Stockwatch: time to back this high-yielding small-cap?

Analyst Edmond Jackson examines a company with results due soon and an eye-catching dividend yield.

30th August 2024 11:30

by Edmond Jackson from interactive investor

Can a near 30% run in home improvement retailer Wickes Group (LSE:WIX) over the last two months be explained in terms of underlying company value, chiefly reflecting a wider market sentiment shift, and a sense of UK equities “catching up”?

Lower liquidity in the small-cap segment can amplify trends, if indeed we are looking at one here. Recruiter Robert Walters (LSE:RWA) is a quite similar example; a cyclical stock rallying 13% this month, essentially after the 1 August interim results, which only expanded on essentials of a 15 July first-half-year update.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Low Cost SIPP

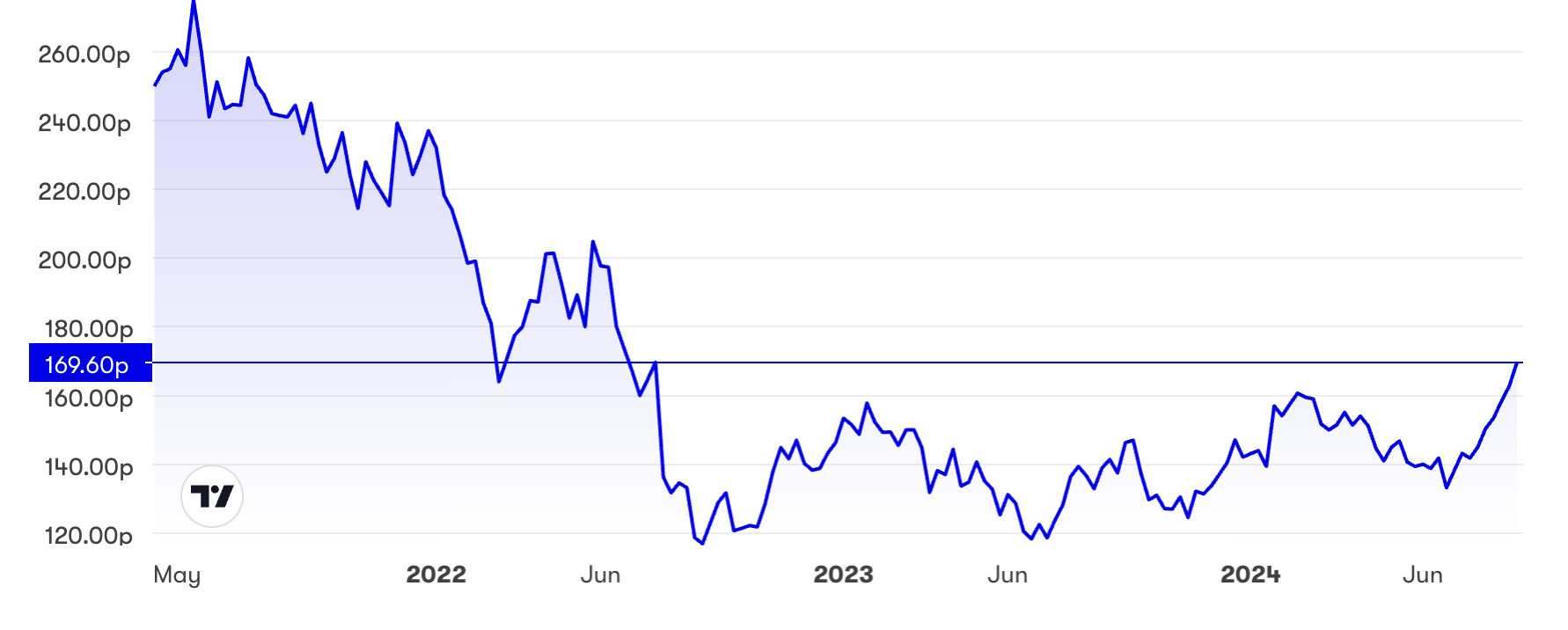

Yet at 170p the stock does appear to be in something of a volatile uptrend from 119p two years ago:

Wickes

Source: interactive investor. Past performance is not a guide to future performance.

A continuing tale of two sides

Wickes issued a first-half update on 31 July and is due to report interims in early September. This update did not discernibly change the message of a 1 May one, on the first four months of 2024, itself reiterating trends in the last quarter of 2023.

The group’s retail side, constituting nearly 80% of revenue, saw minor progress from around 1% in the first quarter to near 2% in the second, albeit dividing between soft consumer demand and stronger from professional trade. “DIY sales remain in moderate decline as customers continue to focus on smaller projects”, it said. But, overall, this side is barely pegging inflation.

- The 20 most-popular dividend shares among UK fund managers

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The smaller “design and installation” side, in kitchen and bathroom refits, saw an 18% first-half revenue fall, which it said is due to a particularly strong comparative, although 2024 sales had shown single-digit, year-on-year decline. Lower-priced kitchen sales leapt 25% but larger purchases remained challenging.

So, there has been no identifiable trigger of positive change within Wickes’ reporting. The past two months’ rally is therefore an aspect of mean-reversion towards fairer value after a drift from around 160p at end-February to 133p by July. The wider market senses better macro prospects ahead; and/or UK equities are engaged in a relative “catch-up” to global valuations.

An 8% prospective dividend yield lent a prop

The consensus has been, for a 10.9p dividend – paid since the 2021 financial year after Wickes floating that April, as a spin-off from Travis Perkins – to be maintained. The 2023 annual results offered no guidance on dividend policy, but to keep investors interested in growth prospects generally, we can expect the board to do its best – to at least sustain 10.9p.

With 2024 normalised earnings per share (EPS) of 12.7p expected, earnings cover would barely be 1.2x, however a retailer’s inherently cash-generative business model aids paying out.

The historic table shows how free cash flow has usually been significantly in excess of EPS. It therefore lent confidence to buyers from 133p last July that a yield over 8% was probably realistic despite the mixed commercial narrative.

Wickes Group - financial summary

Years to 1 Jan then 31 Dec

| 2019 | 2020 | 2021 | 2022 | 2022 | 2023 | |

| Turnover (£ million) | 1,200 | 1,292 | 1,347 | 1,535 | 1,559 | 1,554 |

| Operating margin (%) | 4.7 | 4.4 | 4.5 | 6.3 | 4.3 | 4.1 |

| Operating profit (£m) | 56.6 | 56.2 | 61.0 | 96.7 | 67.1 | 62.9 |

| Net profit (£m) | 14.9 | 12.9 | 26.3 | 58.8 | 31.9 | 29.8 |

| Reported EPS (p) | 5.9 | 5.1 | 10.4 | 23.3 | 12.5 | 11.7 |

| Normalised EPS (p) | 11.0 | 14.1 | 17.8 | 34.6 | 29.2 | 15.5 |

| Earnings per share growth (%) | 28.5 | 26.1 | 94.8 | -15.6 | -47.0 | |

| Return on total capital (%) | 5.2 | 5.3 | 7.2 | 11.8 | 8.6 | 8.3 |

| Operating cashflow/share (p) | 70.1 | 43.0 | 83.8 | 40.2 | 49.4 | 70.2 |

| Capex/share (p) | 17.4 | 9.6 | 8.0 | 10.5 | 15.9 | 15.0 |

| Free cashflow/share (p) | 52.7 | 33.4 | 75.8 | 29.7 | 33.5 | 55.3 |

| Dividend/share (p) | 0.0 | 0.0 | 10.9 | 10.9 | 10.9 | 10.9 |

| Cash (£m) | 16.2 | 25.4 | 6.5 | 123 | 99.5 | 97.5 |

| Net debt (£m) | 879 | 830 | 784 | 619 | 592 | 578 |

| Net assets (£m) | 264 | 279 | 130 | 161 | 164 | 163 |

Source: flotation prospectus and company accounts.

Yet in the last week or so, the stock has risen consistently from 158p, reducing the prospective yield to 6.4%, which could be seen as the basic return required to compensate holders in a weak consumer environment.

Buyers are therefore optimistic about the forthcoming results and “the average UK consumer” under this Labour government. Time will tell whether October’s Budget avoids much general taxation increase, such as fuel duty, relative to Labour’s electoral promises.

Wickes has kept buying back its shares, albeit since July 2023, and yet the stock had two downtrends during this time, hence buybacks are no driver of the current rally.

Consensus is for 2025 net profit over £37 million for EPS of 15.5p, hence a forward price/earnings (PE) ratio of 11x on this basis.

Margin improvement is a significant need, and challenge

The table shows this struggling to get out of a 4% range at the operating level and presumably the 2025 forecast trusts in “productivity plans in place for 2024”. Yet when citing this last May, management qualified that this “will not offset fully the cost headwinds from the scale of increases in National Minimum Wage and business rates”.

Quite what else a fiscally cash-strapped new Labour government might apply, 1% extra corporation tax, for example, than hit voters directly? A fuel duty rise has not been ruled out, slightly affecting Wickes besides its customers. Otherwise, the group looks to have benefited from lower freight costs this year as oil prices trended down, given that plenty of its products are sourced abroad such as from the Far East.

Possibly, investors are increasingly optimistic, UK wage increases will continue and percolate down to consumer spending, such that Wickes’ top line improves.

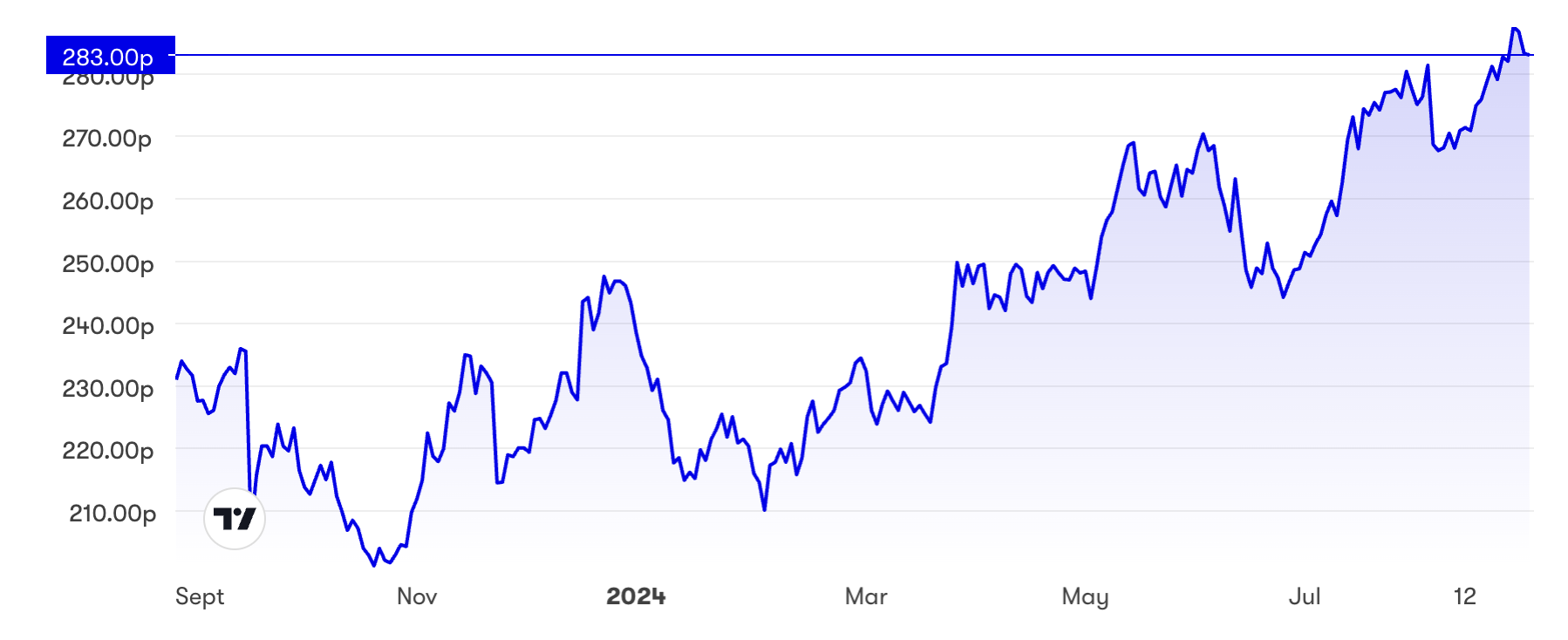

The chart for Kingfisher (LSE:KGF), which owns Screwfix, has also been in uptrend especially during August:

Source: interactive investor. Past performance is not a guide to future performance.

Is this finally a break-out from a recent 120p-160p range?

I, somewhat prematurely, set out a “buy” case at 135p in March 2023 – albeit noting to average in – and kept this at 157p last January on the grounds that Wickes looked a sufficiently resilient retailer to capitalise on improving the UK housing stock. The price breached 160p last February, but only after visiting 120p in July 2023.

Not to grasp for excuses as to belated performance, but I think this shows the stock market can be slow to respect intrinsic value. Unless a business is in fundamental decline, a dividend yield of over 6% implies the stock price is more likely to adjust higher.

Wickes’ challenges seem chiefly “cost of living-related”, hence if a Labour government does help achieve national growth without materially raising taxes on working people, then the stock should be capable of recovering its pre-June 2022 levels of over 200p. It is early days to assume much about a new government though.

- Think tank proposes £10bn shake-up to pension tax: how it could affect you

- Stockwatch: serious upside potential at this small-cap

Lower interest rates would also mitigate £22 million net finance costs relative to £63 million operating profit in 2023. This extent of charge is curious given the balance sheet has no financial debt beyond £596 million longer-term leases and £80 million shorter term, but must explain the charge.

Such liabilities were mitigated by £152 million cash and the ratio of current assets to current liabilities was satisfactory at nearly 1.2x, so the balance sheet is not inherently risky beyond the lease-cost drag. Goodwill and intangibles constituted a modest 14% of net assets.

It raises intrigue as to whether the outlook statement due soon affirms Wickes’ modest re-rating, or the numbers re-affirm retail as sweating to outpace inflation while “design and installation” declines. More needs explaining on productivity achievements, lately and for 2025.

I am going to retain a “buy” stance, taking a long-term view. However, I draw holders’ attention to the results due soon, lest traders clip this rally. In the short term, the numbers do need to justify it.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.