Stockwatch: hard to bet against this FTSE 100 star

Half-year results have been well received, and this blue-chip business is flying high. After revisiting his successful long-term buy tip, analyst Edmond Jackson talks through the rationale for his latest rating.

14th May 2024 13:02

by Edmond Jackson from interactive investor

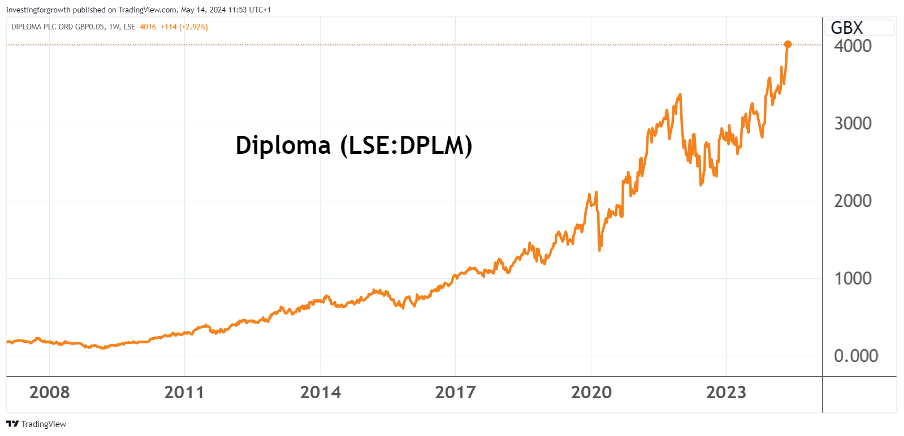

Can Diploma (LSE:DPLM) 20-bag again like it has in the last 14 years as it transitioned from small-cap to FTSE 100 status?

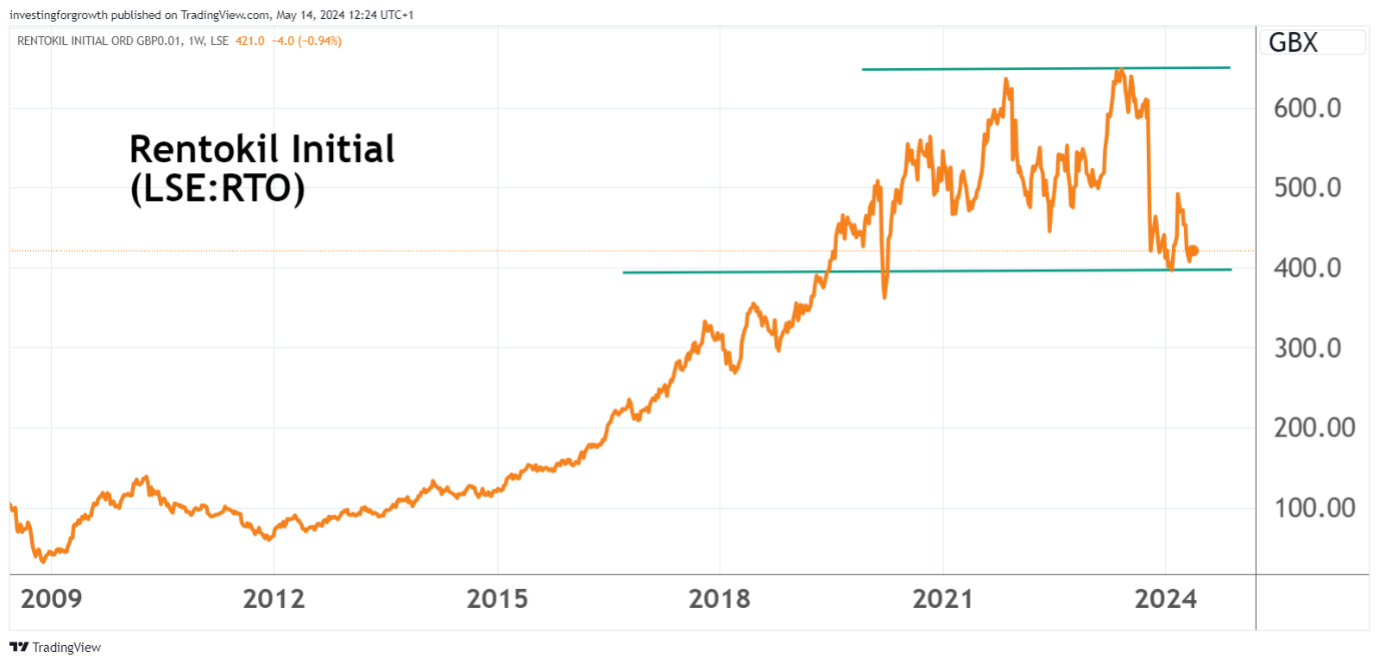

With its technological prowess in specialist controls, seals and life sciences, should it not stand a decent chance of beating Rentokil Initial (LSE:RTO) in pest control and cleaning? Over four decades, Rentokil has achieved a fine run overall, from 25p to over 600p last year, with two main growth phases after it first hit trouble.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

I draw comparison because both companies have exuded confidence in double-digit earnings per share (EPS) growth, albeit Diploma professing more like 15% than “Mr 20%” as Rentokil’s boss Sir Clive Thompson was known some 30 years ago. That was always over-ambitious to sustain – a risk of acquisitive overstretch – and after a number of debacles the consensus became, avoid acquirers who focus on EPS.

Yet investors are flocking again to the concept. After Diploma’s interim results raised guidance for 2024, at around 4,100p the shares trade possibly on 27x earnings albeit on a dividend yield of just 1.5%, despite paying out roughly half of earnings. Such a snapshot implies a full valuation, yet Diploma’s narrative is distinctly strong; “scaling effectively for sustainable growth”. Moreover, returns on capital employed are around 15%, even 20% for recent acquisitions.

Plenty of investors are liable to flock to a share like this in a sense of safety, despite a PEG ratio (price/earnings (PE) ratio divided by the earnings growth rate) of 1.9 when preferably you are looking for below 1.0 with exceptions up to 1.5 perhaps. Diploma has no disclosed short-sellers, showing how moderate overvaluation is not enough to interest them, it needs the underlying story to break down.

Yet Diploma is possibly the best London-listed example of “buy-and-build”, achieving acquisitive and organic growth as a multinational. Even if the stock is overvalued in the near term, a danger for shorters would be Diploma simply “growing into its valuation”.

Source: TradingView. Past performance is not a guide to future performance.

In 2010, Diploma’s PEG rating was below 1.0

Delving into my article records, I drew attention to Diploma as a “buy” at around 200p in April 2010, a month ahead of its interim results when it was still a small-cap. The stock had eased from a 215p high having doubled over the previous 12 months - as if looking like their best run had happened. The forward PE was below 13x, easing to near 11x, yet expected earnings were getting a boost into mid-high teens growth rates.

Return on capital employed had averaged 28% from 2000 to 2009 including a 22% return in the 2009 trough. The table shows this has moderated in recent years.

Diploma - financial summary

Year-end 30 Sep

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

| Turnover (£ million) | 485 | 545 | 538 | 787 | 1,013 | 1,200 |

| Operating margin (%) | 15.1 | 15.4 | 13.0 | 13.2 | 14.2 | 15.3 |

| Operating profit (£m) | 73.2 | 84.1 | 69.8 | 104 | 144 | 183 |

| Net profit (£m) | 53.8 | 61.9 | 49.3 | 69.8 | 94.7 | 118 |

| EPS - reported (p) | 47.6 | 54.7 | 43.5 | 56.1 | 76.0 | 90.4 |

| EPS - normalised (p) | 46.5 | 54.3 | 47.4 | 61.7 | 78.7 | 114 |

| Operating cashflow/share (p) | 57.7 | 62.1 | 75.3 | 93.3 | 100 | 145 |

| Capital expenditure/share (p) | 5.8 | 9.6 | 8.3 | 5.0 | 12.4 | 17.7 |

| Free cashflow/share (p) | 51.9 | 52.5 | 67.0 | 88.3 | 88.0 | 128 |

| Dividends per share (p) | 25.5 | 29.0 | 30.0 | 42.6 | 53.8 | 56.5 |

| Covered by earnings (x) | 1.9 | 1.9 | 1.5 | 1.3 | 1.4 | 1.6 |

| Return on total capital (%) | 23.3 | 21.4 | 12.0 | 12.9 | 12.9 | 13.5 |

| Cash (£m) | 36.0 | 27.0 | 207 | 24.8 | 41.7 | 62.4 |

| Net debt (£m) | -36.0 | 15.1 | -173 | 230 | 398 | 335 |

| Net assets (£m) | 291 | 321 | 527 | 536 | 662 | 896 |

| Net assets per share (p) | 257 | 284 | 423 | 431 | 531 | 668 |

Source: company accounts.

Instrumental also are relatively high operating margins: 2010 interim results showed a rise above 19% at the adjusted level. While the table shows 13-15% at the reported level, Diploma is now guiding for a 0.8% rise this year, up to 20.5% in adjusted terms, helped by recent acquisitions.

It follows from supplying essential products unique to Diploma, to medical, industrial and technological sectors.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- Insider: boss buys share stake at big discount

The table also shows a strong record of free cash flow enabling dividends besides acquisitions, albeit less material now in yield terms.

In November 2010 I wrote on Diploma: “There is a frustrating adage involving shares that never look cheap to buy, as if always fully valued relative to their underlying earnings growth rate – until another year of solid performance and possibly upgrades, quite leaves you thrashing why you sat on the fence.”

Same applies today if we consider Rentokil Initial’s true long-term context. But should you heed Diploma’s significantly higher valuation yardsticks nowadays, or just swallow and buy?

Rentokil was similarly feted for consistent outperformance

From a base in pest management, Rentokil expanded into a wide range of facilities management services – the 1996 acquisition of Initial introducing laundry and washrooms. Nowadays, at 420p a share it is capitalised at £10.6 billion, or twice the size of Diploma, yet is rated in “growth” terms - a forward PE of around 17x and prospective yield of 2.2%.

Its PEG ratio is 1.9, like Diploma, although it has a more volatile earnings record so who knows if consensus for around 8% EPS growth might be outstripped another year. Operating margins have bumped along at roughly 10% but return on capital employed has been distinctly lower than Diploma at mid-single-digit per cent in the last two years.

This helps explain why, despite excellent shareholder returns in a 40 years context, Rentokil has more recently been a sideways-volatile situation.

Source: TradingView. Past performance is not a guide to future performance.

Comparison with Diploma can seem tenuous, but I see commonality in terms of strong industry positions able to deliver multi-decades of capital appreciation and dividends. Rentokil’s growth profile has been bumpy but in due respect, EPS has trebled over the last six years.

Mind any modest deterioration in Diploma’s narrative

Operationally, it reads so well – to an extent that if there was much downturn in key segments, this would be the trigger for sentiment change. The only reason I can fathom why the stock fell 34% from 3,400p in the first half of 2022, was Russia’s invasion of Ukraine potentially affecting aerospace (an industry supplied) and/or expectations of higher interest rates affecting “growth” ratings. Updates during this period were strong with no glitches.

To its credit, I cannot recall when Diploma has ever needed to make a profit warning, only upward revisions. Maybe its strong overall narrative will just persist.

- Lloyds Bank and Aviva part of FTSE 100’s £9bn dividend windfall

- Shares for the future: a maximum score for quality

Yesterday’s interim results asserted 10% growth in adjusted earnings per share, with adjusted operating profit up 14% to £125 million. There was some disparity, with reported operating profit slipping 5% to £88 million albeit chiefly goodwill amortisation. Interim adjusted EPS rose10% to 65.1p, although basic EPS eased 9% to 43.1p and the interim dividend edged up 5% to 17.3p, implying nearly four times adjusted earnings cover.

Despite “a more challenging market”, momentum is cited as “encouraging going into the second half”, hence annual revenue guidance is upgraded to 16% comprising 6% organic and 10% from acquisitions.

The company says: “Our current performance and upgrade reaffirms our confidence in delivering sustainable quality compounding...six quality businesses brought into the group during the first-half-year...including Peerless and PAR Group – two founder-owned businesses with great organic growth credentials and strong value-add business models.”

Management’s acquisition-sourcing remains highly capable, this pipeline cited as being “strong by sector, size and geography.”

Last March, the stock jumped 11% to over 3,800p in response to the £236 million acquisition of Peerless Aerospace Fastener, said to drive an 8% advance in group EPS. This boosted Diploma’s market value by around £500 million which felt a bit like exuberance rather than rational assessment of synergy.

Will the price ever come back usefully again?

A typical way to rationalise Diploma is to “buy on weakness” – which feels like a cop out, given this premier UK growth stock has consistently defied such hopes. You do at least have the unexpected first-half 2022 experience, and perhaps if interest rates do not come down (led by the US, whose inflation is proving sticky) then growth stock multiples could contract. Arithmetically, Diploma looks pricey. The upside risk to waiting is another deal creating excitement, yet management should have enough to digest.

I therefore reiterate long-term “buy”, although would prefer to see if the mood settles back. Who knows if “sell in May” might kick in generally this year.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.