Three banks to buy and one to avoid

Our leading industry commentator, author and columnist tells us when to buy this trio of big US banks.

13th February 2019 10:30

by Rodney Hobson from interactive investor

Our leading industry commentator, author and columnist tells us when to buy this trio of big US banks.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Deutsche Bank (XETRA:DBK) is one of the best known financial firms in Europe and is a particularly popular trade among interactive investor clients. After a torrid 12 months it is time to question whether that standing is justified and whether it would be better to look across the Atlantic.

The German bank hit a low point in 2015, but has improved net income and pre-tax profits in each year since. Figures for 2018, revealed this month, were €300 million and €1.3 billion respectively. However, figures for the fourth quarter were decidedly worse than for the same period a year earlier.

On the credit side, Deutsche is reducing costs, though that has meant continuing job losses and a difficulty in retaining high calibre staff. It has also resolved all but one of the most serious litigation issues it has faced in recent years. However, it has never fully bounced back from the 2008 global financial crisis, and its attempts to move from corporate banking into investment banking to compete with Wall Street rivals have been thwarted by fines and management reshuffles in a highly competitive market.

The shares have lost more than three-quarters of their value in less than four years, falling from €33 to around €7.50, where they yield a measly 1.5%. Since the financial crash there have been three rights issues, with shareholders stumping up a total of €27 billion.

Source: interactive investor Past performance is not a guide to future performance

Deutsche is a global bank but it cannot avoid being affected by events in its home territory. The impact of Brexit, however it works out, will be added to the current dramatic economic slowdown in the eurozone and continuing financial problems in European Union member states.

Life is admittedly uncertain in the United States, but the world's largest economy has survived, and even thrived in two years under President Donald Trump. Growth is slowing but is still way ahead of Europe, and any settlement of the trade wars with China could be a major boost.

Interest rates have edged higher, allowing lending margins to improve, though investors should remember that further rate rises have been put on hold.

The best chance to invest has gone: it fell just before Christmas when a dire December turned into a January recovery. Edmond Jackson, interactive investor's companies analyst, quite rightly spotted the sector as a contrarian investment a month ago. However, some shares are currently stalled around a previous support level. If they break through there should be $2-$3 upside in pretty short order.

- Stockwatch: Sound rationale for buying US bank shares

- The tech share I want to own

- UK bank sector: What to expect this results season

JPMorgan Chase (NYSE:JPM) is the largest bank in the US and is led by Jamie Dimon, who has enhance his reputation by steering the bank through the financial crisis and the upheavals since while rivals fell by the wayside. He is set to stay for another four years.

JPMorgan raised its dividend by 40% in 2018, giving a yield of 2.65%. The price/earnings (PE) ratio is an undemanding 11.2 times.

Source: interactive investor Past performance is not a guide to future performance

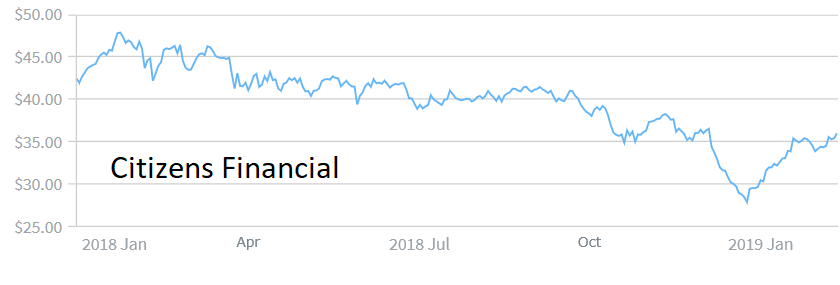

Citizens Financial Group (NYSE:CFG) is the holding company that owns Citizens Bank. Its shares were knocked back heavily last year, opening up a buying opportunity for contrarian investors.

At $36 it trades on only 10.2 times earnings and offers a decent yield of 3%.

Source: interactive investor Past performance is not a guide to future performance

US Bancorp (NYSE:USB) is another regional bank. Fourth quarter earnings were $1.10 a share, up from 97 cents a year earlier and better than the forecast $1.06. Bancorp cited a 4% increase in revenue from lending as a result of higher interest rates.

Source: interactive investor Past performance is not a guide to future performance

The shares have rallied since hitting a low of $44 just before Christmas but ran out of steam at $52, a level they should break back above. At $51 the PE is 12.4 and yield 2.6%.

Hobson's Choice: Buy JPMorgan Chase below $104, Citizens below $37 and US Bankcorp below $52. Avoid Deutsche Bank, the worst may not be over yet.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.