Stockwatch: buying this small-cap for its 9% dividend yield

There’s usually extra risk when owning smaller companies for generous dividend payments, but analyst Edmond Jackson believes this well-run business offers attractive risk/reward.

1st October 2024 10:55

by Edmond Jackson from interactive investor

Are companies genuinely on the cusp of better prosperity from lower interest rates? Or is the short to medium term, curdled not only with belated effects of higher rates but also a new Labour government likely to raise taxes and regulation?

A week ago, interim results from retailer Card Factory (LSE:CARD)surprised investors with a 40% plunge in pre-tax profit, said partly to be due to “substantial increases in National Living Wage plus freight inflation”.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

This week has kicked off with four profit warnings for varying reasons: supply chain issues and weaker Chinese demand, hurting Aston Martin Lagonda Global Holdings Ordinary Shares (LSE:AML); a tough outlook for floor coverings (discretionary spending) at Likewise Group (LSE:LIKE); weaker revenue for automotive brake discs at Surface Transforms (LSE:SCE); and wage pressures plus good ol’ British wet weather at Brighton Pier Group (The) (LSE:PIER).

A mix of factors is involved yet they share effects of tighter monetary policy after two years, and lately higher wage costs. Employee pay awards are running relatively high in the UK, especially in services, which are the backbone of the modern UK economy. It therefore seems unlikely that the Bank of England will proceed with rate cuts near the pace expected for the US Federal Reserve.

Such warnings, and also the possibility of inheritance tax relief being lost for AIM stocks, put into question a “risk-on” approach, for October at least. High dividend yields in particular need a kick of the tyres, especially where smaller companies are involved.

- The funds most at risk of AIM stocks losing IHT relief

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

An apparently strong dividend prospect

So it is timely – and after its own update – to re-consider Duke Capital Ltd (LSE:DUKE), a £138 million provider of finance to unlisted companies, which offers an 8.5% yield, assuming a 2.8p per share dividend is sustained in the year to March 2025. If recent guidance is fair, this should be covered around 1.4x by earnings and possibly nearer twice by free cash flow, given that there is no real capital expenditure. Net asset value at the year-end last March was close to 39p, which offers an element of comfort relative to the current price around 32.5p.

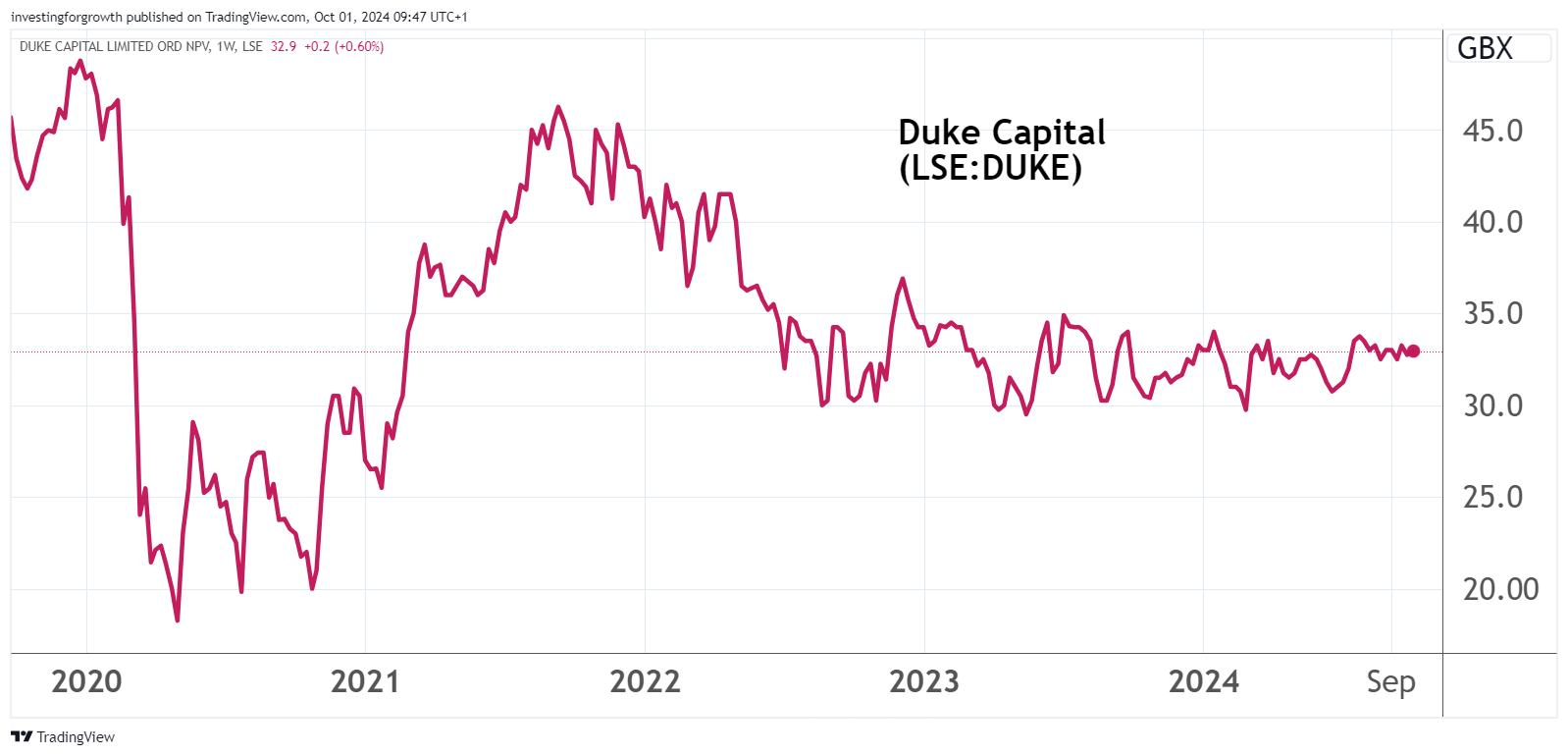

I drew attention as a “buy” last February at 31p, and the price twice hit 34p in July, otherwise the share has been sideways-volatile – not untypical of high-yield stocks where the market wonders if there really is sustainable upside.

Duke Capital - financial summary

Year end 31 Mar

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

| Turnover (£ million) | 1.8 | 6.0 | -2.3 | 21.6 | 28.8 | 31.0 | 26 |

| Operating profit (£m) | -0.9 | 1.9 | -10.6 | 16.6 | 21.4 | 20.4 | 12.3 |

| Net profit (£m) | -0.9 | 1.8 | -8.9 | 14.0 | 20.4 | 19.6 | 11.6 |

| Operating margin (%) | -47.8 | 31.9 | 454 | 76.7 | 74.4 | 65.7 | 48.1 |

| Reported earnings/share (p) | -1.3 | 1.1 | -4.0 | 5.8 | 6.0 | 4.9 | 2.8 |

| Normalised earnings/share (p) | -1.3 | 1.0 | -3.8 | 6.4 | 6.2 | 5.0 | 2.8 |

| Operational cashflow/share (p) | 0.4 | 2.4 | 3.1 | 3.7 | 3.3 | 4.3 | 5.6 |

| Capital expenditure/share (p) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Free cashflow/share (p) | 0.4 | 2.4 | 3.1 | 3.7 | 3.3 | 4.3 | 5.6 |

| Dividend per share (p) | 2.0 | 2.8 | 2.95 | 1.1 | 2.4 | 2.8 | 2.8 |

| Covered by earnings (x) | -0.7 | -0.4 | 0.0 | 5.5 | 2.5 | 1.8 | 1.0 |

| Return on total capital (%) | -2.6 | 2.2 | -11.7 | 15.9 | 11.7 | 9.2 | 5.2 |

| Cash (£m) | 6.0 | 14.0 | 20.6 | 16.0 | 26.5 | 41.7 | 36.3 |

| Net debt (£m) | -5.0 | -2.4 | -5.1 | 1.1 | 21.2 | 12.2 | 33.5 |

| Net assets (£m) | 32.2 | 72.1 | 74.0 | 85.8 | 133 | 164 | 165 |

| Net assets per share (p) | 32.0 | 35.1 | 30.0 | 34.7 | 38.1 | 40.3 | 39.8 |

Source: company accounts.

Founded in 2015 and listing in 2017, Duke’s business concept is providing hybrid credit and equity capital to small and medium-sized enterprises. The “hybrid” aspect links to royalty re-payments based on growth of those businesses’ revenues.

Its portfolio of interests – which has appeared to be around 15 situations but needs specifying more regularly, and also to show the balance of industries in portfolio weightings – grew to over £100 million by the March 2020 year-end but Covid meant non-cash write-downs totalling over £15 million that year, hence a £9 million annual net loss.

This was quite a dramatic example of what can happen to balance sheet values when unlisted companies hit a downturn; and why investment company shares related to private equity also tend to trade at a discount to net assets.

- Insider: four recovery bets plus FTSE 100 chief pockets £29m

- Shares for the future: maximum score for price but risk increases

Moreover, Duke has adjusted its approach to take equity stakes selectively, compared with royalty-based financing where the business owners retain full control. This addresses concern that the stock otherwise has no capital growth appeal, but does then make it rather hostage to economic cycles.

After the price plunged from 46p to below 20p in early 2020, there was a robust recovery; then expectations for higher interest rates to cool inflation sent the stock back down to 30p by September 2022, and it has traded sideways-volatile since:

Source: TradingView. Past performance is not a guide to future performance.

While the company has paid out around £50 million to shareholders since inception, dividends took a “scrip” or share-based form in 2021 to retain as much cash as possible. That could happen again, I believe, in another sharp recession.

The financial dynamics proclaimed at full-year results on 27 June did, however, show Duke’s business model as plenty effective. Total cash revenue soared 38% to over £30 million, with the recurring element up 12% to over £24 million. Three successful and profitable exits generated £23 million of additional liquidity and £46 million been deployed including new situations: £9 million in a management buy-out of a US designer and installer of custom glass, and £14.5 million for development of care homes in South-East England.

A latest update in respect of Duke’s first quarter to 30 June cites nearly £3 million applied to Bay Broadcasting, an Irish radio operator. A total £6.8 million equivalent was being generated from the sale of another Irish business, in education, and a further £3 million applied to the US glass-maker – taking that equity stake to 74%.

A focused yet balanced portfolio of interests

Client companies are in the UK, Ireland, Canada and the US, which spreads risk away from reliance on the domestic economy – the classic risk with small-cap stocks.

Yet this update sustained a relatively flat near-term profile, especially adjusting for inflation. Recurring revenue rose 5% to £6.3 million, with guidance at £6.4 million for the second quarter (just closed), which would be only a 3% like-for-like increase on the same period last year. Total cash revenue has shown a spark of growth by way of £10.2 million in the fourth quarter of last year but is necessarily lumpy given that it includes disposals.

It was insufficient to inspire investors yesterday – the balance of trades apparently weighted to “sell”, albeit on modest volume of 325,000 shares. The wider market was down, if consolidating after last week’s surprise of major Chinese stimulus rather than concern about economic prospects.

I believe the chief risk is recession along the lines that Mark Spitznagel, the US hedge fund manager, predicts – as if economies face a pre-determined downturn after tighter monetary policy, although you could argue that “he would say that, wouldn’t he” given that his fund effectively offers investors insurance for macro risks. I think the odds less likely, but I respect the view.

Even the likes of JP Morgan Chase have lately raised the probability of a recession from 25% to 35%, and if the US falters it would be felt in Europe and elsewhere. Who knows if China’s stimulus will actually work, and where current military escalation in the Middle East will lead.

Such fears are friendly to income investors

They keep selective stocks priced usefully for yield, if we can be reasonably sure the risks do not outweigh the rewards.

Looking at assets on Duke’s 31 March balance sheet, its equity component in client firms rose from £13.3 million to £15.9 million; and credit finance investments from £158.5 million to £177.6 million. This was assisted by a near 30% rise in total debt to £70.4 million, generating (presumably net) finance costs up 29% to £7.4 million – despite material cash on the balance sheet, which reduced from £9 million to just below £3 million.

So, the equity exposure is just shy of 10% of Duke’s own net assets. Management has had no write-offs for failures, just a small loss related to a Dutch riverboat operator hit by Covid, in context of the £15 million write-down for carrying values back then.

It is impossible to be sure of the macro outlook, but I think Duke remains a useful example for income investors of how well run small-caps can offer attractive risk/reward. Dividend guidance so far is for a 0.1p rise to 2.9p a share for March 2026, constituting a 9% yield. I therefore retain: Buy.

Edmond Jackson is a freelance contributor and not a direct employee of interactive investor.

AIM stocks tend to be volatile high-risk/high-reward investments and are intended for people with an appropriate degree of equity trading knowledge and experience.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.