Small is beautiful when it comes to company size

14th April 2023 14:01

Kepler Trust Intelligence believes that current discounts in smaller company and private equity investment trusts offer an opportunity for long-term investors to pick up conservatively valued and strongly performing companies at a significant markdown.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Investing is all about looking forward. Share prices today tend to reflect expectations of the future, rather than the experience of the past. In the context of the last few years, one might imagine that this would be a positive. However, economic uncertainty continues to pile up for stock markets and companies are still grappling with the impact of inflation in supply chains, not to mention the slower ticking time bomb that is the normalisation of interest rates. So far, most economies have avoided a recession and views on the short-term outlook remain unusually bifurcated. It is no surprise that discounts across the investment trust universe have widened.

- Invest with ii: Buy Investment Trusts | Top UK Shares | Open a Trading Account

Sentiment is at a low ebb, but what of fundamentals? Going into Q1 earnings’ season - in the US, this starts in mid-April - analysts are pencilling in significant declines in earnings. The consensus for the S&P 500 Index’s Q1 earnings is for a decline of 6.6%, according to a recent FactSet report. As at the end of March 2023, 106 companies in the index had issued earnings per share (EPS) guidance for Q1 2023, of which 79 had issued negative EPS guidance and 27, positive. 75% of companies issuing negative guidance compares to the five-year average of 59% and the ten-year average of 66%. This is an unusually poor outlook. However, perhaps it is reassuring that valuations are not too far out of line with the 10-year average, with a forward price-to-earnings (P/E) ratio of 17.8x. If earnings disappoint and the world spirals into a deep recession, then there is clear potential for equity markets to fall. On the other hand, if earnings don’t disappoint, valuations may be supported.

Nitty-gritty

Hiding behind the rather negative high-level numbers, within the S&P 500 index there is plenty of divergence by sector and, within these sectors, by industries. Those sectors which analysts expect to experience the largest falls in earnings during Q1 2023 include the materials sector. It is expected to report the largest year-on-year earnings’ decline of all 11 sectors, at 35.9%. Within this, metals and mining are expected to decline by 52%, although admittedly from record levels of earnings in the previous year. The Healthcare sector is also expected to report a significant decline of 20.5%.

Elsewhere, the picture appears more nuanced. For example, within the Information sector, three of the six industries there are predicted to suffer year-on-year earnings declines: Semiconductors & Semiconductor Equipment (43%), Technology Hardware, Storage, & Peripherals (14%), and Electronic Equipment, Instruments, & Components (8%). On the other hand, three of the six industries in this sector are projected to report year-on-year earnings growth: Communications Equipment (14%), Software (6%), and IT Services (1%). On a more positive trajectory is the Financials sector, with Consumer Finance projected to increase earnings by 16%, Financial Services, 14%, and Banks, 14%. The Consumer Discretionary sector is expected to report the highest year-on-year earnings growth rate of all 11 S&P 500 Index sectors, at 33.8%.

Dispersion

The key takeaway is that broad indices, such as the S&P 500 index, mask a huge variety of markets and business niches and that, within the averages, some companies are experiencing strong headwinds and others are finding a more supportive environment. This divergence is undoubtedly repeated across different stock markets and different political and economic areas. In our view, the plethora of divergence suggests that the coming year is likely to suit stockpickers best, who are able to select niche businesses able to navigate a very changed economic landscape and grow earnings, despite the economic headwinds.

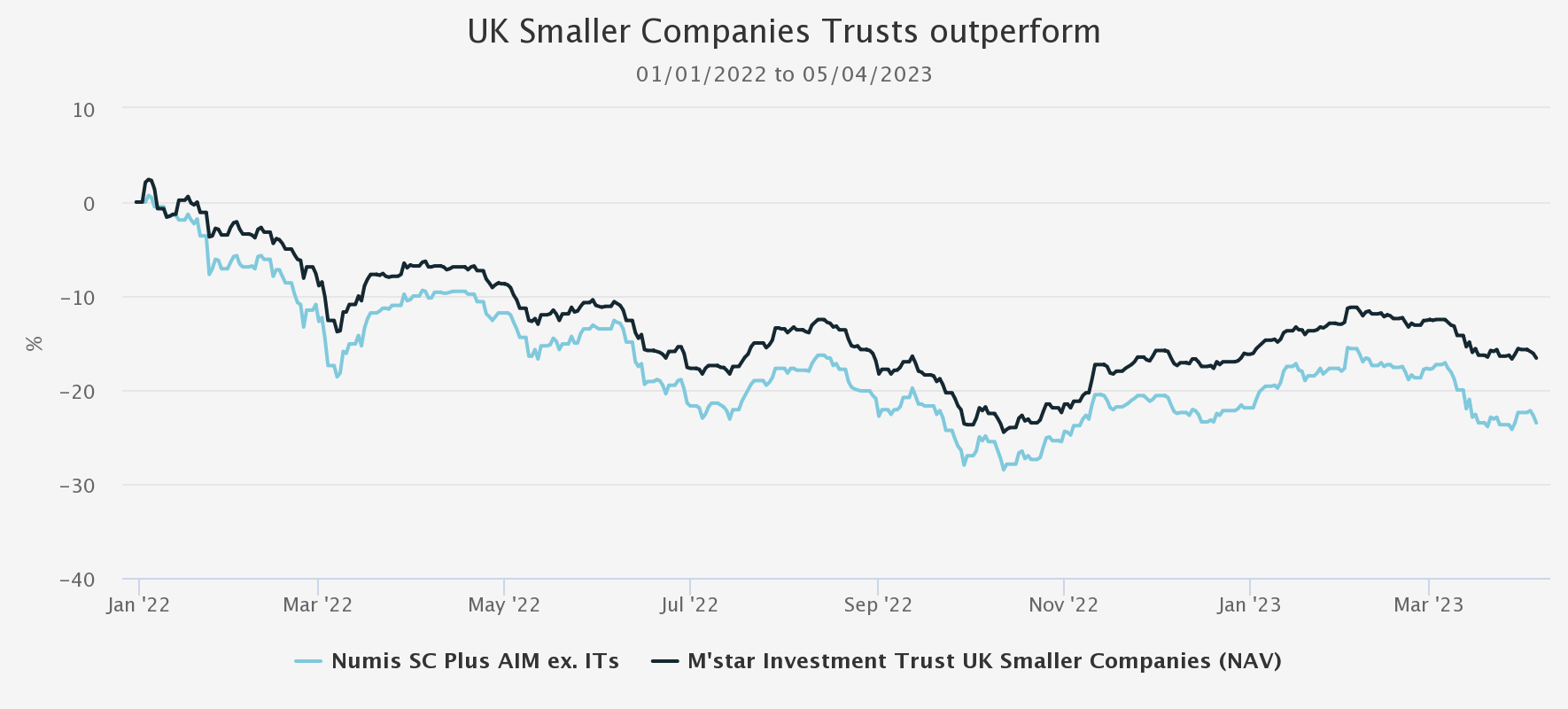

Trusts in the small and mid-cap sectors may fit the bill here, both of which have seen significant NAV falls, as well as discounts widening. Managers of trusts and funds investing in smaller companies have the ability to pick fundamentally attractive businesses and take long-term views, based on fundamentals and specifics, rather than being dependent on broad economic trends. In our view, this is a key attraction, not just for the growth opportunities, but also because of the fact that having a variety of idiosyncratic risks within a portfolio provides genuine diversification, resulting in higher risk-adjusted returns. If the Factset analysis, suggesting a diverse pattern of circumstances for companies, extends to the UK and the rest of the world, the potential for managers to add alpha through stock picking remains undiminished. And on a share-price basis, if and when investment appetites return, there is clear potential for discounts to narrow, thus boosting shareholder returns. In our view, that discounts have widened and valuations have fallen suggests an opportunity for long-term investors to top up exposure.

UK SMALLER COMPANIES TRUSTS

Source: Morningstar. Past performance is not a reliable indicator of future results.

We provided a detailed review of the UK small-cap sector in January (found here), highlighting the range of different trusts which offer an opportunity for investors with different risk appetites. JPMorgan Mid Cap (LSE:JMF)may also offer an opportunity, given that it is trading at a wider discount than most UK small-cap trusts, i.e. circa 15%. The trust is run by Georgina Brittain and Katen Patel, who also manage JPMorgan UK Smaller Companies (LSE:JMI), which trades at a similar discount. JMF was caught up heavily in the 2022 sell-off, but historically has a tendency of doing very well in relative terms in rising markets. This makes it a potentially exciting option for a recovery play. The team believe that their companies are at once-in-a-lifetime levels, in terms of relative valuations.

For global investors, Global Smaller Companies Trust (LSE:GSCT)may offer attractive diversification potential at a circa 12% discount to NAV. Run by Peter Ewins at Columbia Threadneedle Investments, investments are made through direct equity exposures and funds, which Peter employs for access to regions, such as emerging markets, Asia and Japan. Well-diversified across geographies and sectors, Peter looks for high-quality companies and applies a valuation-sensitive approach. This means that, relative to its peers, GSCT is less exposed to any single geopolitical risk and structural risks.

Same, but different

What applies to public markets also applies to private companies and, in this way, we believe the listed private equity (LPE) sector is exposed to identical dynamics as those we suggest above. History has shown that underpinning the listed private equity sector is a diverse set of niche businesses, picked and run by specialist and expert teams, with an eye on strong long-term returns. Returns to shareholders, based on share prices, not NAVs, have been impressive over the past five years, as the table below shows. On a NAV basis, all of these trusts, except Oakley Capital, which has seen its discount narrow slightly over five years, have done even better. As a result of the significant sell-off during 2022, as we show further below, the sector currently stands at historically wide discounts to NAV.

FIVE-YEAR SHARE PRICE TOTAL RETURNS

| FIVE-YEAR SHARE PRICE % | % PER ANNUM | |

| Oakley Capital Investments Ord (LSE:OCI) | 192.2 | 23.9 |

| 3i Group Ord (LSE:III) | 136.5 | 18.8 |

| HgCapital Trust Ord (LSE:HGT) | 114.8 | 16.5 |

| S&P 500 in £ | 92.8 | 14.0 |

| NB Private Equity Partners (LSE:NBPE) | 78.6 | 12.3 |

| HarbourVest Global Priv Equity Ord (LSE:HVPE) | 71.7 | 11.4 |

| Apax Global Alpha Ord (LSE:APAX) | 61.5 | 10.1 |

| MSCI ACWI in £ | 58.6 | 9.7 |

| CT Private Equity Trust Ord (LSE:CTPE) | 57.5 | 9.5 |

| abrdn Private Equity Opportunities Ord (LSE:APEO) | 52.2 | 8.8 |

| ICG Enterprise Trust Ord (LSE:ICGT) | 42.5 | 7.3 |

| Pantheon International Ord (LSE:PIN) | 22.9 | 4.2 |

| Princess Private Equity Ord (LSE:PEY) | 17.8 | 3.3 |

| Average (LPE Trusts) | 77.1 | 12.1 |

Source: Morningstar, Kepler Partners; as at 31/03/2023. Past performance is not a reliable indicator of future results

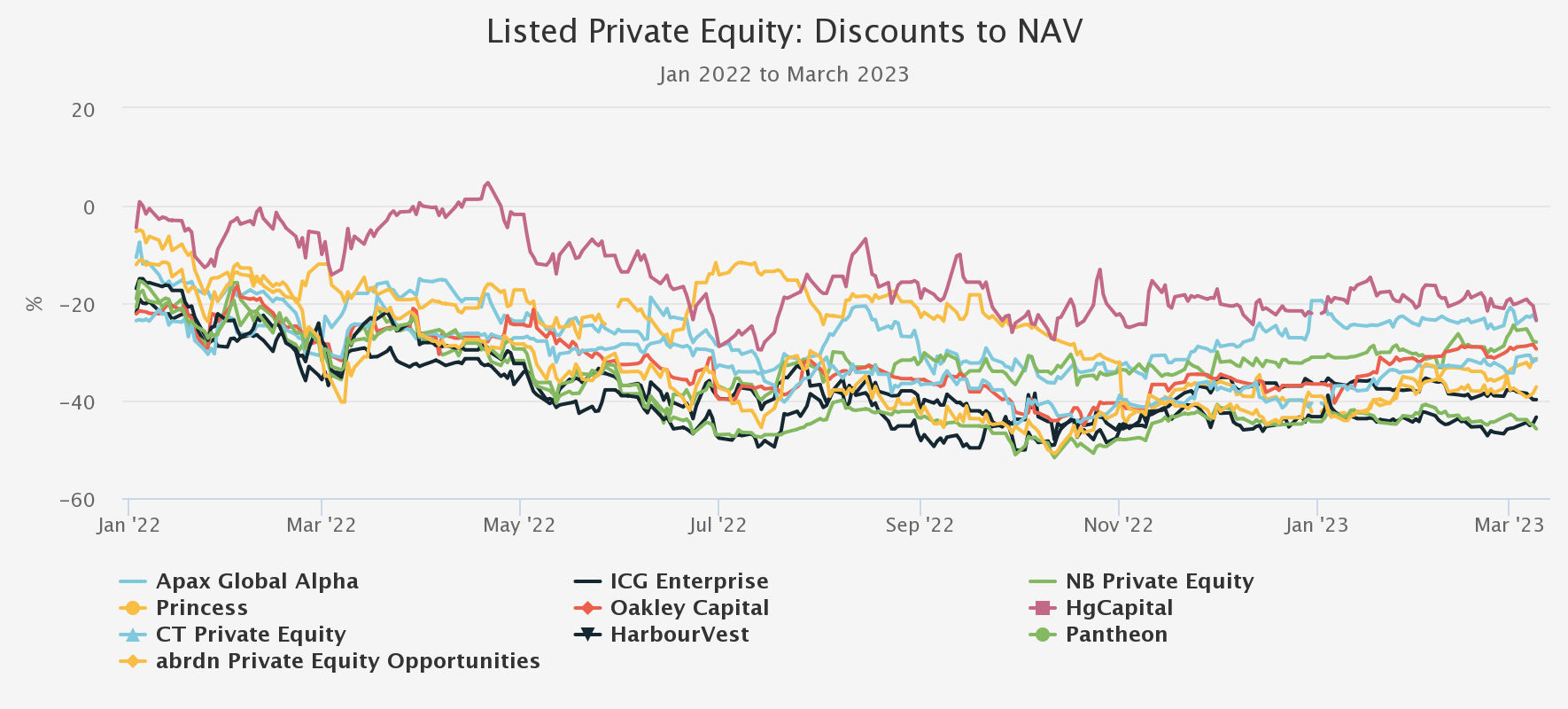

In our view, there are attractions for investors in these trusts, aside from their long-term track records. Like firms in the small-cap space, underlying companies tend to occupy very different niches from those that represent listed markets, especially on a market-cap weighted basis. For example, there is almost zero exposure within LPE trust portfolios to companies in cyclical industries, such as semiconductors, miners or energy companies. Similarly, pharmaceuticals and biotech tend to be absent, given the specific specialisms that each requires. Historically, the problem has been that any diversification offered by LPEs’ NAVs has been offset by the tendency of trusts’ discounts to widen very significantly during periods of market stress. The last year provides an illustration of this. Despite resilient NAV returns, which have far outperformed most listed equity indices, share prices have performed poorly amid a strike by buyers. Potentially this offers an opportunity, with many trusts now buying shares back. This may, at the margin, reduce the chance of discounts widening yet further.

DISCOUNTS IN THE PRIVATE EQUITY SECTOR

Source: Morningstar

Why have buyers abandoned the LPE sector? Long term, has anything changed to the fundamental ability of the LPE sector’s underlying companies to deliver? One worry may be the changed interest rate environment: private equity-backed companies are, typically, more enthusiastic users of gearing. In a rising interest rate environment, this may present cash flow or refinancing problems over the medium term, depending on whether debt is floating rate or fixed. At the same time, if debt financing cost was a live problem, then evidence for this would be felt immediately in realisation values and deal activity. In fact, across the listed private equity sector, trusts continue to report sales of portfolio companies at significant premia to carrying values.

ICG Enterprise Trust Ord (LSE:ICGT), for example, has so far reported realisation proceeds for the first nine months of the financial year ahead of the full-year realisations for the financial years ending January 2019, 2020 and 2021. This is down on the exceptional levels seen last year, but uplifts to the carrying value of 33% are very much in line with the levels seen over the past five years. Across the sector, deal activity continues, which one might imagine would be the first domino to fall if rising interest rates were to make private equity-investing structurally unattractive. On the other hand, perhaps these are the more mature businesses being sold, that have perhaps repaid debt and de-risked over the private equity managers’ holding periods. In our view, so far, nothing suggests that rising interest rates is the smoking gun behind the widening of LPE discounts.

Similarly, in the financial press, there has been plenty of discussion as to why private equity buyout valuations haven’t followed public markets down during 2022. There is an impression that discounts may reflect caution by investors, who expect NAVs to fall. Valuations are largely a function of earnings’ multiples and earnings. We believe that anecdotal evidence would suggest that earnings’ multiples used within LPE portfolios tend not to change dramatically over time. By all means, they have marginally increased over the past ten years, but there is no evidence of a significant upward move over 2020 and 2021. This is unlike in public equity markets, when valuation multiples were at significantly higher levels than historical averages, especially in the US. Not having risen significantly, private equity buyout valuations have not had to fall now. A recent report from Hamilton Lane, which advises or manages more than $800 billion in PE, corroborates this. The report suggests that, according to their data, private valuations should hold up.

Back to earnings

This brings us back to where we started: earnings. The evidence we have seen so far is that the idiosyncratic nature of underlying investments, because of private equity buyout managers’ selection bias, means that earnings of private equity portfolios are not seeing significant declines. Whilst trusts and their underlying companies are still reporting 2022 performance, and even when they do, usually on a selection of the portfolio, i.e. top 30 holdings etc, anecdotally profits and growth seem to be proving resilient. LPE managers have made much of their portfolios’ defensive growth characteristics, but their claims seem to be holding water in this most testing of choppy seas.

CT Private Equity Trust (LSE:CTPE), for example, recently reported that most companies in its portfolio have “generally seen good growth in revenues and profits over the year”.Oakley Capital Investments (LSE:OCI), which occupies a much narrower niche than most peers, reported that “despite the macro environment…underlying portfolio companies have maintained a weighted average organic EBITDA growth of over 20%”. Direct-investing LPE trusts report quicker than fund of funds and 3i has already reported continued strong growth from its main holding, Action. HgCapital Trust (LSE:HGT) reported strong portfolio trading over 2022, with revenue and EBITDA growth of 30% and 25% respectively, across the top 20 investments, accounting for 77% of the portfolio. Elsewhere, we are expecting results soon from NB Private Equity Partners (LSE:NBPE), which should provide interesting insights into the operating performance of its portfolio of co-investments, in mainly US buyouts.

Hg provided some interesting commentary in HGT’srecent results, which highlights that over the long term, changes to valuation levels have delivered a negligible contribution to cumulative returns for their portfolio. Consequently, the good and bad years cancel out each other. They highlight that historical performance is almost entirely due to earnings growth. We believe that many LPE managers will share the same sentiment. Our contention is that, as they have for many years in the past, private equity-backed businesses will grow earnings faster than those in the public sphere over the long term and that is the reason to own them. The next few months will provide an interesting period over which to observe whether this pattern is exhibited over the short run and, if they do, given the discounts they currently stand at, offer the potential for a rerating.

Conclusion

An article from the FT in mid-February supports our argument that private equity buyout companies and portfolios look very different to those in major public market indices, often being exposed to growthier niches. The article not only states that buyout companies tend to be more resilient than those in public markets, but also, echoing Hamilton Lane’s report, that buyout managers tend to be more prudent in changing valuations.

In the public markets, small and mid-cap companies are in a strong position to swim against the tide too. Macro conditions are tough and could get tougher. However, nimble companies operating in niches should be able to dodge many of the bullets that may hit their large-cap brethren.

As such, in our view, current discounts in smaller company and private equity trusts offer an opportunity for long-term investors to pick up conservatively valued and strongly performing companies at a significant discount. At the same time, they will also add diversification to portfolios, giving exposure to companies and management teams able to be more dynamic and be better masters of their own destiny, rather than the companies that represent large parts of equity indices.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.