The three oil majors worth buying

Our leading industry commentator, author and columnist names the best oil stocks.

6th February 2019 10:40

by Rodney Hobson from interactive investor

Our leading industry commentator, author and columnist names the best oil stocks and when to buy them.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

While wild swings in oil prices have a direct impact on inflation, affecting all companies to a greater or lesser extent, the biggest impact is obviously on the oil companies themselves, particularly those heavily involved in exploration and upstream refining.

Heavy fixed costs severely curtail the scope for savings when the crude price falls; on the other hand, it is not easy to ramp up production when the price rises. Thus, most of every dollar change in the price of black gold tends to flow straight in or out of the bottom line. It makes investing in oil companies something of a rollercoaster ride.

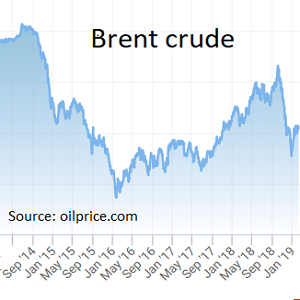

Over the past 50 years, crude has lurched from $20 a barrel to $120 and back to $20. Then it shot to $160 and, just as abruptly, fell all the way to $35.

In the past 12 months alone, crude oil has risen from $65 a barrel to $85 in October, then slumped alarmingly to $50 on Christmas Day before edging back above $60.

Source: interactive investor

So long-term investing in oil stocks is not for the fainthearted. On the other hand, the sector has provided a good stream of returns in the form of dividends to steady the nerves.

Results tend to be detailed and complicated. Take the underlying figures in preference, which are fortunately the ones that the oil companies tend to highlight.

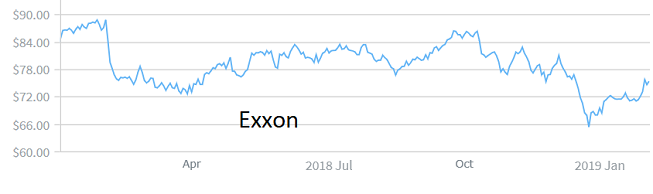

Figures this month from US giant Exxon Mobil (NYSE:XOM) reflect the vagaries of the crude market. The final three months of 2018, also the fourth quarter of Exxon's financial year, showed how the tail-off in crude prices took its toll. Earnings dropped from $8.4 billion to $6 billion in the quarter, detracting from a 6% rise to $20.8 billion for the full year.

Source: interactive investor Past performance is not a guide to future performance

There are some promising points to note. The full-year cash flow from operating activities of $36 billion was the highest since 2014. A discovery offshore Guyana increased estimates there by more than 5 billion barrels. Upstream profits from outside the US doubled over the year. And the fourthh quarter, although showing a decline in profits, was much better than analysts expected. Hence the 3.4% jump in the share price immediately after the announcement.

The past two years or so have been disappointing for the Exxon share price, which peaked at $94 in mid-2016. Since then we have seen a succession of ever lower peaks and troughs, the lowest point being $68 at the end of 2018.

The shares are now back up to $75, a previous trough that could be a resistance point on the way up. However, at this level the markets are factoring in all the downside of the Trump-China trade wars and very little of the upside of any kind of boost to the global economy.

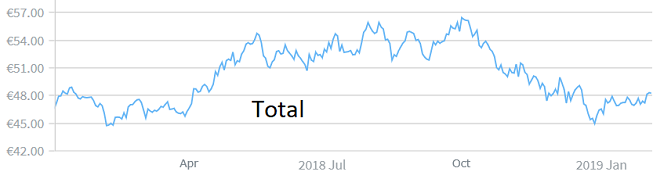

An alternative option in oil and gas is French group Total (EURONEXT:FP), which peaked much later than Exxon in September 2018 before a torrid three months took the shares down to €46. Although the economic slowdown in the eurozone was probably a factor, that looks like clear overselling.

Source: interactive investor Past performance is not a guide to future performance

It is true that a messy Brexit is likely to inflict as much pain on European Union members as on the UK, but oil giants are truly international so it is wrong to worry too much about local factors.

Total currently stands at around €49, where it offers a juicy yield of 5.2% on an undemanding price/earnings (PE) multiple of 16.8.

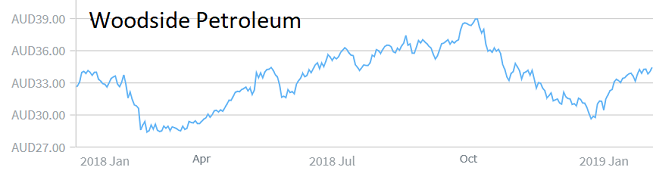

Shares in Australia's biggest producer Woodside Petroleum (ASX:WPL) have followed a similar pattern to Total, diving from A$39 at the start of October to A$30 just before Christmas. The recovery to A$34.50 is stronger but the yield of 3.9% is still a carrot.

Source: interactive investor Past performance is not a guide to future performance

Hobson's choice: Buy Exxon at around $75. At worst, the solid dividend, giving a yield of 3.4%, should compensate for any slippage in the share price. Buy Total below €50. Buy Woodside below A$35.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.