Shares for the future: the latest list revealed

Our companies analyst publishes Decision Engine scores for the first time since a major update.

27th November 2020 15:27

by Richard Beddard from interactive investor

Our companies analyst publishes Decision Engine scores for the first time since last month’s major update.

Since I updated the Decision Engine last month, I have scored Volex (LSE:VLX) and James Cropper (LSE:CRPR) for the first time and re-scored PZ Cussons (LSE:PZC) and Softcat (LSE:SCT) (see the end of this article for links to the profiles).

Traders have, of course, been buying and selling shares too, which has moved the prices of all the shares in the Decision Engine.

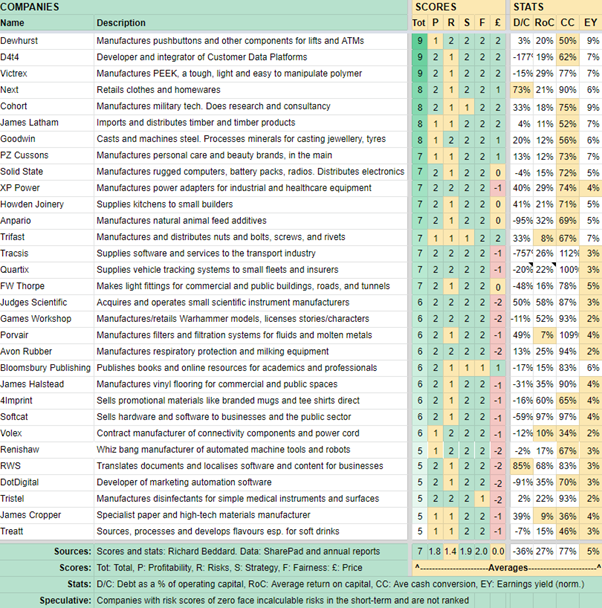

The factors I score determine each share’s score and rank in the Decision Engine table.

These are profitability, risk, strategy, fairness, and the factor dependent on the actions of traders in the market: price.

- Invest with ii: Top UK Shares | Super 60 Investment Ideas | Open a Trading Account

The closer to the top of the table a share is, the more attractive I consider it to be for long-term investment:

That does not mean the shares near the bottom of the table are bad long-term investments. If I lack confidence in a share, I remove it from the table.

Castings and Portmeirion relegated

This month, I have relegated two shares, Castings (LSE:CGS) and Portmeirion (LSE:PMP), to a second speculative table:

This table already contains Churchill China (LSE:CHH), Hollywood Bowl (LSE:BOWL), Jet2 (LSE:JET2) and RM (LSE:RM.). Respectively, they are a manufacturer of tableware for the hospitality industry, a tenpin bowling centre operator, a leisure airline and package tour operator and a company that among other things supplies software for marking exams.

Before the pandemic I had deemed them excellent businesses, but during the outbreak they have, in some respects, barely been able to operate at all.

They are speculative shares because I do not know how seriously their finances will be affected by the extreme loss of business. Because I could not evaluate the risk, I scored them zero for the risk factor.

Due to the pandemic, Castings (LSE:CGS) has manufactured and sold fewer truck components and Portmeirion (LSE:PMP) has manufactured and sold less tableware and scented candles, but their businesses are still relevant during a pandemic.

They have entered the speculative table because, last time I scored them, I could not be unequivocally positive about profitability, risk, strategy, or fairness. I scored both companies one out of two for each of these factors.

The only thing I could say unequivocally was that their share prices were relatively low in comparison to their historic profits.

Castings says little about its strategy. I reckon it tried to expand its customer base beyond the three big European truck manufacturers it has supplied for decades but the new business was unprofitable.

The company’s policy today is to make more products for its existing customers, but Brexit, and, more distantly, the introduction of electric or hydrogen power trains into vehicles, could disrupt these storied supply chains.

Portmeirion was highly profitable as a manufacturer of famous British tableware brands, but it has acquired and distributes a wider range of homewares today. So far the results have been disappointing.

- Avon Rubber and Softcat boom with Covid-proof models

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Distribution, the rationale for the acquisitions, has been a problem for Portmeirion, which has struggled to stop overseas distributors competing outside their territories, and it is only belatedly addressing the internet.

Buying shares in Portmeirion or Castings for the long-term, requires me to decide their strategies address the risks. But I do not see how Castings’ strategy does address palpable risks and while Portmeirion’s strategy may, the risks have grown as it has diversified.

People within these companies, we expect, are working hard to turn things around. Perhaps they will. But with the level of insight I have, that too is a speculative proposition.

Removing a share to the speculative table is meant to be temporary. Next time the company publishes its annual report I will have to decide whether to score it or not.

If I do not score it, it will leave the Decision Engine.

If I do score it, I will be hoping to reinstate it to the main table.

Scoring Softcat

Softcat (LSE:SCT) says its purpose is to help customers by putting employees first. That’s the way it has to be if it is to differentiate itself, because it sells the same products that other IT suppliers do: From Microsoft, Amazon Web Services and Dell for example.

It does not rely on contracts to earn repeat business, it relies on the goodwill of customers who have dealt with the company for many years.

Softcat’s strategy is beguilingly simple: it plans to sell more to existing customers (Softcat reckons it receives 15% of their budgets currently) and recruit more of them (it believes it sells to 20% of its addressable market in the UK and Ireland).

To do that it needs to motivate its salespeople, who are the interface with customers. It recruits young account managers as apprentices and trains, rewards, and promotes them so they and the customers they develop relationships with stay with the business.

No doubt protective of this culture is founder Peter Kelly, who is no longer a director. He owns 33% of the shares and has the right to nominate a non-executive director to the board, a right he has not taken up.

His views are probably well represented by the chairman, who until 2018 was his successor as chief executive. John Hellawell describes himself as the company’s “memory”.

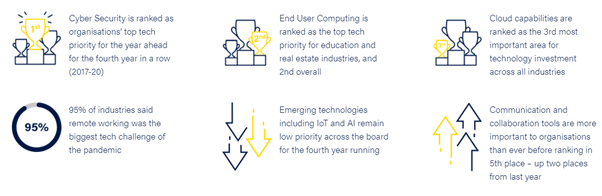

IT tends to be rolled out in waves. We had the tech bubble of the late 1990s, and are now experiencing a new wave of demand as companies migrate to cloud solutions and software plays a bigger role in the way organisations manage and innovate.

Cyber-security, protecting this software, has become many organisations’ highest priority.

According to Softcat’s Business Tech Priorities Report, organisations are more interested in IT that helps them run their day-to-day operations efficiently than flashy new technologies.

I do not know whether the current wave of adoption will subside, or whether as IT is increasingly embedded in the core functions of businesses that companies like Softcat are part of an ever-growing market. They do say software is eating the world...

A second worry about the future is Softcat’s culture, which may be diluted as it evolves as a public company (it listed in 2015).

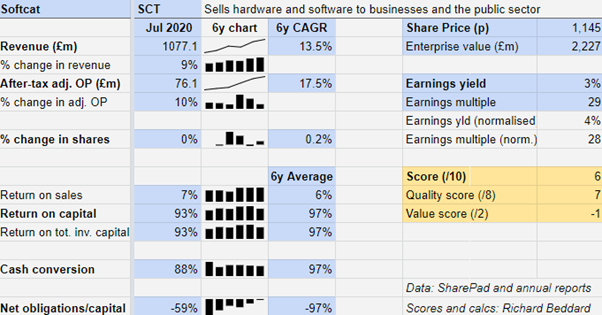

Currently, there is little evidence to support either of these concerns. Softcat is an exemplary business judging by the financial metrics as well as the non-financial ones:

Softcat grew slightly less rapidly than average during the year to July 2020 but otherwise performed pretty much as well as usual. Customers reduced IT spending in some areas, but this was largely offset by increased spending on security and software to enable home working during the pandemic.

Does the business make good money? [2]

+ High average return on capital

+ Good cash conversion

? Modest profit margins

What could stop it growing profitably? [1]

+ Softcat has never had debt and revenue from renewals, subscriptions and warranty/service contracts is resilient

? Culture may be diluted now founder has stepped back

? IT spending may not be sustained after wave of digitisation

How does its strategy address the risks? [2]

+ Trains salespeople in new technologies to stay relevant

+ Sells more to existing customers

+ Wins new customers

Will we all benefit? [2]

+ Company’s founder and his successor as chief executive are major shareholders and still involved

+ High levels of employee engagement (93%) and customer satisfaction (97%)

? With the recruitment of new executives, pay has risen

Is the share price low [-1]

+ No. A share price of £11.70 values the enterprise at £2.3 billion, about 30 times adjusted profit

Softcat is probably a great business, but the market sees the value it is creating, and the share price takes the edge off the investment. It is ranked 24 out of 39 shares in the Decision Engine.

Still, it is probably a good long-term investment.

Links

Richard owns shares in most of the companies listed in the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.