Should you own company behind biggest bank profit ever?

This American lender made more money in the second quarter than any other US bank in history, but what should investors do now. Overseas investing expert Rodney Hobson gives his view.

17th July 2024 08:50

by Rodney Hobson from interactive investor

The American banking sector is looking in better health than at any time since the pandemic started to bite. These are still early days but there is much for shareholders to be cheerful about.

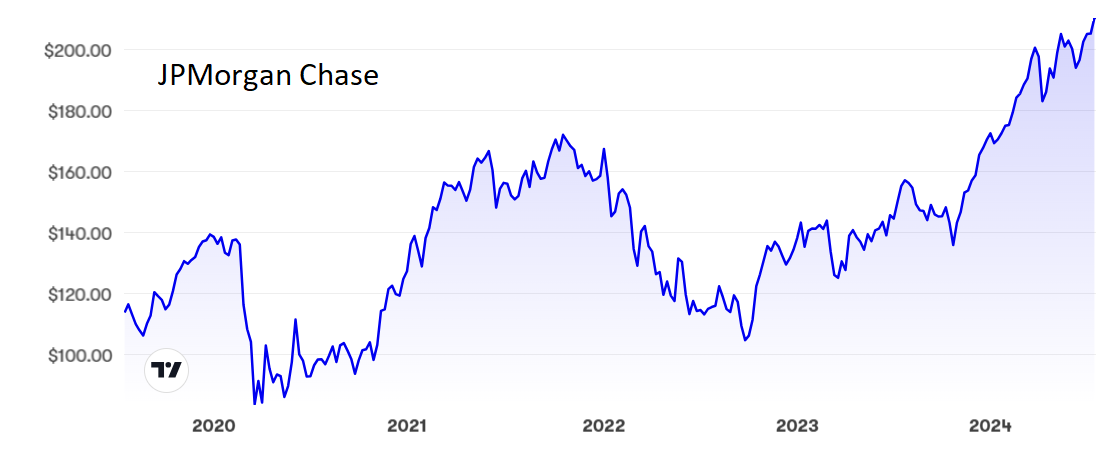

Great figures from banking group JPMorgan Chase & Co (NYSE:JPM) got the half-year reporting season off to a positive start. Unfortunately for those investors who failed to buy in at an earlier stage, this success is fully reflected in the increased share price.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

JPM credited a bounce in investing banking for improved second-quarter earnings, with revenue up 22% to just over £50 billion and net income 25% better at $18.15 billion. Both figures beat expectations and the bank had the added distinction of producing the largest quarterly profit figure in US banking history.

The improvement came pretty much across the board, with revenue from consumer banking rising 2.7%, commercial and investment banking 8.5% and asset management 6.3%. There was a 50% surge in investment banking fees and a 21% improvement in revenue from equity trading.

Particularly encouraging was the contribution from First Republic Bank, which JPM took control of in a rescue operation in May last year.

JPM remains surprisingly, though perhaps realistically, cautious about the rest of this year. However, there were one or two weak spots. For example, consumer banking and wealth management suffered from attracting lower deposit balances.

JPM’s warning of multiple forces threatening to undo the progress in reducing inflation is standard fare and offers little to worry about given that high interest rates tend to favour the banking sector. The view that the geopolitical situation is potentially the most dangerous since the end of the second world war looks a bit over the top to those old enough to remember the cold war.

The shares have had a meteoric rise over the past six months, from a low of $135 at the end of October last year to $213 now. Hard to believe they hit $90 in the worst of the pandemic. The price/earnings (PE) ratio is still only 11.7 and the yield is 2.1%, respectable if unexciting.

Source: interactive investor. Past performance is not a guide to future performance.

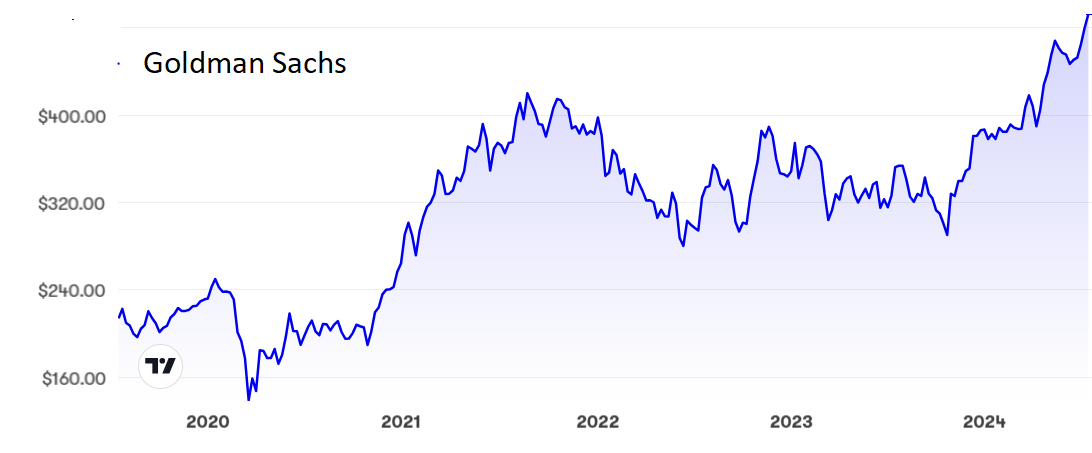

Further encouragement came from The Goldman Sachs Group Inc (NYSE:GS), where chief executive David Solomon reckons that activity in capital markets plus mergers and acquisitions is starting to pick up. Followers of US banking will recall that the collapse of M&A, in which Goldman is a leading light, was a major setback for the sector after the pandemic.

Goldman’s profits in the three months to the end of June leapt 150% to $3 billion, ahead of market expectations. Net revenue rose 17% to $12.7 billion, again higher than expected.

- Goldman’s bear market indicator is urging you to be cautious

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Goldman thinks there should be better to come, even though it complains that inflation has been stickier than many economists had expected. Some transaction volumes are below the average for the past 10 years and the bank is ready to pounce on opportunities.

Higher interest rates are apparently not creating problems while the US economy continues to thrive. Just $283 million was set aside to cover credit losses, less than half the $615 million provision in the same quarter last year.

The shares were only $140 in March 2022, but the great results pushed them above $500. Astonishingly, they have increased by nearly 70% over the past nine months. At current levels the PE has crept up to 15.8, though that is hardly excessive, and the yield is slight better than JPM’s at 2.2% thanks to a rise in the quarterly payout from $2.75 to $3.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: US banks were generally less upbeat only three months ago, so investors should remember that circumstances can change quite quickly. In an unintended understatement I said Goldman was worth considering as a buy at just under $400 in April. That was quite a buy if you took it in time to enjoy a 25% uptick. I was more cautious about JPMorgan, suggesting that buyers should hold off until the price dropped to $172. Alas, $180 was the floor.

Both shares look to be fully valued now but holders should hold on. Otherwise, look to buy on weakness.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.