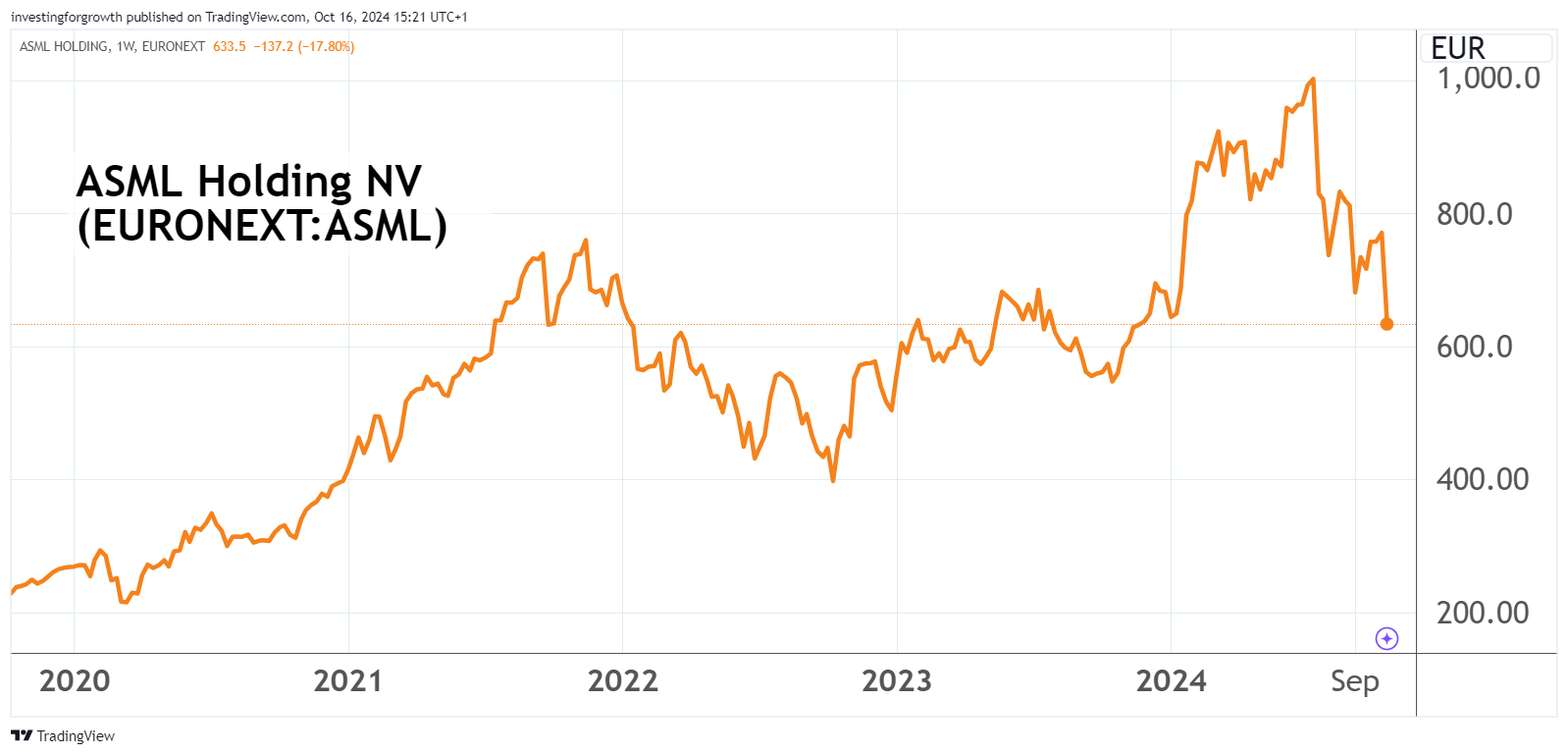

Tech giant and Scottish Mortgage stock ASML plunges

Once a star of the global technology sector, shares are trading more than a third lower than their summer peak. Graeme Evans explains what’s gone wrong.

16th October 2024 15:06

by Graeme Evans from interactive investor

Technology investors have been braced for more earnings volatility after chip equipment maker ASML Holding NV (EURONEXT:ASML) showed the gulf between surging AI demand and pace of recovery in other areas.

Europe’s largest technology stock and a top ten holding of Scottish Mortgage Ord (LSE:SMT) investment trust yesterday endured its worst session since June 1998 as the semiconductor supplier cut its 2025 sales guidance in a disappointing set of third quarter results.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

ASML warned that non-AI areas were weaker for longer than expected, leading companies that make logic chips to delay orders and for customers that make memory chips to only plan limited new capacity additions. This is expected to continue into next year.

Shares across the sector were shaken by the update, with NVIDIA Corp (NASDAQ:NVDA) down by 4.7% in Tuesday’s session and the Philadelphia Semiconductor Index lower by 5.3%. ASML’s weighting also meant it was the worst day for the Euro STOXX 50 since early August.

Source: TradingView. Past performance is not a guide to future performance.

UBS Global Wealth Management said the update highlighted the division between strong AI demand and mixed trends in more traditional segments such as smartphones, PCs and consumer electronics.

It added: “Based on our recent supply chain checks, the bifurcated trend will likely continue in the near term.

“As more tech companies report their third-quarter earnings in the coming days and weeks, we expect further market swings in a month that has historically seen the highest tech volatility.”

- ii investment performance review: Q3 2024

- Beyond the ‘Magnificent’: five big growth themes to watch

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The plunge in ASML’s share price came as the company reported third-quarter bookings of €2.6 billion (£2.2 billion), about half the level forecast. Its new guidance for 2025 pointed to a 15-20% downgrade to consensus earnings forecasts.

Bank of America today retained its Buy rating but lowered its US-listed price target from $1,149 to $939 based on tentative expectations that ASML will see a more meaningful recovery in 2026. The shares started today’s Wall Street session at $730.

The bank’s new target is based on 24 times projected earnings, down from 28 times and within ASML’s historical range of between 17.5 and 35 times. The bank said ASML's capital markets day in mid-November will be critical to better understand the likelihood of a big recovery in 2026.

The event will also provide an opportunity for ASML to reiterate or review its 2030 revenue guidance of €44-60 billion (£36.8 billion-£50.2 billion). The mid-point would imply about.18% earnings compound annual growth from 2025 to 2030.

The stock is double October 2022’s level but down by a third from its July peak, a performance not helped by export restrictions. ASML said yesterday it expects China revenues to be more in line with historical levels at around 20% next year.

- US Q3 results season: Wall Street braced for slower growth

- An election-year playbook for investors

- Three investments that thrive after the Fed’s first rate cut

Scottish Mortgage first took a stake in 1996 but the weighting of the former Philips and ASMI joint venture reduced during this year from 8% to 3.7% as the seventh largest holding.

It has described ASML as “probably the most important company that nobody has heard of”.

As the leading supplier of lithography equipment, ASML works with all the major semiconductor manufacturers including Samsung and Intel.

Scottish Mortgage added in last year’s annual report: “The semiconductor industry depends on ASML’s exceptional engineering skills to produce cutting-edge chips, and AI is just one driver of the strong demand we anticipate over the next decade.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.