Three funds to protect against election volatility

Saltydog Investor looks to the bond market for income and portfolio protection.

17th June 2024 13:41

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After a difficult April when 24 out of the 34 sectors that we regularly report on made losses, last month we saw a distinct improvement. During May, 27 sectors rose but mainly because of their performance in the first couple of weeks. Only two sectors, the Short-Term Money Market and Standard Money Market sectors, managed to make gains in each of the last two weeks of the month.

The first couple of weeks of June have been better, but it feels like a bit of a rollercoaster ride. A couple of good weeks followed by a couple of bad ones.

As we count down to the election, we are concerned that volatility might increase. We saw stock markets in South Africa and India fall during their recent elections as both incumbent leaders lost their majorities, but they are now heading back up. Since the European Parliament elections, the German DAX has fallen by 3.5%, the Spanish IBEX has dropped 3.9%, the Italian MIB is down 6.2%, and the French CAC 40 has lost 6.7%.

There is no way of telling how markets will react to the result of the UK election, so we need to be aware that we are heading towards an event that could change market momentum.

Invest with ii: How Bonds & Gilts work | Tax Rules for Bonds & Gilts | What is a Managed ISA?

Investors have a choice to make. They can ignore it and accept some short-term excitement. But in the long run, it probably will not make a lot of difference. Or, they can sell up and hunker down until it is all over, and then go back into the markets. We are opting for the middle ground. Over the last couple of months, we have avoided increasing the overall amount invested in the most volatile funds, while adding to three funds that have been making steady progress since we went into them last year.

- Benstead on Bonds: should investors be worried about a Labour government?

- DIY Investor Diary: why I’m ‘all in’ on this volatile gilt

They are the MI TwentyFour AM Monument Bond, Schroder High Yield Opportunities, and Invesco High Yield funds.

There are a couple of things that we look at when assessing the potential volatility of a fund. The first is which sector it is in. We look at the historic performance of the sectors and use that to put funds into our Saltydog Groups. They range from “Safe Haven”, through to “Full Steam Ahead”. Every week we also calculate a “Vindex” ranking for each fund.

We do this by working out the standard deviation for each fund in our analysis over the last 12 weeks. Initially, we just published the actual standard deviation for each fund, but we soon changed it to a decile ranking system. Decile one for the funds with the lowest standard deviation and decile ten for the funds with the highest standard deviation. We call this the Vindex (short for volatility index).

Last year, when we started reducing the amount that we were holding in the money market funds: one of the first funds that we invested in was the MI TwentyFour AM Monument Bond. That was in June, and at the time was in Vindex One. It is in the Specialist Bond sector and invests in European and Australian asset-backed securities – things like mortgages, car loans, credit cards, student finance, etc.

A few months later we bought the two Sterling High Yield funds: Schroder High Yield Opportunities and Invesco High Yield. They were also in Vindex One at the time. Funds in this sector invest in sterling denominated (or hedged back to sterling) fixed interest securities with a credit rating below BBB minus. (Funds that invest in similar securities with a rating of BBB minus or above would normally fall into the Sterling Corporate Bond sector).

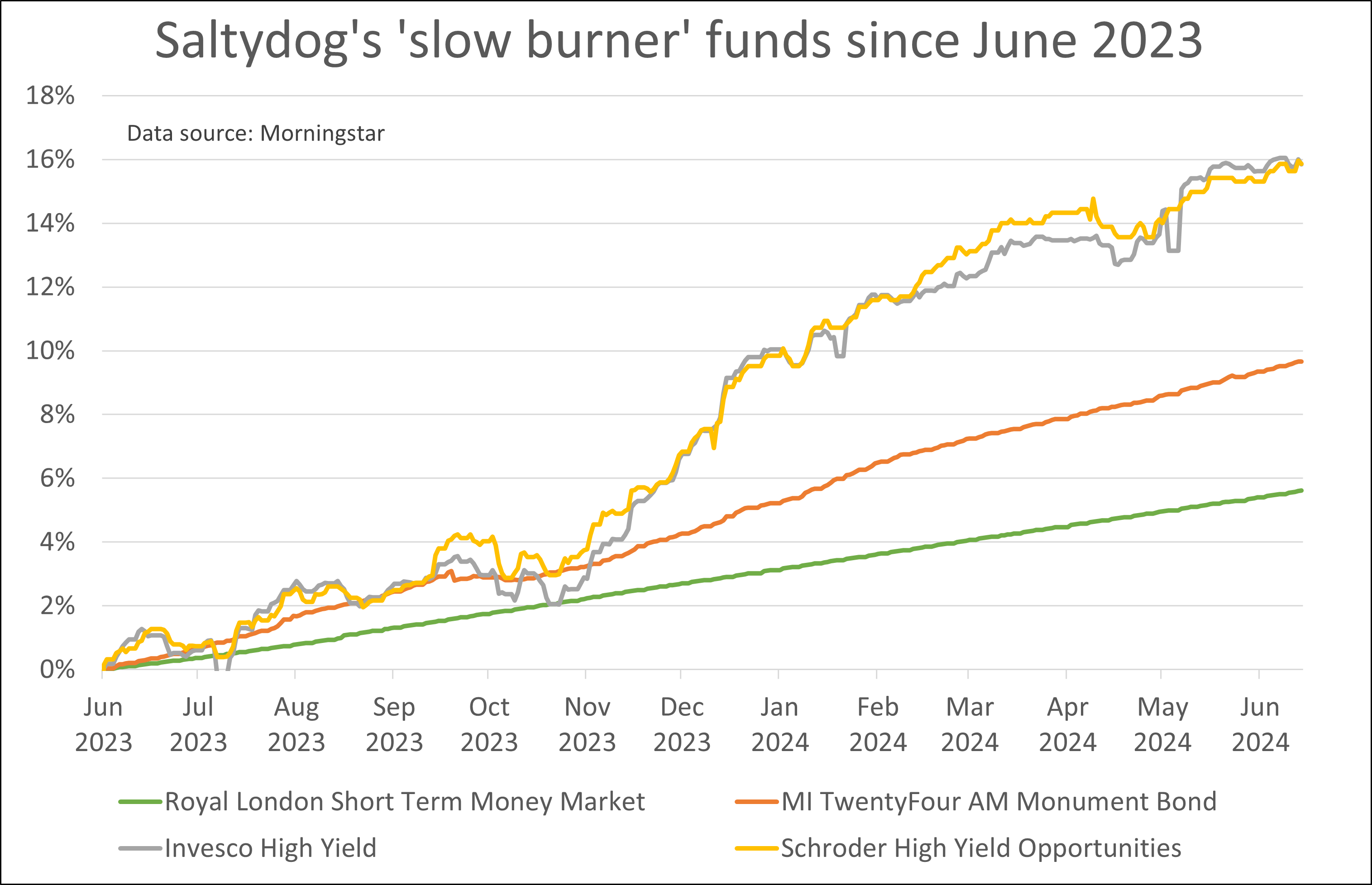

Since investing in these funds, they have consistently been in either Vindex One or Vindex Two, with the majority of their time in Vindex One. Here is a graph showing how they have performed since the beginning of June last year. I have also included the Royal London Short Term Money Market fund for comparison.

As you can see, the MI TwentyFour AM Monument Bond has only been slightly more volatile than the money market fund, but in just over a year has gone up by 9.7%, compared with 5.6% for the Royal London fund. It is worth pointing out that on rare occasions, the MI TwentyFour AM Monument Bond has seen some larger falls. In March 2020, it fell by more than 6%, and between January 2022 and October 2022, it dropped by more than 5%.

Although still some of the least volatile funds that we analyse, the Invesco High Yield and Schroder High Yield Opportunities funds have done considerably better, especially over the last six months. However, they have also seen much more significant drops in the past. In March 2020, the Schroder High Yield Opportunities fund went down by 25%, and in June 2022 it fell by nearly 6%. The Investec fund dropped by similar amounts.

- Everything you need to know about investing in gilts

- Benstead on Bonds: why gilt auction access is a win for small investors

We do still hold some cash, and have not completely exited the money market funds, but are also comfortable having a relatively large part of the portfolios allocated to these three funds. They are higher risk, but still towards the bottom end of our volatility rankings, and have performed well over the last year.

In the next few weeks, we will sell any funds that break our usual investment rules, and probably will not replace them until after the election.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.