Three-quarters of Britons don’t invest

Lack of knowledge is a key blocker, new interactive investor research finds, as it launches the new ii Managed ISA, where experts take care of your investments.

20th May 2024 13:17

by Myron Jobson from interactive investor

- Almost half (48%) of respondents who don’t currently invest said they would be more likely to do so if they received help

- Over two-fifths of respondents say managed portfolio services could help investors overcome common investment pitfalls

- With the new ii Managed ISA, customers can choose expertly curated portfolios that match the level of risk they’re comfortable with and that suit their long-term investment goals.

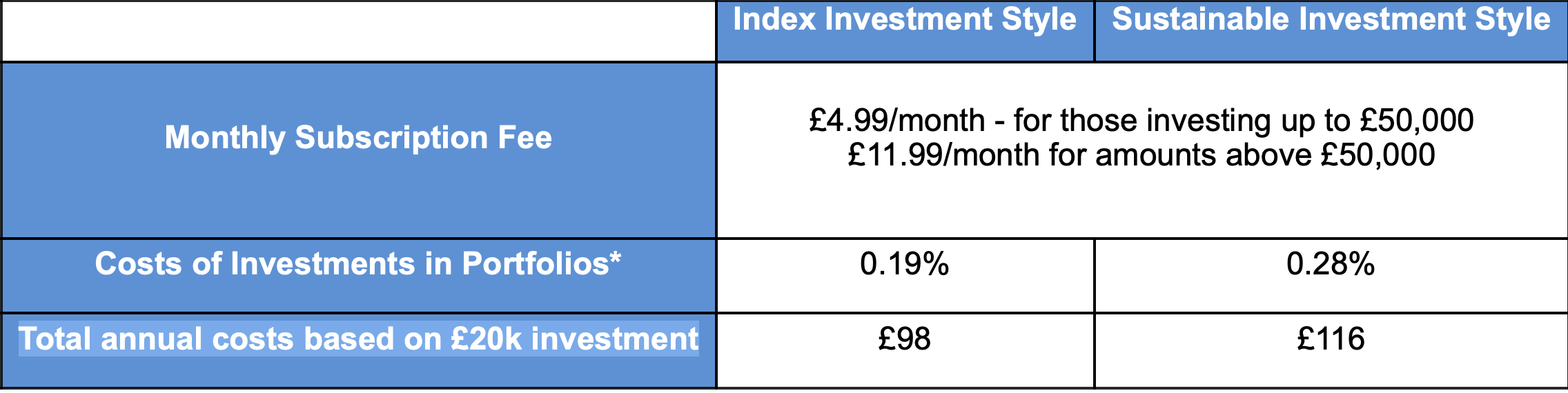

- Low-cost flat subscription fee: no extra cost for the ii Managed ISA. Customers pay the same platform fee as they would for a ‘do it yourself’ ISA. £4.99 monthly fee for the ii Managed ISA for those investing up to £50,000 and £11.99/month for amounts above £50,000. No separate management fees.

Over three-quarters (78%) of UK adults don’t invest, rising to 84% among women compared to 72% for men, with concerns over lack of knowledge and losing money cited as the key blockers, new research by interactive investor finds.

- Invest with ii: Open a Stocks & Shares ISA | Top ISA Funds | ISA Offers & Cashback

The survey of 2,000 UK adults, conducted by Opinium on behalf of interactive investor, the UK’s second-largest investment platform for private clients, also found that only 18% of adults aged 35 to 54 hold investments, fewer than 18-34 (22%) and the 55+ (24%) age groups.

Why aren’t people investing?

More than two in five of respondents (44%) said they have considered investing but decided against it for a variety of reasons.

The reasons in ranking order are: lack of general knowledge and understanding of investing (22%); concerns about losing money (20%), fear of market volatility (12%), and lack of confidence in their ability to pick the right investments (12%).

The rankings of the reasons are the same among the sexes, although men appear slightly more confident in their investing knowledge, with 9% claiming they don’t understand investing compared to 12% of women.

Adults aged 18 to 34 appear the most willing of the age groups to invest, with 56% claiming they’ve considered investing but decided against it because of their reservations, compared to 45% and 34% among the 35 to 54 and 55+ age categories, respectively.

Lack of general knowledge and understanding of investing is the most cited concern for the 18-34 (32%) and 35-54 (24%) age groups, while losing money is the top concern among the 55+ cohort (13%), with retirement income likely to be a key consideration.

Half of adults want help to invest

Investing is deemed too complicated (58%) and intimidating (56%) by the majority of the sample, which includes those who already hold investments. Another 46% believe the investment process is too time consuming.

Women are more likely to agree that investing is too complicated (63%), intimidating (61%) and time consuming (49%) than men (53%, 49% and 43% respectively). It is a similar story across the age cohorts.

However, almost half (48%) of respondents who don’t currently invest said they would be more likely to do so if as part of their investment product they could get help with building and managing a portfolio of investments to match their financial goals and risk appetite.

A significant portion of respondents also said that a managed portfolio investment service could help investors overcome common investment pitfalls such as over-emotional decision making (48%); not reviewing investments enough (44%); reviewing investments too much (39%) and not diversifying enough (41%).

ii Managed ISA

The research comes as interactive investor launches a new Managed ISA service, a guided investment service which makes it easier for people who want to invest.

ii Managed ISA has been available to existing ii customers from 15 May 2024, and is now available to new ii customers from today (Monday 20th May 2024).

Myron Jobson, Senior Personal Finance Analyst, interactive investors, says: “It is clear from our research that there is appetite among Britons to invest, but many are crying out for a helping hand to break through the complexity and intimidation to enable them to take the first step. This is where Managed ISA comes in. The service has been designed to be simple, convenient and affordable for investors, with no investment experience necessary and experts managing their investments for them.

“Some people prefer to call their own shots when it comes to investing and many of our customers do so successfully. But not everybody has the time, expertise or inclination to manage their own money. This is where ii Managed ISA can help. It’s not a binary choice between doing it yourself or using a guided service to help you do it. Both strategies can be equally rewarding. It all depends on what people want and are most comfortable with.”

How ii Managed ISA works

- The individual is asked a few questions about how much they want to invest and the level of risk they’re comfortable with – and there is plenty of guidance to help them along this journey.

- Based on the risk level and savings goals, they will then be matched to one of the managed portfolios.

- All they need to do then is check they’re happy with the portfolio recommended and open their ISA – after which it’s over to the experts to manage.

- The portfolios have two distinct styles, and five levels of risk to choose from. There are 10 portfolios in total, meaning investors can easily find a portfolio that matches the type of investor they are.

The two styles of investment portfolios are:

- Index investment style: This style aims to keep costs low by not making frequent changes to the investments held. The portfolio invests predominately in passively managed funds and provides exposure to a diversified range of investments.

- Sustainable investment style: This style aims to keep costs low by predominately investing in passively managed funds, in addition to seeking funds that integrate environmental, social, and governance (ESG) criteria into its investment selection. It will also invest in neutral assets such as cash and bonds.

- ii customers can have the best of both worlds – in addition, they can choose to manage their own investments alongside the ii Managed ISA at no extra cost (within the same flat subscription fee).

ii Managed ISA: cost breakdown

*Based on ii Managed ISA mid risk balanced portfolio. Includes OCF and Transaction Charges.

Commenting on the survey findings, Myron Jobson says: “Our research lays bare the dearth of an investment culture in the UK. This needs to change.

“Shying away from investing can severely limit your financial potential and stability. Stock market investments have a strong track record of producing inflation beating returns that far outstrip those of conventional savings accounts. Whether it’s buying a home, funding your children’s education, or ticking off items on your bucket list, not investing can make these aspirations harder to achieve due to the lack of substantial growth on your funds.

“A considered and balanced investment strategy, aligned with your risk tolerance and financial goals, is essential to securing your financial future.’

“Another key finding from the survey is that while both sexes share the same reservations about investing, men are seemingly more likely to push past these reservations to invest, compared to women.

“Meanwhile, middle-aged adults are less likely to hold investments. Middle age often coincides with significant financial responsibilities, such as paying off a mortgage, raising children, and even supporting ageing parents. These expenses can limit disposable income available for investment.

“These factors can also make middle-aged adults more cautious and less likely to hold a diverse portfolio of investments compared to younger individuals who might have fewer financial responsibilities and more time to recover from market fluctuations, or older individuals who might have accumulated more wealth and experience in managing investments.”

NOTES TO EDITORS

More information about interactive investor’s subscription plans can be found here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.