Stockwatch: I think I’ve found an effective inflation hedge

24th March 2023 12:45

by Edmond Jackson from interactive investor

Asset prices were inflated by low interest rates and quantitative easing, but with inflation now stubbornly high, analyst Edmond Jackson studies opposing views of economists and pragmatists on how best to live with it.

In my last piece - on asset allocation - I considered means to cope with an inflationary environment.

Next day came a “surprise” jump in the UK consumer price index to 10.4% - blamed on food shortages, although I would mind wage awards in a tight labour market had a big impact. Listed companies also often say they are passing on higher costs to customers. It all adds up to ingrained inflation.

- Invest with ii: Share Dealing with ii | Open a Stocks & Shares ISA | Our Investment Accounts

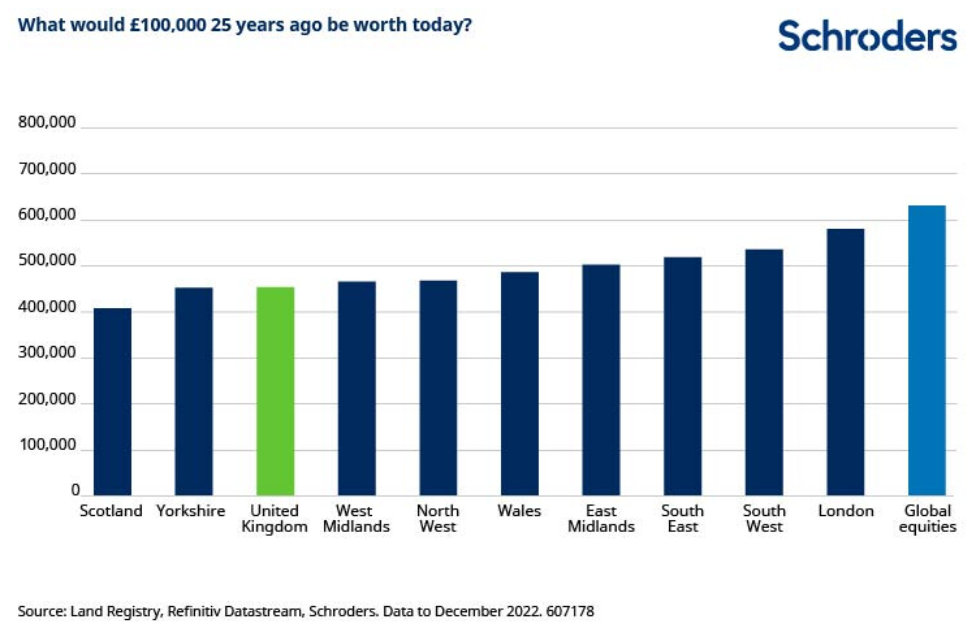

Despite evidence over the last 25 years, equities have consistently outperformed residential property. So I expand my base-case about how homes resistant to climate change appear a long-term inflation hedge, to include those which are also energy-efficient.

Physical assets can do well in an inflationary environment

If the cost of building materials and labour is rising, so does existing property. It helps explain why house prices have lately been quite sticky despite what appeared a speculative bubble – especially in country homes – around Covid.

As home insurance costs rise, flooding risk is more in focus. Climate change means more extremes of weather, and if sea levels rise as predicted, then by 2050 an estimated 200,000 coastal homes could be underwater. Ironically, Cornwall, one of the most desirable counties, is among those possibly worst-affected.

Old national housing stock is being replaced

With higher heating bills liable to persist, the Energy Performance Certificate (EPC) which grades homes at A to G is gaining importance.

A chief moan – that Britain does not insulate homes effectively – is compromised for example by Victorian solid walls. No way are such buildings suited to heat pump technology.

Period homes, unless having undergone a thorough gutting to insulate walls and floors, simply cannot compete with modern construction – hence languish on EPC ratings, typically D at best.

- 10 housebuilder shares: best value, momentum, margins, and dividends

- Property stocks demolished by this vote of no confidence

- Stockwatch: bonds, equities or cash – my investing tactics

Older buildings are thus disadvantaged as the market steadily shifts towards energy-efficient new and re-builds, unless they offer compelling emotional appeal – say by way of location and historical splendour.

It explains quite a flood of larger old homes coming on to the market where owners can no longer support maintenance costs and are downsizing. It’s also the case with country barns once converted for holiday letting, but with an F grade EPC which means the property cannot legally be let. And sometimes even circa 50-year-old houses are being replaced with eco-lodges built on the Continent, imported and assembled here.

This is part-driven by new-builds being zero-rated for VAT, while home improvements attract the standard 20% rate. You may still see an isolated old wall or two, retained to get planning permission.

It is a radical leap for the relatively wealthy – but I say marks out energy-efficient homes as the better long-term investment, able to resist much de-rating of the wider market.

Latest data contradicts forecasts of 10% fall in house prices

Anyone mortgaged can take some relief at predictions of being underwater on a recent purchase.

A Rightmove survey finds average UK house prices up nearly £3,000 this month, and while that is below a typical March rise of 1% in the last 20 years, it reflects a market “on a much more stable footing than many anticipated”.

Yes, some ask-prices have reduced after country homes became frothy during Covid. But I became aware of one such re-listing last month at an August 2022 valuation – a 22% premium to its October 2020 ask-price – and selling (subject-to-contract) in a fortnight. Its EPC was even E-grade.

Mid-cap housebuilder Vistry Group (LSE:VTY) said alongside its 2022 results, “market conditions are improving” and assuming private sales rates continue towards 2019 levels, then a profit upgrade is due.

Small-cap Henry Boot (LSE:BOOT) cites “a partial recovery in home-buyer interest from lows in the final quarter of 2022” at its Stonebridge Homes operation. As if contradicting claims that buy-to-let is no longer a viable property investment strategy: “the march of the buy-to-rent sector, both in terms of customer and investor demand, continues.”

Perhaps it all reflects a fundamental shortage of homes in the UK as capable of defying “price crash” doomsters, unless inflation forces the Bank of England to keep raising interest rates.

The long-term context for residential property?

Economists warn of an unsustainable gap between house prices and wages - the average UK house costs nearly nine times average earnings. This compares with four times in the mid-1990s.

Last month, Schroders published analysis of 175 years of UK housing data, asking “is property really a better investment than a pension?”

Land Registry data shows the last time house prices were this expensive was back in 1876.

- UK housing most unaffordable since Victorian times

- Will overpaying my mortgage or pension make me richer?

- FTSE 250 round-up: M&S rally joined by Vistry and Bytes

Prices remain stretched everywhere, especially London (at 12 times the average local wage) and the South East.

The house/earnings multiple declined from the late 19th century amid substantial building especially of smaller homes and rising wages.

I have recently noted how in January 2022, the Office for National Statistics cited 36% of homes are owned outright versus 28% with a mortgage (19% being rented privately and 17% in social rent).

Polarising wealth has also changed aspects of the market, which can end up a tussle between 100% cash buyers when a home is especially desirable.

Equities have outperformed property up to now

Schroders compares the 25-year return from £100,000 invested in UK property – worth an average £454,000 today – with £631,000 invested in the global stock market. Equities have delivered a near 10% better return than even the best-performing regional property market, London.

Whichever five-year horizon you pick within this period, “the stock market would always have resulted in a bigger increase compared with UK residential property”.

I question this differential persisting; its historic horizon from just before the millennium benefited from inflation having been crushed by tough monetary action in the 1980s then the 1990s recession. Equities also enjoyed an exceptional period of loose monetary policy from the 2008 crisis until last year.

Currently, central banks may not be able to raise rates enough to tackle inflation without causing a slump, given there is so much accumulated debt.

Medium-term prospects therefore differ radically from the last 25 years. If we face broadly a stagflation environment, then attractive physical assets are likely to be perceived as useful to cope with inflation.

I will eat my words if UK inflation is sub-3% by year-end, as some authorities predict, but so they did that it would be “transitory”.

A firm case exists to prioritise energy-efficient, climate change-resistant, residential property – if you can.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.