth potential from a subsector that will have a critical role to play if we are to reach net zero.

Scottish Mortgage Ord (LSE:SMT), the UK’s largest, and arguably most well-known investment trust is also managed by Baillie Gifford. Private companies have been a big part of the trust’s success, and whilst this has contributed to a pullback in the past couple of years as interest rates have risen, the managers maintain steadfast that they will be a feature of the trust going forward.

Traditional private equity also stands to benefit from the trend for companies to stay private, such as NB Private Equity Partners Class A Ord (LSE:NBPE). Decisions on what to invest in are made by a 13-strong investment committee who will co-invest alongside the wider Neuberger Berman firm which offers excellent deal flow due to its size and experience. This approach sets NBPE apart from its peers, and offers investors an interesting vehicle with which to harness the strengths of the private equity investment model. The managers focus on only their highest conviction co-investment opportunities, meaning the trust has around 87 companies invested in alongside 50 third-party private managers. We believe the lower cost approach of a co-investment strategy will be supportive for future returns as well as allow the managers to capture the significant growth potential on offer should PE continue to succeed.

Schroder British Opportunities Ord (LSE:SBO)has an interesting model. It invests in public markets, but also in private markets, with a traditional growth and buyout private equity approach. The four-strong management team have built a portfolio of some of what they see as the most attractive small and mid-sized growth companies primarily in the UK, across both public and private markets. This flexibility means the managers can invest in a range of opportunities, whatever stage they are at in their growth story. One example is portfolio holding Mintec. The company is a price reporting agency for non-exchange traded commodities and is enjoying strong organic growth, as well as through acquisition. The managers invested alongside Synova, which is a PE specialist in software investments, validating the potential of the opportunity. The company has been a big contributor to performance since investment, and allows the trust to benefit from a company that many peers would miss out on, therefore mitigating some of the concerns over de-equitisation.

None in, one out…

Another major factor contributing to the de-equitisation trend has been the increase in M&A activity. This has been a particularly strong factor in the UK, especially over the past couple of years as a result of low valuations and a weak currency.

This is arguably another consequence of the high levels of cash in PE. There are many PE firms which focus on buying listed companies at knockdown valuations, rejuvenating the business and then selling on at a profit. With market valuations down so much, and PE having plenty of capital waiting to be deployed, they have recognised the opportunities on offer and taken numerous companies into private ownership. A recent example would be the $5.3 billion takeover of cybersecurity firm Darktrace by PE firm Thoma Bravo, agreed in April. There have also been plenty of strategic buyers looking to take advantage of cheap valuations, such as Chinese e-commerce player JD.com, which was one of two bidders for Currys.

This has contributed to the reduction of listed companies, as companies being taken private are outweighing any new companies joining through IPOs. Furthermore, the current weakness in markets, leading to these depressed valuations has contributed to firms being unwilling to list as they are unlikely to achieve the valuations they feel they deserve. Whilst this is accelerating a long-term issue, there is arguably a strong element of cyclicality to this. Should the investing landscape improve, most likely as a result of falling interest rates, the more stable market will likely lead to more companies coming to market, as we have seen with Raspberry Pi.

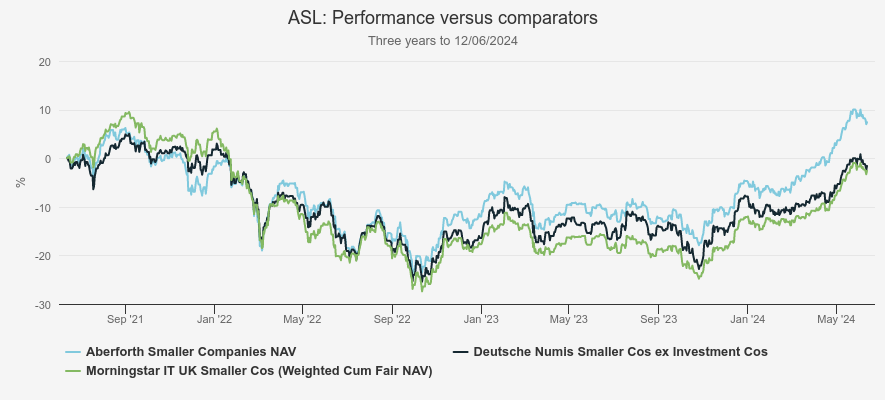

We would highlight that M&A is not a completely negative factor though. In fact, for Aberforth Smaller Companies Ord (LSE:ASL), it has been a big contributor to performance. The seven-strong management team have a strong valuation focus, meaning M&A is likely to be more prevalent amongst the stocks they look for, though their hit rate over the past couple of years has been particularly impressive. Of the 37 companies that were takeover targets in the Deutsche Numis Smaller Companies Index between January 2022 and April 2024, ASL owned 18 of them. This has led to impressive returns relative to the benchmark and peer group over the past three years, as we show in the chart below, and in particular strong performance since Q4 last year as markets have rallied.

ASL THREE-YEAR PERFORMANCE

Source: Morningstar. Past performance is not a guide to future performance.

Clustering

Another factor that has affected de-equitisation is the trend for companies to re-list in other geographies, primarily the US. Weak valuations are one reason for this, with US markets typically ascribing more value to future growth potential than markets such as Europe and the UK.

However, we think this is as much about the US’ success as it is about the UK’s shortcomings, and it is another global phenomenon. In particular, the US’ primary tech index, the Nasdaq, has become the world’s primary tech index. We think there is a winner-takes-all effect operating here as it does in many technology sectors. This led to more companies being drawn to the index due to the deeper pool of capital, greater number of specialist investors, and all the synergies that come by being a global hub. This in turn brings higher valuation potential, which has attracted more companies and led to a self-reinforcing cycle. The Nasdaq is a rare instance of a market that has increased its number of companies in the past few years, from just over 3,000 in 2018 to circa 3,400 in 2023. This includes an 89% jump in international companies.

With tech companies having the ability to quickly replicate their business model across different geographies, there is arguably less logic for a board to list in a company’s ‘home’ market and instead focus on where it can achieve the best valuation for the company. As such, we think this trend is likely to continue in certain industries, and be a further factor in the de-equitisation of many developed markets. From an investors’ perspective, this is nothing to fear, but we think it’s sensible to look for funds that have the flexibility to invest in overseas holdings, meaning either re-listing doesn’t mean they are forced sellers, or they can gain exposure in certain sectors not available in their home market.

One example of this is Edinburgh Investment Ord (LSE:EDIN), which is a UK-focused trust that can invest up to 20% overseas. Newly appointed managers Imran Sattar and Emily Barnard believe the UK offers many excellent value opportunities at the moment and therefore they have been selective with their overseas holdings, though one exception is Verisk Analytics Inc (NASDAQ:VRSK). It is one of the trust’s top 10 holdings and specialises in data analytics. The company is listed on Nasdaq and has performed well this year, up over 9% at time of writing which will have contributed positively to both relative and absolute performance.

The success of the tech sector has arguably contributed to it achieving ‘critical mass’, meaning the clustering of companies around the Nasdaq is likely to continue. Outside the tech sector, we think the same dynamic is visible in the biotech sector.

International Biotechnology Ord (LSE:IBT), managed by Ailsa Craig and Marek Poszepczynski, is overwhelmingly invested in the US, where the industry is centred. It also invests in a small number of private investments worth between 5% and 15% of the portfolio via funds managed by SV Health. This broadens the pool of potential investments and increases the exposure to early-stage companies. This flexibility has recently proved its worth following Merck’s decision to buy EyeBio, an unlisted ophthalmology firm. This was part of the SV Health Fund and added 2.9% in NAV terms to IBT. Not only has this demonstrated the value of being able to invest in private holdings, but the managers also noted that this is another sign of improved optimism in the sector. The fact that IPOs and secondary fund raises have seen renewed appetite is in our view a potential early sign that some of the more cyclical impacts of the de-equitisation trend may be starting to reverse.

Conclusion

There has been a big fall in the number of listed companies in the UK over a number of years, though this is part of a much bigger trend among many developed markets. The primary driver has been companies staying private for longer due to the big increase of assets in private equity, boosted by the likes of sovereign wealth funds, which has allowed firms to get the capital they need, without the burdens of public markets. However, this impact has arguably been accelerated by the market weakness of the past couple of years which has compounded the effects in either direction.

However, the flexibility of the investment trust structure means there are a number of vehicles that can capitalise on these trends. Not only are there trusts that specialise in private equity, but also a number that can hold private companies alongside listed, thus giving the managers access to the best growth opportunities wherever they may exist. The more cyclical elements of the de-equitisation trend are arguably seeing signs of reversing too, which could offer some exciting opportunities within the IPO market in the months to come. A useful reminder that it is never doom and gloom for ever!

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.