Three investments that thrive after the Fed’s first rate cut

The Federal Reserve’s actioned its first rate cut since 2020. But we’ve seen a 'first cut' many times before, and those periods can show us which assets tend to come into their own after a trimming.

27th September 2024 11:02

by Russell Burns from Finimize

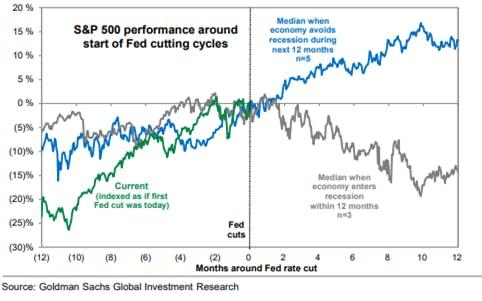

- The S&P 500 has returned an average of over 10% in the 12 months following the Fed’s first rate cut – if the economy avoids a recession

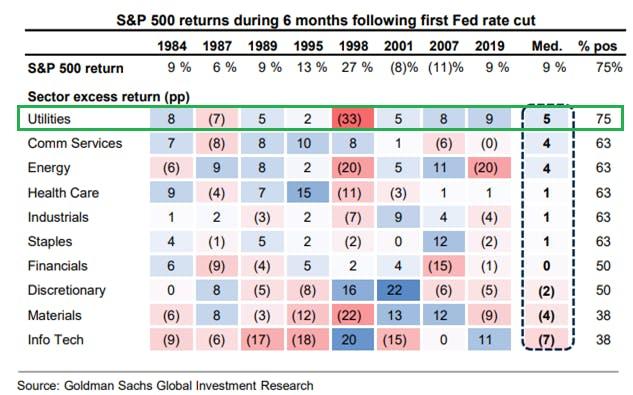

- The utilities sector has historically been the best-performing one in the six months after the first rate cut

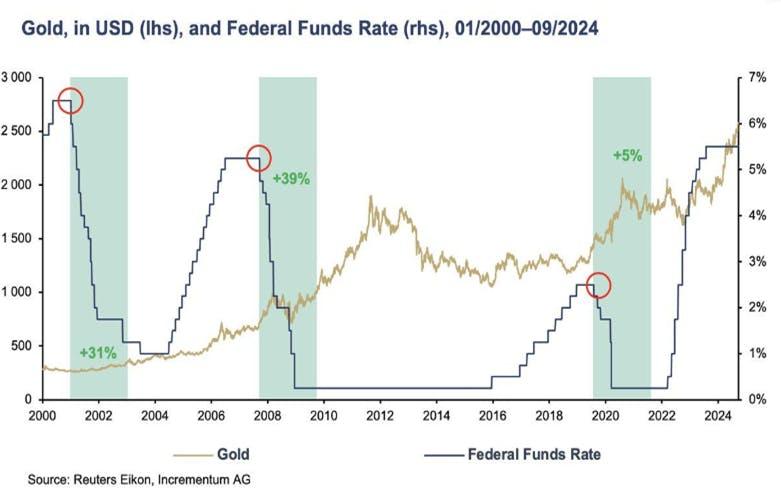

- Gold’s price usually moves higher following the first rate cut, and concerns about the growing US debt burden and ongoing central bank buying could keep its price on an upward trajectory

The Federal Reserve (Fed) cut interest rates for the first time since March 2020 last week. What’s more, the central bank opted for a 0.5 percentage point trim instead of the standard 0.25. Now, history doesn't necessarily repeat itself – but it often rhymes.

So, I’ve taken a look back in time to see which investments have performed well when interest rates are first cut, and put together something of a cheat code for post-trim ideas.

Idea number one: stocks

The chart below shows the performance of the S&P 500 Index for the 12 months before and after the first rate cut. The green line is the current performance, up until September 12th, which is why it stops at zero just ahead of the interest rate cut. The blue line is the S&P’s median return when there was no recession in the following 12 months after a cut. You can see that in that environment, the index averages returns of around 12%. The gray line is the median S&P performance when the economy entered a recession in the next 12 months. That’s a problematic outcome for stocks, so you’ll see a fall of around 15%.

You’ll notice a sharp fall in the green line from one to two months ago. That’s when investors panicked about weak US economic data, and the risk of a recession briefly rose. See, company earnings fall sharply if a recession hits, and rate cuts aren’t always enough to support the economy and the stock market.

The S&P 500 index returns for 12 months before and after the first interest rate cut, in both recessionary and non-recessionary conditions. Source: Goldman Sachs

If you believe the US economy will avoid a recession, then you might be expecting a repeat of those roughly 12% returns. In that case, you may want exposure to an S&P 500 ETF.

Idea number two: gold

Gold’s price typically increases after the first rate cut. You can see in the chart below the gold price (gold-coloured line, left-hand axis) and the interest rate level – specifically, the federal funds rate (blue line, right-hand axis). The red circles indicate the first interest rate cut in their respective cycles. Put them all together, and you’ll notice that the gold price usually rallies in the period following that first rate cut.

Gold price in US dollars (left-hand axis) after the first interest rate cut. Sources: Incrementum AG, Reuters Eikon.

Gold has performed well over the past couple of years, despite interest rates reaching over 5% for more than a year. That’s interesting: higher interest rates have historically made the precious metal look less attractive to investors, as it doesn’t pay holders dividends or provide them with cash flows. But that wasn’t the case this time. Central banks around the world have been buying gold in earnest to diversify their US dollar holdings – and, in turn, they pushed up prices. Looking forward, investors are expected to keep the price propped up. See, the US’s debt pile has reached alarming levels, and it may continue to mount up if the government approves hefty spending to spur on the economy. Investors worried about a potential default may well flock toward gold, then, for its safe-haven status. Plus, lower rates reduce the purchasing power of the US dollar, creating another reason to diversify away from the greenback. So if you think the precious metal will pick up as it has done before, and want exposure to gold’s price without buying the metal itself, a gold shares ETF could be worth a look.

Idea number three: utilities

If you’re already considering the S&P 500 (or any wider basket of stocks) for a post-cut investment, you might want to think about zooming into the sectors that benefit the most in that environment. The chart below shows that utilities ranked as the best-performing sector in the six months following the first cuts in previous cycles, outperforming the S&P 500 75% of the time by a median of five percentage points.

S&P 500 sector returns during the six months following the first Fed rate cut. Source: Goldman Sachs.

The sector has been the best performer in the S&P 500 this year, up 26% so far. Remember, investors have been backing utilities as an indirect AI play, as the data centres fuelling the tech devour a ton of power. And as a defensive sector, utilities should offer protection in case of an economic slip-up – they’re always in reasonable demand, after all. Plus, they pay a reasonable 2.7% dividend on average.

If you think utilities could repeat their previous successes, a utilities sector ETF could be the way to go. It’s also worth noting that some utility companies like Constellation Energy Corp (NASDAQ:CEG) and Vistra Corp (NYSE:VST) are more heavily exposed to AI power demand. In fact, both stocks picked up sharply on Friday: news broke that Constellation Energy was set to restart the Three Mile Island nuclear plant, and Microsoft promised to buy all the power it produced for the next 20 years.

Russell Burns is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.