Stockwatch: four stocks to back a UK building boom

With minsters confidently citing housebuilding and infrastructure as key means to invigorate UK growth, is this a new investment trend to back? Analyst Edmond Jackson thinks so.

9th July 2024 12:25

by Edmond Jackson from interactive investor

While it was always a key policy objective for Labour, it took until confirmation of a strong majority government for housebuilding equities to respond from last Friday. With housebuilders, the rally has typically only been around 3% for the majors, more so in small-caps, if only taking both back to levels of last springtime.

In infrastructure, key shares are edging to multi-year highs but remain on modest single-figure price/earnings (PE) multiples.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

So, with minsters confidently citing housebuilding and infrastructure as key means to invigorate UK growth, is this effectively a new “secular” investment trend to back? Bosses of Barratt Developments (LSE:BDEV) and Berkeley Group Holdings (The) (LSE:BKG) have responded positively, as if this is a breakthrough – effectively for private companies to piggy-back public spending.

I think the stock market is being wise to avoid a knee-jerk reaction up. Labour’s plan, effectively for around 65,000 extra homes built per year, within their objective for 1.5 million homes over five years, is going to require forceful action versus councils, and there will be local and“green lobby” resistance. The Conservatives wanted to build more houses but met the dilemma of alienating their own supporters.

In the short term, builders should get some bonus from existing stalled building sites being accelerated, and also “brownfield” sites and Labour’s de-defining Green Belt boundaries – pinpointing “grey” areas within.

Affordability remains just one issue among others

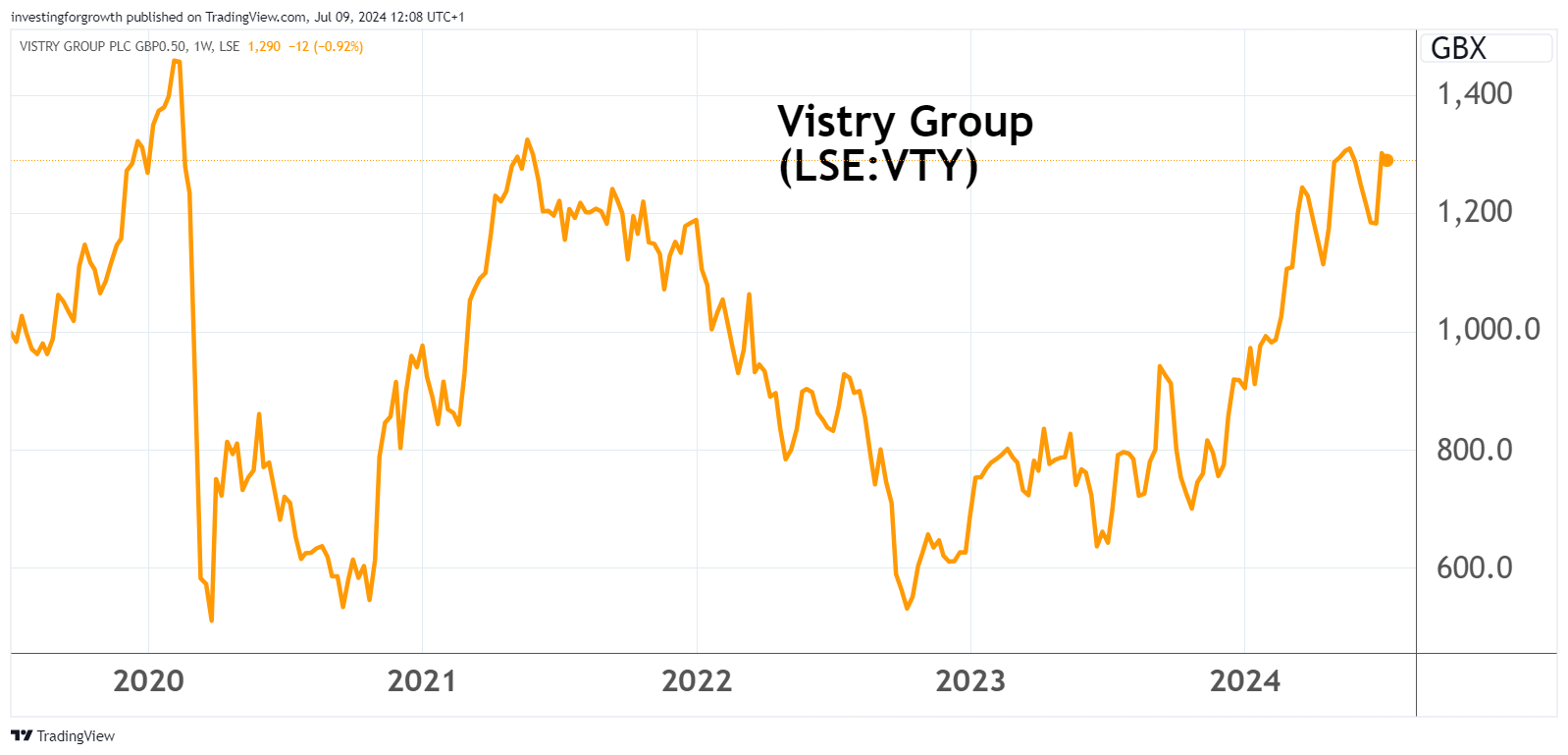

Affordability of homes is the chief reason housebuilders’ profits are projected to shift materially lower than they were in the years before interest rates hiked. Initially, Labour needs to prioritise “build/buy to rent” where Vistry Group (LSE:VTY) is showing it can capitalise.

More positively, Vistry’s trading update today cites forward sales up 21% on last year, so the market is picking up. I have rated this stock “buy” since 832p in July 2022.

But mind how, if Labour does achieve its objective to deliver more homes, this will temper house price rises which are one key element in housebuilders’ profits.

There are snakes in the grass besides ladders of opportunity.

What will be the public/private balance under Labour, will it move towards some kind of nationalised housebuilding and where would the funding come from? All this may be revealed at an autumn budget.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- What Labour’s landslide means for investors

- Time for unloved UK stocks to shine again

Despite Labour’s contempt for shareholder dividends, I doubt they will hit housebuilders with a windfall tax, given it would promptly assert an “anti-business”approach when Labour needs private builders on its side.

Lack of skilled workers is another factor: if wages have to rise further to attract people into the industry, it counters the Bank of England’s objective to grind inflation assuredly down to 2%. For younger people, however, checking house price growth (via greater supply) is the most serious aspect of inflation to deal with.

Does this justify upgrading housebuilders from 'hold' to conviction 'buy'?

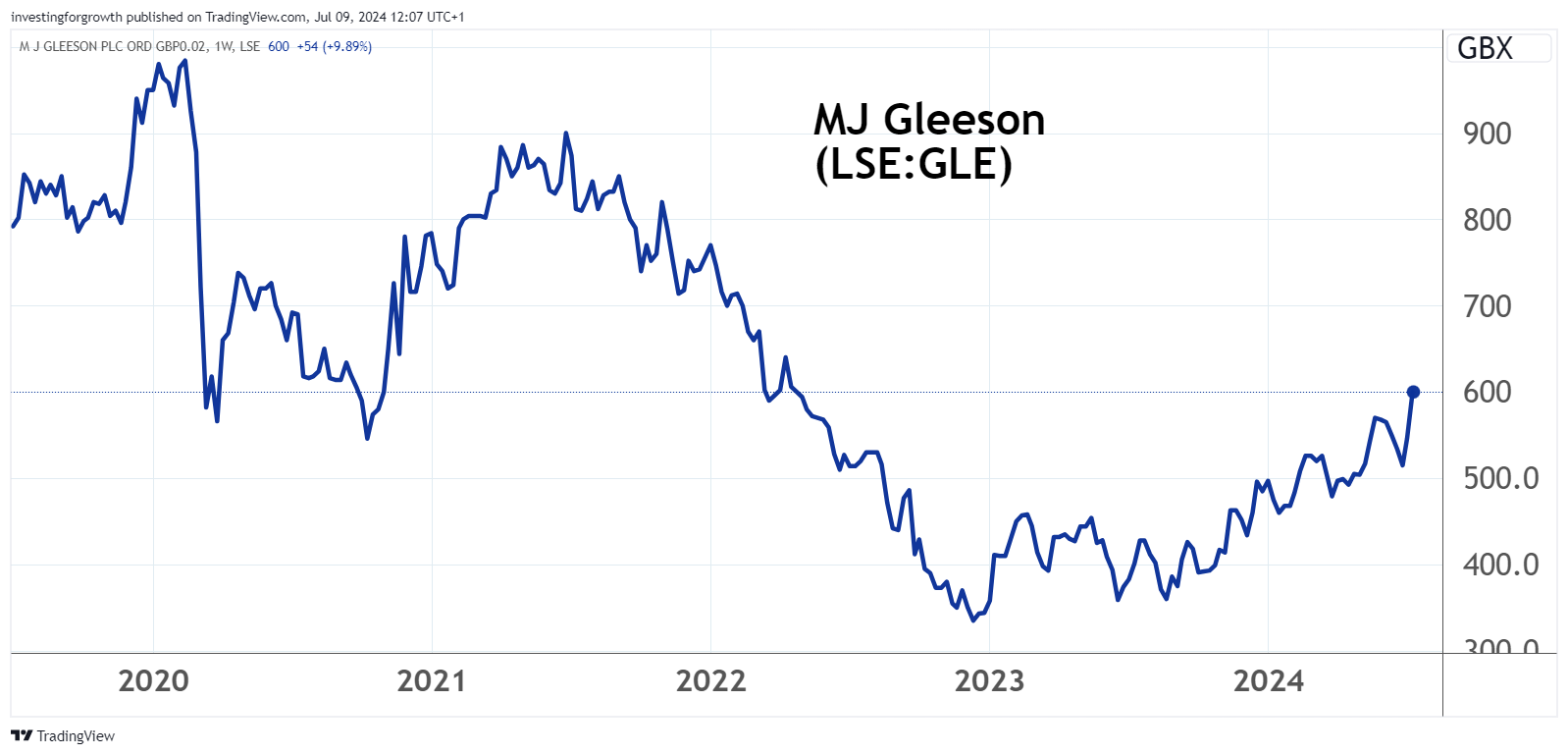

Shares in MJ Gleeson (LSE:GLE) are up 11% to 590p since the election, the best gainer given its strategic focus on low-cost homes and a near £350 million small cap status – relative to the volume builders such as Persimmon (LSE:PSN) up barely 3% as a £4.7 billion FTSE 100 company. I had previously upgraded my stance on Gleeson to “buy” at 383p a year ago.

Despite a forward PE near 17x and yield of 2% with around 3x earnings cover, Gleeson remains well down on its all-time high above 950p in early 2020, after which it slumped to around 350p by late 2022 and in chart terms is in a recovery trend:

Source: TradingView. Past performance is not a guide to future performance.

It adds to intrigue over a trading update due this Thursday 11 July and, if there is a builder I would upgrade to “buy”, it is probably Gleeson given it is in the right space to co-operate well with Labour and of small size to leverage gains.

Vistry I continue to like after a £580 million deal was struck last month with Blackstone and Regis for 1,750 new homes in the South East. That its stock is as yet unable to respond positively to today’s trading update implies patience may be needed for a break-out over 1,300p but meantime it offers a 4.5% yield:

Source: TradingView. Past performance is not a guide to future performance.

We can expect all housebuilders to adapt their narratives to Labour’s agenda, for example the boss of Berkeley Group welcoming new government proposals – saying 87% of its homes were delivered were on brownfield land in the last financial year. Around 4,800p, Berkeley's prospective yield is around 5% albeit with cover around 1.4x.

If you have no exposure to housebuilders then a case exists to consider buying into the sector, where plenty should benefit. If you already hold, then continue to rather than go overweight. We have yet to see for example, what Labour will do on corporation tax.

Infrastructure solutions stocks still face low-margin dilemma

Whereas operating margins for housebuilders Persimmon and Taylor Wimpey (LSE:TW.) are in low-teen percentages, infrastructure groups such as Costain Group (LSE:COST) and Kier Group (LSE:KIE) have only in the last year or so recovered margins of around 2% (after losses during Covid).

The chief risk with low-margin contractors on high revenues (Kier expected to achieve over £4 billion in its latest financial year, Costain £1.2 billion) is financial results potentially being disrupted if just one major project hits trouble. Yet with the stocks on modest single-figure PE’s, they have enjoyed recovery trends as managers have asserted better controls.

These companies are broadly set to get further support from Labour’s agenda. We need to see the policy details and how financed, but infrastructure spend is a classic priority for centre-left governments.

- The Income Investor: two FTSE 100 stocks where dividends count

- Shares for the future: now is a good time to own this stock

I have been positive on both these stocks as recovery plays: Costain for “deep value” at 50p in March 2023 and Kier likewise as a “buy” at 90p exactly a year ago after declaring a string of contract wins. “Serving highways, rail, infrastructure and nuclear, a public sector bias may well be helping Kier – versus private firms deferring commitments during uncertainty.”

In both cases, a forward PE of 6x has only needed to improve to around 7x for share prices to advance, by 80% for Costain and 65% for Kier – hence their currently passing momentum investors’ screening criteria.

| Kier Group - financial summary | ||||||||||

| year ended 30 Jun | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Turnover (£ million) | 2,907 | 3,276 | 3,998 | 4,112 | 4,220 | 3,966 | 3,423 | 3,261 | 3,144 | 3,381 |

| Operating margin (%) | 1.0 | 1.7 | -0.3 | 1.1 | 3.1 | -5.2 | -5.9 | 1.3 | 1.4 | 2.4 |

| Operating profit (£m) | 29.0 | 57.3 | -10.2 | 45.3 | 129 | -205 | -201 | 43.7 | 45.1 | 81.5 |

| Net profit (£m) | 10.0 | 4.4 | -17.6 | 10.7 | 87.3 | -210 | -273 | -0.3 | 12.7 | 41.1 |

| Reported EPS (p) | 15.8 | 39.3 | -25.3 | 12.8 | 75.5 | -126 | -90.9 | 11.6 | 2.8 | 9.3 |

| Normalised EPS (p) | 56.1 | 58.0 | 72.9 | 65.3 | 81.7 | 98.7 | 80.8 | 51.7 | 17.8 | 18.3 |

| Earnings per share growth (%) | -10.5 | 3.4 | 25.7 | 4.7 | 25.1 | 20.9 | -18.2 | -35.9 | -65.6 | 3.1 |

| Operating cashflow/share (p) | -8.5 | 168 | 172 | 130 | 111 | -53.5 | -37.9 | 22.8 | 16.3 | 41.6 |

| Capex/share (p) | 78.0 | 58.7 | 53.9 | 52.1 | 54.1 | 20.3 | 4.1 | 3.0 | 1.5 | 1.5 |

| Free cashflow/share (p) | -86.5 | 109 | 118 | 77.6 | 57.3 | -73.8 | -42.0 | 19.8 | 14.8 | 40.1 |

| Dividend per share (p) | 56.5 | 54.2 | 63.4 | 56.7 | 58.0 | 4.2 | 0.0 | 0.0 | 0.0 | 0.0 |

| Covered by earnings (x) | 0.3 | 0.7 | -0.4 | 0.2 | 1.3 | -30.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Net debt (£m) | 210 | 181 | 143 | 146 | 213 | 195 | 510 | 171 | 163 | 124 |

| Net assets/share (p) | 545 | 603 | 587 | 439 | 517 | 274 | 127 | 97.8 | 124 | 115 |

| Source: historic Company REFS and company accounts | ||||||||||

Costain’s interim results are due in August, after the 16 May AGM cited in-line trading with “a high-quality forward work position that aligns with our strategic plans both for transportation and natural resources.”

Kier is also due to report soon: last year there was a 20 July trading update in respect of annual results to 30 June (announced September). The March interims had asserted revenue up 23% and operating profit up 15% on a 3.4% margin, albeit the order book up more modestly at 6%.

- Best UK stocks, sectors and markets in first half of 2024

- Insider: directors buy this ‘undervalued’ FTSE 100 share

Reinstating a dividend in context also of a 44% reduction in net debt, helped confidence that Kier is at a positive watershed.

My instinct is both stocks remaining “buy” as government doubles down on infrastructure development. You do, however, need to respect inherent risks with low-margin contractors.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.