Tipping point: trusts on wide discounts, opportunities and bargains

12th May 2023 14:39

Battered growth strategies have staged a comeback recently, but what happens now? Nicholas Todd at Kepler Trust Intelligence highlights the trusts which have performed best, and identifies those that look good value.

The level of volatility we have seen in financial markets over the past few years shows little sign of ending. It has been a tough period for global equity managers to navigate, as policy-makers grapple with the trade-offs associated with fighting inflation versus the lingering threat of a recession and lacklustre growth. Against that turbulent backdrop, we look at how they have fared, highlighting the trusts which have performed best, and identifying those that look good value.

Equity market backdrop

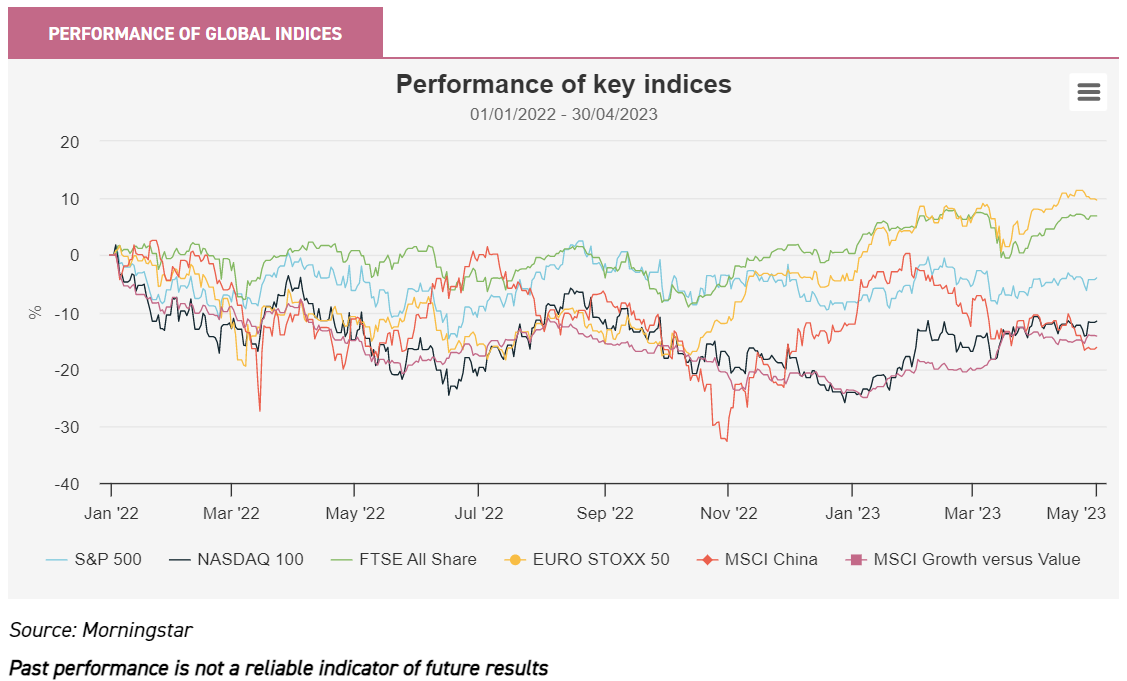

The performance of some key equity markets since the start of 2022 is illustrated in the chart below. It highlights the broader weakness of global equity markets over the period, caused by overhanging supply-chain disruption from the coronavirus pandemic and Russia’s invasion of Ukraine. This, combined with the vast stimulus measures used over the past decade, has resulted in a prolonged period of inflation. Such events have had a particularly detrimental impact on the European market. The sharp rise in interest rates used to combat inflation also had a disproportionate impact on high-growth companies, sectors, and markets, with the NASDAQ 100 and S&P 500 Indices generating returns of -23.8% and -7.8% over 2022, respectively. China was also in the firing line, mainly relating to the persistency of regulatory uncertainties and its zero-COVID policy.

Since the start of Q4 2022, equity markets have staged a partial recovery, as inflation expectations started to ease and the prospects of a slowing pace of interest rate hikes started to be priced in. European equity markets have rebounded from their lows of 2022, driven by a recovery in consumer sentiment, falling energy prices and improving supply. The UK market has continued to perform well, too, which may partly reflect both regions’ relatively cheap valuations, particularly compared to the US. We note that, since the start of 2023, the US has also shown some signs of recovery. However, this has been driven by a relatively narrow cohort of technology companies, as reflected by the 16.1% year-to-date gains by the Nasdaq Index. Furthermore, a recent Financial Times article noted that only 20 stocks have accounted for 90% of the S&P 500 Index’s gains this year to date, as at 08/04/2023, thus highlighting the market influence of big tech.

Which trusts have performed well?

The Global and Global Equity Income sectors are by default unhindered by geographical restrictions, which allows the managers to invest where they see the greatest opportunities to fulfil their investment mandates. Often, this results in investment strategies which can suit a range of investor needs, providing somewhat of a core investment solution that can perform across the market cycle. Looking over the past year, a striking observation is that the global equity income sector trusts have performed particularly well, as shown in the table below. One factor was likely the stylistic exposure of the typical equity income fund, which has more exposure to value stocks and a greater allocation to core stocks. The average allocation to value stocks in the equity income sector is 25.8%, according to Morningstar, versus 16% for the growth sector. However, the core focus was likely important too: the income sector has an average allocation of 48% and the growth sector, 40%.

PERFORMANCE OF GLOBAL AND GLOBAL EQUITY INCOME AIC SECTORS

| TRUST | AIC SECTOR | EQUITY STYLE VALUE (%) | EQUITY STYLE CORE (%) | EQUITY STYLE GROWTH (%) | TOTAL PERIOD (NAV) 01/01/2022 - 30/04/2023 | BETA |

| Murray International | Global Equity Income | 43.32 | 44.26 | 12.42 | 12.47 | 0.66 |

| Invesco Select Global Equity Income | Global Equity Income | 18.75 | 58.85 | 22.41 | 6.55 | 0.90 |

| Henderson International Income | Global Equity Income | 36.00 | 56.53 | 7.47 | 4.21 | 0.75 |

| JPMorgan Global Growth & Income | Global Equity Income | 22.29 | 38.26 | 39.45 | 2.60 | 1.16 |

| Scottish American | Global Equity Income | 18.24 | 54.40 | 27.35 | 0.12 | 0.83 |

| Securities Trust of Scotland | Global Equity Income | 24.12 | 60.07 | 15.82 | -0.50 | 0.67 |

| Brunner | Global | 18.60 | 53.19 | 28.21 | -1.19 | 1.06 |

| Alliance Trust | Global | 27.28 | 35.84 | 36.89 | -2.38 | 1.15 |

| Witan | Global | 18.96 | 43.44 | 37.60 | -6.93 | 1.05 |

| Bankers | Global | 26.56 | 39.80 | 33.64 | -7.18 | 0.90 |

| F&C Investment Trust | Global | 28.87 | 47.19 | 23.95 | -7.36 | 0.96 |

| Lindsell Train | Global | 1.20 | 67.04 | 31.76 | -7.72 | 0.54 |

| AVI Global Trust | Global | 24.97 | 55.96 | 19.07 | -11.11 | 0.89 |

| Mid Wynd International Inv Tr. | Global | 19.36 | 39.00 | 41.65 | -14.27 | 0.93 |

| Martin Currie Global Portfolio | Global | 3.44 | 34.92 | 61.63 | -14.50 | 1.42 |

| Keystone Positive Change | Global | 9.86 | 35.44 | 43.76 | -22.91 | 1.33 |

| Monks | Global | 13.64 | 42.61 | 43.76 | -22.91 | 1.33 |

| Manchester & London | Global | 1.06 | 10.40 | 88.54 | -28.74 | -.59 |

| Scottish Mortgage | Global | 14.14 | 20.97 | 64.90 | -42.12 | 1.53 |

Source: Morningstar

Past performance is not a reliable indicator of future results

In addition, the average beta of 0.83 for the Global Equity Income sector is significantly lower than the 1.07 for the global sector, relative to the MSCI ACWI Index across this period. Naturally, this makes the sector significantly less exposed to the more volatile market conditions we have experienced. Interestingly, if we remove the high 1.16 beta value of JPMorgan Global Growth & Income, which pays a dividend largely from capital, from the calculation, the average of the equity income sector reduces further to 0.76. Generally, the trusts with the lower betas have performed better over this period.

Murray International Ord (LSE:MYI) has performed particularly well. Managed by longstanding manager Bruce Stout, MYI’s strategy is benchmark-agnostic, offering a diversified portfolio across sectors and geographies. Its underweight allocation to the US and unique allocations to both emerging markets (EM) equity and a 5.9% allocation to EM fixed income has also contributed positively to the trust’s underlying yield. A high allocation to Latin America has been particularly helpful over the year. His approach is both relatively defensive and diversified, which seems to have helped in a volatile period.

Scottish American Ord (LSE:SAIN) has also performed relatively well. Many of Baillie Gifford’s trusts have been under pressure, as the market has rotated away from growth. However, SAINTS has had a good year relative to the peer group, perhaps due to its more balanced exposures, which has allowed it to perform well across both stylistically-driven market environments. SAINTS has a 36.3% allocation to Europe inc. UK equities, a 3.8% allocation to fixed income and 7.6% allocation to property, highlighting this diversification. Managers James Dow and Toby Ross focus on quality through allocating to what they term ‘compounding machines’.

Two other trusts stand out to us as having been able to strike a balance between income and growth:Invesco Select Global Equity Income (LSE:IVPG)andJPMorgan Global Growth & Income (LSE:JGGI). We have published updated notes on both trusts in recent weeks. They aim to offer investors a core portfolio and offer a dividend which is paid partially out of capital, allowing a more flexible investment approach, less restricted by yield targets. Instead, IVPG’s manager, Stephen Anness, seeks dividend compounders that can demonstrate a greater sustainability of future cash flows that can fuel longer-term dividend growth. Naturally, this reduces the exposure to typically cyclically-driven companies and so-called value traps associated with certain sectors, such as oil and banks. Since taking over the trust’s management, Stephen has worked to reduce IVPG’s exposure to factor-specific risks. However, the trust has displayed market risk. At 1.16 over this period, its beta places it amongst the higher-beta strategies within the global equity income sector.

The tipping point

There is a clear break between two periods over the past year, in our view. At the beginning of October, markets began to stage something of a rally and growth strategies started to come back into favour. We show in the table below the performance of the trusts during these two periods.

PERFORMANCE OF TRUSTS OVER BOTH PERIODS

| TRUST | AIC SECTOR | 01/01/2022 - 30/09/2022 (NAV) | 01/10/2022 - 30/04/2023 (NAV) |

| Martin Currie Global Portfolio | Global | -29.51 | 21.28 |

| Invesco Select Global Equity Income | Global Equity Income | -9.18 | 17.32 |

| Brunner | Global | -13.20 | 13.84 |

| Henderson International Income | Global Equity Income | -6.21 | 11.11 |

| Witan | Global | -16.09 | 10.92 |

| Keystone Positive Change | Global | -29.64 | 10.73 |

| Alliance Trust | Global | -11.70 | 10.56 |

| Bankers | Global | -15.71 | 10.12 |

| Scottish American | Global Equity Income | -8.57 | 9.50 |

| Murray International | Global Equity Income | 2.76 | 9.45 |

| JPMorgan Global Growth & Income | Global Equity Income | -5.77 | 8.88 |

| AVI Global Trust | Global | -16.07 | 5.91 |

| Mid Wynd International | Global | -18.11 | 4.70 |

| Securities Trust of Scotland | Global Equity Income | -3.79 | 3.42 |

| F&C Investment Trust | Global | -10.36 | 3.35 |

| Manchester & London | Global | -30.91 | 3.15 |

| Lindsell Train | Global | -10.30 | 2.87 |

| Monks | Global | -24.39 | 1.95 |

| Scottish Mortgage | Global | -35.47 | -10.31 |

Source: Morningstar

Past performance is not a reliable indicator of future results

MYI stands out as having done well in both periods, being the only trust to deliver positive returns in both. We believe this can be attributed to Bruce’s valuation-sensitive, highly-diversified and benchmark-agnostic investment strategy, as demonstrated by MYI’s low beta of 0.66 to the broader equity market.

Securities Trust of Scotland (LSE:STS) also performed well over both periods. At first glance, the trust’s performance in absolute terms may not have shot the lights out. However, we believe its consistency and low volatility are attractive features, as reflected in its 15.3% standard deviation – the lowest in the global sectors here, which averaged 22.9%. We believe this can be attributed to the investment manager, Troy Asset Management’s, overarching investment philosophy of capital preservation. When combined with the manager’s focus on high-quality companies that exhibit clear competitive advantages, and an ability to generate surplus cash flows, which are aided by a greater predictability of revenues, it is reasonable to expect the strategy to provide some insulation from higher inflation and the rising cost of debt. Furthermore, STS, MYI and Henderson International Income (HINT), had the three lowest maximum drawdowns and downside capture ratios across the two sectors over this period.

The second period considers the beginning of the end of the cyclical rally, from the start of Q4 2022 to 30/04/2023. Over this time, there was a clear resurgence of performance by growthier-focussed AIC Global sector strategies. The prospects of peak inflation and the potential of a slowdown in rate hikes has resulted in growth-focussed strategies making up some of the top performers. Notably, this includes trusts that focus on identifying quality-growth companies, such as Martin Currie Global Portfolio (LSE:MNP), whose portfolio manager, Zehrid Osmani, seeks companies set to benefit from the most exciting secular growth trends. Such growth is typically associated with sectors such as technology and healthcare, rather than the cyclically-exposed sectors of energy, financials and real estate, for example. Perhaps unsurprisingly, MNP has a Morningstar growth style score of 61% and one of the lowest three value allocations across the two sectors. Zehrid’s high conviction, combined with the trust’s relatively high beta of 1.42 and aggressive approach to gearing, means it has the potential to continue to benefit, should markets continue their recovery.

Keystone Positive Change (LSE:KPC) has led the charge for the Baillie Gifford-managed global investment trusts over this period. Following the release of the trust’s latest interim results, covering the six months to 31/03/2023, KPC’s managers, Lee Qian and Kate Fox, said they remain confident around their companies’ operating performances and are pleased with their annualised median revenue growth rate of 18.1%, versus the benchmark’s 12.7%. We note that performance has been driven by a few select holdings, such as the acquisition of Abiomed by Johnson and Johnson, and by strong returns from Latin American online marketplace MercadoLibre, on the back of strong operating margins through its expansion into financial services. We note that KPC is designed to suit long-term investors in search of a strategy that offers exposure to companies offering genuinely positive solutions to critical social problems.

We think Brunner's (LSE:BUT) focus on quality has also begun to shine through. BUT saw the introduction of Julian Bishop to the now four-man managerial team to bolster resources, however, the trust’s longstanding balanced strategy with a focus on quality is highly unlikely to change. The strength of the portfolio’s underlying holdings and focus on stable growth, combined with the managers’ overarching focus on the digitalisation of the global economy, has positively impacted performance over this period. Furthermore, BUT’s significant c. 20% allocation to the UK and 27% allocation to Europe has helped the managers to generate the best performance amongst the global sector contingent, in our first period.

Impressively, IVPG has generated strong performance over this period, but has done relatively well in both periods. Again, we might attribute this to the freedom afforded to Stephen, which allows him to invest in longer-term, slightly growthier companies that may offer both capital and dividend growth. Despite his stock-specific approach limiting the exposure to sectors such as energy and utilities, Stephen’s focus on quality and valuation has benefitted performance over the longer term.

Where are the bargains?

The table below highlights the widest discounts versus history through the Z-score, which reflects the number of standard deviations away from the mean the current discount is. As highlighted in our recent article,‘Are we nearly there yet?’, SMT tops the table as a standout discount opportunity, with its discount trading at a greater than 3.5 standard deviations below its five-year average. Similarly, since the start of 2022, Monks' (LSE:MNKS)high-growth strategy has led to its shares drifting to a wide discount.

Interestingly, despite being one of the top-performing trusts across the two sectors, IVPG’s discount has, in fact, widened over this period to 13.4% at the time of writing. This is 2.6 standard deviations below its five-year average of 3.4% and we think this looks great value. We think the possibility of rising dividend income over the next three years is an attractive feature and could play an increasingly important role for total returns in an environment where capital growth is harder to come by.

Bankers (LSE:BNKR) also looks good value versus the sector’s history. The trust has a significant exposure to the US and a more balanced exposure to the technology sector, which was impacted last year and has since lagged major indices due to the narrowness of the rally in mega-cap tech stocks. To a lesser extent, Witan's (LSE:WTAN) discount has remained wide, despite its relatively strong NAV performance over the second period, in our analysis. We note that MYI actually trades at a premium, which is remarkable, given the market environment. However, perhaps this reflects its strong performance, discussed above.

LOWEST FIVE-YEAR Z-SCORES

| TRUST | SECTOR | LATEST DISCOUNT (CUM-FAIR) | FIVE YEAR AVERAGE | Z-SCORE |

| Scottish Mortgage | Global | -20.54 | -1.84 | -3.58 |

| Invesco Select Global Equity Income | Global Equity Income | -13.41 | -3.77 | -2.64 |

| Bankers | Global | -10.33 | -2.09 | -2.51 |

| Monks | Global | -10.49 | 0.15 | -2.31 |

| Mid Wynd International | Global | -1.31 | 2.44 | -1.81 |

| Witan | Global | -9.61 | -5.49 | -1.58 |

| Scottish American | Global Equity Income | 0.03 | 2.76 | -1.34 |

| Lindsell Train | Global | -4.43 | 25.02 | -1.30 |

| Brunner | Global | -12.96 | -10.39 | -0.95 |

| Manchester & London | Global | -14.67 | -8.14 | -0.86 |

| Keystone Positive Change | Global | -15.70 | -11.41 | -0.83 |

| Henderson International Income | Global Equity Income | -5.44 | -2.51 | -0.80 |

| AVI Global Trust | Global | -10.43 | -9.46 | -0.66 |

| JPMorgan Global Growth & Income | Global Equity Income | 0.64 | 1.50 | -0.44 |

| Alliance Trust | Global | -6.24 | -5.93 | -0.27 |

| F&C Investment Trust | Global | -5.01 | -4.09 | -0.22 |

| Securities Trust of Scotland | Global Equity Income | -1.35 | -0.89 | -0.14 |

| Martin Currie Global Portfolio | Global | -0.17 | -0.10 | -0.04 |

| Murray International | Global Equity Income | 1.37 | 0.37 | 0.29 |

Source:Morningstar, to 30/04/2023, Kepler Calculations

Conclusion

The volatility that has been experienced by global equity markets over this timeframe has supported the more core global equity strategies, for the most part. With the high level of uncertainty that remains, investors may think this remains the way to be positioned. In our view, there could also be a case made for managers who focus on quality, as high inflation and weakening economies create competitive pressure. The relatively wide discounts that are still available, particularly in the global sector, suggest that investor sentiment has lagged the recovery we have seen in markets since October. For those who think markets could carry on hiking upwards, this could represent an opportunity.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.