Stockwatch: third time lucky for this takeover target?

Following a couple of failed bids in recent years, analyst Edmond Jackson has another look at this interesting stock either as an acquisition target or recovery play.

6th August 2024 12:12

by Edmond Jackson from interactive investor

Does a slump of more than 30% in the mid-cap shares of John Wood Group (LSE:WG.) present another buying opportunity after a second potential bidder in a year or so for this consulting engineer has walked away?

The reason cited yesterday was “rising geopolitical risks and financial market uncertainty” – prompting a plunge from around 200p – after negotiations on a 230p a share takeover had proceeded to a due diligence investigation. Perhaps it was felt that a substantive integration is just too risky to attempt right now, given Wood’s still complex structure.

- Invest with ii: Top UK Shares | Share Tips & Ideas | What is a Managed ISA?

But the stock rallied from around 120p initially yesterday to close at 128p, and this morning is up to 133p with global markets rebounding.

Potential for upwards mean-reversion to over 150p

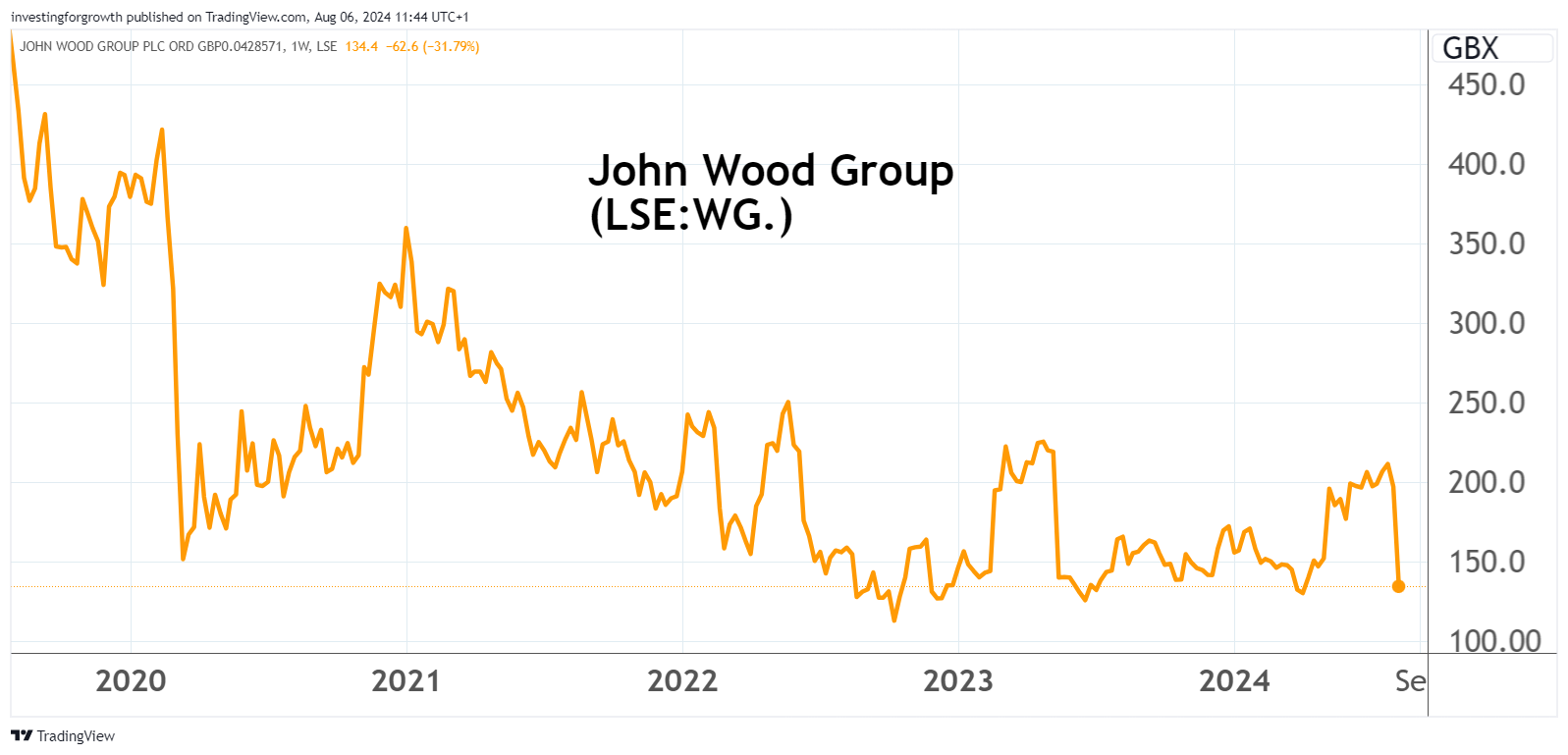

After two potential offerers have tried to buy Wood at over 200p a share, there looks scope in chart terms at least for a third run towards some kind of equilibrium, from those 120p lows:

Source: TradingView. Past performance is not a guide to future performance.

Last May, I re-examined Wood after an approach from Sidara (Sidara, Dar Al-Handasah Consultants Shair and Partners), a London-headquartered but global network of specialist firms albeit with quite similar operations to Wood.

This company looked to stand a better chance of generating value than financial investor, Apollo private equity, which negotiated 240p a share over the spring of last year. But I was only cautiously prepared to rate the stock a “hold” at 193p.

I had drawn attention as a “buy” at 115p in October 2022 after Wood directors had bought over £300,000 worth of equity. War in Ukraine had hit cyclical stocks, but the chief executive cited a strong order book and the sale of the “built environment” consulting side had raised £1.5 billion.

Having expected such proceeds to transform the balance sheet, I was therefore perturbed that Wood’s 2023 annual results showed net debt excluding leases had actually jumped 77% to $694 million (£543 million) or by 49% to $1,094 million including leases.

The directors continued to buy shares determinedly after these results, for example the CEO added nearly £200,000 worth at 133p. He cited the order book picking up, with “double-digit growth in our pipeline and positive pricing trends”, which doubtless also intrigued Sidara.

Wood is therefore a test-case of relying on director cluster trades when conservative investors might otherwise steer clear.

A dicey macro situation could extend volatility

After last week’s shock news on US employment impacted oil prices, right now the Middle East looks on the cusp of more vigorous conflict than when Iran sent a salvo of missiles at Israel in April.

Oil prices – which can be very significant for demand for service-related activities - could therefore jump again; although there is a risk of any commercial decisions being deferred if uncertainty soars.

Despite Wood yesterday re-affirming its outlook both for this year and 2025, “the growth strategy continuing to deliver, with further growth in EBITDA, margins and order book”, this year’s consensus net profit outlook has dropped from $32 million to $23 million, and in 2025 from $118 million to $113 million.

Sterling-equivalent earnings per share (EPS) is seen at only 1.2p and 10.5p respectively – hence a 17-month forward price/earnings (PE) multiple near 13x on this basis.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Insider: bosses buy shares in this trio after results

After the 34.5 cents dividend was axed in 2019, a 0.7 cents token restoration is targeted for 2025, but patience will be needed for any material yield given Wood’s debt - which meant an $89 million net interest charge hit $114 million normalised operating profit.

Do not regard the financial table as necessarily indicative of Wood’s capability, the group’s woes being derived chiefly from a previous management’s 2017 acquisition of Amec Foster Wheeler for £2.2 billion causing more trouble than it was worth – for example a bribery and corruption probe.

John Wood Group - financial summary

Year end 31 Dec

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover - $ million | 5,001 | 4,121 | 5,394 | 10,014 | 9,890 | 7,564 | 5,238 | 5,442 | 5,901 |

| Operating margin - % | 3.2 | 2.2 | 0.5 | 1.7 | 3.1 | -0.4 | -1.2 | -10.4 | 0.4 |

| Operating profit - $m | 159 | 89.4 | 27.9 | 165 | 303 | -32.9 | -62.1 | -568 | 26.4 |

| Net profit - $m | 79.0 | 27.8 | -32.4 | -8.9 | 72.0 | -229 | -139 | -356 | -111 |

| Return on capital - % | 5.0 | 3.0 | 0.3 | 2.1 | 4.1 | 0.5 | -0.9 | -10.8 | 0.5 |

| Reported EPS - cents | 17.3 | 7.3 | -7.4 | -1.3 | 10.5 | -34.1 | -32.2 | -104 | -19.4 |

| Normalised EPS - c | 67.5 | 51.3 | 38.7 | 28.7 | 22.2 | -0.3 | -11.2 | -1.4 | -8.5 |

| Operating cash flow/share - c | 123 | 49.5 | 34.2 | 80.9 | 96.4 | 45.1 | -8.8 | -53.0 | 7.1 |

| Capital expenditure/share - c | 21.8 | 22.7 | 18.0 | 13.8 | 21.3 | 13.1 | 17.0 | 20.1 | 21.2 |

| Free cash flow/share - c | 101 | 26.8 | 16.2 | 67.1 | 75.0 | 31.9 | -25.8 | -73.1 | -14.1 |

| Ordinary dividend/share - c | 30.3 | 10.8 | 34.0 | 34.5 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Covered by earnings - x | 0.6 | 0.7 | 0.0 | 0.0 | 2.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Cash - $m | 851 | 580 | 1,257 | 1,353 | 1,857 | 585 | 491 | 522 | 385 |

| Net debt - $m | 320 | 349 | 1,641 | 1,559 | 2,052 | 1,568 | 1,855 | 751 | 1,144 |

| Net assets/share - c | 633 | 576 | 732 | 674 | 645 | 606 | 590 | 539 | 526 |

Source: historic company REFS and company accounts.

Yet with revenue projected to rise towards $6.5 billion in 2025, having achieved $5.9 billion in 2023, the CEO’s trend in share buying is understandable – given a capable boss should in due course be able to raise margins, at the net and operating level.

The 2023 results narrative made a big issue of driving higher margins in a three-year turnaround plan to end-2025 – with improved pricing and cost control in a better business mix.

A “simplification programme” is certainly needed given ongoing complexities in the 2023 results, which compromised an adjusted EBITDA margin near 11% on the consulting side (13% of continuing operations’ revenue), while “projects” (complex engineering design and project management) a 7% such margin (41% of revenue), “operations” was on a near 7% margin (42% of revenue) and investment services on 30% margin (4% of revenue).

Showing how EBITDA is not the same as profit, the extent of Wood’s various charges meant a 2023 net loss of $30 million.

The essential trade here is therefore between holders weary of the time being taken to properly sort this group out – now with fresh macro risks on the horizon – and buyers who see Wood having attracted two suitors over 200p a share, hence currently priced too low.

Be aware of $307 million asbestos claims in the US

Note 21 to the 2023 accounts explains these personal injury claims as related to the 2017 acquisition of Amec. It includes a caveat how “the number and cost of current/future claims could be substantially higher than estimated”, also timing of payment of claims being sooner than expected, which could impair the group’s financial position and cash flows.

This, for a balance sheet groaning with $4.3 billion of goodwill and intangible assets, meant negative net tangible assets of $677 million at end-2023. Despite $434 million of cash, $1.7 billion trade payables meant the ratio of current assets to current liabilities was 0.9. I would not expect a meaningful dividend yield for some years.

Underlying trading therefore needs to be improving, simply to sustain such a balance sheet.

Last May’s first quarter 2024 update cited a 9% improvement in the order book to $6.2 billion on March 2023 compared with 7% ahead when annual results were reported on 26 March. Yet revenue had slipped 6% like-for-like amid mixed divisional performance, and an 11 July interim update then put the order book $6.1 billion.

Having cited a “second-half-weighted performance” this year, the interim results due on 20 August seem unlikely to surprise positively, although at this share price level the outlook statement will be most significant.

Overall, I think Wood’s stock can continue to rise, albeit tricky to quantify any target until the group better simplifies itself. In the very short term, mind what retaliation from Iran and its proxies there might be against Israel, causing further fear. The balance of probability at around 133p still favours “buy”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.