The tech fund we bought that’s up more than 30% this year

12th June 2023 13:00

by Douglas Chadwick from ii contributor

Saltydog Investor switched out a Europe fund to make room for this top-performing strategy.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

The general investment climate remains challenging. Last month, only 27% of the funds we analyse rose in value, and less than 7% have risen in each of the last three months. This explains why our demonstration portfolios remain predominantly in cash and money market funds.

There was a time when there was not a great deal of difference between leaving our money on our trading platform, where it earns interest, and investing it in the money market funds. That is no longer the case. The Royal London Short Term Money Mkt fund, which we bought last October, has risen by more than 1% in the last three months. We also hold the L&G Cash Trust fund and have recently added the abrdn Sterling Money Market fund.

- Invest with ii: Top Investment Funds | Index Tracker Funds | FTSE Tracker Funds

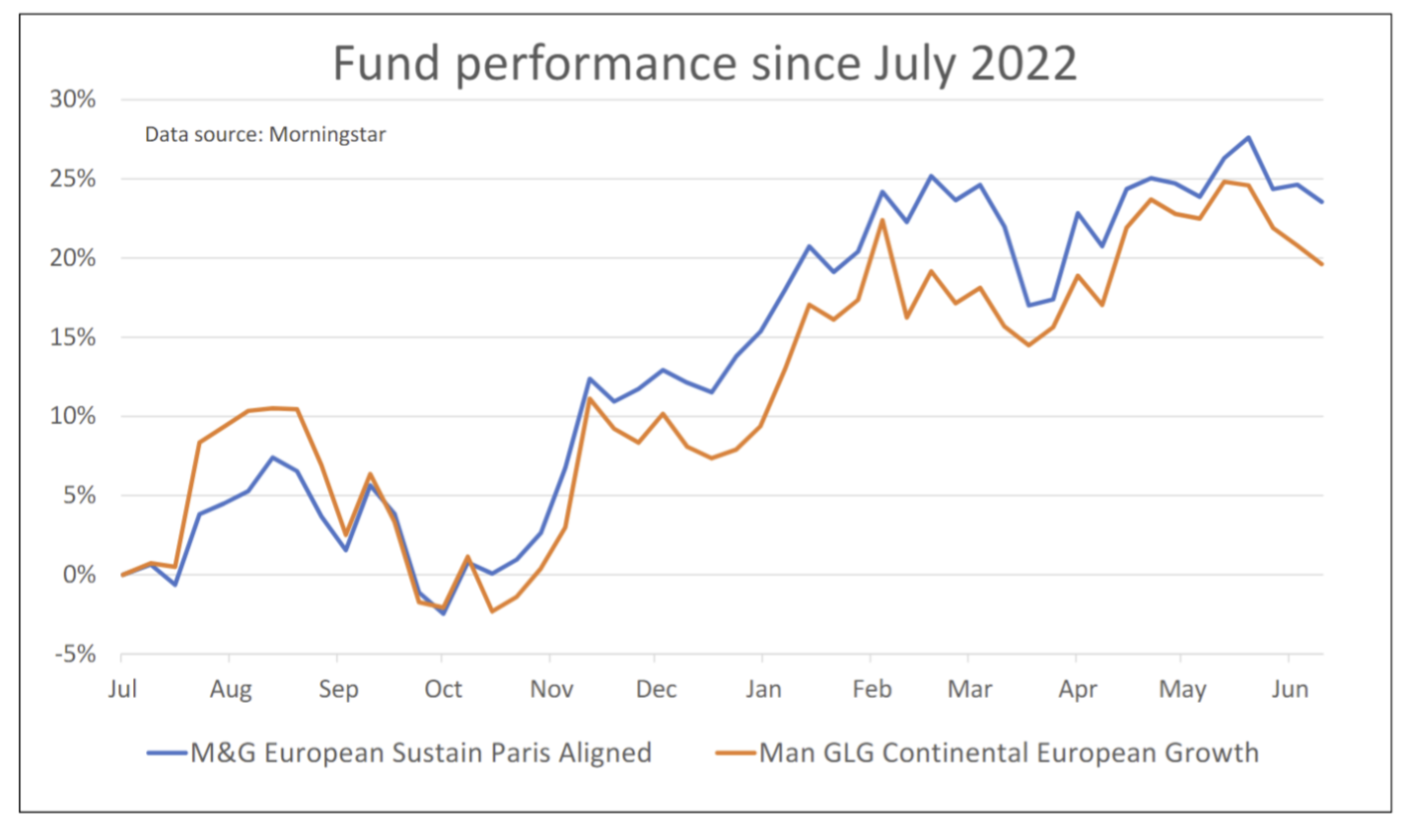

Until recently, our next largest holdings have been in funds buying European shares. We invested in the Man GLG Continental European Growth fund last November and the M&G European Sustain Paris Aligned fund at the beginning of this year. They have both done reasonably well for us, but their performance has deteriorated in the past few weeks.

Past performance is not a guide to future performance.

We have now sold the Man GLG Continental European Growth fund.

Just because we are happy holding a lot of cash and ‘safe’ funds, does not mean that we are not always looking for sectors and funds that are performing well. If we see potential opportunities, like we did with the Europe funds, we are happy to dip our toes in the water with a relatively small investment. If the trend continues, we can increase our holding, but if it falters we can exit without having lost too much.

Although most sectors fell last month, including Europe funds, there were a few exceptions. The best-performing sector, by a significant margin, was Technology and Technology Innovations with a one-month return of 9.1%. The next best was the India/Indian Subcontinent sector, which made 4.1%.

- Why you may already be profiting from AI

- Be cautious of ‘AI tech hype’ as seven US stocks dominate returns

- The funds and trusts profiting from Nvidia’s unstoppable rise

- Ian Cowie: how to buy AI stock winners on the cheap

Last week, I highlighted the top 10 funds in May. All of them were either from the Technology and Technology Innovations sector or were funds from the Global and North America sectors, which also invest heavily in the large US technology stocks.

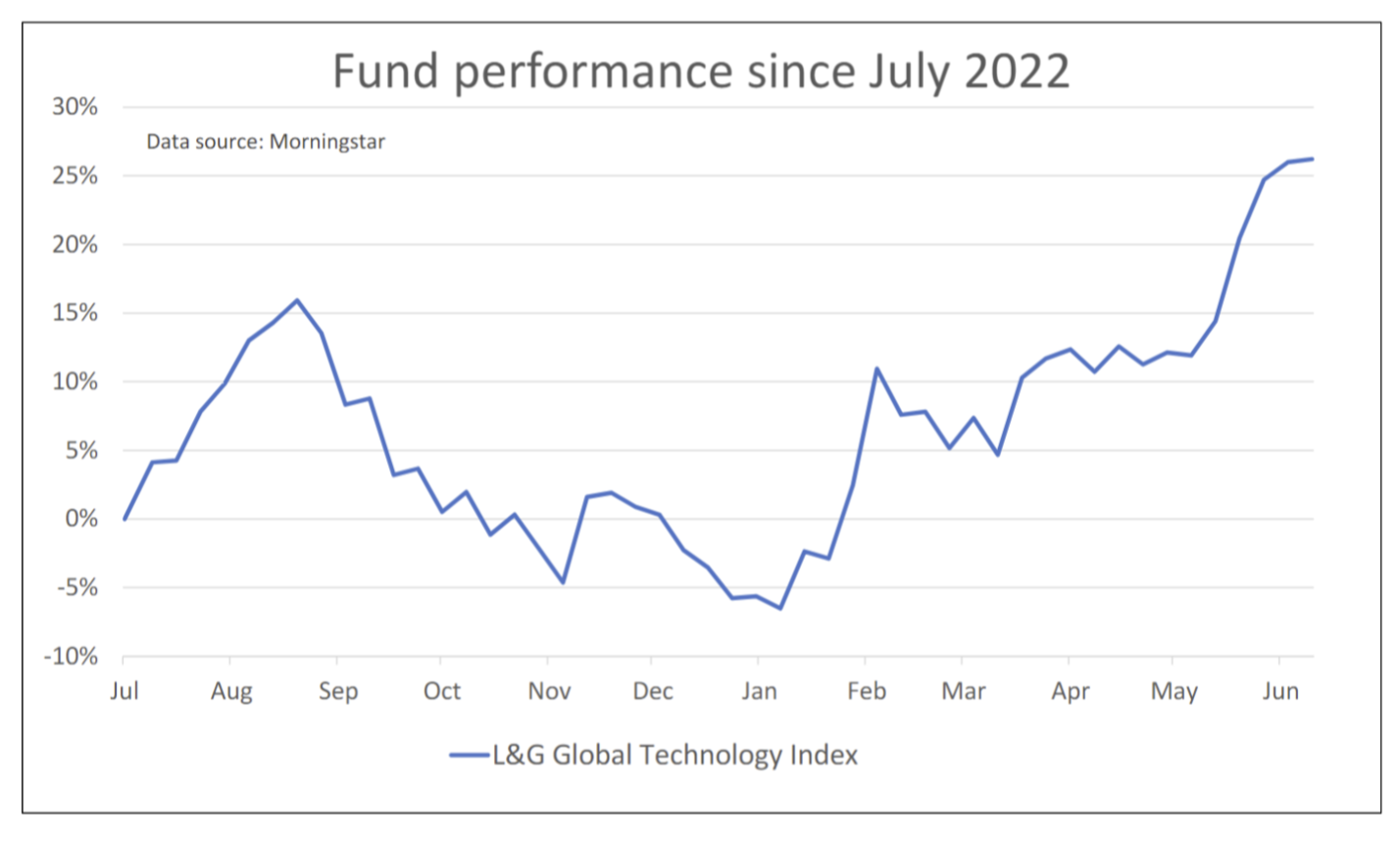

In the middle of the table was the L&G Global Technology Index fund with a one-month return of 13%. It has made further gains in the past couple of weeks. Since the beginning of the year it has gone up by more than 30%, but it has not been plain sailing. It shot up in January, did not do much in February, March or April, but has taken off in the past few weeks.

Our Ocean Liner portfolio has recently invested a small amount into this fund.

Past performance is not a guide to future performance.

My concern is that even though this latest surge has been going on for only a few weeks, we may have already missed the boat. Having said that, we know from past experience that when these technology funds get the wind in their sails, they can keep rising for longer than many expect. Only time will tell.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.