Shares for the future: a milestone year for this outperformer

This FTSE 250 company has almost tripled in value over the past two years and is clearly a good business. Here’s what analyst Richard Beddard thinks of it following latest results.

20th September 2024 14:49

by Richard Beddard from interactive investor

Engineering conglomerate Goodwin (LSE:GDWN) has been on something of a journey over the past decade.

The results for the year to April 2024 hint that we might finally be reaching a destination.

Scoring Goodwin: a tale of two divisions

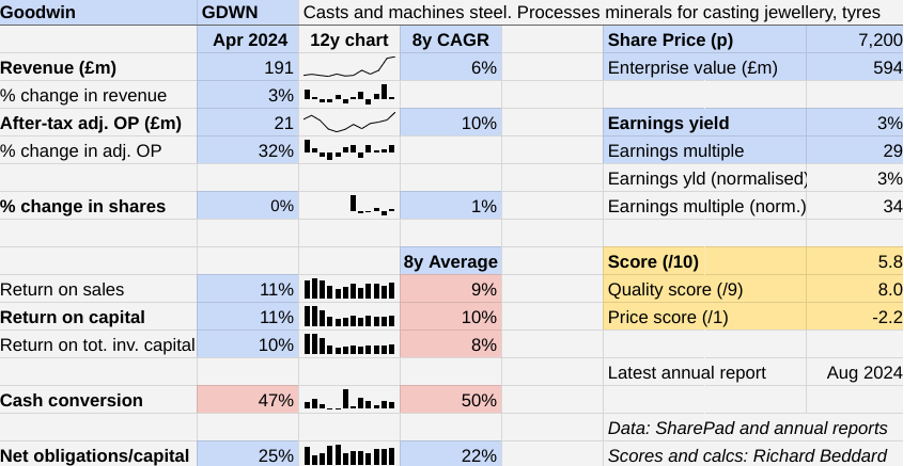

After a 29% surge in revenue in 2023, revenue only increased 3% in the year to April 2024. Adjusted profit increased 32%, the result of higher margin contracts in Goodwin’s Mechanical Engineering Division.

- Invest with ii: Top UK Shares | Free Regular Investing | What is a Managed ISA?

Revenue growth in this division is lumpy due to large multi-year contracts with movable delivery dates.

Revenue growth from Goodwin’s more reliable Refractory Engineering division was reduced by currency movements and the normalisation of Covid demand for jewellery, its biggest end-market.

The Past (dependable) [2.5]

- Profitable growth: Decent profit growth [1]

- Strong finances: Modest stable borrowings [1]

- Through thick and thin: Lowest RoC 7% in 2017 [0.5]

Profit growth was significantly ahead of the 10% compound annual growth rate (CAGR) Goodwin has achieved since 2016, a year I picked as a starting point because it was the first set of results impacted by the prior year’s oil price crash.

Then, profit collapsed because Goodwin was more dependent on products like patented check valves, which control the flow of oil and gas in pipelines.

The company has rebuilt, winning new contracts to supply components for the storage of nuclear waste, and naval propulsion and hull construction.

This is higher margin work than the work that has tidied it over, and Goodwin anticipates repeat business for the same components. Now that it has ironed out the manufacturing processes, efficiency should improve.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Shares for the future: big upgrade for this stock

2024 represents something of a milestone: the first year Goodwin’s after-tax adjusted profit has beaten its oil boom high.

The company achieved an 11% Return on Capital, slightly above average,

But Goodwin converted less than half of those returns into cash.

Weak cash conversion is typical, and explained by investment. Capital expenditure has gobbled up 66% of operating cash flow since 2016. Goodwin has enlarged the foundry to cast larger components required by the nuclear and defence industries, expanded capacity, and incubated an entirely new business.

There is more to Goodwin than the recovery of the Mechanical Engineering division. Starting with Refractory Engineering...

The Present (distinctive) [3]

- Discernible business: Group of niche engineering businesses [1]

- With experienced people: Multiple generations of experience! [1]

- That creates value for customers: Reliable, high performance, sometimes unique products [1]

Goodwin consists of many subsidiaries organised into two divisions.

Mechanical Engineering is primarily a foundry and a machine shop. These businesses cast and machine advanced steel components in sizes up to 35 tonnes. They manufacture containers for nuclear waste, nuclear submarine components, and check valves.

Few foundries can cast at this size in the Western world, making Goodwin an important supplier of giant components - especially for military customers.

There are other notable Mechanical Engineering subsidiaries. Goodwin Submersible Pumps makes slurry pumps in India and sells them to mines worldwide. Easat Radar Systems makes air traffic control systems.

Easat is frustrating. Originally a supplier of antennas, the company has developed complete radar systems. Goodwin says this is advantageous, because it controls costs unlike many competitors who are systems integrators.

But it is taking loss-making Easat a long time to sell the systems. Two years ago, chair Tim Goodwin felt confident enough to anticipate an unprecedented workload. Last year, he told me that the company was still in the running for that workload but had yet to convert it. He also put a number on its value: £47 million.

The company had hoped it would have been working on at least one major radar system order in 2024. The order book is sufficient to bring Easat back into profitability in 2025, and the opportunity pipeline is growing, but it still has not won enough business to achieve the “respectable results” Tim Goodwin is confident of.

The new business is Duvelco, which manufactures a high-performance polyamide (a type of plastic) using a novel process.

- Rolls-Royce among UK stocks benefiting from big US rate cut

- Listen here: 100th episode special: the Terry Smith interview

A resin factory is currently being commissioned, after which Duvelco will be able to ship production samples to prospective distributors and end users. It is also developing the capability to manufacture parts made from the resin at its German subsidiary, Novera.

Achieving sufficient volume to break-even depends on how long it takes companies to add Duvelco to their approved supplier lists, but Tim Goodwin tells me the highly automated facility can operate profitably at a fraction of its capacity. He believes it will become a “truly special business” over the next few years.

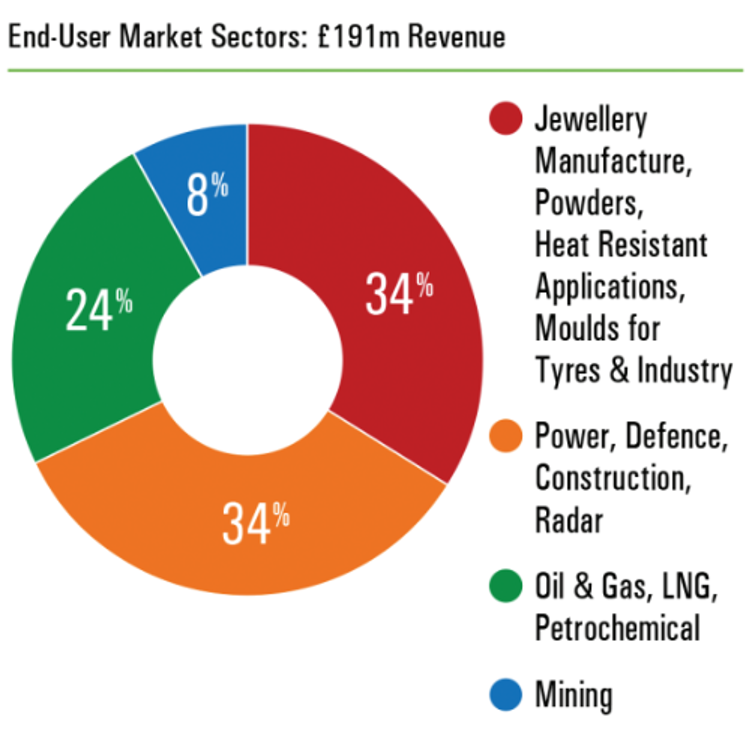

The Refractory Engineering division processes minerals into investment powder, materials used in jewellery and tyre casting. These are industries Goodwin dominates in the UK and supplies around the world.

In 2024 it increased capacity at its facility in China and opened a new facility in India, where demand for jewellery is high and growing strongly.

Another business in the division that is increasing manufacturing capacity processes vermiculite, a naturally occurring thermal insulator used in a wide range of industries.

Having developed a method of dispersing vermiculite in water, Goodwin has also found a home for it in fire extinguishers. These put out lithium battery fires.

This year it is bringing the manufacture of fire extinguishers in-house, illustrating one of Goodwin’s strengths. Both divisions are vertically integrated, putting the company’s destiny in its own hands.

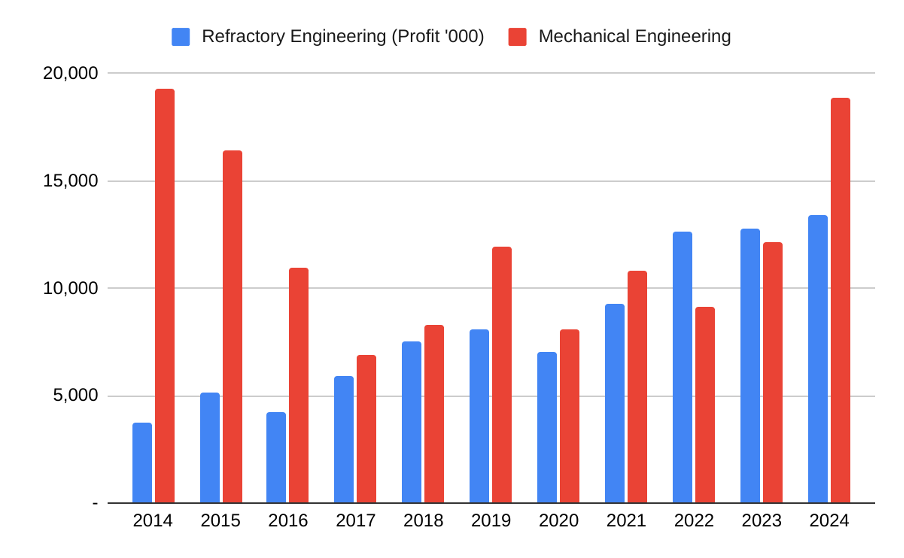

In 2023’s annual report, Goodwin predicted that the Mechanical Engineering division (red bars in the chart below) would regain supremacy in terms of operating profit over the steadily growing Refractory Engineering division (blue bars).

The prediction was vindicated, although higher margin Refractory Engineering still punches above its weight.

It earned about half the revenue of the Mechanical Engineering division in 2024, but achieved a 21% operating profit margin compared to 15% for Mechanical Engineering.

Once, when oil prices were high, the bigger Mechanical Engineering division was also the most profitable.

In a future where the forward order book is dominated by “high quality” nuclear and naval contracts and Easat and Duvelco are contributing, perhaps that can be true again.

The Future (directed) [2.5]

- Addressing challenges:Complexity, climate change [0.5]

- With coherent actions: Investment, vertical integration, efficiency [1]

- That reward all stakeholders fairly: Loyal employees, long-term focus [1]

Goodwin’s strategy is investment led. It has developed new products and processes in both divisions, and funded new capacity to diversify away from oil and gas.

Today, 76% of total revenue comes from other markets.

Source: Goodwin annual report, 2024

Recent results offer reassurance that Goodwin is capable of profitable growth.

The company is also signalling that for three or four years at least, it is going to make the most of the investments it has already made. Capital expenditure will reduce, and cash conversion will improve substantially.

I think this is reassuring. Keeping tabs on Goodwin's moving parts is exhausting. I cannot imagine what running them is like. A pause, while it soaks up new capacity and gets new manufacturing processes underway, is probably a good thing.

But the results also remind us that Goodwin’s large order book stretches over many years. Contracts are lumpy and delivery dates move around, so revenue increases in any year are not guaranteed. It takes time to prove products in new markets.

Managing this complexity is a board of five executives and one non-executive director. The chair, the managing directors of the two divisions, and one of the other two executive directors are from the sixth generation of the Goodwin family, which owns the majority of shares.

- What can we expect from the Budget that isn’t a tax hike?

- DIY Investor Diary: my long-term strategy allowed me to retire early

The fifth generation, brothers Richard and John, stepped down to make way for their sons, Tim, Matthew and Simon, in 2019. All three had years of experience in the business before that.

Making steel and mineral processing are energy intensive industries. and Goodwin’s long-termism extends to reducing C02 emissions, where it is commercially viable.

It has achieved a 67% reduction in its carbon intensity ratio since 2019 by electrifying vehicles, modifying manufacturing processes, installing solar power, and offsetting emissions via a woodland project.

Ultimately it expects to replace natural gas with hydrogen for its most energy intensive applications, but it wants the government to help fund a bespoke hydrogen calciner (furnace) at Hoben International, a sticking point.

Hoben is one of Goodwin’s main mineral processing facilities. It is where it processes the minerals that become casting powders.

Operating these businesses requires skilled labour.

In 2023, when the labour market was especially tight, Goodwin said it coped because few of its highly trained employees leave and its apprentice school feeds “the group’s requirements with eager engineers.”

It also pays well. Median pay has increased from £34,000 in 2022 to £42,000 in 2024, an increase of 24%

Loyal motivated employees are of course a prerequisite of a growing business being run for the long term.

The price (discounted?) [-2.2]

- No. A share price of £72 values the enterprise at about £594 million, 34 times normalised profit.

A score of 5.8 reflects my verdict that Goodwin is a good business but the share price is high, so it is probably fairly valued.

Goodwin is ranked 35 out of 40 shares in my Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Cropper (James) (LSE:CRPR) has published and is due to be re-scored. I am also planning to re-score Focusrite (LSE:TUNE) next week as I am having second thoughts about the score I gave it last year.

I have moved PZ Cussons (LSE:PZC)s to the bottom of the table pending the publication of its annual report in September. The collapse in the value of the Nigerian currency and the impact on the company’s finances and strategy mean I no longer have faith in the score.

0 | Company | * | Description |

1 | Manufactures tableware for restaurants and eateries | ||

2 | Designs recording equipment, loudspeakers, and instruments for musicians | ||

3 | Imports and distributes timber and timber products | ||

4 | Manufactures pushbuttons and other components for lifts and ATMs | ||

5 | Distributor of protective packaging | ||

6 | Makes light fittings for commercial and public buildings, roads, and tunnels | ||

7 | Supplies kitchens to small builders | ||

8 | Whiz bang manufacturer of automated machine tools and robots | ||

9 | Manufacturer of scientific equipment for industry and academia | ||

10 | Flies holidaymakers to Europe, sells package holidays | ||

11 | Manufactures/retails Warhammer models, licences stories/characters | ||

12 | Manufactures military technology, does research and consultancy | ||

13 | Manufactures filters and filtration systems for fluids and molten metals | ||

14 | Manufactures computers, battery packs, radios. Distributes components | ||

15 | Manufactures PEEK, a tough, light and easy to manipulate polymer | ||

16 | Surveys and distributes public opinion online | ||

17 | Sells hardware and software to businesses and the public sector | ||

18 | Sources, processes and develops flavours esp. for soft drinks | ||

19 | Manufactures vinyl flooring for commercial and public spaces | ||

20 | Sells promotional materials like branded mugs and tee shirts direct | ||

21 | Translates documents and localises software and content for businesses | ||

22 | Manufactures natural animal feed additives | ||

23 | Distributes essential everyday items consumed by organisations | ||

24 | Manufactures surgical adhesives, sutures, fixation devices and dressings | ||

25 | Online retailer of domestic appliances and TVs | ||

26 | Supplies vehicle tracking systems to small fleets and insurers | ||

27 | Operates tenpin bowling and indoor crazy golf centres | ||

28 | Online marketplace for motor vehicles | ||

29 | Manufactures specialist paper, packaging and high-tech materials | ||

30 | Repair and maintenance of rail, road, water, nuclear infrastructure | ||

31 | Retails clothes and homewares | ||

32 | Publishes books, and digital collections for academics and professionals | ||

33 | Manufactures sports watches and instrumentation | ||

34 | Acquires and operates small scientific instrument manufacturers | ||

35 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | |

36 | Manufactures disinfectants for simple medical instruments and surfaces | ||

37 | Manufactures power adapters for industrial and healthcare equipment | ||

38 | Makes marketing and fraud prevention software, sells it as a service | ||

39 | Runs a network of self-employed lawyers | ||

v Frozen v | |||

? | Develops and manufactures hygiene, baby, and beauty brands |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Goodwin and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.