Three stocks doing better than anyone expected

25th August 2021 09:03

by Rodney Hobson from interactive investor

This trio of household names has overdelivered this results season, but what does our overseas investing expert think?

While retailers in the United States are still struggling to cope with the effects of the pandemic – store closures and reopenings, an online sales surge and the subsequent rush to return to real-life shopping, stockpiling by some panicking consumers – there are some hopeful signs showing in second-quarter figures.

- Invest with ii: Trade US Stocks & Shares | US Earnings Season | Open a Trading Account

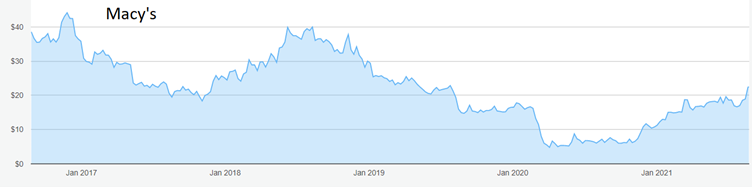

It is quite some time since shareholders in retail chain Macy's (NYSE:M) have had cause to feel optimistic but two better-than expected quarters have raised hopes of improving times to come. Latest results actually sent the stock up 19% on the morning after they were released.

Source: interactive investor. Past performance is not a guide to future performance

Revenue increased 58.7% from the Covid-affected second quarter of 2020. More encouraging news was that sales were actually 1.8% higher than in the more normal quarter in 2019 with digital sales, the saving grace during the pandemic, holding up remarkably well even as stores reopened. This was substantially better than analysts had expected. Macy’s reported a loss last year but this time earnings per share were $1.29, again ahead of 2019. The first quarter of 2021 also beat forecasts.

The company has $2.1 billion in cash, enough to allow the restoration of a 15 cents quarterly dividend, initiate a $500 share buyback programme and reduce debt to strengthen the balance sheet. Meanwhile, underperforming stores are being closed and fixed costs are being reduced.

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Don't be shy, ask ii...how do I tidy up my investment portfolio?

Some caution is required, as the US retail sector generally, and department stores in particular, are still struggling. However, Macy’s reckons it is attracting new, younger customers with new brands and lines without losing touch with its core older clientele. Indeed, a whole new generation of Americans could be lured in as Macy’s is restoring the Toys R Us brand that already sells through the Macy’s website and will, over the next two years, appear in 400 stores within the chain.

The shares dipped below $5 in the pandemic panic last year but are currently around $22.50, the best for two years. Another strong quarter would push them towards the $40 level they enjoyed in the middle of 2018.

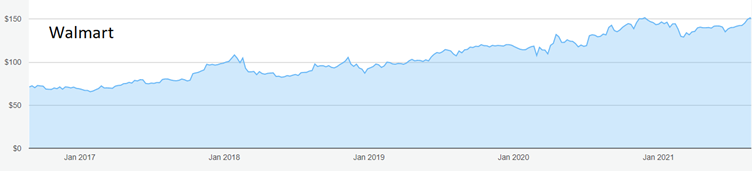

Walmart (NYSE:WMT) was another retailer to beat revenue expectations as total sales rose 2.4% to $141 billion. Analysts had thought that the figure might slip slightly from last year’s $137 billion for the same three months. Instead, they came in 8.2% higher than in 2019, before the pandemic struck. As at Macy’s, this is the second quarter of rising sales.

Source: interactive investor. Past performance is not a guide to future performance

The company now expects a small growth in revenue for the current year compared with earlier guidance of a single-digit decline, citing pent-up demand from consumers piling back into stores as lockdowns ease alongside growth in online sales. The release of pent-up demand is set to continue through into next year, Walmart now believes.

The profit picture was more clouded, though. Pre-tax profits slumped 32% to $5.92 billion, and although most of the fall was because of a massive one-off gain last time, the bottom line was still slightly adrift on an underlying basis.

Walmart shares have doubled over the past five years to $150 and the upward trend looks set to continue. The yield is 1.46%. I recommended buying at $119 in December 2019 and those who followed that advice and gritted their teeth in the market crash have been vindicated.

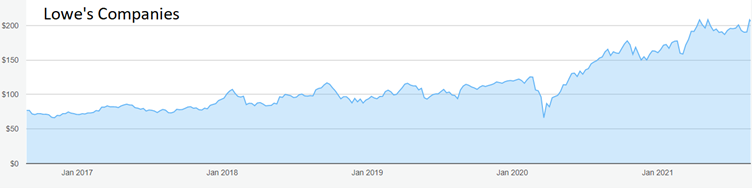

Home improvements retailer Lowe's Companies (NYSE:LOW) faces a more uncertain future as life gets back to normal and homeowners spend less time fretting about the properties they have been trapped in.

Earnings were admittedly strong in the second quarter, up 13% to $4.25 a share against analysts’ estimates of just over $4. Revenue at $27.6 billion were also a pleasant surprise. That was a rise of only 1%, but it was enough to prompt the board to raise expectations for the full year from $86 billion to $92 billion.

Source: interactive investor. Past performance is not a guide to future performance

However, chief executive Marvin Ellison conceded that there was a decline in DIY demand compared with a year earlier.

Much depends on whether Lowe’s can continue to gain a greater share of the professional market. It needs to overcome the perception that rival Home Depot (NYSE:HD) has a better range with more items in stock. Lowe’s policy is to have distribution centres that can deliver within 24 hours rather than try to stock every item in every store. That will keep down inventory costs but will not suit professionals who need the goods on the spot.

Lowe’s shares have tripled since slumping to $66 in the depths of the stock market crash last year, so a lot of good news is already in the price, with $208 proving a ceiling three times this summer. However, there seems to be a floor around $190. The yield is 1.46%. The stock could well move sideways until third-quarter results clarify prospects.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.