Share Sleuth: why this share keeps its place in the portfolio

7th December 2022 09:14

by Richard Beddard from interactive investor

Richard Beddard is short of cash, so cannot add more shares in a company he wants to buy. As he looks to raise readies, he weighs up selling a company that’s changing strategy.

In the last Share Sleuth portfolio update in early November, I made a rookie error.

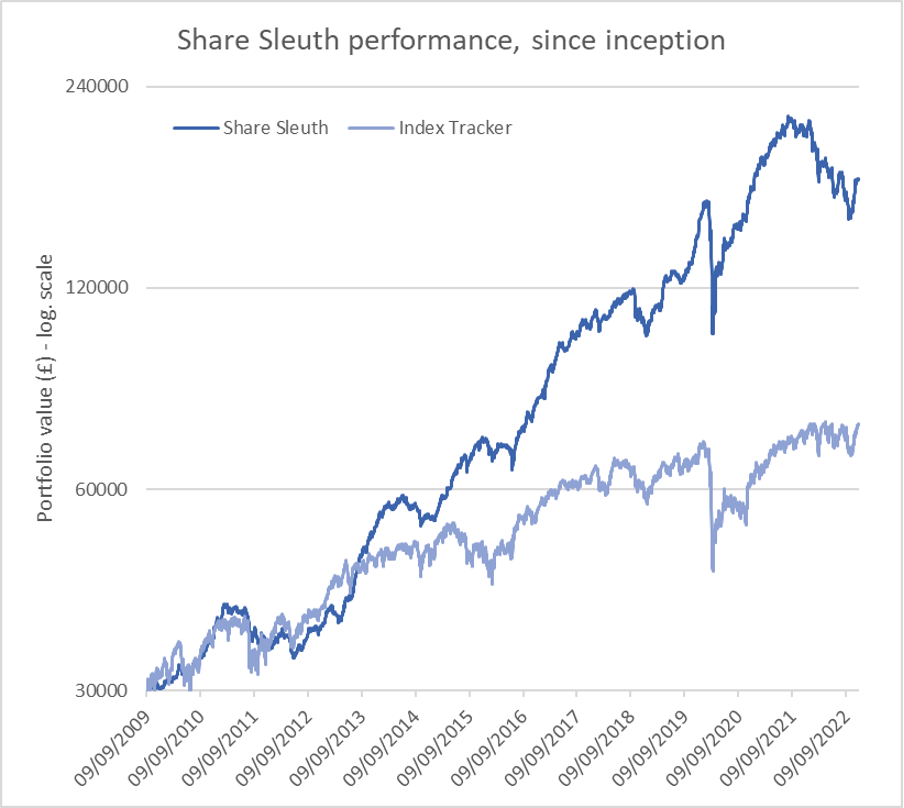

The Share Sleuth portfolio is a model portfolio started with an imaginary £30,000 over 13 years ago, and to keep the measurement of its performance simple I do not add new pretend money to it.

This means additions can only be financed with cash from notional dividends paid by the constituents of the portfolio or from cash liberated when I reduce or liquidate a holding.

- Find out about: Transferring a Stocks & Shares ISA | Share prices today | Top UK shares

Last month, there was not enough money in the pot to fund a purchase, yet I wasted the time I allocate to thinking about trades each month deciding that I would like to add more shares in Focusrite (LSE:TUNE). The firm makes recording equipment, loudspeakers, and instruments such as synthesisers and grooveboxes for making electronic music.

It seems ridiculous now, especially as Focusrite shares have risen nearly 30%, and with that rise, some of my enthusiasm for adding more shares has waned.

A new policy should encourage me to do things in the right order. From now on, if the portfolio does not have enough money to finance a new purchase, I will make sure I re-evaluate its holdings until I find one I want to reduce or liquidate.

First holding on the block is D4t4 Solutions (LSE:D4T4).

Should D4t4 go?

My lack of confidence in D4t4 stems in part from my ignorance about the software industry, and in part from changes within the industry.

D4t4 still is a data consultancy that knits together and resells third -party software and hardware.

Not too many years ago, though, it acquired Celebrus, a Customer Data Platform (CDP). Selling this software, derivations of it, and related cloud-based hosting has become its strategic focus.

Celebrus’ CDP does something D4t4’s chief executive Bill Bruno says is unusual in the CDP world, it collects information about customers as they interact with commercial websites and apps.

It does this in a unique way, capturing first-party information about customers as they navigate websites and apps, rather than relying on third-party cookies.

This gives it a big advantage as sharing personal information in cookies is ever more tightly regulated by laws and by the policies of companies such as Apple Inc (NASDAQ:AAPL) and Google.

Like all CDP’s, Celebrus also marshals information from a company’s disparate software systems so that it can personalise websites and apps, and target us with email campaigns.

From Celebrus CDP, D4t4 developed Celebrus FDP (Fraud Data Platform), which like CDP captures and marshals customer data, but with the intention of detecting fraud.

One of its customers is online retailer Very, which, among other things, uses Celebrus CDP to trigger an email if we put things in our shopping baskets but fail to check them out.

- Shares for the future: downgrades shrink my list of favourite shares

- Share Sleuth: two cheap shares on my radar, but there’s a problem

- Richard Beddard: gettin’ on down, movin’ on up

It also uses Celebrus FDP to detect bots, fake shoppers that distort the data it provides its marketing teams.

Historically, D4t4 has marketed itself through partners, themselves larger software ecosystems that incorporate Celebrus as an option.

Although partners have won D4t4 many profitable sales, it says it can be very inefficient. There has been too much toing and froing between D4t4 and the partner, the company says, and maybe not enough between partner and end-customer.

Now it is taking the lead by approaching customers directly, which has required a reorientation of D4t4’s sales and partnership teams.

The sales team is focusing on selling particular “use cases” instead of the whole platform, as it tries to break down customers’ doors. When they experience the product, D4t4 expects them to find other uses for it, as Very has.

Since Celebrus can connect so many systems, a decision to adopt the platform used to involve many decision makers, which makes selling the platform difficult. Even when D4T4 succeeded, the process typically took more than a year.

Now the company has adopted an initially less ambitious sales approach, it says it has reduced the sales cycle down to six to eight months.

One way to reduce it further is to integrate Celebrus more tightly into platforms, so it works out of the box. A recent integration with Salesforce, the Customer Relationship Management (CRM) giant, may reduce the time it takes to make a sale to weeks.

D4t4 believes it is selling a unique product in an almost limitless market, if only the market knew about it. And it is finding more ways to tell them.

One possibility, mooted in a recent presentation to investors, is to advertise on billboards opposite the offices of prospective customers.

I like D4t4’s focus on its own intellectual property, and selling direct, but change is unsettling.

Normally when a company changes strategy, I would look at its financial performance for reassurance that things are working out, but D4t4 has also changed the terms under which it sells software and services.

- Is this the top investment idea for 2023?

- Investment forecast for 2023: hot sectors, income and growth

Like many software companies, instead of collecting all the money up front through perpetual licences like it used to, it contracts for annual payments, sacrificing money now for regular streams of it in the future.

This transition has depressed revenue and profit in recent years, although perhaps the worm is turning. D4T4 believes it should make at least £4.2 million adjusted pre-tax profit in the year to March 2023, an increase of 27% over 2022.

It seems to me that life for small software companies is precarious. They live with the danger that the capability they provide could be replicated by a rival or developed as a feature by one of the platforms they facilitate.

That said, D4t4 appears to have a good patent protected product, and it is shouting about it in an intelligent way.

The rewards could be high, but the risks mean D4t4 is ranked relatively lowly by my Decision Engine, and the portfolio’s holding is correspondingly small. It is 2.1% of the portfolio’s total value.

I think that is appropriate, and I am not inclined to liquidate D4t4.

Santa rally

It is not just Focusrite that has enjoyed a recovery in its share price. The portfolio has rallied since I last updated you in early November.

Past performance is not a guide to future performance.

At the close on Monday 5 December, the Share Sleuth portfolio was worth £174,808, 483% more than the £30,000 of pretend money I started with in September 2009.

In comparison, the same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £74,886, an increase of 150%.

After dividends paid by Anpario (LSE:ANP), Bloomsbury Publishing (LSE:BMY), Thorpe (F W) (LSE:TFW), Games Workshop Group (LSE:GAW), Howden Joinery Group (LSE:HWDN), PZ Cussons (LSE:PZC) and Renishaw (LSE:RSW), the cash balance is £2,833.

That is insufficient to fund a purchase at my minimum trade size of 2.5% of the portfolio’s total value (about £4,400).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 2,833 | ||||

Shares | 171,975 | ||||

Since 9 September 2009 | 30,000 | 174,808 | 483 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 5,541 | 37 |

BMY | Bloomsbury | 1,681 | 5,915 | 8,111 | 37 |

BNZL | Bunzl | 201 | 4,714 | 6,072 | 29 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,472 | -4 |

CHH | Churchill China | 682 | 8,013 | 8,082 | 1 |

CHRT | Cohort | 1,600 | 3,747 | 6,624 | 77 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,675 | 5 |

DWHT | Dewhurst | 532 | 1,754 | 6,118 | 249 |

FOUR | 4Imprint | 190 | 3,688 | 8,066 | 119 |

GAW | Games Workshop | 148 | 4,709 | 11,048 | 135 |

GDWN | Goodwin | 266 | 6,646 | 8,485 | 28 |

GRMN | Garmin | 53 | 4,413 | 4,102 | -7 |

HWDN | Howden Joinery | 2,020 | 12,718 | 12,096 | -5 |

JDG | Judges Scientific | 85 | 2,082 | 6,851 | 229 |

JET2 | Jet2 | 456 | 250 | 4,640 | 1,756 |

LTHM | James Latham | 750 | 9,235 | 9,375 | 2 |

NXT | Next | 106 | 6,071 | 6,205 | 2 |

PRV | Porvair | 906 | 4,999 | 4,901 | -2 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,955 | 2 |

QTX | Quartix | 1,085 | 2,798 | 3,309 | 18 |

RSW | Renishaw | 92 | 1,739 | 3,529 | 103 |

RWS | RWS | 1,000 | 4,696 | 3,452 | -26 |

SOLI | Solid State | 356 | 1,028 | 4,681 | 355 |

TET | Treatt | 763 | 1,082 | 5,074 | 369 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 8,390 | 280 |

TSTL | Tristel | 750 | 268 | 2,700 | 906 |

TUNE | Focusrite | 400 | 4,530 | 3,320 | -27 |

VCT | Victrex | 292 | 6,432 | 5,203 | -19 |

XPP | XP Power | 240 | 4,589 | 4,896 | 7 |

Table notes: | |||||

November: No new trades | |||||

Costs include £10 broker fee, and 0.5% stamp duty where appropriate | |||||

Cash earns no interest | |||||

Dividends and sale proceeds are credited to the cash balance | |||||

£30,000 invested on 9 September 2009 would be worth £174,808 today | |||||

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £74,886 today | |||||

Objective: To beat the index tracker handsomely over five-year periods | |||||

Source: SharePad, 5 December 2022 | |||||

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.