Stockwatch: can this exceptional stock keep defying a bear market?

8th July 2022 11:34

by Edmond Jackson from interactive investor

Little more than two months after our columnist backed the shares to go higher, this AIM growth stock is up 17% and at a record high. Here’s what Edmond thinks now.

In April, I made a “buy” case for Cerillion at 820p, then a £240 million billing software provider to the telecoms industry. Instead of taking two years to reach the 1,000p target I set, Cerillion (LSE:CER) has pretty much reached it already – at 990p offered.

Is this a portent of a strong company set for years of growth and one of a scant few able to withstand recession and sustain a premium stock rating? Or is this just temporary froth that will get wiped away when the market truly turns down?

Capitalising on the full-fibre and 5G roll-out

This looks a sound niche business because telecoms companies vie with each other to provide the best service; hence this infrastructure upgrading looks as if it will offer possibly two years of growth, irrespective of the wider economy.

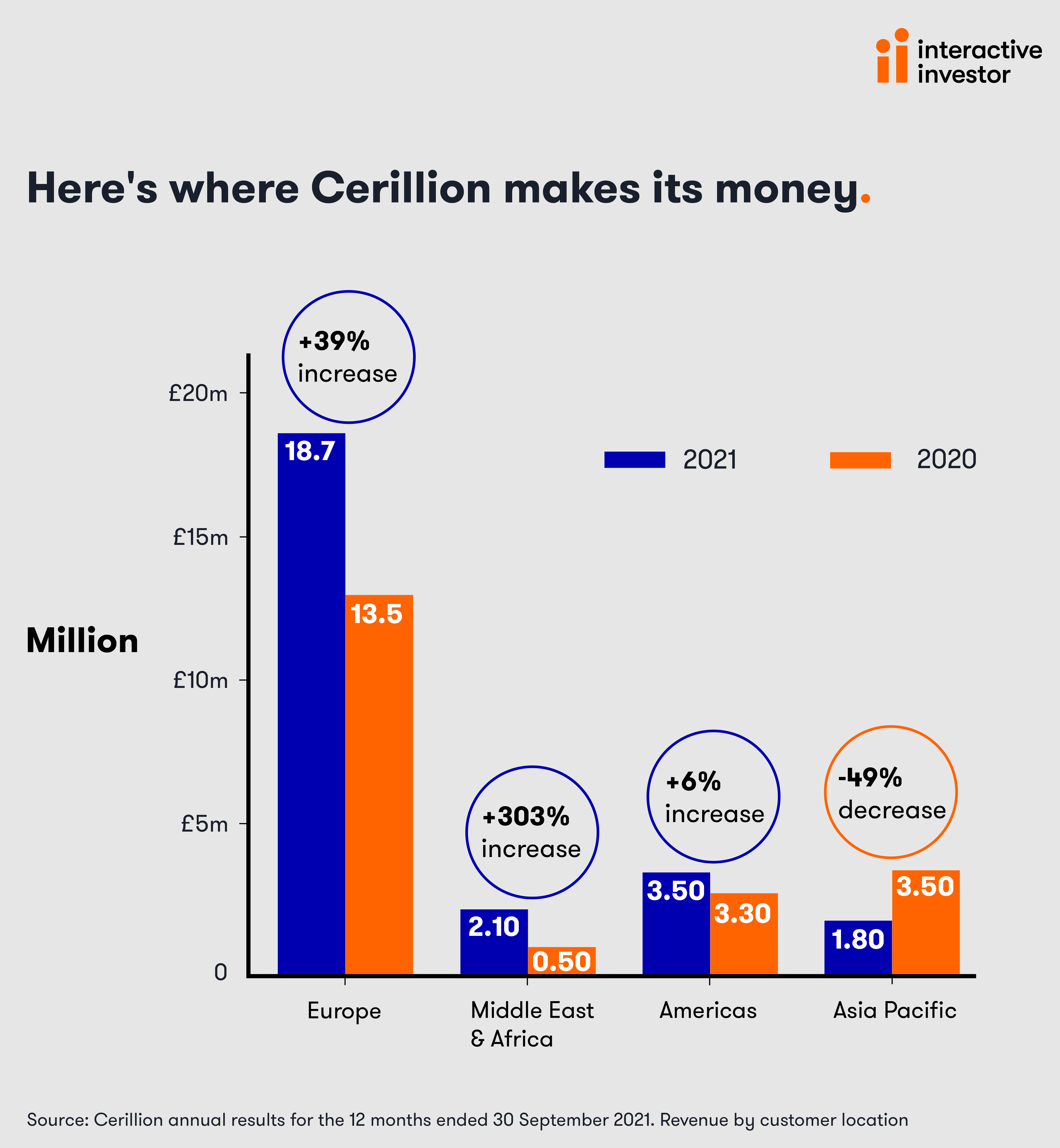

The 9 May interim results did not provide a geographic breakdown of revenue, but the September 2021 accounts showed 72% Europe, 13% Americas, 8% Middle East/Africa and 7% Asia-Pacific.

Be aware that in Europe, two customers accounted for just over 30% of group revenue in the last financial year and, while the largest customer has ramped up, the second has nearly halved.

While “bigger deals from larger customers” implies leverage, mind it can also mean lumpiness going forward. If the market gets edgy about the stock on a high multiple, any aspect of downgrading – according simply to the timing of revenue recognition – could cause jitters, even if irrational in a value sense.

A new team has been established in Bulgaria as part of a push to accelerate recruitment and diversify the talent base to meet growing demand. There are also overseas offices in India and Australia.

- Stockwatch: why I have serial affections for this AIM company

- How AIM shares can bounce back from 2022 crash

- Read more AIM articles by Andrew Hore here

Management proclaims 80 customers being served across 44 countries, although I suspect the UK constitutes the majority of its main European orientation.

The pace of telecoms advances implies further generations of upgrades over the long-term, though be aware how software companies can have a good run – capitalising on change – then a crux comes if growth slows. The question for revenue sustainability is how long are the contracts?

Classically, that would be the point where the stock de-rates to a price/earnings (PE) potentially sub-20x as momentum traders sense the best growth run is over; and pricing depends on the level at which the yield stock can appeal to income investors.

Cerillion’s strength of free cash flow (see table) implies it would quite easily manage such a scenario, albeit with the PE de-rated from what we see today.

Cerillion - financial summary

year-end 30 Sep

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | |

| Turnover (£ million) | 8.4 | 16.0 | 17.4 | 18.8 | 20.8 | 26.1 |

| Operating margin (%) | 5.2 | 13.1 | 10.9 | 13.4 | 13.5 | 28.9 |

| Operating profit (£m) | 0.4 | 2.1 | 1.9 | 2.5 | 2.8 | 7.5 |

| Net profit (£m) | 0.3 | 2.0 | 1.9 | 2.3 | 2.6 | 6.4 |

| EPS - reported (p) | 1.3 | 6.9 | 6.5 | 7.8 | 8.8 | 21.7 |

| EPS - normalised (p) | 3.4 | 6.9 | 6.8 | 7.8 | 8.8 | 21.7 |

| Operating cashflow/share (p) | -3.5 | 11.7 | 12.5 | 17.1 | 22.2 | 33.1 |

| Capital expenditure/share (p) | 3.2 | 3.6 | 5.6 | 4.1 | 4.8 | 4.3 |

| Free cashflow/share (p) | -6.7 | 8.1 | 6.9 | 13.0 | 17.4 | 28.8 |

| Dividends per share (p) | 3.9 | 4.2 | 4.5 | 4.9 | 5.5 | 7.1 |

| Covered by earnings (x) | 0.3 | 1.6 | 1.4 | 1.6 | 3.1 | 3.5 |

| Return on total capital (%) | 2.4 | 12.0 | 11.1 | 14.8 | 13.0 | 29.7 |

| Cash (£m) | 5.0 | 5.3 | 5.3 | 6.8 | 8.3 | 13.2 |

| Net debt (£m) | -0.4 | -1.7 | -2.5 | -5.0 | -2.1 | -8.4 |

| Net assets (£m) | 13.0 | 13.8 | 14.4 | 15.5 | 16.0 | 20.2 |

| Net assets per share (p) | 43.9 | 46.6 | 48.9 | 52.7 | 54.5 | 68.8 |

Source: historic company REFS and company accounts

Current rating assumes 30%-plus earnings growth

Back in April, forward PE multiples in a low twenties’ range compared with annual revenue to September 2021 up 25%, new orders by 43% and the operating margin from 13.5% near 29%, helping earnings per share (EPS) more than double.

On the classic price/earnings-to-growth (PEG) measure of growth stocks, Cerillion therefore offered value.

An update for the six months to 31 March showed momentum continuing, and the sales pipeline remained strong. A trend towards bigger deals and larger customers looked able to re-rate the business financially.

This is now manifesting by way of last Wednesday’s news of a £15 million 10-year contract. And, if there are more such in the pipeline, it will further distinguish Cerillion in a difficult stock market.

I had set a £10 price target based on EPS climbing to 40p over the next two years and applying a 25x PE.

A £15 million contract spread over 10 years implies a 5% revenue upgrade to the September 2022 forecast, where the EPS consensus before this deal was announced was for 30% growth to 28.2p, then 33.7p in 2023.

(That is just for context, as the contract will only contribute three months’ worth to the current financial year.)

If assuming nearer 35p for the September 2023 year, the PE at 984p would be 35x, easing to 28x – i.e. the market is starting to price in more big deals emerging.

On a truly long run view such a rating is unlikely to last, even if EPS is materially higher.

Will enough buyers step up to engage it?

Cerillion is a test of current market sentiment. Up to last autumn, an attractive story had been quite enough to tempt momentum buyers, but many stocks have declined since last September and more attention is being paid to valuation.

Optimists may say a circa 30x PE constitutes “growth at fair price” and a premium for scarcity is justified, hence continue to buy.

There being no demonstrable margin of safety, however, it does not strictly constitute investment value.

Buyers most definitely will be needed, as central banks’ new-found resolve to combat inflation – using interest rates as their chief, if blunt weapon – means greater risk of recession. This is going to mean jittery markets in the months ahead. Will buyers favour high-priced growth stocks or (over) beaten-up cyclicals?

The market technical concern for holders is thus a buyers’ strike unless price comes back.

If you are less-tolerant of the risk environment taking shape, then consider selling say 20-30% of your position to lock in some of the 20% gain – but also stay in the game.

The case for keeping Cerillion tucked away

Even since April, the stock has managed to rise impressively despite experiencing drops. Volatility can be a trait of successful long-term stocks, especially in technology. A genuine investor would keep focused on further contract success emerging in the next two years.

Cerillion is not exposed to higher fuel/energy costs, such as travel/distribution and certain manufacturing firms. Its chief inflationary risk would appear to be wage demands. Though I am not aware what scope exists in the contracts to raise price according to inflation, telecoms providers have already set that culture with their own customers.

If you bought Cerillion, it probably was not a big purchase anyway given its liquidity. There is a case to retain selective stocks through a market downturn, rather than retreat fully to cash. Despite its valuation leaving no room now for upsets, Cerillion is possibly one such.

Can the recurring income element continue to rise?

Income may ultimately be the crux for stock sentiment: the recurring element needs to rise by enough to smooth out potential lumpiness in contracts, especially if any larger ones are not renewed.

The six months to 31 March saw revenue up 26% to £16.1 million, while “recurring” revenue rose 9% to £9.8 million - i.e. 61% of the total. That is respectably high anyway, helping justify the rating.

I have still seen contracting and software companies boast of high recurring income, yet stock sentiment can get upset at any caution in the narrative versus prior revenue guidance. This risk could increase as Cerillion grows larger.

Variability is to be expected. The interim results showed total new orders more than halved to £10.9 million, while new orders from existing customers rose 12% to a same amount. The new customer pipeline, however, swelled by 31% to a record £172 million with “major new signings expected in the second-half-year and beyond”.

Such news flow being likely, I tilt to suggesting retention as Cerillion shapes up as a rare growth company. Hold.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.