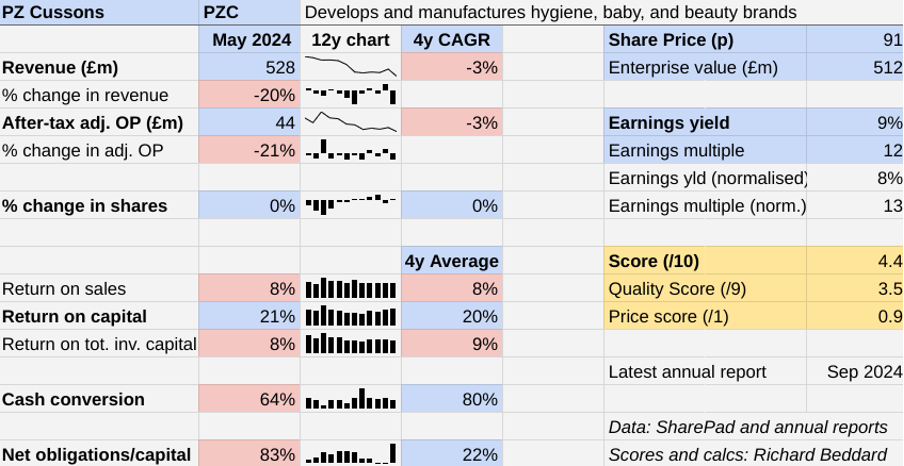

Shares for the future: is the game up for this risky small-cap?

This well-known company and owner of even better-known brands has had its problems in recent years. Analyst Richard Beddard acknowledges the risk in his new ranking.

11th October 2024 15:19

by Richard Beddard from interactive investor

PZ Cussons’ results for the year to May 2024 were dominated by one event, the devaluation of the naira, Nigeria’s currency.

It must stabilise or exit its businesses there if it is to realise its potential everywhere else.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Scoring PZ Cussons: stretched too thin

Exchange rate movements dominate the numbers.

A strong pound meant PZ Cussons (LSE:PZC)’ earnings in Australian dollars, Indonesian rupiah and US dollars were all worth less than they would have been at constant exchange rates.

But the 70% devaluation of the naira was another level. It accounted for 87% of a £149.9 million currency headwind.

Revenue from Nigeria fell to 24% of total revenue. It was still PZ Cussons’ second-biggest market after the UK, which accounted for 34% of revenue.

But for this headwind, revenue would have risen modestly. Because of it, revenue fell 20%. Adjusted profit fell 21%.

The Past (dependable) [0.5]

- Profitable growth: Revenue and profit have contracted [0]

- Strong finances: Mostly funded by borrowings and lease obligations [0]

- Through thick and thin: Lowest heavily adjusted Return on Capital 14% (2020) [0.5]

I am using a four-year period to measure PZ Cussons’ performance because it coincides with Jonathan Myers’ tenure as chief executive.

After he joined, he launched an ambitious policy to revitalise “Must Win Brands” in territories where PZ Cussons already had advantages.

The adjusted figures ignore the crushing £108 million foreign exchange losses.

The Nigerian businesses earn money in local currency but pay suppliers in dollars. The devaluation meant PZ Cussons had to pay more naira to settle its bills.

I do not think we can ignore the devaluation. Now that the Nigerian government has removed currency controls, currency movements are part of the cost of doing business in Nigeria.

On their own, the foreign exchange losses were enough to deliver a thumping loss.

But other costs removed from the adjusted figure include £10 million in restructuring costs, and the £24 million impairment of UK beauty brand Sanctuary Spa.

The collapse in the naira also had a major impact on PZ Cussons’ financial position, devaluing cash trapped in Nigeria by the currency controls.

PZ Cussons has been able to repatriate about £50 million in cash, but its Nigerian cash balance devalued by £140 million while the company was scrambling to get it out.

This has put net financial obligations way above levels I can easily tolerate (they are 83% of operating capital).

Now, PZ Cussons says Nigeria is self-sufficient. It does not require loans from the group to pay for dollars, so the impact on profit may be reduced. Buried in the notes to the accounts, though, is this ominous statement: “There remains no effective and functioning market to hedge USD liabilities in Nigeria.”

The naira has weakened since the year-end and, assuming the average rate in the first quarter of 2025 prevails for the rest of the year, the company expects to report adjusted operating profit of between £47 million and £53 million.

In other words, PZ Cussons expects to grow, but under the weaker naira scenario the growth will be rubbed out by exchange rate losses.

Compared to 2024, the forecast for 2025 is a decline of 19% to 9%. But it is an increase of between 18% and 33% on 2024 profit restated at the same exchange rate (the figures in my table are different because I have deducted tax from them at the standard corporation tax rate).

For a more sober assessment we can turn to the Going Concern Statement in the annual report. A further 10% or greater decline in the value of the naira from the rate at the beginning of the second quarter, which the company deems a severe but plausible scenario, could cause a breach of its interest cover covenant at the end of November.

This would require PZ Cussons to repay its credit facility on demand, a situation it could avert by negotiating a waiver, cutting costs, and disposing of assets.

Some of these processes are already under way.

The Present (distinctive) [1.5]

- Discernible business: Famous brands, diverse territories [0.5]

- With experienced people: Not particularly [0.5]

- That creates value for customers: Distinctive, sustainable products [0.5]

PZ Cussons manufactures soap, baby, and beauty products, principally in the UK, Nigeria, Australia, New Zealand and Indonesia.

In the UK, it is known for its biggest soap brand, Carex, body wash Original Source, and slightly fusty Imperial Leather soap. Morning Fresh dominates the Australian washing-up liquid market.

I feel a bit sorry for chief executive Jonathan Myers and chief financial officer Sarah Pollard. Myers joined the company in March 2020, as the pandemic broke out and Pollard joined soon after.

They set out to simplify and focus a business that had grown through acquisition into an unmanageable sprawl and neglected basic capabilities like sourcing, manufacturing, product development and marketing.

They had an ambition to improve its already decent social and environmental credentials, by achieving B-Corp certification.

But they have been saddled with Nigeria, and like the bomb in “pass the bomb”, it went off in their hands.

The Future (directed) [1.5]

- Addressing challenges:Nigeria, competition [0.5]

- With coherent actions: Mooted divestments, focus on MWBs and core competencies [0.5]

- That reward all stakeholders fairly: Yes, but can it keep it up? [0.5]

PZ Cussons has long taken what it describes as bold risks in emerging markets, where it believes rising populations mean faster economic growth.

Perhaps too, for historical reasons, the company has remained wedded to its Nigerian businesses. It was originally a 19th-century West African trading company, and the founding Zochonis family are still major shareholders.

With a number of popular products in each of its main markets, PZ Cussons believes it has more focus than multinational rivals and more resources to apply to them than local rivals.

But its aspirations are shrinking because its resources are too stretched.

The impaired beauty brand Sanctuary Spa is a “Must Win Brand”. PZ Cussons favours MWBs with greater investment as it battles for attention online and shelf space with low-cost retailers’ own brands and the brands of other consumer goods companies.

But the write-down, which follows a similar impairment in 2023, means the company has less confidence in Sanctuary Spa's potential.

It has reduced investment in its UK beauty brands because we’re spending less on them. And it has folded the Beauty division into Personal Care, which contains the soap brands.

It looks like Sanctuary Spa’s Must Win status may be in jeopardy.

The other MWBs are: Carex, Childs Farm, Cussons Baby, Joy, Morning Fresh, Original Source, Premier, and St. Tropez.

Some of these MWBs may be in jeopardy too. Joy and Premier are Nigerian soap brands, and PZ Cussons is exploring selling some or all of its Nigerian businesses. Fake-tan brand St. Tropez is for sale.

St. Tropez is a bit of an outlier. Its biggest market is the US, where PZ Cussons’ other brands are not strong. Selling it will raise cash to invest in MWBs in the company’s main markets.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- GSK update eases investors’ fears as focus turns to vaccines

The future of the Nigerian brands, where the company also sells electrical goods and cooking oil through joint ventures, is more confusing.

Last year the company believed the mid to long-term prospects of the businesses there were improved by the removal of the currency peg, despite the pain caused by the subsequent collapse in the naira’s value.

But PZ Cussons’ interest in joining the exodus of businesses from Nigeria may mean it is more worried about surviving in the short term.

In the annual report, there is no mention of the eye-catching aspiration to become a B Corp by 2016.

Principles are probably taking a back seat now resources are strained.

That makes me wonder whether PZ Cussons can maintain its existing social and environmental standards. Its mantra “for everyone, for life, for good”, is part of its attraction to employees, and its environmentally friendly products are part of its attraction to customers.

Doubling down on these values when a business is financially strong is a good strategy, but PZ Cussons probably cannot afford it.

Recruitment and retention in Nigeria is hampered by high levels of emigration due to economic uncertainty, but also by uncertainty about the company’s future status there.

I do not know how far PZ Cussons will have to cut to turn itself around, and consequently how recognisable the rump will be.

The price (discounted?) [0.9]

- Yes. A share price of 91p values the enterprise at about £512 million, 13 times normalised profit.

When the outcome of short-term events eclipses long-term prospects, the game is probably up for long-term investors.

A score of 4.4 implies PZ Cussons is risky.

The company is ranked 39 out of 40 shares in my Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores once a year, soon after each company has published its annual report.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Renishaw (LSE:RSW) has published its annual report and is due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.9 | ||

4 | Supplies kitchens to small builders | 8.6 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Manufacturer of scientific equipment for industry and academia | 8.1 | ||

8 | Flies holidaymakers to Europe, sells package holidays | 8.0 | ||

9 | Manufactures/retails Warhammer models, licences stories/characters | 7.8 | ||

10 | Surveys and distributes public opinion online | 7.8 | ||

11 | Manufactures filters and filtration systems for fluids and molten metals | 7.6 | ||

12 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.6 | ||

13 | Manufactures military technology, does research and consultancy | 7.6 | ||

14 | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | ||

15 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

16 | Manufactures computers, battery packs, radios. Distributes components | 7.4 | ||

17 | Sources, processes and develops flavours esp. for soft drinks | 7.4 | ||

18 | Sells hardware and software to businesses and the public sector | 7.3 | ||

19 | Distributes essential everyday items consumed by organisations | 7.2 | ||

20 | Whiz bang manufacturer of automated machine tools and robots | 7.2 | ||

21 | Translates documents and localises software and content for businesses | 7.0 | ||

22 | Manufactures natural animal feed additives | 7.0 | ||

23 | Sells promotional materials like branded mugs and tee shirts direct | 7.0 | ||

24 | Manufactures vinyl flooring for commercial and public spaces | 6.9 | ||

25 | Supplies vehicle tracking systems to small fleets and insurers | 6.7 | ||

26 | Operates tenpin bowling and indoor crazy golf centres | 6.7 | ||

27 | Online marketplace for motor vehicles | 6.7 | ||

28 | Online retailer of domestic appliances and TVs | 6.6 | ||

29 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.3 | ||

30 | Retails clothes and homewares | 6.2 | ||

31 | Acquires and operates small scientific instrument manufacturers | 6.0 | ||

32 | Manufactures sports watches and instrumentation | 6.0 | ||

33 | Publishes books, and digital collections for academics and professionals | 5.9 | ||

34 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | |

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.7 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 4.9 | ||

38 | Runs a network of self-employed lawyers | 4.6 | ||

39 | PZ Cussons | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | |

40 | Manufactures specialist paper, packaging and high-tech materials | 3.6 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns PZ Cussons and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.