Shares for the future: four firms re-scored

Our columnist reshuffles the Decision Engine, and this is the result.

29th January 2021 16:20

by Richard Beddard from interactive investor

Our columnist reshuffles the Decision Engine, and this is the result.

Since the last Decision Engine update a month ago I have re-scored four shares: dotDigital (LSE:DOTD), Treatt (LSE:TET), Tracsis (LSE:TRCS) and Avon Rubber (LSE:AVON).

14 shares for the future

As you would expect, they are all good businesses. This is a requirement for inclusion in the Decision Engine. They are also profiting through the pandemic, so they are in particularly high demand.

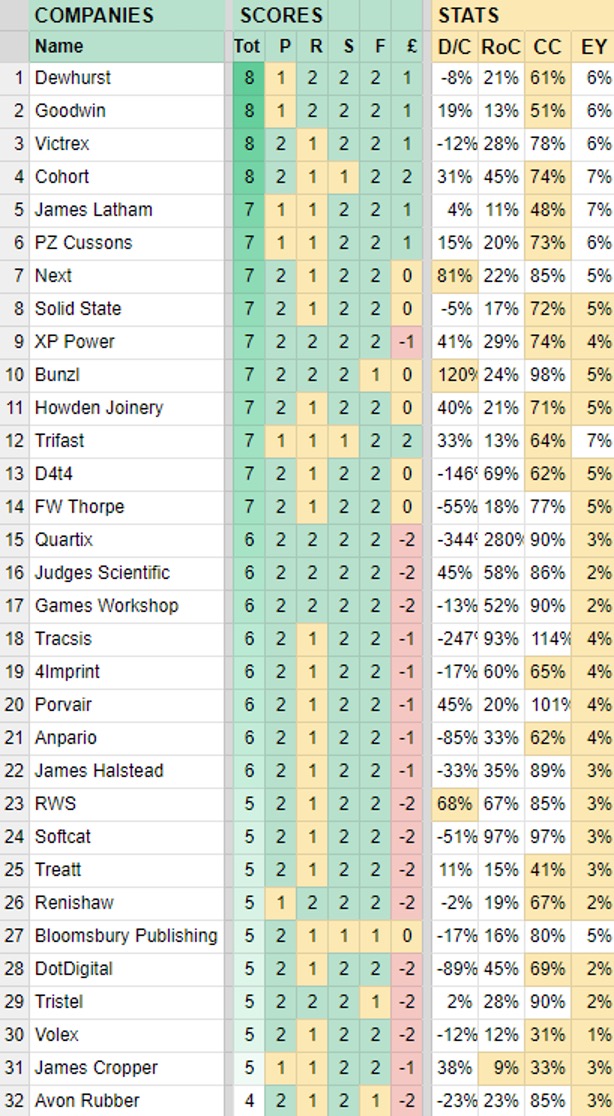

If you cast your eye down the price (£) column of the Decision Engine table (below), you will see that only seven companies achieve a positive score coloured green. This means they have an earnings yield (EY) of 5% or more, equivalent to an enterprise multiple of less than 20 times adjusted profit, normalised over a representative number of years.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

All of the other companies in the table are more highly rated, and before long we get into a block of red coloured negative price scores.

High prices in relation to earnings do not necessarily make shares a bad investment. Companies can grow into their valuations, but we must be confident in their quality to believe they will. They must score highly for the other four factors: profitability, risks, strategy and fairness.

Scoring the factors allows me to make the trade-off between quality and price.

I consider companies that score seven or more out of 10 to be undervalued. This means that XP Power (LSE:XPP) which scores a maximum of two for all four quality factors can still be undervalued even though it scores minus one for price, because eight minus one is seven.

Quartix (LSE:QTX), on the other hand, which also scores a maximum two for all four quality factors, scores minus two for price. Its higher earnings yield of 3% counts more heavily against it than XP Power’s 4% earnings yield, and Quartix scores six out of 10 overall.

There is nothing scientific about a score of seven. I picked it because I wanted to be able to pay a little over the odds for the highest-quality companies. Some growth investors would be willing to pay more, and hair-shirted value investors might be sickened at the thought of paying twenty or twenty five times earnings for any share, even a high quality one.

A score of seven though, is where I draw a line. Shares that score less than seven are not obviously overvalued. ‘Fair value’ is not a point on a scale, but a range, and I consider shares scoring five and six to be fair value.

That puts only one company in the Decision Engine table in the overvalued category. It is Avon Rubber, which I scored last week. Avon Rubber’s share price is much higher than it was a year ago, and I am not as certain about the business’ quality as I was.

Decision Engine ranked by score

Scores and stats: Richard Beddard. Data: SharePad and annual reports. Tot: Total score, P: Profitability, R: Risk, S: Strategy, F: Fairness, £: Price, D/C: Debt as a % of capital, RoC: Ave return on capital, CC: Ave cash conversion, EY: Ave earnings yld

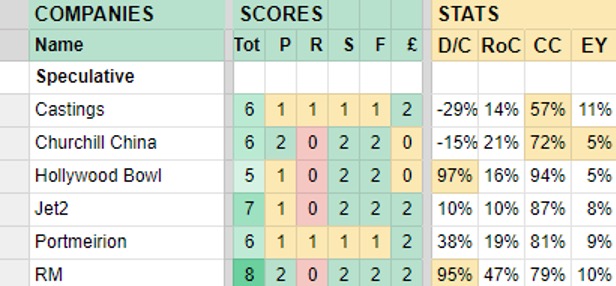

Six shares remain unranked and stranded outside the Decision Engine because I believe their scores are too speculative to be compared with the rest.

Four of them, Churchill China (LSE:CHH), Hollywood Bowl (LSE:BOWL), Jet2 (LSE:JET2) and RM (LSE:RM.) are there because the main risk to their business is the pandemic, which has at various times closed large parts or all of their operations down. I do not feel I can put a number on the risk, but I hope to bring them back into the fold.

The other two, Castings (LSE:CGS) and Portmeirion (LSE:PMP), score one out of two for each of profitability, risk, strategy, and fairness. That means I can say nothing unequivocally good about them except that they trade on a low multiple of profit.

Their mediocre scores of four out of eight for quality brings into doubt their status as good businesses, and whether they belong in the Decision Engine. They have joined the speculative category to give me time to decide whether I want to drop them entirely.

Scores and stats: Richard Beddard. Data: SharePad and annual reports. Tot: Total score, P: Profitability, R: Risk, S: Strategy, F: Fairness, £: Price, D/C: Debt as a % of capital, RoC: Ave return on capital, CC: Ave cash conversion, EY: Ave earnings yld

Lane closures

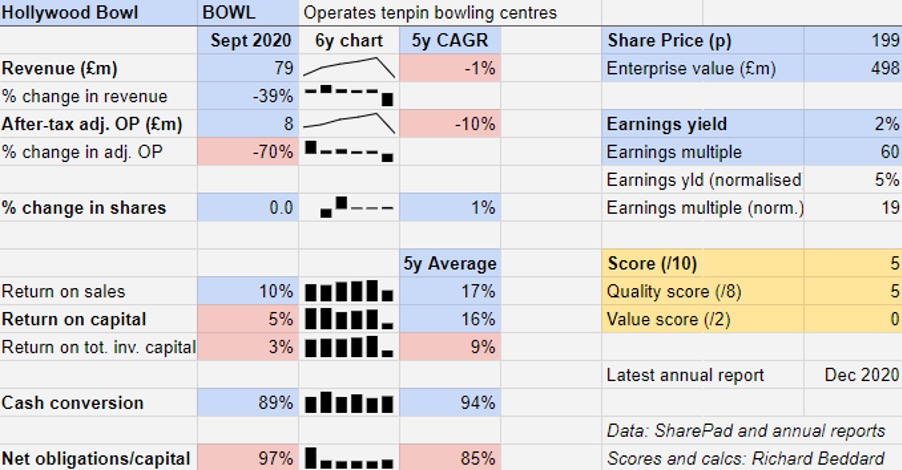

Normally a highly profitable firm, Hollywood Bowl is not a good business in a pandemic. The chain of tenpin bowling centres has been forced to operate with one hand, or both, tied behind its back.

During the first part of the financial year from October 2019 to February 2020 it operated unencumbered. From March to September 2020, it was shut down, and belatedly allowed to reopen at reduced capacity in August.

Under the circumstances, the headlines are heartening. The company made a profit and it turned profit into cash. Net financial obligations, though, increased.

Hollywood Bowl even opened one new bowling centre in York and three new indoor crazy golf centres in Leeds, York and Rochdale, a new format branded Puttstars.

It achieved these results because it had performed very well in the first half of the year, quickly cut costs and investment, restrained pay and made redundancies. But its prosperity depended on others too. The government suspended rates and paid furloughed salaries. Lloyds Bank waived some covenants and relaxed others on its borrowings, landlords deferred or waived rent, and shareholders provided new capital.

The going concern statement in the annual report is not comfortable to read. The worst-case scenario envisaged centres closed under the tier system introduced in December 2020 remaining closed until the end of February 2021.

Under that scenario it was unlikely the company would breach its revised covenants, and Hollywood Bowl was confident it would be able to renegotiate if necessary.

In fact, all centres are closed by national lockdowns and we do not know when they will reopen.

The likelihood of a breach has probably increased. The company still expects a waiver when a covenant requiring it to lose less than £3 million is tested in March. But, if it passes as expected, it will remain hostage to the evolution of the pandemic and government policy and our attention will shift to June and the bank’s next covenant test.

Scoring Hollywood Bowl

Looking beyond the grimness of the pandemic, there is the un-estimable (to me) probability that once Hollywood Bowl is allowed to operate again, it will resume its successful roll out.

Hollywood Bowl is the largest and most successful UK tenpin bowling chain because its employees focus on giving families a good time. It achieves this by locating bowling alleys in popular locations, where there are also restaurants and cinemas, by refining and updating the Hollywood themed experience, and by encouraging customers to return and beat their high scores.

The success of the business model drives success and happy customers return. Landlords favour Hollywood Bowl for new developments because, Covid-notwithstanding, it is a reliable tenant. The bank recognises that under normal circumstances this is a good business.

Because it has only existed independently for a decade, Hollywood Bowl is untested in a prolonged recession. Tenpin bowling and crazy golf are inexpensive forms of family entertainment. They might remain popular when money is tight, and the company’s normally high profit margins imply revenue could fall substantially and it would remain profitable.

With an eye on the more distant future, Hollywood Bowl now has two formats. Should Puttstars succeed, it will have more options for investment.

Does the business make good money? [1]

+ High return on capital

+ Good cash conversion

? Untested in prolonged recession

What could stop it growing profitably? [0]

+ Competition

? Bank debt and lease obligations

˗ Closure/reduced capacity due to pandemic

How does its strategy address the risks? [2]

+ Roll out of two new centres a year (deferred to 2022)

+ Continued refinement of Hollywood Bowl format

+ Testing and development of new Puttstars format

Will we all benefit? [2]

+ Experienced managers

+ Employee first culture

? Executive pay

Is the share price low relative to profit? [0]

? No. A share price of 199p values the enterprise at about nineteen times normalised and adjusted profit.

A score of five out of 10 puts Hollywood Bowl in the fair value range but I am very uncertain about that judgement. The company remains unranked.

How I scored the Decision Engine shares

I score shares soon after companies publish their annual reports. To see how each company was scored, click on their names in the table below. The score may be different from the score in the table due to fluctuations in share price and, very occasionally, because I have re-evaluated a company mid-year.

| Name | Description | Link to updates |

| 4imprint (LSE:FOUR) | Sells promotional materials like branded mugs and tee shirts direct | article |

| Anpario (LSE:ANP) | Manufactures natural animal feed additives | article |

| Avon Rubber (LSE:AVON) | Manufactures respiratory protection equipment and body armour | article |

| Bloomsbury Publishing (LSE:BMY) | Publishes books and online resources for academics and professionals | article |

| Bunzl (LSE:BNZL) | Distributes essential everyday items consumed by organisations | article |

| Castings (LSE:CGS) | Casts and machines parts for vans and trucks, primarily | article |

| Churchill China (LSE:CHH) | Manufactures tableware for restaurants and eateries | article |

| Cohort (LSE:CHRT) | Manufactures military tech. Does research and consultancy | article |

| D4t4 (LSE:D4T4) | Developer and integrator of Customer Data Platforms | article |

| Dewhurst (LSE:DWHT) | Manufactures pushbuttons and other components for lifts and ATMs | article |

| dotDigital (LSE:DOTD) | Developer of marketing automation software | article |

| FW Thorpe (LSE:TFW) | Makes light fittings for commercial and public buildings, roads, and tunnels | article |

| Games Workshop (LSE:GAW) | Manufactures/retails Warhammer models, licenses stories/characters | article |

| Goodwin (LSE:GDWN) | Casts and machines steel. Processes minerals for casting jewellery, tyres | article |

| Hollywood Bowl (LSE:BOWL) | Operates tenpin bowling centres | article |

| Howden Joinery (LSE:HWDN) | Supplies kitchens to small builders | article |

| James Cropper (LSE:CRPR) | Manufactures specialist paper, packaging and high-tech materials | article |

| James Halstead (LSE:JHD) | Manufactures vinyl flooring for commercial and public spaces | article |

| James Latham (LSE:LTHM) | Imports and distributes timber and timber products | article |

| Jet2 (LSE:JET2) | Flies holidaymakers to Europe, sells package holidays | article |

| Judges Scientific (LSE:JDG) | Acquires and operates small scientific instrument manufacturers | article |

| Next (LSE:NXT) | Retails clothes and homewares | article |

| Portmeirion (LSE:PMP) | Designs and manufactures tableware, candles and reed diffusers | article |

| Porvair (LSE:PRV) | Manufactures filters and filtration systems for fluids and molten metals | article |

| PZ Cussons (LSE:PZC) | Manufactures personal care and beauty brands | article |

| Quartix (LSE:QTX) | Supplies vehicle tracking systems to small fleets and insurers | article |

| Renishaw (LSE:RSW) | Whiz bang manufacturer of automated machine tools and robots | article |

| RM (LSE:RM.) | Supplies schools with equipment and IT, and exam boards with e-marking | article |

| RWS (LSE:RWS) | Translates documents and localises software and content for businesses | article |

| Softcat (LSE:SCT) | Sells hardware and software to businesses and the public sector | article |

| Solid State (LSE:SOLI) | Manufactures rugged computers, battery packs, radios. Distributes electronics | article |

| Tracsis (LSE:TRCS) | Supplies software and services to the transport industry | article |

| Treatt (LSE:TET) | Sources, processes and develops flavours esp. for soft drinks | article |

| Trifast (LSE:TRI) | Manufactures and distributes nuts and bolts, screws, and rivets | article |

| Tristel (LSE:TSTL) | Manufactures disinfectants for simple medical instruments and surfaces | article |

| Victrex (LSE:VCT) | Manufactures PEEK, a tough, light and easy to manipulate polymer | article |

| Volex (LSE:VLX) | Manufactures connectivity components and power cord | article |

| XP Power (LSE:XPP) | Manufactures power adapters for industrial and healthcare equipment | article |

Richard owns shares in Hollywood Bowl and many of the shares in the Decision Engine.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.