Shares for the future: a speculative stock expecting steady growth

This small-cap has undergone transformative change. Analyst Richard Beddard likes what the company is doing, and reveals whether he views it as a good long-term investment.

23rd August 2024 15:00

by Richard Beddard from interactive investor

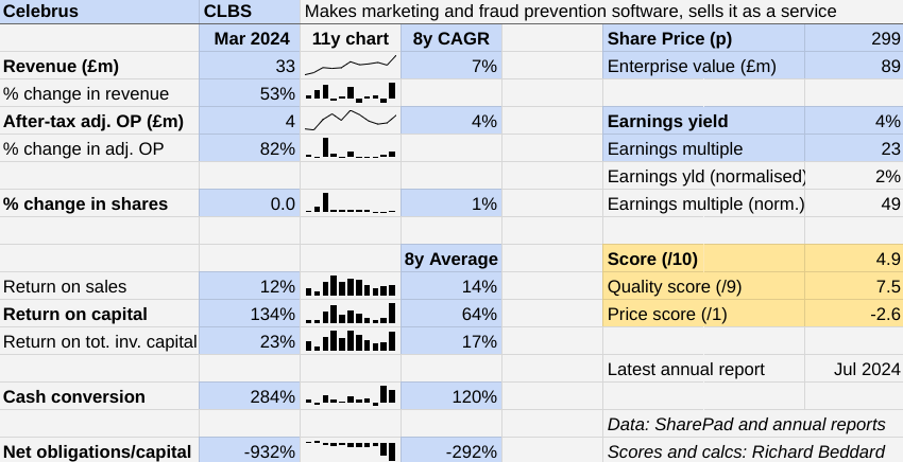

Formerly D4t4, Celebrus Technologies (LSE:CLBS) has transformed itself from a systems integrator to a cloud-based software company. The transformation challenges investors, because the future will not be like the past.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Scoring Celebrus: recurring revenue

The results for the year to March 2024, were in one way like the past though. Revenue included a large proportion of hardware sales.

The Past (dependable) [2.5]

- Profitable growth: Modest 8-year growth in revenue and profit [0.5]

- Strong finances: Net cash [1]

- Through thick and thin: Lowest RoC 18% (2022) [1]

The eponymous Celebrus software is largely bundled with larger IT systems sold by partners like SAS, Pega, and Salesforce.com. Historically, the software was installed and integrated locally, but these days Celebrus steers new customers to its cloud-based solution.

Existing customers still buy integrated systems, though. Celebrus’ biggest partner was responsible for more than £10 million of hardware sales, about a third of Celebrus’ total revenue in 2024.

The impressive increases in revenue (53%) and adjusted after-tax profit (82%) are distorted by these hardware sales for two reasons.

The first is that they cannot be relied on. Much of the revenue was expected for 2023 but delayed into 2024.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Inflation and three other threats to your long-term wealth

The second is that hardware sales are not the long-term future. But they are likely to continue to a varying degree for some time because Celebrus is quite dependent on its biggest partner.

The change in the business model has complicated measuring Celebrus’ performance too. While the company used to charge customers up front for perpetual software licences and hardware, it has shifted to term licences charged annually.

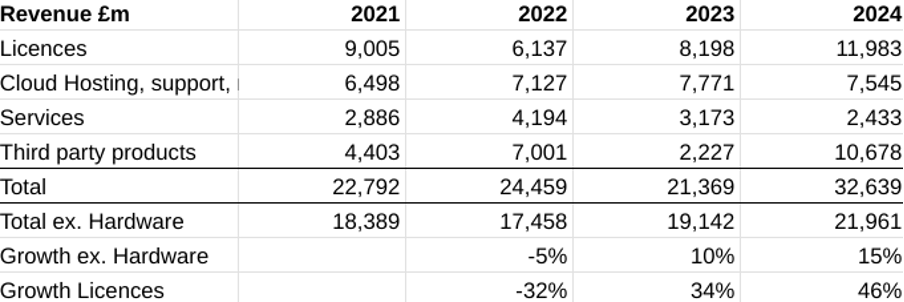

This spreads out the recognition of software licence revenue, which contracted initially as a result. It probably explains Celebrus’ pedestrian growth over the last eight years, but growth has resumed. Since 2022, licence revenue has grown 34% in 2023 and 46% in 2024:

Other software revenue streams also reflect the shift to the cloud. Hosting, support and maintenance has grown slightly. Cloud solutions earn the company revenue if they are hosted on Celebrus Cloud, but they do not require support and maintenance like local installations. Service revenue, like getting Celebrus up and running, has declined because Celebrus works “out of the box” in the cloud.

Celebrus chooses Annual Recurring Revenue as its primary measure of performance. This is revenue contracted to recur within 12 months from software licences, hosting, maintenance and support contracts. It too is building:

Although average cash conversion is above 100%, Celebrus’ cash position at the year end was further swelled because the company owed money relating to the hardware purchases. These bills will have been paid after the year end, reducing the cash pile by about 20%.

Return on capital is a volatile measure of software company performance because they typically employ so little tangible capital (i.e. property, plant and equipment). Most of their investment is in operating costs, principally the salaries of software engineers and technical salespeople. Despite the transformation, Celebrus has remained profitable.

The company anticipates steady but unspectacular growth in 2025.

The Present (distinctive) [3]

- Discernable business: Sophisticated customer profiling software [1]

- With experienced people: Yes [1]

- That creates value for customers: Real time customisation and fraud prevention from first-party data [1]

D4t4 acquired the Celebrus software in 2015 and changed its name last year.

The software collects information about us when we use its customers’ websites and apps, so that their IT systems can interact with us better.

It uses real-time biometrics (tracking our cursors and fingers around the screen and measuring the pressure we put on the touchpad, for example) and natural language processing to work out our intentions and steer us through the sales process.

One of Celebrus’ key selling points is that the data belongs to the customer. It is not gleaned from cookies tracking us around the Internet. Cookies are a less reliable method of building profiles of customers now that their use is restricted by rules such as GDPR and regulations in many US states.

Celebrus was originally designed to help companies with online marketing, but in 2022 it also developed a fraud prevention product because many of its end-customers are financial institutions and retailers.

It sounds Big Brother-ish, but Celebrus’ purpose is more noble: to build better relationships between brands and customers via better data.

Customers benefit from the cloud-based system because it means they can be up and running “in minutes instead of weeks” and they get instant access to new functionality, which is added on a six-month cycle.

Automation also benefits Celebrus because it lowers costs and means the company can, in theory, scale faster. Software licences are more profitable than hosting, maintenance, and support contracts, which are in turn more profitable than hardware sales.

However, automation comes at a price. Celebrus uses hyper-scalers, large cloud service providers such as Amazon Web Services, Microsoft Azure and Google Cloud. These suppliers, Celebrus says, are “very good at adding costs”, so it must design the software to get around their traps.

Overseeing this transformation is chief executive Bill Bruno. Although he was appointed in 2021, he was previously vice-president North America. Since that is where most of the company’s revenue is earned, I have deemed him more experienced than I might otherwise!

The Future (directed) [2]

- Addressing challenges:Customer acquisition, dependency on partners [0.5]

- With coherent actions: Sales focus, product updates, acquisitions [0.5]

- That reward all stakeholders fairly: Customer first, employee friendly, good annual report [1]

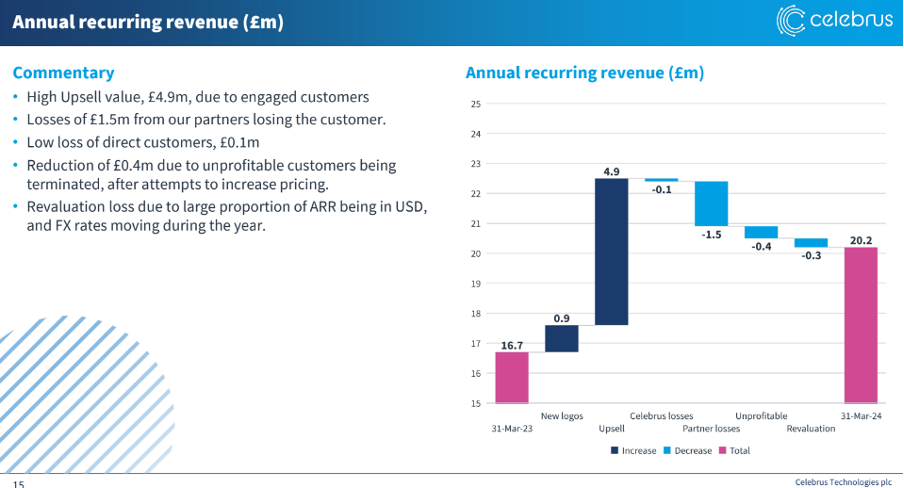

There is a chart in Celebrus’ 2024 full-year results presentation that shows how Celebrus increased Annual Recurring Revenue.

I believe it encapsulates the challenge Celebrus faces. Its sales strategy is called “land and expand” and in 2024 £0.9 million more revenue came from new logos (aka landing new customers) and £4.9 million came from upsell (aka selling more to existing customers, the expand part).

It is better at expanding than landing, but ultimately the amount it can expand depends on how much business it can land. Perhaps this is because the markets it has long supplied, like financial services, have sophisticated requirements, and it is harder to sell Celebrus to other end users, although the company increasingly cites retailers and healthcare customers.

Source: Celebrus results presentation 2024

The chart also reveals another risk. Celebrus’ partnerships. Celebrus lost £1.5 million in revenue because its partners lost the business.

Each partner represents multiple end customers, sometimes dozens. The company’s house broker says there is no risk of all of them leaving at once. Client partner loss is listed as low impact and relatively low probability in the company’s risk report too.

Long term though, Celebrus is dependent on the health of its partner ecosystems.

This is a concern because two partners account for most of Celebrus’ revenue and their contribution has grown in recent years. 75% of 2024 non-hardware revenue came from Celebrus’ two biggest partners, 51% from its biggest.

A case study in Celebrus’ annual report may point the way forward: diversification of sales channels. It describes a victory for the land and expand strategy.

A large US healthcare organisation deployed Celebrus to build a digital patient data model on a subset of its hundreds of websites. Within a year the project had expanded to all of them.

- How professional investors reacted to market turbulence

- Stockwatch: odds improving in favour of this former high roller

The business had been won by the company’s new direct sales team (i.e. not through a partner) and the “expand” element was overseen by its new Customer Success team.

The growth and reorganisation of the sales function has happened in the last two years. In addition to selling direct, Celebrus is courting consultancies and new partners.

The company’s growth also depends on improving Celebrus.

During 2024, the company introduced Celebrus Digital Analytics, a data visualisation platform that competes with Google Analytics. Celebrus says the quality of Google Analytics has declined with the deprecation of cookies.

It also added bot detection. Bots are commonly used to apply stolen credentials to access bank accounts in Account Takeover Attacks. They are also used in pay per click fraud (where companies try to hurt competitors by using up their advertising budgets with fraudulent clicks).

This year’s annual report also moots the acquisition of new capabilities in data activation.

Celebrus gives me confidence it is getting better at managing its biggest asset: developers and salespeople.

Employee retention is 90% (up from 88%) and it publishes details of its employee engagement surveys.

Although restructuring might have been expected to unsettle people, engagement has improved. Unsurprisingly the restructuring was one of the things employees liked least, along with ill-defined roles and un-documented processes. These are things we can expect the company to resolve now the new structure is in place.

Another indication, just a sign, that staff are a priority, is that they are thanked in various places throughout the annual report.

The price (discounted?) [-2.6]

- No. A share price of 299p values the enterprise at about £89 million, 49 times normalised profit.

The price score is not usually something I think much about. It is calculated automatically and compares the share price to the earnings Celebrus would have earned if it had earned its average return on capital over a reasonably long period.

It is good at assessing companies that are evolving slowly. Celebrus, on the other hand, has changed radically since 2015 so the past is less relevant.

The normalised profit gives a price score of -2.6 and a total score of only 4.9 out of 10.

A score of 4.9 means I am not confident Celebrus is a good long-term investment. But I am also not confident in my lack of confidence! I like what the company is doing, and there are signs that it is working.

In other words, Celebrus is an interesting speculation.

Celebrus is ranked 38 out of 40 shares in my Decision Engine.

18 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Cropper (James) (LSE:CRPR), Games Workshop Group (LSE:GAW), Jet2 Ordinary Shares (LSE:JET2) and Cohort (LSE:CHRT) have all published annual reports and are due to be re-scored.

I have moved PZ Cussons (LSE:PZC) to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 9.8 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Designs recording equipment, loudspeakers, and instruments for musicians | 9.0 | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

5 | Supplies kitchens to small builders | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Whiz bang manufacturer of automated machine tools and robots | 7.9 | ||

8 | Manufacturer of scientific equipment for industry and academia | 7.7 | ||

9 | Makes light fittings for commercial and public buildings, roads, and tunnels | 7.7 | ||

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

11 | Manufactures filters and filtration systems for fluids and molten metals | 7.7 | ||

12 | Distributes essential everyday items consumed by organisations | 7.5 | ||

13 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

14 | Sources, processes and develops flavours esp. for soft drinks | 7.3 | ||

15 | Manufactures computers, battery packs, radios. Distributes components | 7.1 | ||

16 | Sells hardware and software to businesses and the public sector | 7.1 | ||

17 | Translates documents and localises software and content for businesses | 7.0 | ||

18 | Manufactures natural animal feed additives | 7.0 | ||

19 | Sells promotional materials like branded mugs and tee shirts direct | 6.9 | ||

20 | Online marketplace for motor vehicles | 6.9 | ||

21 | Manufactures vinyl flooring for commercial and public spaces | 6.8 | ||

22 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 6.8 | ||

23 | Surveys and distributes public opinion online | 6.7 | ||

24 | Operates tenpin bowling and indoor crazy golf centres | 6.6 | ||

25 | Manufactures specialist paper, packaging and high-tech materials | 6.6 | ||

26 | Online retailer of domestic appliances and TVs | 6.4 | ||

27 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.4 | ||

28 | Flies holidaymakers to Europe, sells package holidays | 6.3 | ||

29 | Retails clothes and homewares | 6.2 | ||

30 | Supplies vehicle tracking systems to small fleets and insurers | 5.9 | ||

31 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | ||

32 | Manufactures sports watches and instrumentation | 5.8 | ||

33 | Acquires and operates small scientific instrument manufacturers | 5.8 | ||

34 | Publishes books, and digital collections for academics and professionals | 5.6 | ||

35 | Manufactures military technology, does research and consultancy | 5.6 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Manufactures disinfectants for simple medical instruments and surfaces | 5.4 | ||

38 | Celebrus | Makes marketing and fraud prevention software, sells it as a service | 4.9 | |

39 | Runs a network of self-employed lawyers | 4.5 | ||

v Frozen v | ||||

? | Develops and manufactures hygiene, baby, and beauty brands | 7.5 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Celebrus and many shares in the Decision Engine. He weights his portfolio, so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.