Shares in this industry leader rated a 'buy'

This engineering star is the best at what it does and the shares are a good long-term investment.

1st February 2019 14:36

by Richard Beddard from interactive investor

This engineering star is the best at what it does and the shares are a good long-term investment.

Victrex (LSE:VCT) is adapting to compete with other suppliers of the product it invented. It should not only survive, but prosper, because it is the fittest.

The financial year to September 2018 was the year Victrex waved goodbye to the Large Consumer Electronics Order, an ungainly euphemism that has bedevilled my reporting ever since I decided Victrex was a uniquely successful and profitable business. Part of me feels like cheering, and another part of me feels like crying.

The LCEO (it doesn't even make a good acronym) distorted Victrex's results, ballooning revenue when the order was being fulfilled, and depressing profit margins because it was a low grade of PEEK, the material Victrex manufactures, priced relatively cheaply. Victrex would not confirm the order was ultimately destined for iPhones, but I am confident it was. Apple's manufacturers bought PEEK sporadically in bulk.

The end of the LCEO, perhaps, typifies what is going on in the rest of the business. Solvay, an international chemical company, was the principal supplier of the order but did not have the capacity to fulfil it all and Victrex, which leads the market both in capacity in expertise, supplied the rest. As Solvay increased capacity, Victrex's contribution declined to zero. Pricier specialist grades of Victrex PEEK are still used in most ‘phones, its AptivTM film is used in the speakers for example, and the company believes new 5G smartphones will require high grades of PEEK, which only Victrex may be able supply.

Plastic fantastic

We are not talking about cheap plastic. PEEK is durable, light, and easy to form into components using injection moulding. Small amounts of it are used in the anti-lock braking systems of most cars and in brackets of aeroplane fuel tanks where they must last the lifetime of the plane immersed in highly corrosive fuel. By making equipment lighter and stronger, Victrex components make it more efficient to operate, and cheaper to manufacture, and enable customers to comply with increasingly stringent emissions regulations.

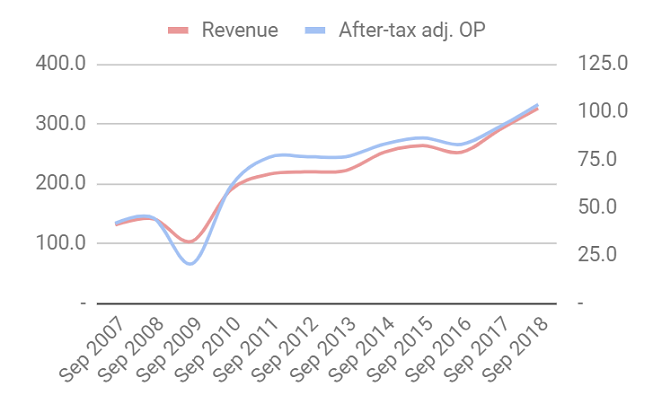

Only about 8 grammes of PEEK is in a typical car (Victrex hopes to raise that to 12 grammes), but there are a lot of cars, planes, smartphones, vacuum cleaners (Dyson uses PEEK for its impellers) and indeed aging people requiring spinal implants, another application of PEEK. In 2018 Victrex sold 4,407 tonnes of PAEK, the broad family of polymers that includes PEEK, at an average selling price of £74 per kilogramme, which is how it earned record revenues of £326m. But, over the last decade or so rivals like Solvay and Evonik, and new entrants in China, have opened factories and are selling more of the basic grades of the material.

The 'C' word

When I met David Hummel, the former chief-executive who spun Victrex out of ICI and oversaw its first decades as a public company, he told me he did not like the word “commoditisation”, but it is happening. As part of ICI, Victrex had invented PEEK, and until the patent ran out in the early 2000's, it had the market to itself. Since then Victrex has maintained prodigious profitability and grown revenue by using its expertise to invent specialist grades of PEEK and increasing manufacturing capacity ahead of demand to make sure it is the company that meets it.

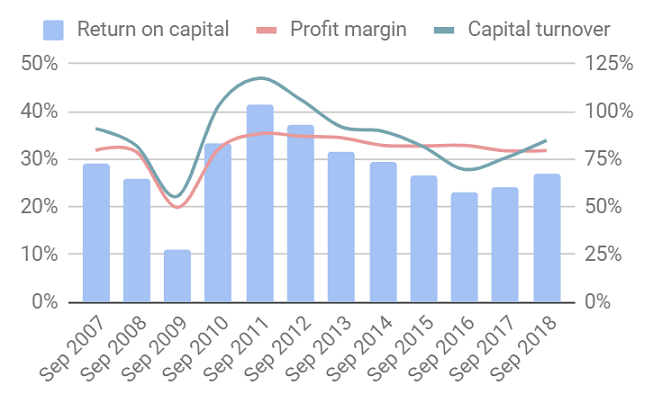

Source: interactive investor Past performance is not a guide to future performance

Source: interactive investor Past performance is not a guide to future performance

More recently Victrex has started nudging industries to use PEEK, often instead of heavier and less durable metals, by acquiring and partnering with component manufacturers to make and market semi-finished or finished parts. This strategy increases the complexity of the business and the risks, because industries can be slow to adapt new materials if the old ones do a reasonable job. Innovations can give established materials a new lease of life too. One reason the revenue from Victrex's £50m medical business has been flat in recent years is that its main market, spinal implants in the United States, is mature. The majority of surgeons use PEEK, but new forms of 3D printed titanium implants are making inroads into the market too.

Victrex has achieved "meaningful revenue" of £1m selling a PEEK variant to Magma, a company it part owns that manufactures the world's only thermoplastic subsea oil pipe. In partnership with an aircraft parts manufacturer it is commissioning a factory that will produce components made from a new grade of composite fibre reinforced PEEK. An agreement with dental implant manufacturer Straumann to supply JuvoraTM, another variety of PEEK, will help Victrex achieve £1m from dental applications in 2019, and a recent acquisition, Kleiss Gears (now Victrex Gears), is supplying the first PEEK gears to a European car manufacturer. The gears use 20 grammes of PEEK, reduce noise vibration, and, the company says, will propel the company "towards" £1m revenue from gears in 2019.

Chief executive Jakob Sigurdsson describes these milestones as "points on the board", but the company is nowhere near mooted peak revenues of £50m for each of these projects and sales from new products, those developed since 2014, are just 4% of the total. Shareholders are learning to be patient too. JuvoraTM first entered the market seven years ago, in 2012.

Survival of the fittest

Victrex must keep innovating to differentiate its PEEK from rivals' and maintain high average selling prices. Every year it emphasises that its employees, over 900 globally, are focused solely on the PAEK family of polymers. It is the only specialist, among diversified chemical companies, it has the most experience, and it is the only PEEK manufacturer moving downstream into component manufacture. Though the board has many new faces, Sigurdsson took over from Hummel in 2017, and the finance director joined in 2018, Victrex is staying with Hummel's strategy. "We will remain the number one PEEK experts," Sigurdsson says in the annual report, "and we are not looking to become a broader diversified polymer business."

Lower down the hierarchy, turnover is low. The managing directors of the industrial and medical divisions have been with the company longer (as has the chairman), and voluntary employee turnover is just 5% a year. Ninety-five percent of employees have share options. While it is difficult to understand a company's culture from outside, these statistics give us some insight, I think, as to why profitability may persist. These people are the best in the world at what they do, and they are staying at Victrex.

In the short and medium term things might get a big wobbly. Cashflow in 2018 was extremely strong, but as Victrex gears up both to persuade industries to use PEEK and to build capacity before demand once again, it will have to invest more in coming years. In 2019, Victrex will not have the benefit of the Large Consumer Electronics Order, but it has a very diversified customer base. The company is stockpiling raw materials in the UK and PEEK products overseas to reduce the potential for disruption when Britain leaves the EU, and although there is a risk the EU might slap tariffs on PEEK imports, at least there are no other EU manufacturers for Victrex customers to turn to.

Scoring Victrex

As usual I have scored Victrex to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

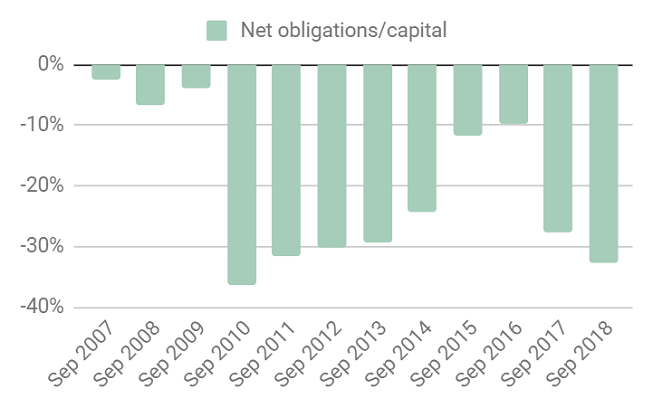

Yes. Return on Capital has averaged 28% over the last 12 years, cash returns are high, which allows the company to operate debt-free and routinely pay out special dividends. It plans to pay one in 2019.

Score: 2

Source: interactive investor Past performance is not a guide to future performance

Adaptable: How will it make more money?

Victrex is building on its long experience to invent new grades of PEEK and commercialise new applications. It is growing from a position of strength, as both the biggest and most expert manufacturer.

Score: 2

Resilient: What could go wrong?

The principal risk is rivals will commoditise lower grades of PEEK quicker than Victrex can invent new ones and generate substantial revenue from new applications. I believe Victrex is following the right strategy, but it is risky.

Score: 1

Equitable: Will we all benefit?

Executives are very well paid and, because they are new, they have modest shareholdings. But employee turnover and a small sample of reviews from recruitment sites indicates Victrex is a good place to work, and customers clearly get a good product.

Score: 2

Cheap: Is the firm’s valuation modest?

At £23.66, I think the shares are reasonably good value. On a debt adjusted basis the PE ratio is about 18.

Score: 0.7

A total score of 7.7/10 clears my arbitrary hurdle of seven. I think Victrex is a good long-term investment.

Richard owns shares in Victrex.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.