Stockwatch: a turnaround prospect with 50% upside potential

This company, a classic indicator of the economy, is being backed to do well by analyst Edmond Jackson if new leaders successfully initiate the change they’ve promised.

30th July 2024 12:48

by Edmond Jackson from interactive investor

Last January I examined small-cap industrial fasteners group Trifast (LSE:TRI), chiefly out of macro concern. At 71p, here was a classic small-cap cyclical stock warning of a disappointing December with “significantly lower than forecasted volumes in both our Asia operations and global distribution sales channel”.

Trifast serves a wide range of industries – traditional to modern and including health – and fasteners tend to be a classic indicator of the economy. It had anticipated a recovery, but its story changed to subdued conditions expected to persist through to the 31 March year-end.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

The industry context was portrayed as geopolitical uncertainty having led to supply chain disruption and persistent, inflation-led price increases. Trifast’s inventory position (which includes raw materials to finished goods) has been high – 37% of turnover in the March 2023 year, trimmed to 31% in respect of 2024.

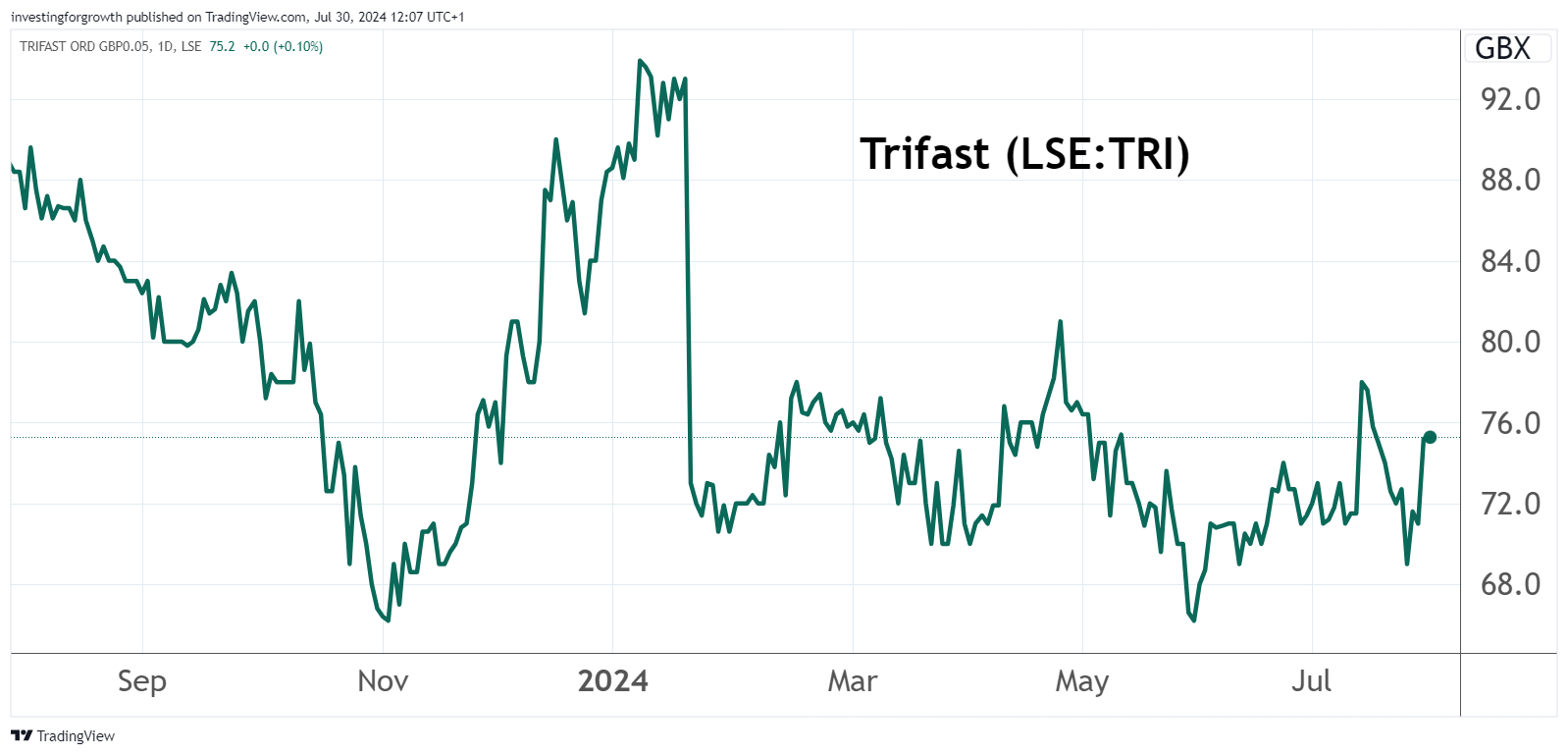

After joining the late-2023 rally in expectation of interest rate cuts, the stock had plunged from 93p in response to this warning, then traded volatile sideways this year, but is up around 6% to 75p in response to latest annual results.

Source: TradingView. Past performance is not a guide to future performance.

At least things did not deteriorate further, and the outcome is in line with a mid-April update: “resilient performance in the final fiscal quarter despite continued subdued demand”.

Trifast’s news flow context has involved two profit warnings, perhaps making investors cautious this year given the classic investing adage suggests a third is likely.

Yet barring some major Middle Eastern conflict or similar, the prospect of lower interest rates implies an improving medium-term context as the effects of high interest rates slowly abate.

Upside investment case rests on margin improvement

Adjusting for amortisation and various exceptional costs, normalised operating profit has come in essentially flat at £11.9 million – representing a 5% margin. Net finance costs leapt from £2.7 million to £5.4 million under higher interest rates, hence pre-tax profit is down 30% to £6.5 million.

Besides the interest charge, Trifast’s tax charge - up from £174k to near £3.7 million - is also responsible for denting the income statement. Together, it has knocked adjusted net profit down from £9.1 million to £2.9 million, and earnings per share are all over the place according to what adjustments you recognise. I see 2.1p, but consensus had been for 3.4p and the company cites 1.6p. The total dividend is thus checked to 1.8p versus 4p pre-Covid.

Perhaps the essential question for this stock is whether a new CEO and new chair, in office for nearly a year, can successfully drive an improvement programme underway to further improve operating margin. In 2017 and 2018 it was near 10% at the reported level compared with this latest year when it was exactly 2%, and marginally negative for March 2023.

Trifast - financial summary

Year end 31 Mar

| 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 187.0 | 198 | 209 | 200 | 188 | 219 | 244 | 234 |

| Operating margin (%) | 9.6 | 9.6 | 8.2 | 2.0 | 4.7 | 5.3 | 0.0 | 2.0 |

| Operating profit (£m) | 17.9 | 19.0 | 17.1 | 4.1 | 8.8 | 11.6 | 0.0 | 4.6 |

| Net profit (£m) | 12.7 | 15.1 | 12.2 | -0.2 | 5.8 | 9.0 | -2.9 | -4.4 |

| EPS - reported (p) | 10.4 | 12.2 | 9.9 | -0.2 | 4.3 | 6.6 | -2.1 | -3.3 |

| EPS - normalised (p) | 10.3 | 11.9 | 9.9 | 3.9 | 4.7 | 6.9 | 2.0 | 1.6 |

| Operating cashflow/share (p) | 14.5 | 8.2 | 8.0 | 12.7 | 17.4 | -13.1 | 2.2 | 21.0 |

| Capital expenditure/share (p) | 2.4 | 2.9 | 3.4 | 3.8 | 2.3 | 3.8 | 0.0 | 0.2 |

| Free cashflow/share (p) | 12.1 | 5.3 | 4.6 | 8.9 | 15.1 | -16.9 | 2.2 | 20.8 |

| Dividend/share (p) | 3.5 | 3.9 | 4.3 | 1.2 | 1.6 | 2.1 | 2.3 | 1.8 |

| Covered by earnings (x) | 3.0 | 3.2 | 2.3 | -0.2 | 2.7 | 3.1 | -0.9 | 0.9 |

| Return on total capital (%) | 14.6 | 15.0 | 12.9 | 2.3 | 5.4 | 5.7 | 0.0 | 0.0 |

| Cash (£m) | 24.6 | 26.2 | 25.2 | 28.7 | 30.3 | 26.7 | 31.8 | 20.9 |

| Net debt (£m) | 6.5 | 7.4 | 14.2 | 30.3 | -0.5 | 37.5 | 53.8 | 21.0 |

| Net assets (£m) | 102 | 110 | 121 | 116 | 132 | 139 | 136 | 124 |

| Net assets per share (p) | 84.5 | 90.9 | 99.3 | 94.9 | 96.9 | 102 | 99.8 | 91.3 |

Source: historic company REFS and company accounts.

Obviously, Covid was a disruptor that coincided with margin loss from 2020, but remarkably this stock is back down at around the same price it traded 30 years and more ago.

It has had two big rallies: around the 2000 stock boom, then post the 2008 crisis from 8p to near 260p over 10 years – for anyone astute and lucky to have bought that trough.

This tells us that fasteners companies are significantly at the behest of wider economic trends; yet Trifast’s recovery programme emphasising some basic measures also suggests to me that a previous management had lost the plot.

The new CEO talks of: “starting a recover, rebuild and resilience journey”, one aim being to operate in the upper quartile of industry peer group performance. A key step has already been achieved: consolidating various UK sites into a national distribution centre, said to enable “re-building revenues with a much higher level of efficiency”.

Hopefully, this means restructuring-type costs have peaked, although I would be steeled for a few more exceptionals as the CEO and chair get to grips with things. The latest income statement shows restructuring charges down from £4.2 million to £1.5 million, but efficiency improvements – “Project Atlas” – edged up from £1.7 million to £2.1 million.

Yesterday’s stock rise suggests investors are becoming willing to recognise scope for margin improvement – even if not back near 10% as before.

In which case, Trifast shares could rise plenty usefully from this level, even if less appealing as a true long-term investment. The harsh argument would be that fasteners are just not a great place to be, perhaps highly competitive on price and offering no radical new products with which any one operator can take share. Trifast has been listed for as long as I can remember but is still only worth just over £100 million.

Downside risk looks limited due to strong asset-backing

Despite my caveat on growth prospects, the stock’s risk/reward profile still appears to tilt attractively given 75p represents half its level through most of 2021.

Inventory control has contributed to cut net debt from £38 million to £21 million, which should mitigate last year’s £5.4 million net interest charge, also as and when interest rates ease.

It can also be seen as explaining a 9% reduction in net assets to £124 million; however, net tangible assets per share still compute usefully at 65p. This can be interpreted positively as downside protection but also negatively (historically) in the sense of a business failing to achieve an adequate return on assets.

Cash flow from operations is up 5% to over £14 million before working capital movements, while the inventories’ reduction boosted this from £3 million to near £29 million at the net after-tax, cash flow level.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Three charts that make the case for UK equities

The dividend is quite cautious – costing just £3 million last year – given a tumult of change in the cash flow statement. Debt reduction has decreased cash held from £32 million to £21 million. Yet this relatively strong cash profile, in terms of generation and reserves, is reason to have confidence in the dividend improving from 1.8p a share.

As yet, this represents just a 2% yield, and the payment is down from 2.25p in 2023, which the market expects Trifast to regain this year.

With consensus looking for around £8 million normalised net profit this year relative to below £3 million last, recovery prospects admittedly are recognised already. At 75p a share, the implied forward price/earnings multiple is 12x based on earnings per share (EPS) above 6p; but if the new chair and CEO can have a far-reaching effect and the industry allows, remember this business generated EPS of 12p in 2018.

Patience required given short-term macro challenges

Current trading is in line with management expectations, yet there remains near-term caution about the macro-economic environment, similar to what we heard from the recruitment sector.

It reminds us how the effects of tighter monetary policy continue to weigh. Continental Europe is Trifast’s main source of revenue at 36% followed by the UK at 31%, Asia 21% and the US 12%. Management therefore defers hope to “significant scope for medium-term improvement and are confident of being more profitable, effective and efficient in the March 2025 year.”

With this stock low in its historic range and new bosses driving improvement, I therefore consider the odds favour “buy” - with over 50% potential upside.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.