Stockwatch: should you act on the rebound in this fallen star?

Analyst Edmond Jackson assesses a pandemic darling experiencing a turnaround and soon to gain a new CEO.

27th August 2024 13:53

by Edmond Jackson from interactive investor

A 50% jump off historic lows in Peloton Interactive Inc (NASDAQ:PTON), a US provider of exercise equipment and training apps, looks as if the market had previously been too negative.

On a technical basis it is compelling to take a look at such a “turnaround”, but aside from mood swing, is there underlying substance to justify it – and is this a longer-term turning point?

Peloton has risen from around $3.3 to $4.9 in three days’ trading after release of fourth fiscal quarter and full-year results to 30 June that affirmed recent turnaround initiatives. After the CEO departed last May, an interim management has cut costs and inventory, taking the company closer to profitability than the market expected.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

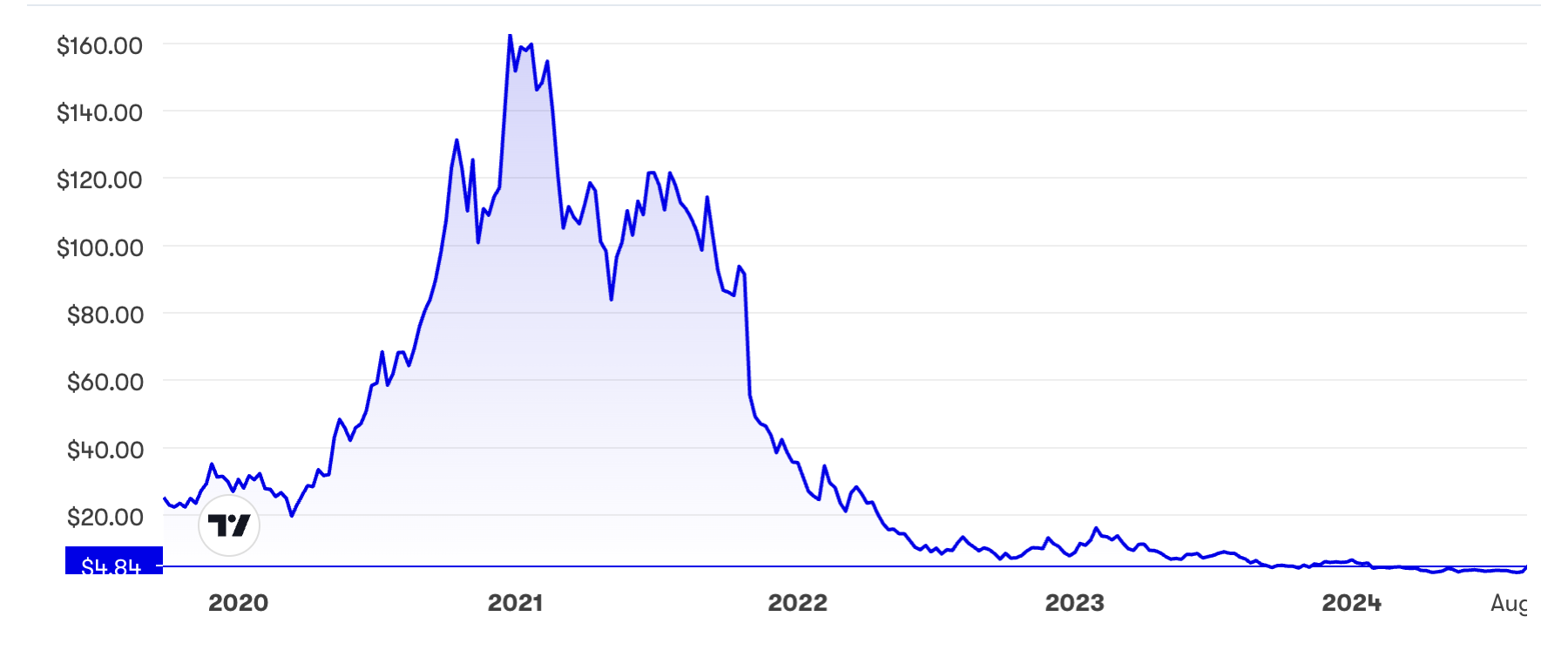

Market value is just over $1.8 billion (£1.4 billion) and Peloton has around $1.3 billion net debts including leases; however the debt is somewhat de-risked by a re-financing to 2029. With fiscal June 2025 revenue guided near $2.5 billion, it implies a modest price/sales ratio of 0.7; so even if the stock never again achieves highs like $160 as seen in December 2020, ongoing capable turnaround initiatives could raise that ratio over 1.0 like most other companies.

That is the principle. In practice, there remains investor scepticism that Peloton was a Covid-lockdown fad stock as wealthy people bought its indoor bikes, treadmills and rowers. Now, those likely to buy probably already have, and sales also benefited from exceptional monetary stimulus from 2020. This company probably needs a favourable tailwind of consumer spending; but does not US employment data show increasing risk of recession? And “professionals” recruiters have cited tough conditions.

- Insider: bosses back up targets with own purchases

- The 20 most-popular dividend shares among UK fund managers

Bulls, however, see all that as “in the price”. Here is a quality brand that well-managed by a new CEO (soon to be announced) could end up bought by private equity. While Peloton has never made a profit and it remains too early to sketch earnings, there is plenty of good to work with. Even modest recovery would imply big gains:

Source: interactive investor. Past performance is not a guide to future performance.

Still a way off proving the business is not in decay

The chief dilemma is revenue prospects continuing apparently to decline; hence despite turnaround actions achieving profitability at the “EBITDA” level (before interest, tax, depreciation and amortisation) in the fourth quarter, only so much can be achieved financially by cost-cutting.

Confusing the demand curve for Peloton products (and to a significant degree, the related apps) is some big swings in behaviour especially around the pandemic. Its original bike was launched a decade ago, then a treadmill in 2018, and the phenomenon of Covid created exceptional demand that was followed by a social trend back to gyms as restrictions lifted.

A key intangible question therefore is, does the variety of equipment and social virtues of gym membership – the ability to get out of the home – trump having a high-quality exerciser at your disposal? It is a tricky one to answer but, I think, goes to the core of whether there is a genuine long-term business here. Some people with comfortable homes do want premium products for the “gym” quite like a stylish kitchen or bathroom – and exercise addicts, more so.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Shares for the future: a speculative stock expecting steady growth

High-quality equipment does, however, have a longer replacement cycle, with middle-class owners possibly feeling the cost means they should “get their money’s worth”. Wealth trends are significant; luxury goods spending has been pressured lately. There are a lot of free exercise programmes for fitness, and apps generally can come into fashion and leave as new ones are innovated.

App revenues constitute the majority two-thirds of revenue

While the general impression of Peloton is of a hardware company, it is the Peloton App – whose offering partly links to the equipment – that the future rests on.

In the UK, for £13 a month you get access to workouts for strength, yoga, outdoor running and the gym; and for £24 those linked to the Peloton machines.

This side of the group has a high level of churn – 26% of subscribers lost, year on year, in the 2024 fourth quarter – which does not surprise me given that people will have accustomed themselves to the various plans and settled on what they want.

I am potentially a bad judge because a key point of exercise is to get away from data and a digital existence, especially outdoors, however I respect some people like to keep tabs and also have an aspect of “personal trainer”. Apps, to me, are still an area where there is terrific innovation; many exercise programmes are available freely online and to achieve health it is not necessary to get obsessed with all this. So, I am cautious about a near multi-billion dollar company that is majority app-driven.

Last Thursday’s results trumpeted partly, a return to revenue growth in the fourth quarter, yet this was just 0.2% like-for-like, and you could say a fall in real terms considering inflation. Within this, equipment sales/rental revenues eased 3.6% while app-based subscription revenue rose 2.1% despite the churn.

Peloton Interactive, Inc

Fourth fiscal quarter to 30 Jun

$ million

| Q4 | Q3 | Q4 | ||

| Jun-23 | Jun-24 | Jun-24 | ||

| Connected fitness products revenue | 220 | 280 | 212 | |

| Subscription revenue | 422 | 438 | 431 | |

| Total revenue | 642 | 718 | 643 | |

| Connected fitness gross profit | -82.6 | 11.6 | 17.6 | |

| Connected fitness gross margin | % | -37.5 | 4.2 | 8.3 |

| Subscription gross profit | 284 | 298 | 294 | |

| Subscription gross margin | % | 67.3 | 68.1 | 68.2 |

| Total operating expenses | 427 | 456 | 375 | |

| Net profit | -242 | -167 | -30.5 | |

| Adjusted EBITDA | -34.7 | 5.8 | 70.3 | |

| Net cash used in or generated by, ops | -55.4 | 11.6 | 32.7 | |

| Free cash flow | -74.0 | 8.6 | 26.0 | |

| User metrics | ||||

| Members (millions) | 6.5 | 6.6 | 6.4 |

Guidance for this current quarter to 30 September is for a 4% drop, although it does tend to be Peloton’s weakest quarter. More worrying is management’s sense for 9% group revenue fall in respect of the fiscal year to 30 June 2025. In turnarounds, after initial efficiency gains are achieved, you want to see an improving top line otherwise shareholder value is being lost. If costs have to keep being cut, to make the business viable, it will end up run into the ground.

Management is optimistic of “improving engagement” to customers through product and content innovation, but concedes uncertainty as to when meaningful benefits will manifest.

Balance-sheet risks have mitigated moderately

Debt refinancing referred to here, means an exchange of long-term liabilities from Peloton’s convertible notes to a term loan. The 30 June balance sheet had nearly $1.5 billion long-term debt and $578 million leases, versus $698 million cash. Additionally, there are $75 million leases.

- Stockwatch: serious upside potential at this small-cap

- The teenagers on track to become ISA millionaires

To management’s credit and what seems quite recently, inventories have reduced from $523 million to $330 million.

While debt maturity risks have been contained, there has still been a $21 million net interest charge during the quarter which boosted the reported net loss over $30 million (including a $10 million impairment charge). This charge is only down 11% year-on-year.

Negative net assets have increased from $295 million to $519 million, year-on-year, although $56 million goodwill/intangibles within this figure are not massive for a respected brand.

Such a balance sheet may sustain the business to overall recovery if US consumer spending is maintained. Recession, however, would be alarm bells for this stock as weaker revenues conflate with balance-sheet risk still.

Impossibility of meaningful projections right now

Much here, depends on the calibre of new CEO – the board seems close to announcing. Meanwhile, there is no established profits record as a basis for projections; the market is being led by management’s guidance on revenue. Currently, they aim for a growth rate similar to US gross domestic product, which would be 2-3%. “We expect continued sales headwinds as a result of an uncertain macroeconomic environment.”

Year-on-year gross margin is still expected to improve, aiding full-year free cash flow of at least $75 million.

In May 2021, I explained why it was best to avoid Peloton at $83 – “this is essentially a pandemic trade”. I will keep the door open to re-assess by way of a “hold” stance now, but is too uncertain as yet to declare “buy”.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.