Shares for the future: the latest rankings

Our companies analyst has been busy tweaking criteria for the Decision Engine.

30th October 2020 15:01

by Richard Beddard from interactive investor

Our companies analyst has been busy tweaking criteria for the Decision Engine and updating its top shares.

Eagle-eyed readers will have noticed that I tweaked the wording of the fifth of the five criteria I use to score shares for FW Thorpe (LSE:TFW), the share I profiled last week.

The fifth criterion used to be: are the shares cheap? Now it is: is the share price low relative to profit?

I am not sure that I have made anything clearer, but let me explain why I tried.

It started with a conversation on Twitter. A reader was interrogating me about my Decision Engine’s scoring system (you can see it in action in the next section of this article).

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

I had explained that the total of the scores of all five criteria determines a share’s value. The higher the share’s score (on a scale of 0 to 10 - each criterion has a maximum of two), the more confident I am that it is a good long-term investment.

Of course, it will only be a good long-term investment if the current share price undervalues the company’s prospects and its prospects are evaluated in the first four criteria.

These are how profitable the company is, how it plans to sustain or improve its profitability (its strategy), what might stymie the strategy (the risks), and whether customers, staff and shareholders will benefit (fairness).

Effectively, the total score measures relative value. Shares that score 10 are the best value because I have most confidence they will be good long-term investments. Shares that score 0 are the worst.

Wiser men than me have said there is more to value than price:

“Long ago, Ben Graham taught me that “Price is what you pay; value is what you get.” Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.”

Warren Buffett - Letter to shareholders of Berkshire Hathaway, 2008 [PDF].

The humble price-to-earnings ratio (PE), a fancy-pants version of which I use to determine whether a share is cheap, is an attempt to compare price to what you get, in terms of profit.

My Twitter correspondent was confused. If the total score is the measure of value, why then do I need a separate score that also measures it?

Some investors do refer to shares that trade at low valuations, a low PE ratio for example, as ‘cheap’ because on average shares that have low PE ratios do perform a little better than shares that have high ones.

But it would be dangerous to assume an individual share is cheap just because it has a low PE ratio, because there is so much more to value about a business than the amount of profit it has made (or an estimate of how much profit it will make next year).

That is why, to avoid confusion, I have reworded the fifth criterion so its description says exactly what it is: is the share price low relative to profit?

We can only truly decide whether a share is cheap, when we have weighed up all the other criteria, the company’s prospects in other words.

While share prices change all the time, I generally review the first four criteria, profitability, strategy, risks, and fairness. I do this once a year for each company, after it has published its annual report.

Since last month’s update I have re-scored Renishaw (LSE:RSW) and FW Thorpe and scored James Latham (LSE:LTHM) for the first time. Links to the individual profiles I wrote of these companies and all the companies ranked by the Decision Engine are in the table at the end of this article.

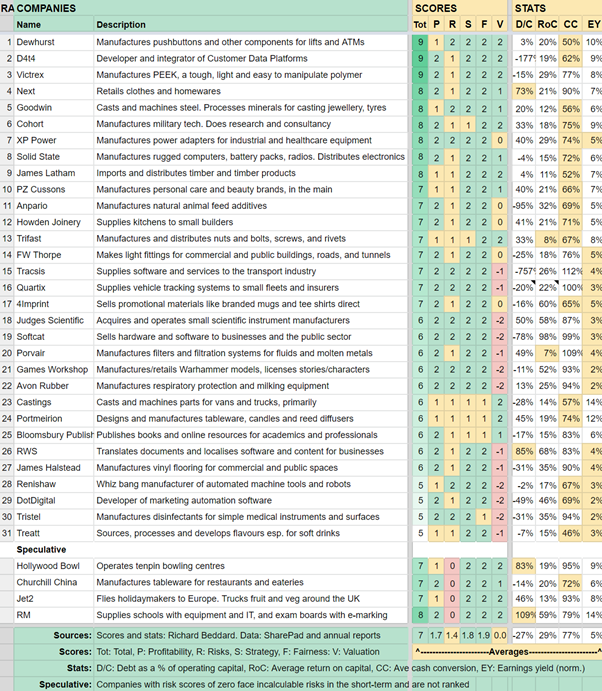

Having fed the latest scores into the Decision Engine, which is also fed continuously with the latest share prices from SharePad, this is the current table ranked so that the most attractive shares for long-term investment are at the top:

I have re-scored one other company this month.

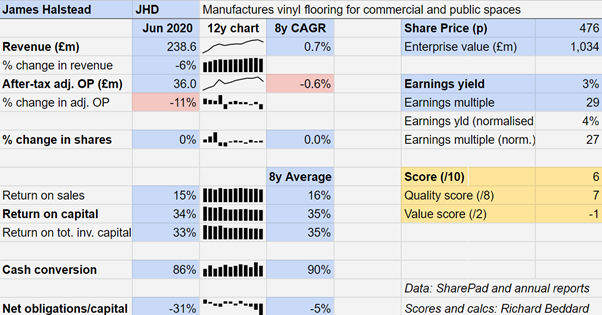

James Halstead (LSE:JHD) makes Polyflor vinyl flooring. Revenue fell 6% in the year to June 2020, the first decline in a generation, and profit fell 11%. But the business has bounced back since June.

Although return on capital is lower than it was a decade ago and growth had been slowing before 2020’s reversal too, James Halstead still conjures prodigious profits from a mundane product.

That is probably because of its focus on serving the end customer via distributors. Their loyalty brings repeat business, it says, and it is so good at making and selling vinyl because that is all it does.

Slow growth probably stems from competitive markets. James Halstead’s vinyl is mostly bound for the commercial construction and refurbishment market, which has followed a stop-go pattern of growth around the world since soon after the financial crisis.

The company already has a global footprint and a sales push in the Far East is one prospective source of growth. The company’s support for home-makeover shows may also imply it is taking a greater interest in the residential market.

Opportunities to grow seem limited though, which means the very high returns James Halstead earns are accumulating in a cash surplus.

If markets improve, the company tells me it has 50% spare capacity, suggesting that one day James Halstead, when less efficient rivals have packed up or demand picks up, may grow faster.

I am predisposed to like James Halstead. To quote the founder: "Quality is when the customer comes back, not the product". Four generations on, the company is still following the same principle.

Does the business make good money? [2]

+ Extraordinary returns on capital employed

+ High profit margins

+ Strong cash flows

What could stop it growing profitably? [1]

+ Very strong finances

? Constrained government finances

? Reduced corporate spending

How does its strategy address the risks? [2]

+ Specialist manufacturer

+ Focused on supporting the end customer

? Increasing sales presence in the Far East

Will we all benefit? [2]

+ Family owned and operated business

+ Focus on training and retention of staff

+ Executives participate in same share scheme as staff

Is the share price low relative to profit? [-1]

+ No. A share price of 476p values the enterprise at just over £1 billion, about 27 times normalised adjusted profit.

James Halstead scores 6/10 and is ranked 27 by the Decision Engine. It is a very good business in a difficult market at a relatively unattractive price.

Even so, it will probably reward patient investors.

Links to latest articles

Richard owns shares in many of the companies listed in the Decision Engine, especially those ranked near the top. He does not yet own shares in James Halstead.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.