Stock births, deaths, and the money to be made in between

Firms follow a certain life cycle – with a few simple stages. Knowing them can help you find the stock winners (and avoid the duds).

25th October 2024 11:47

by Theodora Lee Joseph from Finimize

- Most companies have a pretty short lifespan, with only 5% lasting beyond 50 years. But the ones that hit their golden years – like Apple Inc (NASDAQ:AAPL) and Microsoft Corp (NASDAQ:MSFT) – tend to become wealth-creation machines, generating most of the market’s value.

- A tiny fraction of companies – just 2% – create over 90% of the stock market’s wealth. These much-loved, successful firms tend to have rapid growth, high returns on capital, significant R&D investment, and strong cash flow management.

- To seize upon those big market winners, you could either diversify broadly through index funds or concentrate your portfolio on the few high-growth companies. Sure, both strategies come with risks and rewards, but building wealth takes patience and a long-term vision.

Every time you invest in a stock, you’re making a bet on a company’s future – its ability to grow, endure, and deliver returns back to you. But firms don’t live forever – and most won’t make their shareholders rich before they die. So, understanding how they’re “born”, and what makes them thrive or fail can make a big difference to your portfolio. Finance professor Hendrik Bessembinder looked back at thousands of firms from 1976 to 2022 to understand wealth creation in public markets: here’s what he found and what you can learn from it.

First, what is the life cycle of a firm?

Companies – just like living creatures – go through certain stages. They’re born (go public), grow, thrive, and eventually die (get acquired, go bankrupt, or delist).

Birth. A company’s birth is marked by its initial public offering (IPO) or, more recently, a special purpose acquisition company (SPAC) listing. IPOs have traditionally been the go-to way to get shares into the hands of investors, but SPACs have gained popularity in recent years, by removing some traditional IPO hurdles.

Death. Just like with real life, companies don’t live forever. And a corporate death can take many forms: a friendly merger or acquisition (a happy ending), bankruptcy (a not-so-happy ending), or a delisting for failing to meet exchange standards.

But between birth and death, what matters is how a company performs.

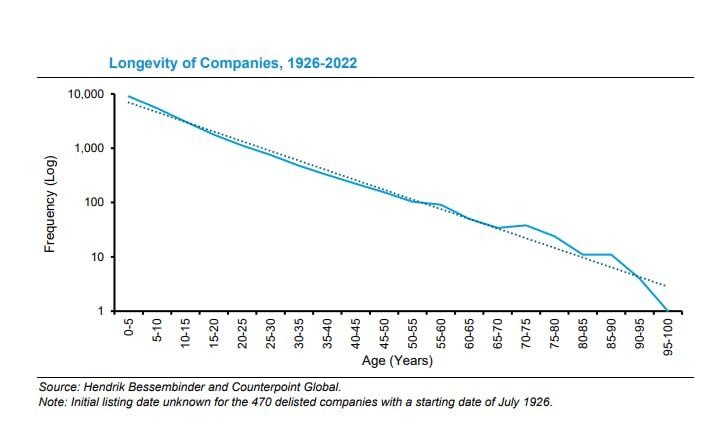

Stock life isn’t just about being born – it’s about survival. In the 1980s and 1990s, public companies dropped like flies, rarely making it past their adolescent years. But in the 2000s and 2010s, firms began sticking around for longer, thanks in part to technological advances and stronger corporate governance.

But by no means all of them: only 5% tend to live beyond 50 years. The ones that do hit their golden years are usually giants like Apple or Microsoft – behemoths that have proven they can adapt and thrive in ever-changing markets. For the average investor, it’s important to recognize this skew in survival rates. The simple rule of thumb here: the bigger the company, the longer the life.

The longevity of nearly 23,000 firms that have debuted on a stock exchange since 1926, based on data from Hendrik Bessembinder. The horizontal axis reflects the company’s age at death, and the vertical axis is frequency. Note that the vertical axis is on a logarithmic scale, which means that the percentage change between hash marks is uniform. Source: Hendrik Bessembinder and Counterpoint Global.

How can you spot the true wealth creators?

Not all companies are created equal: a tiny fraction are responsible for the majority of the wealth created in the stock market. In fact, just 2% of companies have generated over 90% of the market’s vast net wealth. The question, then, is: how do you identify these golden companies?

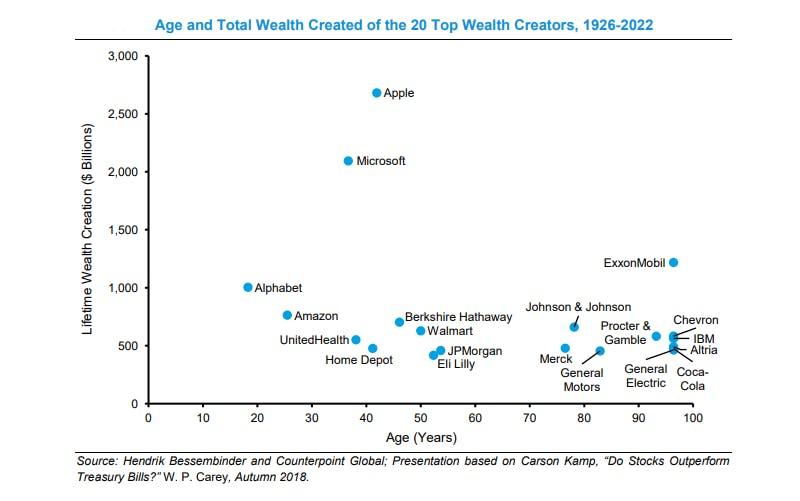

Let’s break this down with a couple of rockstars. Apple, which went public in 1980, has been a wealth-creation machine, generating over $2.6 trillion in value. Similarly, Microsoft, which IPO’d in 1986, has added over $2 trillion to investors’ portfolios. These companies aren’t merely survivors – they’re wealth factories.

The age and fortunes created by the top 20 wealth creators from 1926 through 2022. This collection of companies created a combined wealth of $15.7 trillion over those 96 years . Source: Hendrik Bessembinder and Counterpoint Global (based on a Carson Kamp infographic, “Do Stocks Outperform Treasury Bills?” W.P. Carey School of Business).

And these well-aged companies have four key characteristics in common.

1. High growth. Rapid asset and revenue growth – often internally funded – is a hallmark of these wealth creators. Apple, for example, consistently reinvests in itself and pushes the boundaries of innovation.

2. Strong returns on capital. Wealth-creating companies often have a high return on invested capital (ROIC). That means they’re good at turning their investments into profit.

3. Research and development spending: Companies like Apple and Microsoft pour billions into R&D. It’s their secret weapon for staying ahead of competitors and maintaining their dominance.

4. Cash flow masters. The best wealth creators generate a lot of cash and aren’t afraid to put it to work – whether by reinvesting in the business or rewarding shareholders with dividends and buybacks.

How can you make sure you catch the winners?

There are two schools of thought on how you should take advantage of the wealth-creators.

Option 1: Diversify broadly. Index funds, which include a broad swath of the market, allow you to capture the wealth generated by top-performing companies without putting all your eggs in one basket. The idea is simple: yes, you’ll own some duds, but the outperformers should more than make up for those. Think of it like fishing with a wide net – you’re bound to catch a few big ones.

Option 2: Focus on the winners. If you prefer a more hands-on approach, you can build a more concentrated portfolio by homing in on a select group of firms you believe will outperform. The key here is picking stocks with the potential for massive wealth creation. But beware: with concentration comes risk. A few good bets can send your portfolio soaring, but a few wrong calls can sink it.

If you’re going for broad diversification, index funds are your best friend. If you want to roll up your sleeves and concentrate your bets, make sure you’re investing in companies with the characteristics of top wealth creators – growth, cash flow, and innovation.

And, finally, what are the important takeaways here?

Just like with life, when you take the long view, things fall into perspective. Here are the big lessons you can take from that.

First, don’t get too caught up in the hype of IPOs. Debuts can be exciting, sure, but not all of those newly public companies will be built to last. Be selective, focusing on businesses with strong long-term growth potential. And remember, even the most successful companies have their rough patches. Amazon.com Inc (NASDAQ:AMZN), for example, saw a huge, 91% drop during the dot-com bust, but long-term investors who held on have been richly rewarded.

Second, keep in mind that wealth creation takes time. You’ll need to have patience and a long-term perspective because the best-performing stocks often take years – even decades – to mature.

Third, look beyond the tech sector for wealth creation. Companies in healthcare and energy – such as Johnson & Johnson (NYSE:JNJ) and Chevron Corp (NYSE:CVX) – have quietly built substantial shareholder value over the years.

Finally, keep tabs on companies that invest heavily in innovation. These businesses stay ahead of the competition by continuously improving efficiency, cutting costs, and expanding market share. The road to wealth creation may be long, but sticking with companies that focus on growth, cash flow, and innovation can be well worth the journey.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.