Stockwatch: time to worry over Warren Buffett’s rapid sales?

He doesn’t need the money, so why is the superstar investor selling this stock? Analyst Edmond Jackson investigates and gives his opinion on one of the world's biggest companies.

3rd September 2024 12:06

by Edmond Jackson from interactive investor

Should we read much into Berkshire Hathaway Inc Class B (NYSE:BRK.B) cutting its stake in Bank of America Corp (NYSE:BAC) by 15% to around 11% of its portfolio?

During July and August, the sales of America’s second-largest lender have been relentless, although if below 10% then reports will shift to quarterly rather than within days.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The historic context is Berkshire having injected $5 billion (£3.8 billion) into this bank in 2011 to help finally overcome stresses of “sub-prime” debt and the 2008-09 financial crisis. Yet it is hard to avoid a sense of how, all-considered, Buffett believes action should now be taken to lock in some gains on a stake currently worth around $36 billion.

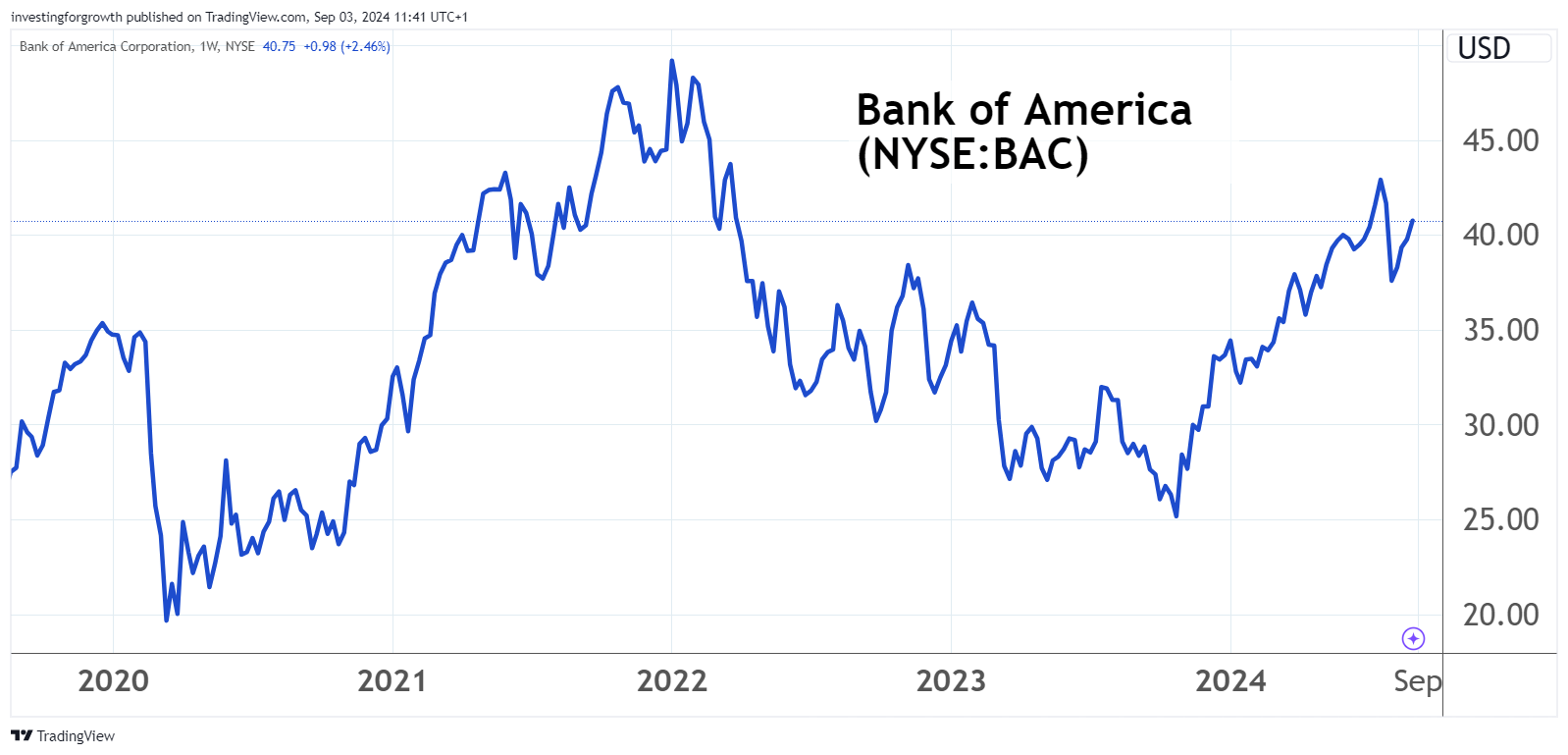

Near $41 currently, the stock has enjoyed a strong run from $25 over the last year, although it did trade higher from April 2021 to 2022:

Source: TradingView. Past performance is not a guide to future performance.

Berkshire’s decades-long success does inevitably mean looking at big trading sums when Buffett decides to act. Its $320 billion equity exposure involves just 41 companies and Bank of America is the third-largest holding. If there is much adjustment it inevitably means a lot of sales.

One might also say that a double-digit percentage portfolio position in one company is over-size and was due to be trimmed. Yet Buffett has let his stake in Apple Inc (NASDAQ:AAPL) run at near 29% of the equity portfolio rather than take profits, implying he judges each stock on its risk/reward credentials rather than fret over portfolio balance - “run your winners”.

- ii view: Berkshire Hathaway cash bolstered by Apple sale

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Such logic implies that he is turning quite cautious over banks, whose equity – by way of underlying performance and market sentiment – is often seen as a play on the overall direction of the economy. At the very least, he does not want currently to be as exposed as he has been. Berkshire’s second-largest holding is American Express Co (NYSE:AXP) at over 12% - although that stake is being maintained - and there is a modest 1% in Citigroup Inc (NYSE:C).

The total equity portfolio is worth close to $280 billion, although Berkshire’s market value has just lately topped $1 trillion – reflecting how the balance sheet includes $180 million of property, $235 billion short-dated bonds and $42 billion cash within net asset value of $1.1 trillion.

Be aware, a total $272 billion of near cash or cash is within insurance companies. My understanding from following Berkshire Hathaway for over 30 years is that these operations generate substantial cash, which Buffett then invests, hence is integral to the business set-up rather than his making an overt call to prefer cash.

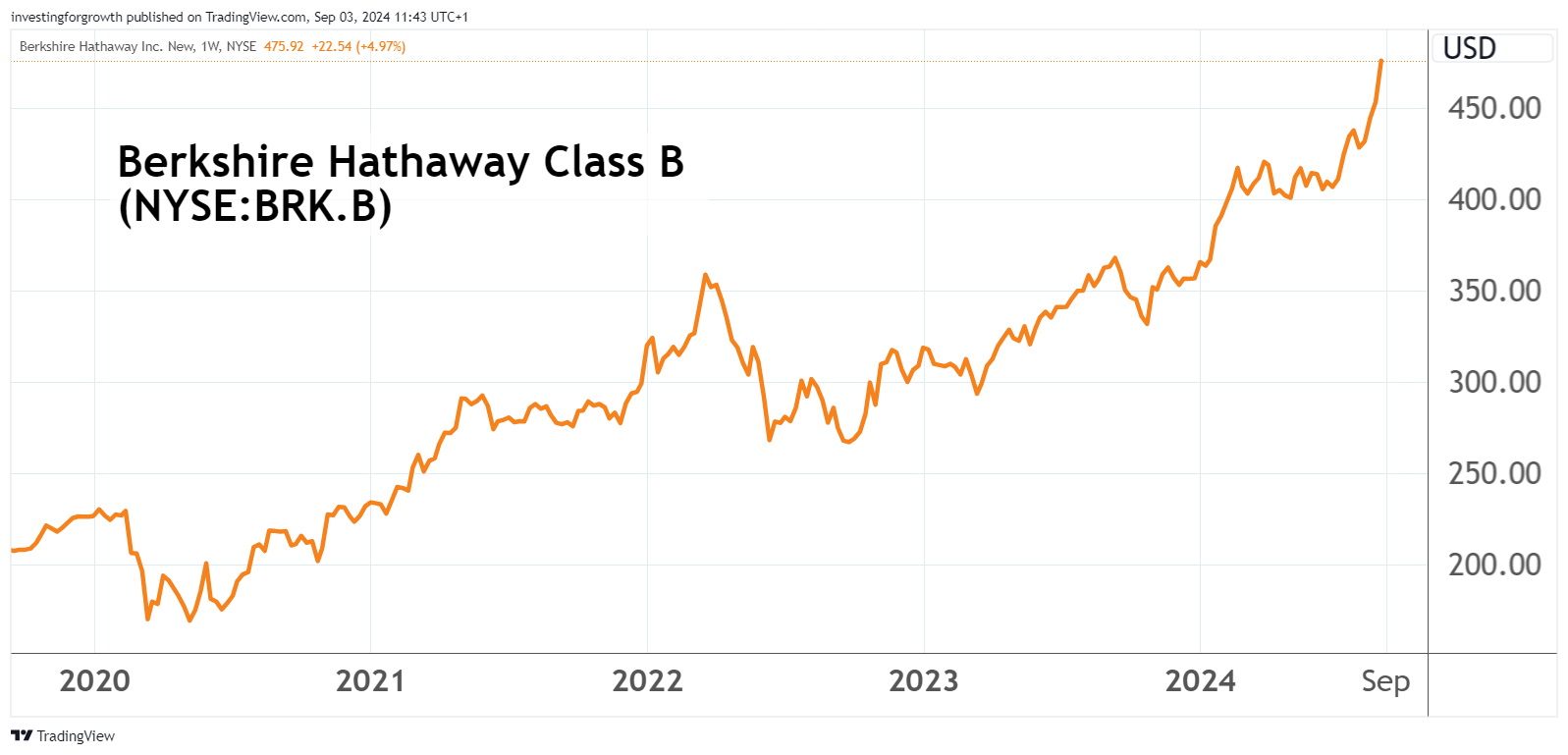

Source: TradingView. Past performance is not a guide to future performance.

Logical implies doubt over US economic prospects

Since Berkshire’s cash and near-cash holdings are broadly equivalent to the equities element, it makes no sense to sell down a US “universal” bank offering a wide range of services from personal and commercial to investment banking. If you are broadly confident, then you would retain a blue-chip financial share.

Buffett’s implied caution perhaps reflects concern about how equity values – especially US – have become expensive by global comparisons. This has come about first with the help of quantitative easing lasting for years beyond the 2008 financial crisis and subsequent recession, and second, huge monetary and fiscal stimulus in response to Covid.

Then, higher interest rates to contain the inevitable inflation have taken over two years to start having any real negative effect on the underlying economy – as shown by weak US recruitment data lately.

Bank of America valuation is not stretched

A share price of $41 represents 14x historic earnings, falling to 12.5x this year assuming consensus for 2024 earnings per share (EPS) of $3.26. Strictly, you could say that EPS is projected to grow by only 8% this year, hence a (more than) fully valued “PEG” ratio of 1.5, dividing the price/earnings (PE) multiple by the expected earnings growth rate.

Yet Bank of America has beaten the last four quarterly estimates, admittedly in strong economic conditions.

More pertinently, the wider S&P 500 index is on 27.5x earnings, which, arithmetically at least, is unsustainable.

- A stock with considerable upside potential and limited downside?

- An American brand I’d still buy shares in

It illustrates a curious aspect to Buffett’s stance, how he has repeatedly said that the best stance for most people is to buy a stock index fund for the long term, and not worry. Yet here is the S&P 500 looking plainly overvalued on historic measures, and Buffett is selling down a blue-chip bank on a relatively modest valuation and when Berkshire does not need cash.

This implies he lacks real confidence not only in the US economy but also financial shares, which tend to be sensitive to market moves.

Admittedly, the dividend yield is only around 1% versus 2.4% for The Goldman Sachs Group Inc (NYSE:GS) and 4.6% for JPMorgan Chase & Co (NYSE:JPM).

The stock’s “price-to-book” (or net assets) ratio has got moderately pricier, up from around 0.9x to 1.2x during this year, although JP Morgan’s has risen from 1.7x to 2.0x. Showing how UK banks offer relatively better value on this measure, Barclays (LSE:BARC) is below 0.5x and NatWest Group (LSE:NWG) at 1.0x.

Advocates of US banking stocks would say they have a better record and prospects given the relatively more vibrant US economy. Yet Buffett at least implicitly begs to differ.

Nothing in Q2 results to justify selling

Bank of America’s second-quarter net income was $6.9 billion, generating earnings per share of 83 cents, with earnings split evenly between consumer, wealth management and global banking. Asset management fees rose 14% year-on-year, helped by 6,100 new relationships; in personal banking, 278,000 new accounts maintaining the first-quarter rate, and the commercial side also gained “thousands” of small business accounts and “hundreds” of commercial banking relationships.

Buoyant markets aided corporate activity and investment banking fees soared 29%, sales and trading revenue grew 7% and card/service revenue in the consumer business also grew by 6%.

- 10 hottest ISA shares, funds and trusts: week ended 30 August 2024

- Insider: blue-chip directors eye more progress

The only reason to take a contrarian stance is not seeing the economic momentum driving such growth rates as sustainable.

Since mid-July, Berkshire has raised over $6 billion selling down Bank of America stock most weeks – achieving an average $41.3 per share relative to $40.75 precisely now. It did sell into a $44 peak and probably contributed to a fall briefly below $37 a month ago.

Admittedly, Bank of America insiders have not set a great example. Over the past year, they’ve been selling more than buying and, in the last quarter, over $4 million worth of stock has been sold with no purchases.

The price is still up just over 20% this year, if trailing the likes of Goldman Sachs, JP Morgan Chase and Citigroup.

I am inclined to rate the stock a “hold” and suggest anyone who does should not be perturbed by Berkshire’s selling.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.