These software stocks could benefit most from the AI wave

14th June 2023 11:10

by Stéphane Renevier from Finimize

AI is set to shake up a lot of industries, and this new framework can help you pick the most promising software stocks for this moment, including the ones that seem just a bit outside of the fray.

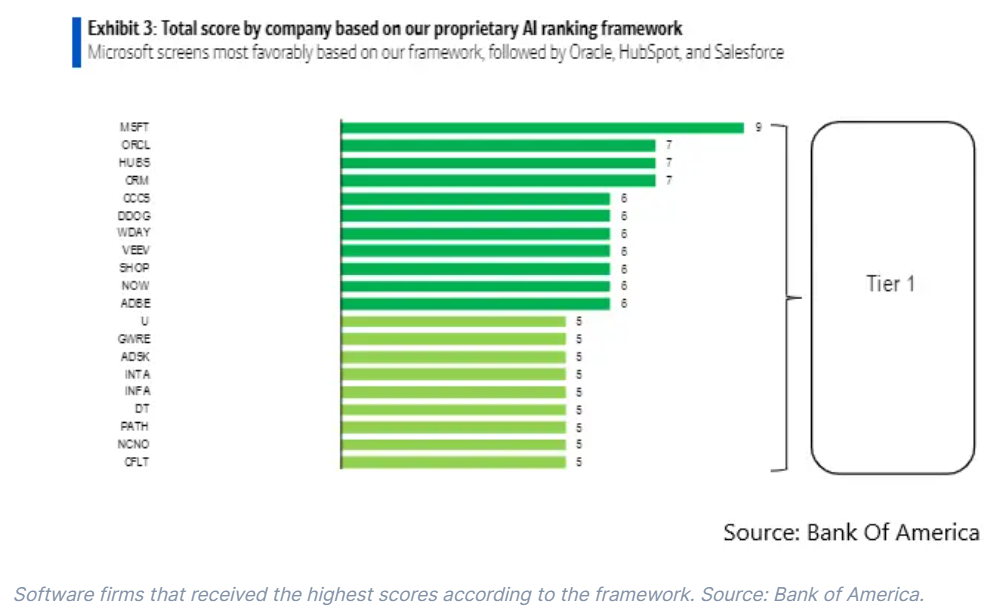

To try and differentiate the AI winners from the losers, Bank of America analysts scored software companies on 13 attributes.

Microsoft came up top, while Oracle, HubSpot, and Salesforce tied for second.

To best profit from this “software AI” theme, consider spreading your bets across different firms and software sub-categories.

AI is set to shake up a lot of industries, and software is going to be one of the first to feel the vibes. Of course, they won’t all benefit equally from the coming tech revolution. That’s why Bank of America’s developed a framework to help you pick the most promising software stocks for this moment, including the ones that seem just a bit outside of the fray.

What’s the framework?

The investment bank’s analysts pinpointed 13 factors that’ll drive AI success for software firms. Then, using a simple yes-or-no system, they scored each company on their AI game.

They kicked off with a round of nine questions about each company’s positive attributes, with every “yes” worth one point and every “no” worth zero.

Does the company have top-tier data from the industries it competes in? For AI, data is like fuel for a car – the more and better the fuel, the better and longer the car can run. And it’s not just about quantity: quality, relevance, and uniqueness matter too, and can provide a significant competitive advantage to the business.

Does the company boast a large user base in its competing industries? More users mean more data for refinement, leading to improved products and insights.

Does the company have international reach? Firms with a global presence not only have more opportunities to sell, but they’re also more likely to convert those opportunities, and upsell new AI products and services down the road.

Can the company generate revenue from diverse sources? AI is primarily an enabling technology, meaning it’s most valuable when it can improve existing products, rather than being used on its own. So the more useful the products and use cases the company has, the more likely it is to benefit from AI.

Does the company invest massively in R&D (over $1 billion over the next year)? Firms that invest heavily in research and development are likely to unlock more value and possibilities with AI, laying the foundation for future innovation.

Does the company offer leading solutions for specific sectors? AI offers the greatest benefit when it’s applied to narrower, industry-specific use cases, so a company that is a leader in its sector is likely to profit more.

Are the company’s AI offerings or roadmap designed to attract more customers through freemium versions? By offering free AI services, firms can pique customers’ interest in their other products, broadening their reach, and potentially increasing sales of paid products.

Is the firm meeting stringent data governance and compliance requirements?

AI doesn’t just present risks (like reputational risks) but it’s also likely to be more heavily regulated going forward, so the companies with the strongest compliance and data governance standards are likely to be heavily favored.

Does the firm have a strong sales channel? Companies with comprehensive sales coverage are in a better position to cross-sell and upsell AI features to their established customer base, enhancing their monetization potential.

The analysts didn't shy away from the tougher stuff. They posed four tricky “red flag” questions, where every “yes” docked a point from the company's score, while a “no” kept things as they were.

Is the company's user base mainly consumers? Business users tend to be stickier and more loyal than consumers, who are more likely to switch to a competitor.

Has the company used a lot of mergers and acquisitions? Organically developed platforms often have more centralized and accessible data, positioning them better than companies that heavily rely on M&A for product expansion.

Does the company offer solutions that are transaction-based or centered on workflows? Workflow-oriented solutions, which help manage and automate a series of tasks, tend to be more resilient to AI disruption, compared to transactional services, which are primarily focused on facilitating individual business transactions.

Could AI be a direct threat to the business? The easier AI can be used by rivals, the more the company’s competitive position will be threatened.

So what are the results?

In what is in no way a shocking turn of events, Microsoft Corp (NASDAQ:MSFT) topped the chart with a perfect score of nine. The tech giant checks literally every box with its industry-leading platform, enormous and diverse user base, potent salesforce, and commitment to infusing AI across its product range. And on top of that, it's one of the biggest spenders on AI R&D and holds an exciting future map for AI product development.

Sitting pretty at a somewhat distant second place is Oracle Corp (NYSE:ORCL), an infrastructure provider serving over half a million business customers globally with AI already powering many of its offerings. Just like Microsoft, Oracle is poised to thrive with AI, given the potential for AI integration within its business model.

HubSpot Inc (NYSE:HUBS) and Salesforce Inc (NYSE:CRM), two front-office software providers, also make the cut with a respectable seven points. With AI's potential to boost sales, marketing, customer analytics, e-commerce optimization, and advanced chatbot development, front-office software companies like these two are set to gain some elevation from generative AI's rise.

Let's not forget the back-office champs either. Software companies that offer tools for supply chain optimization, business management, contract review, employee performance prediction, and risk assessment also stand to gain. Workday Inc Class A (NASDAQ:WDAY), CCC Intelligent Solutions Holdings Inc (NASDAQ:CCCS), and ServiceNow Inc (NYSE:NOW) are top of the pack in this category, scoring a six.

Desktop app maker Adobe Inc (NASDAQ:ADBE) also scores a six – and not surprisingly, considering its massive global customer base and the potential to incorporate AI across its diverse product portfolio.

Other noteworthy mentions scoring a solid six are front-office software companies Veeva Systems Inc Class A (NYSE:VEEV) and Shopify Inc Registered Shs -A- Subord Vtg (NYSE:SHOP), as well as infrastructure provider Datadog Inc Class A (NASDAQ:DDOG).

So, what’s the opportunity, then?

The Bank of America's framework is simple but powerful: just by asking some intelligent questions, it helps filter down the possible winners. If you're keen to invest, spreading your bets across different software sub-categories may be a smarter move than dropping all your eggs in one basket. You can keep tabs on this "software AI" theme in real-time using a watchlist I've curated in the “market” tab of the app. But keep in mind, investing in tech, especially AI-centric tech, carries risks. It's a sector that's seen rapid growth, and big losses can come as fast as big gains, so make sure to invest wisely and carefully.

Stéphane Renevier is a global markets analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.