Shares in these two sports giants have further to run

These household brands have paused for breath after a long sprint, but could soon race away again.

13th November 2019 09:33

by Rodney Hobson from interactive investor

These household brands have paused for breath after a long sprint, but could soon race away again.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

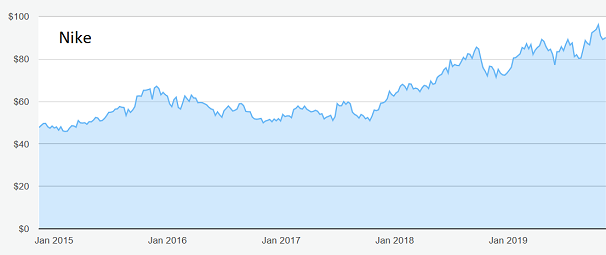

Two giants dominate the world of sports brands, a status that has seen their shares rise strongly over the past five years. Nike (NYSE:NKE) and Adidas (XETRA:ADS) sell the equivalent of £50 billion worth of goods between them. Their shares have come off the boil recently, but they will be back on the upward march soon.

Nike is an American multinational corporation engaged in the design, development, manufacturing, and worldwide marketing and sales of footwear, apparel, equipment, accessories, and services. It is based in Oregon.

Adidas is the world's second-largest provider of sports footwear and clothing after Nike. Based in Germany, it has four divisions: Adidas, Reebok, TaylorMade-Adidas Golf and Reebok-CCM Hockey.

Adidas shares were only €60 five years ago but they touched €285 three times in the past three months. Although they have since slipped below €270 they could well top €300 once they crack the ceiling. The rise in Nike shares has been less dramatic, from $47 to a peak of $96 last month. They are now around $82.

Source: interactive investor Past performance is not a guide to future performance

Nike's footwear side in particular has been set back by the trade wars between US President Trump and China, which is a major footwear producer. If supplies are disrupted by tariffs, the effect will be considerable, as there is not the production capacity elsewhere to make up the shortfall and prices will inevitably rise as demand outstrips supply.

As so often with Trump's tendency to make policy decisions on the hoof, the position has changed several times and is still unclear. The president originally tweeted that the administration would be imposing 10% tariffs on $300 billion worth of Chinese imports at the beginning of September. A piece of brinkmanship took the tariffs up to 15% but, less than a month before they were due to come into effect, they were postponed to mid-December.

Both brands have the strength to ride out the storms. They are also, when necessary, prepared to throw their weight around even at the risk of adverse publicity. Both forbid wholesalers from selling their products on Amazon (NASDAQ:AMZN) or eBay (NASDAQ:EBAY).

Source: interactive investor Past performance is not a guide to future performance

Nike has been raising the minimum amount that retailers must buy from it, otherwise supplies are halted. This has the effect of restricting the number of outlets selling its products and indirectly helps to keep prices high. It has now given notice that it will terminate agreements to supply independent retailers over the next two years. This is part of a move to maximise sales through its own website and network of stores, which should improve Nike's already fat margins by effectively cutting out middlemen.

Adidas, like Nike, has a policy of keeping a tight grip on sales, and consequently pricing, of premium products. It is expected to follow the lead in reducing the number of retailers receiving supplies.

Competition between the two remains fierce. Adidas continues to erode Nike's dominance of the US market although, conversely, Nike is growing faster in Europe. The German company expects a boost in sales of football merchandise ahead of next year's European Championships and from the opening of a new flagship store in London.

Nike reported sales growth of 10% in the three months to the end of August. Significantly, sales in China were up most, by 27%, while growth in North America was a pedestrian 4%. Adidas sales were up 6% in the third quarter, beating analysts' forecasts despite slower growth in China at 11%. Growth accelerated in North America to 10% after problems in the supply chain, which had held it back in the first half, were fixed.

Hobson's Choice: Both are on a demanding price/earnings ratio of around 30 times, but sales growth justifies the rating. Buy Adidas up to $285 and Nike below $90.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.