Shares for the future: an each-way bet on future of manufacturing

Making the top half of analyst Richard Beddard’s Decision Engine, this FTSE 250 company is rated a good long-term investment.

18th October 2024 14:15

by Richard Beddard from interactive investor

Renishaw (LSE:RSW) equips the factories of the future. It makes tools that ushered in a new era of precision in manufacturing, and systems that automate production lines.

The company seems destined to grow as society becomes more technological. But that does not make it a comfortable investment to own because Renishaw’s revenue is at the mercy of the capital equipment cycle.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

When lots of new factories are being equipped with machines, Renishaw prospers. When there is enough manufacturing capacity, it gets by.

Scoring Renishaw: Discombobulation

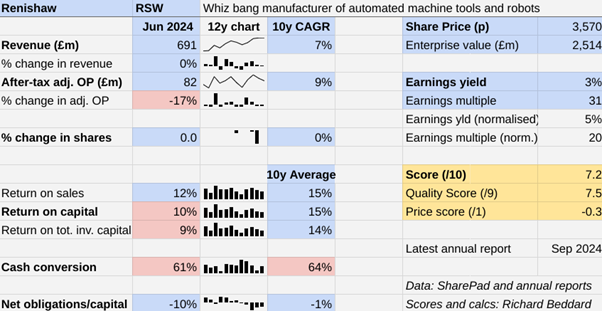

The year to June 2024 was a second consecutive year of contraction. Profit was considerably lower than it was in 2023. It was also considerably lower than its post-Covid peak in 2022, and earlier peaks in 2018 and even 2015.

Taking 2024 as the end point, Renishaw has achieved low single digit compound annual profit growth over the last 12 years.

After-tax return on capital has fallen to 10%, close to the bottom end of the range shareholders have become accustomed to.

The Past (dependable) [2]

- Profitable growth: Single digit 12y profit compound annual growth rate (CAGR) [0.5]

- Strong finances: Net cash [1]

- Through thick and thin: Lowest return on capital (RoC) ex. 2020 was 9% (2016) [0.5]

Renishaw says weaker demand for laser position encoders and calibration products used in semiconductor manufacturing equipment meant revenue did not grow in 2024.

This, it explains, was because customers had overstocked during the pandemic, when there was high demand for consumer electronics and uncertainty about the supply of equipment to make them.

Meanwhile, costs have increased as Renishaw has increased its manufacturing capacity, helped secure the loyalty of highly skilled employees with significant pay rises, and raised research and product development spending to nearly £100 million, about 14% of revenue.

Adjusted after-tax operating profit has fallen 25% since 2018, and capital employed has increased 36%.

It would be tempting, but probably wrong to conclude that Renishaw is throwing money at diminishing returns.

We risk being misled by natural fluctuations. The lacklustre 12-year growth rate compares a good year (2012) with a relatively bad one (2024).

If we compare 2014, a bad year, with 2024, another bad year, we get a more favourable 9% CAGR in profit.

Measuring growth from a good year to a bad year does Renishaw no favours, and Renishaw’s historical growth rate cannot accurately be pinned down.

This is a problem Renishaw itself recognises. It is looking for a better key performance indicator than the rolling five-year CAGR it uses.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- How Budget rumour mill is affecting the UK stock market

Demand for position encoders is recovering, and Renishaw anticipates “solid” revenue growth in the year to June 2025.

Probably the semiconductor equipment cycle is turning. The company may be as competitive as ever, it just does not look like it if you judge it by its results in 2024.

The Present (distinctive) [3]

- Discernible business: Makes manufacturing technologies (mostly) [1]

- With experienced people: Experienced executives. Founders and majority shareholders are non executives [1]

- That creates value for customers: More capable and efficient factories [1]

Most of the industries Renishaw supplies are cyclical, principally manufacturers of semiconductors, smartphones, planes and motor vehicles.

It makes sensors, probes and styli that measure components during the manufacturing process, position encoders that control the motion of machinery and industrial robots, and additive manufacturing (AM, or 3D printing) machines.

A much smaller second division, “Analytical instruments and medical devices” makes spectrometers, which are used in university laboratories. A Renishaw spectrometer helped make the news earlier this year when scientists used it to determine that the stone circle’s altar stone did not come from Wales, as previously thought, but probably Scotland.

The division also makes neurosurgical robots, used by brain surgeons, and a drug delivery system that can administer drugs directly to a patient’s brain.

- Stockwatch: is it now 'darkest before dawn' for this sector?

- This FTSE 100 stock is a top pick for results season

Potentially the laboratory and healthcare markets are more stable sources of profit, and the division has emerged from a long loss-making incubation period. Currently though it earns only 4% of Renishaw’s total adjusted profit from 6% of its revenue.

Renishaw has developed most of these technologies itself.

Its first product, a touch trigger probe developed for Rolls-Royce, was invented in the 1970s by Sir David McMurtry, who recently stepped down as executive chair but remains on the board as a non-executive director.

John Deer, Renishaw’s other co-founder is also a non-executive director, and the pair are majority shareholders. Sir David’s son, Richard, was also appointed a non-executive director in July.

Sir David McMurtry is credited with imbuing the company with a culture of innovation and long-termism, values almost certainly shared by the remaining executives.

Chief executive Will Lee is eight years into the role, but has worked at Renishaw since joining as a graduate trainee in 1996. Chief financial officer Allen Roberts has been a board member since 1980.

The Future (directed) [2.5]

- Addressing challenges:Instability, competition [0.5]

- With coherent actions: Investment from position of financial strength [1]

- That reward all stakeholders fairly: Customer and employee centric [1]

The cyclicality of Renishaw’s markets has been worsened by increased global economic and political uncertainty. This has disrupted trade routes and, if it worsens, could threaten its far-flung businesses because Renishaw earns almost half its revenue on the other side of the world.

In 2024, the Asia Pacific region contributed 46% of total revenue, dominated by manufacturing superpower China (26% of total revenue) and semiconductor superpower Taiwan.

In mitigation, Renishaw should benefit from increased investment in semiconductor fabrication closer to home, as Western industrialised nations onshore production for strategic reasons.

The company’s primary defence against instability is to have plenty of cash and stock on hand to withstand temporary lulls.

By using its own products and systems to automate its factories, Renishaw can also manage production efficiently, reducing the cost of operating at lower volumes when necessary.

This vertical integration also gives it insights into manufacturing processes, which has helped it to develop from a component supplier into a designer of systems for manufacturers in its end markets.

For example, in 2023 Renishaw launched Renishaw Central, a software platform that connects the measurement machines it makes with machining equipment like lathes and mills, to improve automation and control.

The company also has big ambitions for AM, a technology mainly used to prototype small batches of bespoke components and products.

Renishaw has developed 3D printers capable of high-volume manufacturing, principally in healthcare markets. As it continues to improve the machines to reduce the cost of operating them and as it persuades engineers to design products for AM, the company foresees an ever-broadening range of applications.

In a sense, AM makes Renishaw an each-way bet on the future of manufacturing. Long-term it should remain competitive as long as its products stay at the forefront of what is possible.

It achieves this through investment in product development, recruiting and retaining skilled engineers, and collaborating closely with customers.

In terms of competition, China presents a challenge. There, Renishaw is experiencing strong pressure from local rivals. Renishaw is responding as it does everywhere by strengthening the direct sales and engineering capabilities it offers through local subsidiaries.

On recruitment and retainment, its decision to increase pay already seems to have had the desired effect. The voluntary staff turnover rate has fallen to 6%, its lowest for at least five years and significantly lower than the peak of 11% in 2022.

That year, most companies experienced higher levels of employee turnover, as the pandemic had previously subdued recruitment activities.

The price (discounted?) [-0.3]

- No. A share price of £35.70 values the enterprise at about £2.5 billion, 20 times normalised profit.

A score of 7.2 implies Renishaw is a good long-term investment.

It is ranked 16 out of 40 shares in my Decision Engine.

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Company | * | Description | Score | |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Makes light fittings for commercial and public buildings, roads, and tunnels | 9.1 | ||

3 | Imports and distributes timber and timber products | 9.0 | ||

4 | Supplies kitchens to small builders | 8.5 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Manufacturer of scientific equipment for industry and academia | 8.2 | ||

8 | Flies holidaymakers to Europe, sells package holidays | 8.0 | ||

9 | Surveys and distributes public opinion online | 7.8 | ||

10 | Manufactures/retails Warhammer models, licences stories/characters | 7.7 | ||

11 | Manufactures military technology, does research and consultancy | 7.6 | ||

12 | Manufactures filters and filtration systems for fluids and molten metals | 7.6 | ||

13 | Designs recording equipment, loudspeakers, and instruments for musicians | 7.5 | ||

14 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

15 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.5 | ||

16 | Renishaw | Whiz bang manufacturer of automated machine tools and robots | 7.2 | |

17 | Sells hardware and software to businesses and the public sector | 7.3 | ||

18 | Manufactures computers, battery packs, radios. Distributes components | 7.4 | ||

19 | Sources, processes and develops flavours esp. for soft drinks | 7.2 | ||

20 | Distributes essential everyday items consumed by organisations | 7.1 | ||

21 | Sells promotional materials like branded mugs and tee shirts direct | 7.0 | ||

22 | Translates documents and localises software and content for businesses | 7.0 | ||

23 | Manufactures natural animal feed additives | 7.0 | ||

24 | Manufactures vinyl flooring for commercial and public spaces | 6.8 | ||

25 | Operates tenpin bowling and indoor crazy golf centres | 6.7 | ||

26 | Supplies vehicle tracking systems to small fleets and insurers | 6.7 | ||

27 | Online retailer of domestic appliances and TVs | 6.5 | ||

28 | Online marketplace for motor vehicles | 6.6 | ||

29 | Repair and maintenance of rail, road, water, nuclear infrastructure | 6.3 | ||

30 | Retails clothes and homewares | 6.1 | ||

31 | Acquires and operates small scientific instrument manufacturers | 6.1 | ||

32 | Manufactures sports watches and instrumentation | 5.9 | ||

33 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.9 | |

34 | Publishes books, and digital collections for academics and professionals | 5.8 | ||

35 | Manufactures disinfectants for simple medical instruments and surfaces | 5.7 | ||

36 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.0 | ||

38 | Runs a network of self-employed lawyers | 4.7 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.4 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.6 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Shares marked with a question mark are more speculative

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Renishaw and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.