Share Sleuth: why I’ve trimmed one of my best performers

10th July 2023 10:06

by Richard Beddard from interactive investor

The portfolio’s cash pile is now more than sufficient to fund additions after taking some profits from a soaring share price that’s been a gift that keeps on giving.

For the second month running I have had an investment decision foisted on me.

To tender or not to tender part two

Last month, I declined Goodwin (LSE:GDWN)’s offer to buy some of the portfolio’s shares at a premium, and this month I declined Anpario (LSE:ANP)’s.

Tender offers are a form of fixed price share buyback. They reward shareholders who do not tender their shares by reducing the share count and increasing the proportion of the company’s profits they are entitled to.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

I was reluctant to tender the portfolio’s shares because, at the tender offer price, Anpario scores 7 out of 9, which is to my mind good value. A company scoring 7 should ideally be 5% of the portfolio’s total value according to the formula I use (described in the link at the end of this article) but Anpario is only 1.4% of the portfolio.

At the tender offer price I am a potential buyer, not a potential seller.

I fleetingly considered tendering the shares in the hope of buying them back at a cheaper price, but it was not worth it.

By Tuesday 14 June, the day I set aside for trading decisions in June when I could still have accepted Anpario’s tender offer, the shares had gone up to 223p, just 2p short of the 225p offer.

Possibly, the portfolio could have made a few quid. Share Sleuth has 1,124 Anpario shares so the price I could have got at the tender would have netted me £22.48 (2p a share) if I had bought the shares back at that price (excluding broker fees).

On top of the uncertain and probably meagre payoff, there is another source of uncertainty. The company would only buy back all my shares if the tender offer is vastly under-subscribed. Otherwise, it will only buy a proportion of them.

Trading options in June

While Anpario is one of the shares I could add this month, there are four names that I covet more because they are more highly ranked than Anpario and they fulfil the other conditions allowing me to trade, which are that I have not traded them in the last year and they published their annual reports less than six months ago so I have scored them relatively recently.

The four potential additions are: Quartix Technologies (LSE:QTX) (sells vehicle tracking systems), Porvair (LSE:PRV) (manufactures filters and laboratory equipment), Macfarlane Group (LSE:MACF) (manufactures and distributes protective packaging), and Dewhurst Group (LSE:DWHT) (manufactures and distributes lift components).

- Shares for the future: five factors I use to score shares

- Richard Beddard: this cash-rich company could be very good value

Of the four, Macfarlane is the most likely addition because it is not currently a Share Sleuth constituent, but having added more RWS Holdings (LSE:RWS) shares to the portfolio in May I am in the mood to reduce the portfolio’s holding in Judges Scientific (LSE:JDG) instead.

I deferred this trade from May, because I prefer not to trade more than once a month.

Reducing Judges Scientific

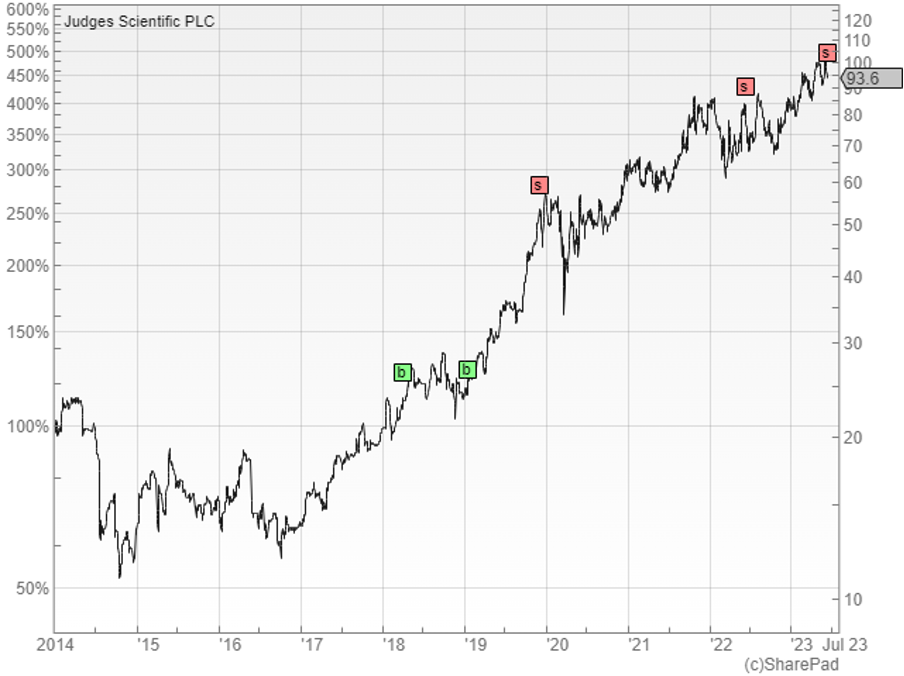

Judges Scientific scores 5. The biggest blemish in the investment case is its share price, which at 43 times normalised profit is very high. That reflects traders’ confidence in the company, which is a serial acquirer of companies that manufacture scientific instruments.

Judges has been one of the portfolio’s best performers since I added the shares in 2018, and it has done nothing recently, bar making a bigger acquisition than normal, to shake my faith in it.

The relentless rise of the share price, and my slight misgivings about the size and complexity of the acquisition though, mean the holding is too big for its score of 5 and so, on 15 June, I trimmed it by 51 shares to just 34.

The trade increased the portfolio’s cash balance by £4,708 after deducting £10 in lieu of costs. That leaves just 2% of Share Sleuth invested in Judges, which like Games Workshop (LSE:GAW), has been a gift that keeps on giving.

Source SharePad: ‘b’ stands for ‘buy’ and ‘s’ stands for ‘sell’, though SharePad is a model portfolio so these were simulated trades.

You might well ask why I did not run my winner?

Each time I increased or reduced the size of the portfolio’s Judges holding, I did not think about what would happen to the share price subsequently. I made a decision based on whether I thought the shares were good value using my scores as a proxy, and based on how large the holding was, using the scores to determine how big the holding should be.

Trader aphorisms like cut your losers and run your winners sound clever but they are tools from the wrong box because they switch our attention from the valuation of the business to the direction of the share price.

The share price is the product of the decisions of all traders, so instead of using our own judgement to make the decisions by scoring shares, we would be following the herd.

Share Sleuth performance

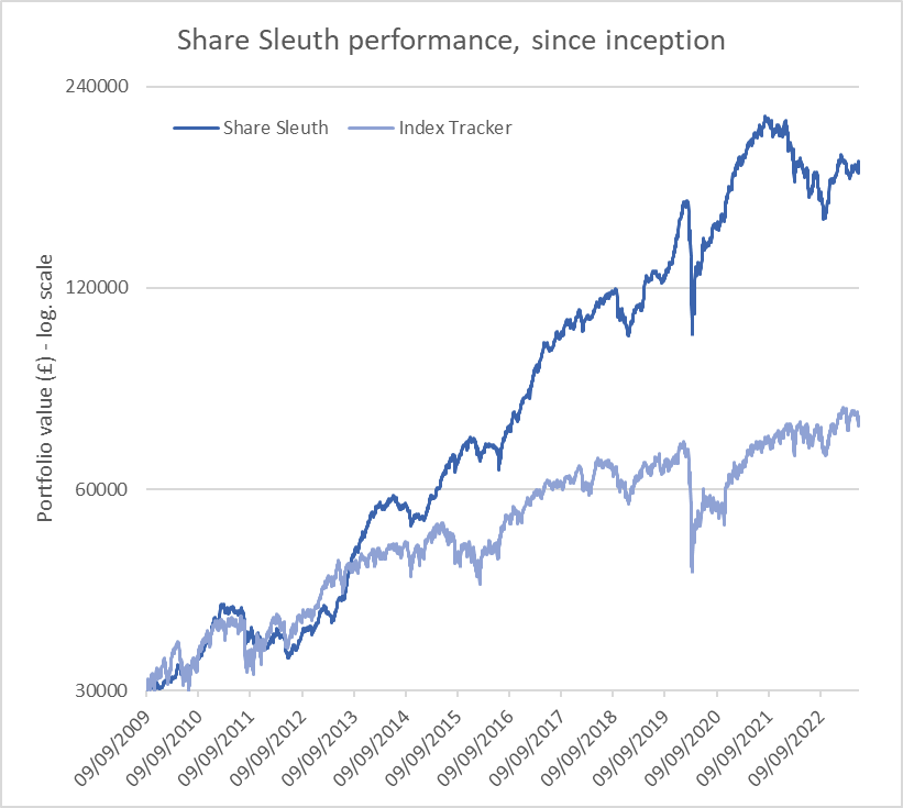

At the close on Friday 30 June, Share Sleuth was worth £177,975, 493% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £75,562, an increase of 152%.

After the liquidation of part of the portfolio’s Judges Scientific holding and dividends paid during the month from Churchill China (LSE:CHH), Focusrite (LSE:TUNE), Garmin Ltd (NYSE:GRMN), Porvair, and Victrex (LSE:VCT), Share Sleuth’s cash pile is £9,709, more than sufficient to fund additions.

The minimum trade size, 2.5% of the portfolio’s value, is £4,450.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 9,709 | ||||

Shares | 168,266 | ||||

Since 9 September 2009 | 30,000 | 177,975 | 493 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,304 | -43 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,178 | 21 |

BNZL | Bunzl | 201 | 4,714 | 5,952 | 26 |

CHH | Churchill China | 682 | 8,013 | 9,105 | 14 |

CHRT | Cohort | 1,600 | 3,747 | 7,600 | 103 |

D4T4 | D4t4 | 1,528 | 3,509 | 2,559 | -27 |

DWHT | Dewhurst | 532 | 1,754 | 5,613 | 220 |

FOUR | 4Imprint | 190 | 3,688 | 8,997 | 144 |

GAW | Games Workshop | 100 | 4,571 | 10,800 | 136 |

GDWN | Goodwin | 266 | 6,646 | 11,358 | 71 |

GRMN | Garmin | 53 | 4,413 | 4,362 | -1 |

HWDN | Howden Joinery | 2,020 | 12,718 | 12,908 | 1 |

JDG | Judges Scientific | 34 | 833 | 3,148 | 278 |

JET2 | Jet2 | 456 | 250 | 5,682 | 2,173 |

LTHM | James Latham | 750 | 9,235 | 9,188 | -1 |

NXT | Next | 106 | 6,071 | 7,221 | 19 |

PRV | Porvair | 906 | 4,999 | 6,106 | 22 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,026 | -22 |

QTX | Quartix | 1,085 | 2,798 | 2,658 | -5 |

RSW | Renishaw | 92 | 1,739 | 3,570 | 105 |

RWS | RWS | 2,790 | 9,199 | 6,584 | -28 |

SOLI | Solid State | 356 | 1,028 | 4,236 | 312 |

TET | Treatt | 763 | 1,082 | 4,547 | 320 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,480 | 239 |

TSTL | Tristel | 750 | 268 | 2,681 | 899 |

TUNE | Focusrite | 1,050 | 9,123 | 4,568 | -50 |

VCT | Victrex | 292 | 6,432 | 3,989 | -38 |

XPP | XP Power | 240 | 4,589 | 4,848 | 6 |

Notes

June: Reduced holding in Judges Scientific

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £177,975 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £75,562 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 3 July 2023.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all of the shares in the Share Sleuth portfolio.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.