Stockwatch: is this unloved sector’s recovery rally sustainable?

These high-yielding shares were out of favour for a long time, but they’ve bounced back in recent months. Analyst Edmond Jackson studies performance and names his favourite stock to own.

10th September 2024 12:19

by Edmond Jackson from interactive investor

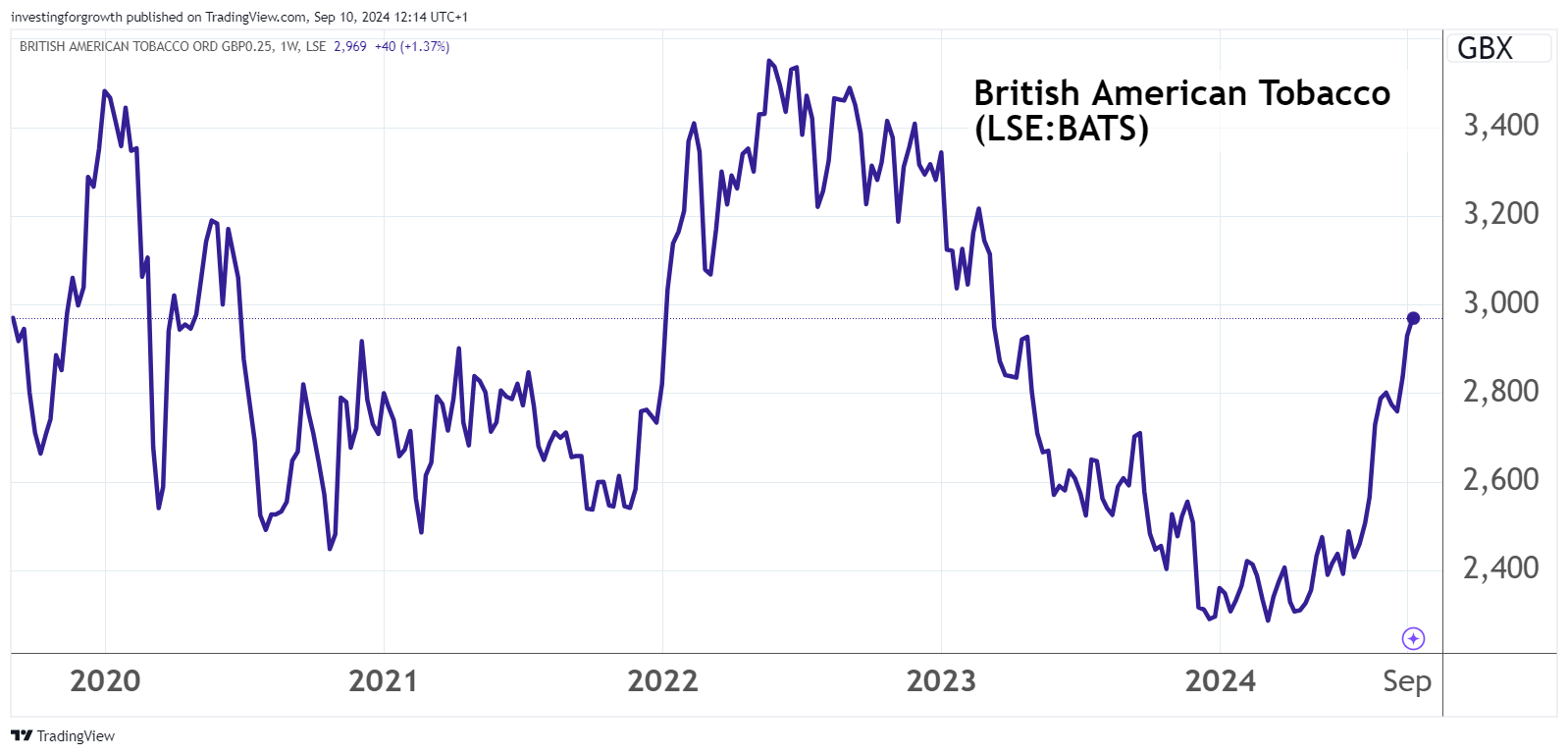

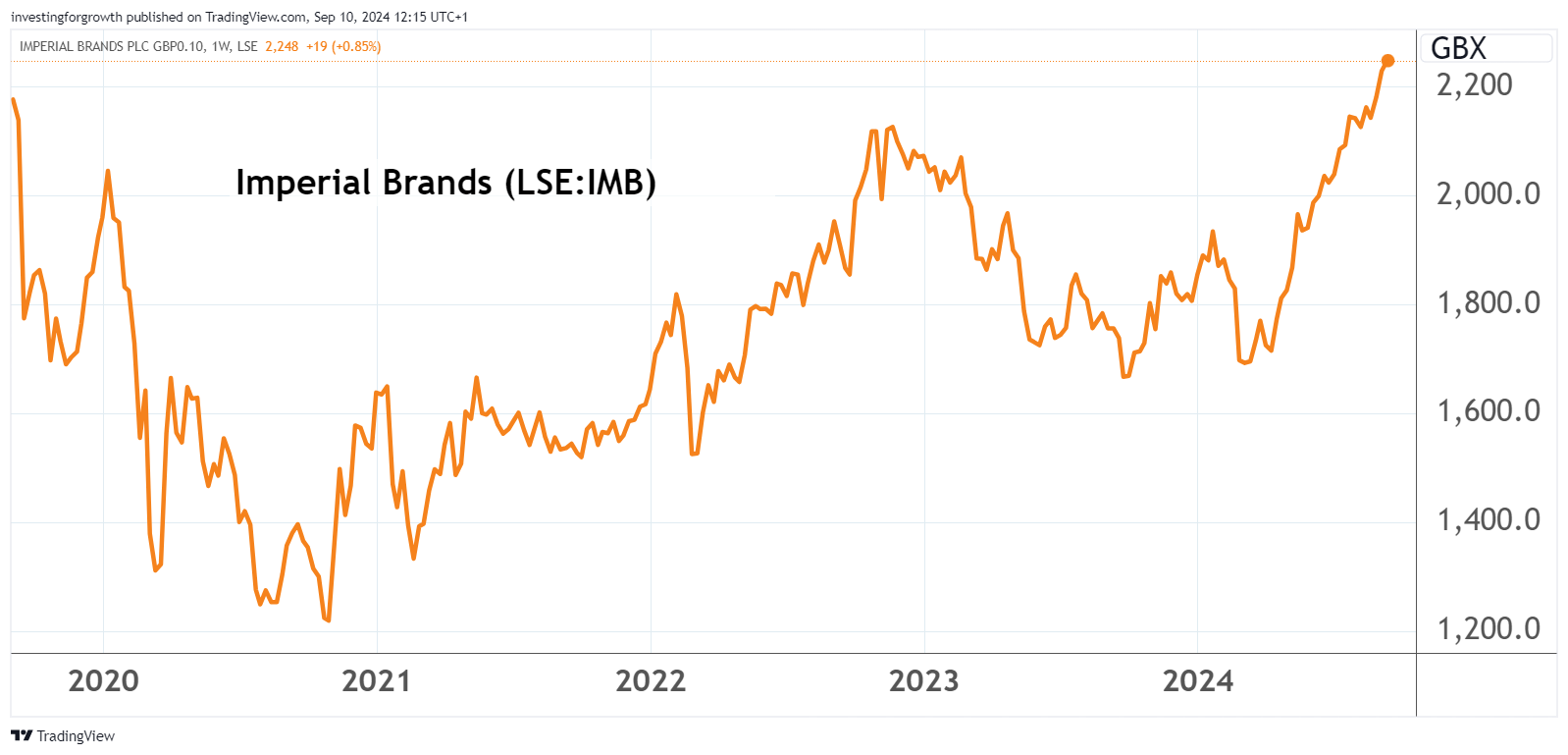

The two main London-listed tobacco stocks are up around a third since April, with charts in strong uptrends. But does this affirm recent gross under-valuation with further capital upside despite high yields, or have two fundamentally high-risk stocks been caught in a major shift from “growth” to “income” which can only run so far?

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Interestingly, it is Imperial Brands (LSE:IMB) that sports the better gain – up 33% versus 29% for British American Tobacco (LSE:BATS) – despite being less advanced in vapes, which arguably constitute the future for smoking-related companies. The re-ratings have been since 10 and 15 April, as if mainly sector than stock-related.

A five-year context conveys BAT engaging mean-reversion following a nasty drop during 2023 when governments initiated stiffer regulations against tobacco and vapes.

Source: TradingView. Past performance is not a guide to future performance.

Imperial has become a momentum stock, and it was notable yesterday how BAT rose 1% to over 2,970p, specifically when the US started trading. Perhaps investors in the States see UK stocks as better value than for example Philip Morris International Inc (NYSE:PM) which trades on a forward price/earnings (PE) multiple in the high teens and 5.2% prospective yield.

Imperial has re-rated from a 12-month forward PE of 5.5x and yield of 9.3% at the 1,680p April low, to 7.0x and just over 7% with the stock at around 2,255p.

Source: TradingView. Past performance is not a guide to future performance.

From BAT’s simultaneous low of 2,270p, it was on a PE of 6.3x and remarkable 10.8% yield, to 6.3x and 8.2% yield at 2,970p now – showing how, in the short term at least, an ultra-high yield does not necessarily mean a company going bust.

This was partly why I drew attention to asset manager and life insurer M&G Ordinary Shares (LSE:MNG) last time, yielding almost 10%, as you would think its activities would be less risky in the long run. It can be tricky to embrace an unloved big-name stock, yet over time the market is more a weighing than voting machine.

As expectations have shifted over the summer towards interest rate cuts, it appears the huge yields offered by smoking stocks created an inflection point. George Soros used to say: one “self-reinforcing trend” gets replaced by another and, despite the new Labour government’s early challenges, possibly international investors increasingly view London-listed equities as a relative haven.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- The shares the pros are backing to deliver their high yields

- The 20 most-popular dividend shares among UK fund managers

While UK small-caps might see profit taking in weeks ahead by investors sitting on big capital gains ahead of Labour’s 30 October budget, FTSE 100 stocks like these are dominated by institutions paying no tax.

Otherwise, the strength of re-rates is surprising versus the UK government seizing on Rishi Sunak’s objective to ban the sale of tobacco products, temporarily sunk by the general election thwarting this bill’s progress to law. Yet while this would represent the world’s toughest smoking ban, the UK is modest revenue in these multi-nationals’ global reach.

I therefore think the market has twitched from long-term fears, meaning these stocks festered to a 20-year low for Imperial and 14 years for BAT, now to a keen sense that dividend yields look robust for the next few years at least and remain attractive with interest rates set to reduce.

Operational and financial progress has been mixed

Imperial’s re-rating coincided with a 9 April update in respect of the first half to 31 March asserted “in-line” trading, although you could say a yield above 9% implied pricing for a worse-case scenario – hence a relief-rally was possibly triggered.

Group revenue appeared stodgy, with gains in the US, Spain and Australia “broadly” offset (as if not exactly) by declines in Germany and the UK. Affirmed guidance did however include a “step-up in adjusted operating profit growth” helped by price increases.

The mid-May interim results helped sustain the stock rally, citing price rises near 9% in tobacco more than offsetting a 6% slip in those volumes. Meanwhile, “new generation products” (vapes) grew revenue nearly 17% but represented only 7% of group revenue versus 13% at BAT.

Adverse foreign exchange movements meant a 2% slip in reported group revenue, but the market accepted how smoking products are proving more resilient than perhaps it had been pricing for.

But how sustainable is relying on price rises, despite the product’s addictive nature?

Also, how fair is it for Imperial to adjust for foreign exchange to re-present a 3% operating profit slip as a 3% gain? And working capital movements again compromised interim operational cash flow, resulting in £59 million absorbed. Paying out over £1 billion as dividends and £600 million deployed for buybacks, looked quite a balancing act versus the cash left.

I concede not to fully appreciate how buybacks were said to help adjusted earnings per share advance nearly 8%, given Imperial’s market value now nears £19 billion. Some 9% of the share capital has been repurchased since October 2022 but that obviously goes back a while. Total buybacks remain targeted at £1.1 billion for the current financial year to 30 September, so perhaps they have helped push the market price higher. The interim dividend rose 4%, affirming a “progressive” policy.

Attention will therefore be on a next trading update in respect of the full-year results to 30 September, as to whether the rally is clipped or sustained.

- The best income opportunities right now

- Lloyds Bank among FTSE 100 stocks paying £14bn in dividends

- Pros’ top reasons to be fearful and cheerful for rest of 2024

On 5 September, Imperial’s chief supply chain officer sold over £290,000 worth at 22,342p, although it’s hard to know whether this is a value judgment or cash needed for say for other personal reasons. It does not help how such announcements no longer appear to require the total holding to be mentioned, which would convey context.

The market’s harsh treatment of smoking stocks during 2023 leaves me wary that sentiment will not at some point twitch to fear again, especially if other governments follow the UK and further price rises will hurt revenues. But for now, I do not “fight the tape” versus a yield above 7% still. “Hold” and heed the update.

| Imperial Brands - financial summary | ||||||||

| Year-end 30 Sep | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Turnover (£ million) | 27,634 | 30,247 | 30,066 | 31,594 | 32,562 | 32,791 | 32,551 | 32,475 |

| Operating margin (%) | 8.1 | 7.5 | 8.0 | 7.0 | 8.4 | 9.6 | 8.2 | 10.5 |

| Operating profit (£m) | 2,229 | 2,278 | 2,407 | 2,197 | 2731 | 3,146 | 2,683 | 3,402 |

| Net profit (£m) | 631 | 1,409 | 1,368 | 1,010 | 1,495 | 2,834 | 1,570 | 2,328 |

| Reported earnings/share (p) | 66.0 | 147 | 143 | 106 | 158 | 299 | 165 | 251 |

| Normalised earnings/share (p) | 94.3 | 178 | 150 | 163 | 187 | 305 | 235 | 261 |

| Operating cashflow/share (p) | 330 | 320 | 323 | 337 | 420 | 229 | 334 | 337 |

| Capital expenditure/share (p) | 17.1 | 23.2 | 41.2 | 44.6 | 47.4 | 21.1 | 25.5 | 54.7 |

| Free cashflow/share (p) | 313 | 297 | 282 | 293 | 372 | 208 | 309 | 282 |

| Dividend/share (p) | 155 | 171 | 188 | 207 | 138 | 139 | 141 | 147 |

| Covered by earnings (x) | 0.4 | 0.9 | 0.8 | 0.5 | 1.2 | 2.2 | 1.2 | 1.7 |

| Return on total capital (%) | 9.9 | 11.3 | 12.3 | 10.4 | 13.7 | 17.2 | 13.5 | 19.3 |

| Net Debt (£m) | 12,664 | 11,925 | 11,220 | 11,348 | 10,325 | 8,786 | 8,405 | 8,385 |

| Net assets per share (p) | 554 | 595 | 605 | 519 | 515 | 566 | 722 | 670 |

| Source: historic Company REFS and company accounts | ||||||||

BAT numbers even more complex than Imperial

BAT’s dilemma was business sales in Russia and Belarus conspiring with foreign exchange headwinds to impact revenue by 8% in its first half to 30 June. Even organic revenue adjusted to constant exchange rates slipped nearly 1% - said due to US investment and negative wholesaler inventory movements. You would think such are part of normal business experience.

BAT’s highlighted motto is “building a smokeless world” with 18% of its revenue so far deriving from smokeless products. Quite whether that equates with Labour’s resolve to stamp out what ultimately compromises the NHS is unclear.

Reported operating profit fell 28% fall due to higher amortisation on US combustibles and lack of Russia/Belarus contribution; and even at the adjusted level it slipped 1%.

Slashing net finance costs by two-thirds, plus a radically higher contribution from associates and joint ventures, rescued reported interim pre-tax profit to a 6% advance – after which there was a lower tax charge also. It all shows how tricky are the moving parts within multinational tobacco groups to be able to forecast dependably.

In BAT’s favour is its adjusted operating margin sustained at 45% versus Imperial at 11%, helping sustain interim net cash from operations over £3 billion hence dividend payouts near £2.7 billion – plus some reduction in debt and buybacks.

I am therefore inclined to favour BAT of the two, with the caveat it is impossible to say when regulatory concerns may again hit sentiment. It appears that enough investors are prepared to take the dividends and not worry. According to 2023, there will not be another trading update until early December. Hold.

| British American Tobacco - financial summary | |||||||||

| Year-end 31 Dec | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Turnover (£ million) | 13,104 | 14,130 | 19,564 | 24,492 | 25,877 | 25,776 | 25,684 | 27,655 | 27,283 |

| Operating margin (%) | 34.0 | 32.2 | 151 | 38.2 | 34.8 | 38.1 | 39.8 | 38.1 | -57.3 |

| Operating profit (£m) | 4,453 | 4,554 | 29,547 | 9,358 | 9016 | 9,820 | 10,234 | 10,523 | -15,625 |

| Net profit (£m) | 4,290 | 4,648 | 37,485 | 6,032 | 5,704 | 6,400 | 6,801 | 6,666 | -14,367 |

| Reported earnings/share (p) | 230 | 249 | 1,360 | 260 | 247 | 273 | 289 | 294 | -645 |

| Normalised earnings/share (p) | 234 | 239 | 251 | 284 | 316 | 328 | 317 | 326 | 377 |

| Operating cashflow/share (p) | 253 | 247 | 261 | 449 | 393 | 426 | 423 | 442 | 497 |

| Capital expenditure/share (p) | 32.3 | 36.1 | 47.7 | 41.1 | 35.6 | 32.9 | 32.4 | 28.9 | 27.0 |

| Free cashflow/share (p) | 221 | 211 | 213 | 408 | 357 | 394 | 391 | 413 | 470 |

| Dividend/share (p) | 154 | 169 | 100 | 195 | 203 | 210 | 216 | 218 | 231 |

| Covered by earnings (x) | 1.5 | 1.5 | 13.6 | 1.3 | 1.2 | 1.3 | 1.3 | 1.4 | -2.8 |

| Return on total capital (%) | 19.8 | 16.3 | 23.6 | 7.2 | 7.4 | 8.0 | 8.4 | 7.8 | -15.2 |

| Net Debt (£m) | 15,003 | 17,276 | 45,649 | 44,259 | 42,243 | 40,088 | 35,933 | 38,590 | 33,897 |

| Net assets per share (p) | 263 | 439 | 2,649 | 2,853 | 2,786 | 2,732 | 2,924 | 3,371 | 2,350 |

| Source: historic Company REFS and company accounts | |||||||||

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.