Shares for the future: can this decent business get even better?

Scars left by erratic post-pandemic trading conditions are beginning to heal, and results have returned to respectability. Analyst Richard Beddard updates his score for this small-cap stock.

10th January 2025 15:01

by Richard Beddard from interactive investor

Although flavour trader and processor Treatt (LSE:TET) is in the same business it was five years ago, it operates from a new facility and is run by different people.

This is quite an adjustment for shareholders, accustomed to consistent management and the incremental improvements of the previous decade.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Cashback Offers

Erratic trading conditions post pandemic and these changes have left scars on the company’s financial track record that may be beginning to heal.

Perhaps Treatt is emerging stronger.

Scoring Treatt: diversifying risk

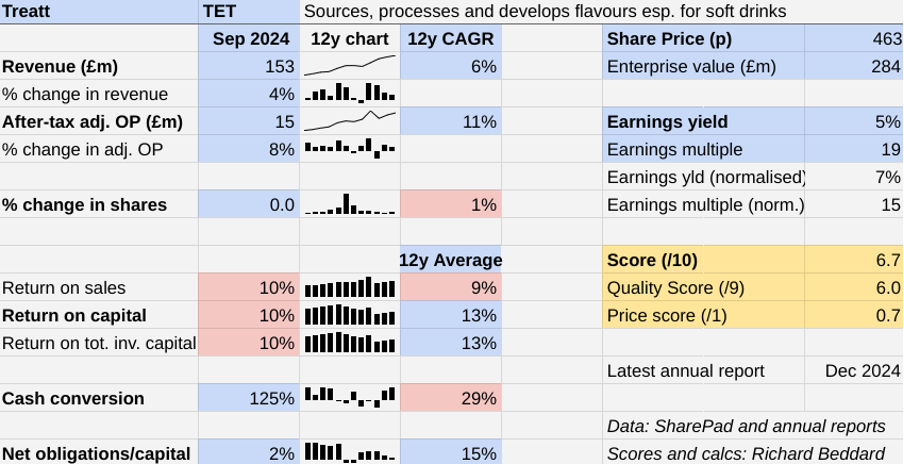

After a couple of lean years, Treatt’s results for the year to September 2024 returned to respectability, just.

The Past (dependable) [2]

- Profitable growth: 6% revenue CAGR, 11% profit CAGR [1]

- Strong finances: Low financial obligations, historically weak cash flow [0.5]

- Through thick and thin: Lowest RoC 8% (2022) [0.5]

Single-digit profit growth and an after-tax return on capital (RoC) of 10% is still below par.

Cash flow has been unusually strong during the last two years, which has allowed Treatt to repay debt leaving it in a strong financial position at the year end.

Trading essential oils is a low-margin business, which weighs on profit margins, but Treatt’s diminished profitability for the last three years also stems from heavy investment.

The company has enlarged its US manufacturing facility in Florida, and relocated from an aged UK facility and headquarters to a new state-of-the-art home just down the road.

Although profit in 2024 is considerably higher than it was before the pandemic, as a proportion of the capital invested, it is lower because of the huge investment.

Return on capital should improve in coming years if the new facilities bring the operating and strategic benefits the company anticipated.

Now capital expenditure has normalised, and the pension fund no longer requires deficit repayments, cash flow should also be more impressive than historic levels.

However, the generous payment terms Treatt gives customers and its need to ensure it can supply them, are still likely to tie up cash.

Receivables - money owed to the company by customers - were 22.5% of revenue in 2024.

The value of stock in 2024 was 33% of revenue, low in comparison to the spike of 2022 when it reached 50%, but nevertheless a substantial cash outlay.

The company anticipates revenue growth of 5-7% in 2025, improved margins and a return to a net cash position for the year to September 2015.

The Present (distinctive) [2]

- Discernible business: Sources, processes, and invents flavours [1]

- With experienced people: New board [0.5]

- That creates value for customers: Strategic stockpiling, trendy flavours [0.5]

Treatt trades essential citrus oils and distils more complex flavours such as tea and coffee. It sources fruit from growers and oils from processors and purifies them into products with consistent flavour profiles, which it sells to flavour houses and beverage companies.

Some of the less flavoursome by-products of distillation are processed into citrus scents for cleaning products.

Traditionally a commodity trader, Treatt does not define itself as a flavour house. Over the years, though, it has sought to make itself more like some of its customers by working directly with beverage companies to invent new flavours.

In 2023, the company earned 23% of revenue from “premium products”.

The commissioning of a new state-of-the art factory and headquarters in its home town of Bury St Edmunds, Suffolk, was heralded as a generational investment intended to facilitate Treatt’s move up the value chain.

- Share Sleuth: it pained me to sell this winner that made 700%

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The new facilities are more efficiently laid out, highly automated, and can handle greater capacity, but perhaps even more importantly they contain modern laboratories and workspaces that make it easier for Treatt’s flavourists to collaborate with customers.

The investment spree was the culmination of a strategy driven by a settled board. In recent years, though, the company’s driving force, chief executive Daemonn Reeve, and the chair and chief financial officer he worked with, have left the business.

The success of the new facility is in the hands of chief executive since June 2024, David Shannon, and Ryan Govender, who has already had an eventful career at Treatt. He joined as chief financial officer a little over two years ago, stepped up for a brief stint as interim chief executive, and has now reverted to his earlier role along with an additional title, managing director for Europe.

David Shannon worked for many years in senior management roles at Croda, a large listed manufacturer of ingredients for a wide range of consumer products, including flavours.

The Future (directed) [2]

- Addressing challenges:Commodification, big customers [0.5]

- With coherent actions: Collaboration, innovation, diversification [0.5]

- That reward all stakeholders fairly: Employee-focused culture [1]

Reassuringly, given the money invested, Treatt’s new managers are continuing to build on the legacy left by the old team.

Their emphasis is on achieving the efficiencies of its new facilities, premium products, and the new markets Treatt has entered.

Premium products include premium citrus flavours, tea, vegetable flavours and ingredients that enhance the taste of low and no-sugar drinks. Treatt wants to win more business from fast-growing categories such as Ready to Drink Alcohol, iced tea and coffee, and sports and energy drinks.

Premium products are more profitable, but revenue growth can be unreliable as customers experiment with new beverages.

In 2021, tea briefly burst to the fore, only to subside the following year. In 2024 it was coffee’s turn to disappoint and tea once again shone with “multiple FMCG iced tea wins” in North America.

Since demand in the commodity trading part of the business is also susceptible to outside forces (fluctuating essential oil prices), Treatt’s strategy to reduce the impact of this volatility is to find more customers for its widening range of flavours.

- Wild’s Winter Portfolios 2024: riskier portfolio outperforms Wall Street

- Stockwatch: attractive yields and a possible upturn

Diversification also helps mitigate another risk faced by Treatt. Flavour houses and beverage companies are big businesses (think Coca-Cola HBC AG (LSE:CCH) and PepsiCo Inc (NASDAQ:PEP)). Treatt discloses that it earned 16% of revenue from its biggest customer in 2024, the only customer responsible for more than 10% of revenue.

The loss of a large customer’s business could have a big impact on Treatt, and its generous payment terms and high levels of stock probably reflect the need to keep them sweet.

One opportunity for growth and diversification is China, albeit at some risk. Treatt earns 8% of total revenue in China, compared to 30% of revenue in Europe and 38% of revenue in North America.

It established a trading office in China three years ago, and it is preparing to build a Commercial and Innovation Centre in Shanghai, which it sees as the cornerstone of expansion in the Asia-Pacific region.

The first reason David Shannon gives for taking the top job in the annual report is Treatt’s “family feel”, which is reassuring because it suggests the company’s focus on motivating and rewarding employees, a hallmark of the business, is undiminished.

Treatt wants employees to be shareholders. It gives free shares to all employees with more than a year’s service, and operates bonus and share save schemes for employees that want more shares on favourable terms.

It is an accredited living wage employer and reports high levels of employee engagement and falling voluntary employee turnover after the disruption of recent years.

The price (discounted?) [0.7]

- Yes. A share price of 463p values the enterprise at about £284 million, 15 times normalised profit.

A score of 6.7 implies Treatt is fairly valued (previously 7.2). It is a decent business that needs to get even better if it is to justify the heavy investments of the last five years.

It is ranked 27 out of 40 shares in my Decision Engine (19th last week).

23 Shares for the future

Here is the ranked list of Decision Engine shares. I review the scores at least once a year, soon after each company has published its annual report. The price scores are calculated using the share price prior to publication.

Generally, I consider shares that score 7 or more out of 10 to be good value. Shares that score 5 or 6 out of 10 are probably fairly priced.

Dewhurst Group (LSE:DWHT), Hollywood Bowl Group (LSE:BOWL), Renewi (LSE:RWI) and Victrex (LSE:VCT) have all published annual reports and are due to be re-scored.

0 | Company | * | Description | Score |

1 | Manufactures tableware for restaurants and eateries | 10.0 | ||

2 | Imports and distributes timber and timber products | 9.0 | ||

3 | Supplies kitchens to small builders | 9.0 | ||

4 | Makes light fittings for commercial and public buildings, roads, and tunnels | 8.6 | ||

5 | Manufactures pushbuttons and other components for lifts and ATMs | 8.5 | ||

6 | Distributor of protective packaging | 8.4 | ||

7 | Manufactures computers, battery packs, radios. Distributes components | 8.3 | ||

8 | Designs recording equipment, loudspeakers, and instruments for musicians | 8.0 | ||

9 | Manufacturer of scientific equipment for industry and academia | 7.9 | ||

10 | Flies holidaymakers to Europe, sells package holidays | 7.8 | ||

11 | Manufactures surgical adhesives, sutures, fixation devices and dressings | 7.7 | ||

12 | Sells hardware and software to businesses and the public sector | 7.6 | ||

13 | Manufactures/retails Warhammer models, licences stories/characters | 7.5 | ||

14 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.5 | ||

15 | Distributes essential everyday items consumed by organisations | 7.5 | ||

16 | Whiz bang manufacturer of automated machine tools and robots | 7.5 | ||

17 | Manufactures filters and filtration systems for fluids and molten metals | 7.4 | ||

18 | Sells promotional materials like branded mugs and tee shirts direct | 7.3 | ||

19 | Manufactures vinyl flooring for commercial and public spaces | 7.2 | ||

20 | Repair and maintenance of rail, road, water, nuclear infrastructure | 7.1 | ||

21 | Online marketplace for motor vehicles | 7.0 | ||

22 | Translates documents and localises software and content for businesses | 7.0 | ||

23 | Operates tenpin bowling and indoor crazy golf centres | 7.0 | ||

24 | Manufactures natural animal feed additives | 6.9 | ||

25 | Surveys and distributes public opinion online | 6.9 | ||

26 | Online retailer of domestic appliances and TVs | 6.8 | ||

27 | Treatt | Sources, processes and develops flavours esp. for soft drinks | 6.7 | |

28 | Supplies vehicle tracking systems to small fleets and insurers | 6.6 | ||

29 | Retails clothes and homewares | 6.3 | ||

30 | Acquires and operates small scientific instrument manufacturers | 6.3 | ||

31 | Manufactures military technology, does research and consultancy | 6.0 | ||

32 | Publishes books, and digital collections for academics and professionals | 5.9 | ||

33 | Casts and machines steel. Processes minerals for casting jewellery, tyres | 5.7 | ||

34 | Manufactures sports watches and instrumentation | 5.5 | ||

35 | Manufactures power adapters for industrial and healthcare equipment | 5.5 | ||

36 | Manufactures disinfectants for simple medical instruments and surfaces | 5.2 | ||

37 | Makes marketing and fraud prevention software, sells it as a service | 5.0 | ||

38 | Runs a network of self-employed lawyers | 4.7 | ||

39 | Develops and manufactures hygiene, baby, and beauty brands | 4.5 | ||

40 | Manufactures specialist paper, packaging and high-tech materials | 3.8 |

Scores and stats: Richard Beddard. Data: SharePad and annual reports

Click on a share's name to see a breakdown of the score (scores may have changed due to movements in share price)

Shares marked with an asterisk (*) have been re-scored, click the asterisk to find out why.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns Treatt and many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.