Stockwatch: Time to cash in this successful tip?

Following our companies analyst would have made a 59% profit in two months. Here’s what he’d do next.

22nd November 2019 11:16

by Edmond Jackson from interactive investor

Following our companies analyst would have made a 59% profit in two months. Here’s what he’d do next.

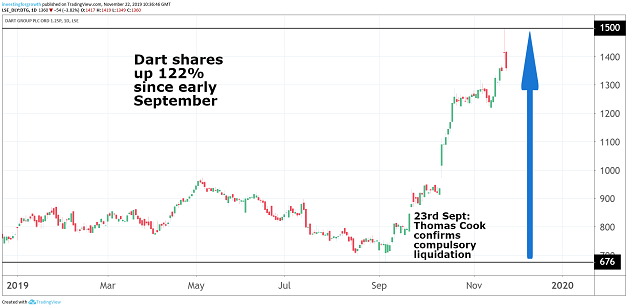

Since the demise of Thomas Cook and its compulsory liquidation on 23rd September, Dart Group (LSE:DTG) shares have re-rated about 70%, hitting 1,500p on Thursday 21st November, as management guided profit expectations for the current year to be “significantly exceeded”.

It set me instinctively scrambling to set the valuation in context: yes, a re-rating is justified in line with my drawing attention as a ‘buy’ at 890p on 24 September, given Dart may be the chief beneficiary of Thomas Cook (LSE:TCG) revenues up for grabs. But is its market value now reasonable for the risk/reward profile on this stock?

Comparative context versus TUI

In September, Dart’s forward price/earnings (PE) ratio was a modest 10.5x, albeit against cautious forecasts for a circa 15% fall in earnings per share (EPS) for the current year to March 2020, and low single-digit growth in 2020/21.

Dart was capitalised at around £1.3 billion versus TUI (LSE:TUI) - which owns Thomson/First Choice - at £5 billion when priced at around 850p a share. Dart owns the “Jet 2” brand of package holidays and independent flights to the Mediterranean, Canary Islands and European leisure cities. It also retains a smaller logistics side (only 3.3% of interim group revenue and sub-1% of operating profit).

The company has appeared potentially the chief beneficiary of the Thomas Cook fallout, versus TUI projected to gain around a 10% uplift in revenue. TUI shares have also risen, though by a relatively modest 24% to about 1,050p.

Source: TradingView Past performance is not a guide to future performance

So Dart’s context was one of already-cautious forecasts, plus a sector valuation respecting the fact that such stocks are chiefly a play on UK discretionary spending, where the imminent general election looks a choice between “Brexit resolution” of sorts (or disaster according to your view) and protracted uncertainty in a hung parliament.

Up to yesterday’s interim results, it appeared consensus was for Dart’s net profit expected to fall from £145.6 million last year to a mid-£130 million area both in the current year and 2020/21, hence normalised EPS would fall from 96.4p to 94p this year.

Management says a modest 2% increase in pre-tax profit to £339.7 million “reflected a later customer booking pattern in our leisure business, with customer demand strengthening throughout the summer season,” although “losses are still to be expected in the second half as we continue to invest in readiness for further flying programme expansion at several of our UK operating bases in the summer 2020 season.”

The smaller food distribution & logistics business (Fowler Welch) grew operating profit by 23% to £2.7 million. So, analysts have raised forecasts to £152.1 million net profit for the current year, albeit as yet still a decline then to £149.5 million in 2020/21, representing a forward PE of around 13.5x, with the stock currently volatile at around 1,400p.

| Dart Group - financial summary | ||||||

|---|---|---|---|---|---|---|

| year ended 31 Mar | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Turnover (£ million) | 1,120 | 1,253 | 1,405 | 1,729 | 2,380 | 3,143 |

| Net profit (£ million) | 35.9 | 32.8 | 88.8 | 76.7 | 107.1 | 145.6 |

| Operating margin (%) | 4.4 | 2.6 | 7.5 | 6.0 | 5.3 | 6.5 |

| IFRS3 earnings/share (p) | 24.3 | 22.2 | 59.9 | 51.5 | 71.8 | 97.6 |

| Normalised earnings/share (p) | 24.3 | 31.4 | 59.9 | 51.5 | 71.7 | 96.4 |

| Price/earnings multiple (x) | 14.5 | |||||

| Operational cashflow/share (p) | 88.6 | 78.6 | 165 | 222 | 278 | 297 |

| Capital expenditure/share (p) | 56.5 | 51.7 | 144 | 318 | 276 | 203 |

| Free cashflow/share (p) | 32.1 | 27.0 | 21.0 | -96.0 | 2.0 | 94.0 |

| Dividend per share (p) | 2.7 | 3.0 | 4.0 | 5.3 | 7.5 | 10.2 |

| Dividend yield (%) | 0.7 | |||||

| Covered by earnings (x) | 8.9 | 7.4 | 15.0 | 9.8 | 9.6 | 9.6 |

| Net assets per share (p) | 125 | 107 | 216 | 283 | 346 | 400 |

| Source: historic Company REFS and company accounts |

Improving cash flow albeit a scant 0.8% yield

The board underlines its confidence by raising the interim dividend from 2.8p to 3p, if effectively in line with consensus for a rise in the total dividend from 10.2p to 11.4p, a yield only around 0.8%.

Not to make too close a comparison with TUI but, after its re-rating, its prospective yield is around 5.5% and more meaningful as a prop. Even if you are solely interested in capital growth, if Dart’s narrative changes adversely then there’s no real financial support and you could see a sharp fall – unlikely, I believe, below 1,000p, but annoying even so. Dart is a UK-oriented business where consumer spending is outside its control.

More positively, these interims show net cashflow from operations up 16% to £512.5 million, chiefly boosted by leisure travel, versus capital expenditure reduced by 45%, potentially beneficial for raising payouts. It’s a snapshot, however, in context of the table below showing pretty hefty annual capital expenditure and a highly varied trend in net “free” cashflow. Capex currently implies additional aircraft, maintenance of the fleet and technology/infrastructure projects across the group; demands that may ebb and flow. Dart also has hefty lease liabilities and debt of versus £1,655.7 million cash – hence net cash of £455.2 million, up 51%.

Yet last year’s accounts show the dividend costing only £13.1 million, so you’d think the board could either re-rate the ordinary or introduce special payouts. Not to over-emphasise yield, but for the time being the stock might be less volatile at around 1,400p if the payout was higher.

What balance of growth versus cyclical rating, is fair?

Bulls can cite the growing success of Dart’s leisure travel offering – in the last financial year, flight passengers rose 21% and package holiday customers 27% - to argue that this stock deserves a benchmark PE in the mid-teens and a higher rating if you factor in potential to capitalise on gaps left by Thomas Cook.

Management isn’t outlining what they consider to be this opportunity though as it relates to capex budgets. I’d prefer to read a ball-park estimation as to potential that Dart envisages, partly to justify higher capex – despite it dampening profits growth in the near term. That would be the kind of outlook growth investors warm to. I suspect management doesn’t want to make itself hostage to fortune, given UK economic/political uncertainties.

A sympathetic view could be that Dart is nevertheless at an early stage of potentially delivering serial upgrades. Indeed, I envisaged that when the shares were sub-900p a share and versus cautious forecasts. At around 1,400p, however, a near-14x forward PE looks more like fair pricing, certainly amid risks to UK consumer spending.

Management is unclear whether “currently encouraging” consumer demand is sustainable. Without referring to Boris Johnson's recent EU Withdrawal Agreement, they say: “much will depend on the UK government securing a pragmatic and balanced Brexit agreement with the EU” – as if a future trade agreement is what counts.

Cost pressures by way of fuel, foreign exchange, carbon emissions etc, plus investment which includes staff, are described as “headwinds our leisure travel business faces”. At least it appears oil prices seem capped for now.

Politics are likely the key issue for valuation

So, there’s a tussle between growth and cyclical factors affecting Dart. In a positive scenario, I’d favour holding it over TUI but, if the economic/political mess persists, then TUI may now be lower risk in terms of downside.

If Corbyn/McDonnell make it to Downing Street, then both stocks are at high risk of a sell off, at least initially, given fiscal demands (including the hit to corporation tax) of Labour’s spending promises. If the Conservatives continue to make a mess of Brexit and ramp up government spending (some would say, both being inevitable) then similarly consumer finances could end up hit.

More positively, if Boris gets his parliamentary majority and the UK out of a corner versus the EU, while higher government spending helps a low-growth UK economy now that interest rates are becoming less effective stimulus, then it could be “game on”.

For now, however, tactical voting and many more young people registering to vote, puts the Conservatives’ current polling majority in question, recalling 2017.

So, while Dart as a company remains well-positioned, as a share it looks prudent to consider locking in some gains according to your risk appetite (and still maintain a long-term position). Blipping around 1,400p currently: Take profits.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.