Stockwatch: is this speculative tipple to your taste?

This company had an incredible post-pandemic period but, as with many others, it didn’t last. Now, with the shares at rock bottom, analyst Edmond Jackson thinks there could be an opportunity for those prepared to stomach the risks.

14th November 2023 12:14

by Edmond Jackson from interactive investor

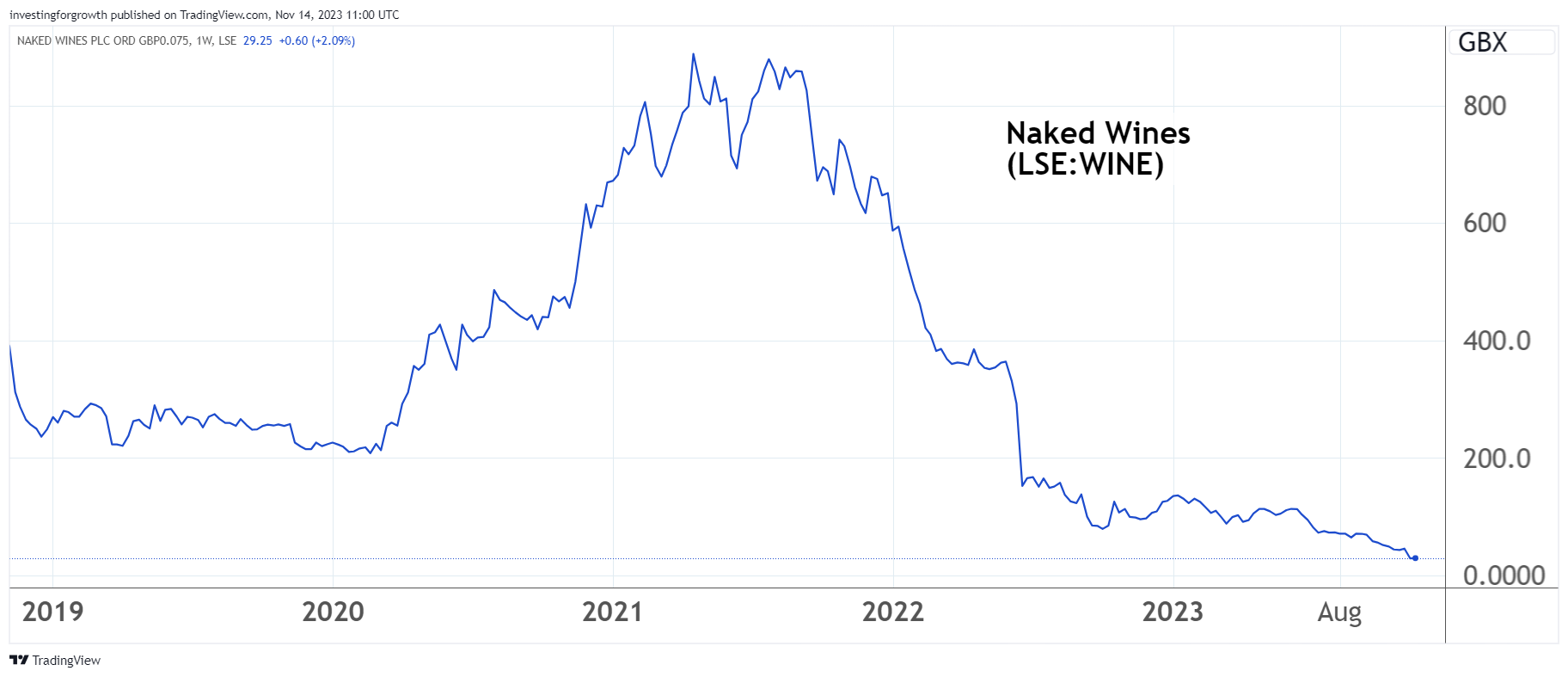

With its stock having lost 96% of market value since trading above 870p in September 2021, there is speculative intrigue about how three directors of Naked Wines (LSE:WINE) have bought £75,000 worth of shares in the company at around 30p.

Capitalised at just over £21 million versus £629 million at the peak, it represents barely 6% of 2023 sales – but the table for the last six years shows no established operating margin and the last two years’ cash flow has been awful. At least last April’s balance sheet had nearly £40 million cash, although it is tricky to decipher to what extent this reflects customer subscriptions than genuinely available cash. It did mean the ratio of current assets to current liabilities was a comfortable 1.75 times, and lately Naked has said “the group has met all borrowing covenants to date and is projected to continue to”.

- Invest with ii: Top UK Shares | Free Regular Investing | Open an investment Account

Mind that last September’s (delayed) annual accounts to 3 April contained a substantive going concern statement with a “material uncertainty” warning. Experienced speculators will know that auditors have tightened up on this, but potentially going too far.

It significantly explains why the stock trades so low. I suspect it is also because investors doubt a subscription-based wine club is durable enough – especially to turn around – in challenging times.

Naked Wines - financial summary

Year-end 3 Apr

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 476 | 178 | 203 | 340 | 350 | 354 |

| Operating margin (%) | 2.0 | -5.1 | -2.4 | -3.4 | 0.5 | -4.0 |

| Operating profit (£m) | 9.3 | -9.1 | -4.9 | -11.7 | 1.9 | -14.3 |

| Net profit (£m) | 7.4 | -9.4 | 8.2 | -10.0 | 2.4 | -17.4 |

| EPS - reported (p) | 10.1 | -13.7 | -9.3 | -13.8 | 3.2 | -23.6 |

| EPS - normalised (p) | 15.8 | -12.2 | -9.2 | -13.7 | 3.2 | 3.1 |

| Operating cashflow/share (p) | 36.4 | 8.3 | 30.1 | 46.1 | -57.5 | -43.4 |

| Capital expenditure/share (p) | 5.2 | 9.9 | 1.6 | 3.7 | 2.6 | 2.0 |

| Free cashflow/share (p) | 31.2 | -1.6 | 28.5 | 42.4 | -60.1 | -45.4 |

| Dividends per share (p) | 7.2 | 2.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Covered by earnings (x) | 1.4 | -6.8 | 0.0 | 0.0 | 0.0 | 0.0 |

| Return on total capital (%) | 6.6 | -6.8 | -4.1 | -10.9 | 1.7 | -10.8 |

| Cash (£m) | 15.6 | 19.1 | 55.3 | 85.2 | 40.2 | 39.5 |

| Net debt (£m) | 8.5 | 18.6 | -49.8 | -82.3 | -36.6 | -4.5 |

| Net assets (£m) | 121 | 109 | 114 | 103 | 110 | 98.7 |

| Net assets per share (p) | 169 | 151 | 156 | 141 | 150 | 133 |

Source: company accounts

A cult subscription group for wine enthusiasts

In due respect, the website tastingwine.com gives Naked Wines an “outstanding” 9.7/10 overall score on various criteria. It says: “With good quality wines and great prices, we think they’ll stick around for a long time to come.”

Paying £25 a month in the UK enables them to spend whenever they want, while also supporting producers. Naked used to be part of a listed group including Majestic Wine, but they split in 2019, with Majestic going private. There were shareholder grumbles, the offer was downgraded to generate cash to fund Naked – as a favoured cult enterprise for its founder Rowan Gormley, who was CEO of the wider group.

- Richard Beddard: a new score for my top 10 company

- Stockwatch: can UK retail sector withstand fall in money supply?

Subsequently, both businesses prospered and an August 2020 update from Naked showed new customer sales nearly doubling and total sales up 73% year-on-year. At that time, Naked was valued around £300 million, or 50% more than when the group split. It’s unclear whether it reflected exceptional trading due to Covid lockdowns and high domestic wine consumption as bars and restaurants closed.

Source: TradingView. Past performance is not a guide to future performance.

A chief balancing act at any point is spending to sign up new members, hoping they stay around long enough to recoup acquisition costs. But the chief financial officer – who has just spent nearly £24,000 buying shares – has argued that nearly 70% of such cost is recouped in the first 12 months, given close attention to customer behaviour and margin.

US market turns from opportunity to millstone

Naked hoped to gain leverage in America after online sales of wine leapt from 5% to 20% of the US total, but lately it has turned problematic. A 7 November update – which triggered a drop in share price from 45p – cited weaker US trading, hence the downgrade for annual revenue to April 2024 extended from 10% like-for-like to a 15% drop.

In the last financial year, the US constituted 48% of group sales versus 39% UK and 13% Australia.

Despite the CEO and his approach being affirmed at September’s final results, he has now stepped down and chair Gormley assumed an executive role as interim measure. When founders do this at smaller companies, it signals that the business is on the ropes.

Gormley blames the shortfall on the CEO having split his time between group responsibilities while also presiding over US operations – but you also have to ask, is this not a sign of US consumer fragility now higher interest rates are biting? A wine club subscription is just the kind of thing that aspirant middle classes under the cosh would cut. Will the US experience be mirrored here?

Cash flow improves as inventory winds down

Excess wine held partly reflects output being impossible to coincide with fluctuations in consumer demand. So, inventory rose from £142 million to £166 million in the last financial year, but the US incurred a £14 million charge for “right-sizing” it there.

Guidance at last September’s results had been for “material cash generation in the second half of the April 2024 year and 2025 as excess stock is unwound” – which though no guarantee, makes for interesting speculation about whether a dire cash flow profile now improves, even if revenues are challenged.

Helping this, management targets a £10 million annual run rate cost reduction by April 2024, additional to eliminating a £5.4 million marketing spend in the last financial year.

- Four stocks this UK Buffett-style fund just bought

- Nick Train: the UK stock market has a dividend problem

Even so, and with Gormley conceding “a new customer acquisition problem”, does the group have cash sufficient to spend on getting more? At least cost of sales as a proportion of revenue eased from 59.5% to 58.1% in the last financial year. Naked should not be spending any aspect of customer deposits, otherwise it would become a Ponzi scheme.

He claims they can also “extend the number of ways we service our customers to monetise that traffic more effectively.” Such initiatives are yet to be tested at scale though.

Even if new customer economics does not improve, the firm says “we still expect to have a profitable, cash generative business, albeit smaller than the one we have today.”

On such basis, the group is potentially a bid target – where offering even three times market value currently would get it for around 0.3 times sales.

Revenue slide reflects hit to discretionary spending

The last two quarters have been bleak. Do they reflect a behavioural shift that is essentially over, or can things get worse? The festive season lies ahead, so recent numbers should improve in the near term.

First-quarter group revenue to June slumped 18% like-for-like; a combination of new customer sales plunging 41% and repeat-customer sales down 15%.

Second-quarter UK and Australian revenue was in line with expectations, but in a first half-year context it fell 11% and 19% respectively, while the US was down 20%.

They say the business is still expected to be profitable, at least at the operating level.

- Shares vs bonds: which offers the best opportunity for income seekers?

- Oil shares to watch both large and small

It would be an improvement on the April 2023 year, which was resilient at the revenue and gross profit levels – up 1% and 5% respectively – yet higher costs and a £10 million inventory write-down meant a near £2 million operating profit for the 2022 year became a £14 million operating loss.

You have to trust that Gormley is sufficiently capable and hands-on to deliver what he says – especially the cost benefits.

In early October, the group had £3 million net cash plus a £45 million available credit facility. But it should not be raising debt to acquire new customers. It said: “The group is currently at its lowest point of forecast liquidity and continues to anticipate converting excess inventory to cash over the next 12-18 months...”

Reflecting uncertainties: year-end net cash (excluding nearly £6 million leases) has been guided down to a whopping £0-15 million range from £10-30 million, compared with £10 million last April.

Getting involved in the shares at this level does therefore mean submitting to such uncertainties, but they are why the stock is priced as it is.

Naked can pull through

There is no need for three directors to “prove” anything given this stock has fallen off the market’s radar. Their judgement is in their personal financial interest, where the founder has bought nearly £39,000 worth of shares (and owns 2.9% of the group), the chief financial officer nearly £24,000 and a non-executive director £12,000.

I take most notice of the CFO buying as founders can have an emotional edge, and here it is all about the financial risk/reward profile. So, if you can stomach the risks, at 30p Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.