Share Sleuth: taking some profits in Games Workshop

4th May 2023 09:21

by Richard Beddard from interactive investor

Usually, Richard Beddard sleeps on trading decisions but this time, there was no need for him to do so. He explains why.

Despite dividends from PZ Cussons (LSE:PZC), Renishaw (LSE:RSW) and Tristel (LSE:TSTL) in the first week and a half of April, there was insufficient cash in the Share Sleuth portfolio to add to any holdings or create a new one when I sat down on the morning of the 11th to trade.

To keep things meaningful, I trade chunks of 2.5% of the portfolio’s total value, which would have required around £4,400. The portfolio’s cash balance was a little over £1,000 shy.

- Invest with ii: Top UK Shares | How to Start Trading Stocks | Open a Trading Account

Although my Decision Engine was nudging me to make many potential additions, my attention inevitably turned to disposals, of which there was only one on offer, a slightly unusual case.

Reducing Games Workshop

I first added Games Workshop Group (LSE:GAW) to the Share Sleuth portfolio on 9 September 2009, the day the portfolio was born. It is, along with Dewhurst Group (LSE:DWHT), one of two survivors out of six notional investments I made that day.

Since then, I have traded Games Workshop five times, including the trade I am reporting today, a record that is in danger of tarnishing my reputation as a long-term investor.

That is especially true considering it is only 10 months since I added to the portfolio’s Games Workshop holding in June last year. Normally I will not trade a share if I have traded it in the prior year.

The 51% increase in the share price since last June pales in comparison to the gains that precipitated earlier nibbles into the portfolio’s Games Workshop holding.

They came after share price gains of 703%, 2,380%, and 3,230% from that first trade.

Source: Sharepad. “b” indicates buy and “s” indicates sell. I call them additions and disposals or reductions because no actual money changed hands. Share Sleuth is a model portfolio.

So be it.

None of these reductions in holding size came about because I had lost confidence in Games Workshop. The size of the portfolio’s Games Workshop holding had simply grown too big - larger than its ideal size as determined by the share’s score.

Each time I only sold enough shares to trim the holding to its ideal size.

Inevitably this means I am trading, but the portfolio has also been fully invested in Games Workshop for nearly 14 years. It remains so, here is the calculation:

On the day of the trade, Games Workshop scored 7 out of 9, sufficient to justify adding more shares if the portfolio did not already own so many. It scored -1 for price and +8, the maximum, for profitability, risks, strategy and fairness.

- Shares for the future: how I would set up a new portfolio step by step

- Richard Beddard: these shares are good value after triple hit to results

- 10 small-cap growth shares at cheap prices

The formula that determines how much I trade is described in the links at the end of this article. A score of 7 meant Games Workshop’s ideal holding size was £9,065, just over 5% of the portfolio’s total value. The holding was actually worth £13,831, 7.8% of its total value.

The minimum I will trade is 2.5% of the portfolio’s total value, £4,400 or so. To return the holding to its ideal size I could have reduced it by a little bit more (£4,750).

There was no question of reducing the holding below its ideal size, given the share’s high score and the fact that I have learned nothing to dent the case for investing in Games Workshop for the long term, which I last revisited in September.

Normally I sleep on trading decisions but this time, there was no need. Trades to keep holdings at a reasonable size are uncontroversial and pretty much automatic.

I reduced the portfolio’s Games Workshop holding from 148 shares to 100. The share price, quoted by a broker, was a fraction under £94.07. After deducting £10.00 in lieu of fees, the trade added £4,505 to the portfolio’s cash balance.

Next month my attention will return to adding to a holding, or creating a new one. Perennial bridesmaid Auto Trader Group (LSE:AUTO) is the most likely new candidate. With a score of 7 and a rank of 13 it is the only share that is not already a member of the Share Sleuth portfolio in the buy zone.

There is a long list of current holdings that could be augmented. The top three eligible shares ranked by my Decision Engine are: Porvair (LSE:PRV) (score 8, rank 3), which makes industrial filters and laboratory equipment, lift component supplier Dewhurst (score 8, rank 4), and RWS Holdings (LSE:RWS), which does translation (score 8, rank 5).

Other highly ranked shares are ineligible, either because I have recently traded them (Focusrite, score 8, rank 1) or the holding is already close to its ideal size (Howden Joinery, score 8, rank 2).

Share Sleuth performance

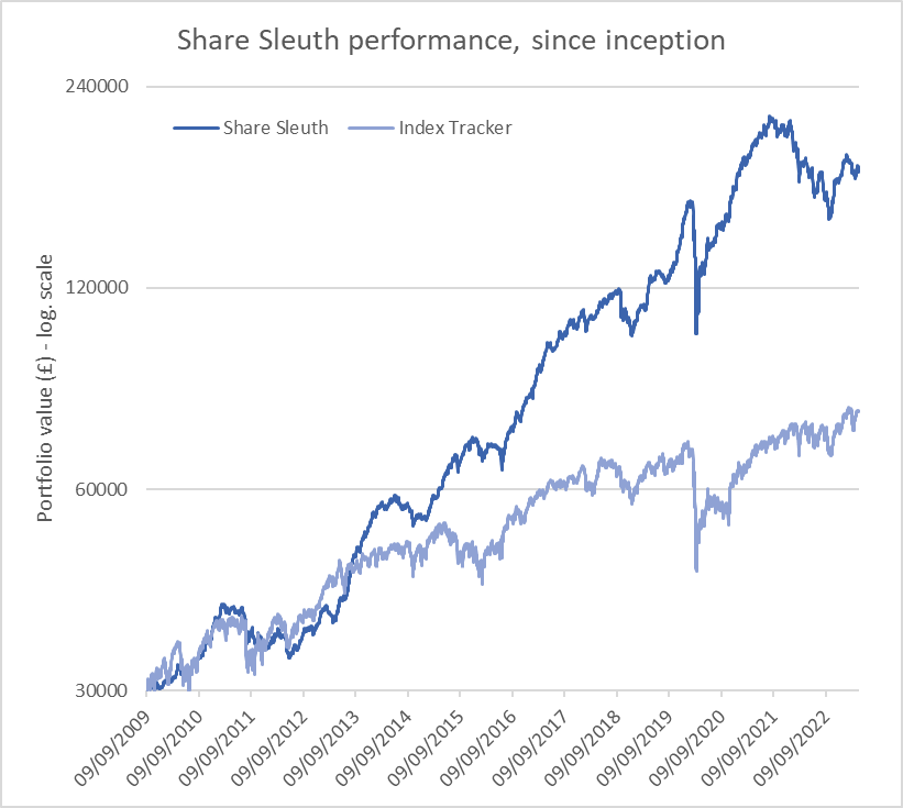

At the close on Friday 28 April 2023, Share Sleuth was worth £179,126, 497% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £78,425, an increase of 161%.

After the liquidation of 48 Games Workshop shares and dividends paid during the month from Thorpe (F W) (LSE:TFW), Goodwin (LSE:GDWN), PZ Cussons, Quartix Technologies (LSE:QTX), Renishaw, Tristel and XP Power (LSE:XPP), Share Sleuth’s cash pile is £8,234, more than sufficient to fund additions.

The minimum trade size, 2.5% of the portfolio’s value, is £4,480.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 8,234 | ||||

Shares | 170,892 | ||||

Since 9 September 2009 | 30,000 | 179,126 | 497 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,866 | -29 |

BMY | Bloomsbury | 1,681 | 5,915 | 7,539 | 27 |

BNZL | Bunzl | 201 | 4,714 | 6,360 | 35 |

CHH | Churchill China | 682 | 8,013 | 9,514 | 19 |

CHRT | Cohort | 1,600 | 3,747 | 6,960 | 86 |

D4T4 | D4t4 | 1,528 | 3,509 | 3,094 | -12 |

DWHT | Dewhurst | 532 | 1,754 | 5,719 | 226 |

FOUR | 4Imprint | 190 | 3,688 | 8,569 | 132 |

GAW | Games Workshop | 100 | 4,571 | 9,920 | 117 |

GDWN | Goodwin | 266 | 6,646 | 10,321 | 55 |

GRMN | Garmin | 53 | 4,413 | 4,169 | -6 |

HWDN | Howden Joinery | 2,020 | 12,718 | 13,829 | 9 |

JDG | Judges Scientific | 85 | 2,082 | 8,449 | 306 |

JET2 | Jet2 | 456 | 250 | 5,591 | 2,136 |

LTHM | James Latham | 750 | 9,235 | 9,413 | 2 |

NXT | Next | 106 | 6,071 | 7,144 | 18 |

PRV | Porvair | 906 | 4,999 | 5,617 | 12 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,749 | -3 |

QTX | Quartix | 1,085 | 2,798 | 2,550 | -9 |

RSW | Renishaw | 92 | 1,739 | 3,316 | 91 |

RWS | RWS | 1,000 | 4,696 | 2,548 | -46 |

SOLI | Solid State | 356 | 1,028 | 4,023 | 291 |

TET | Treatt | 763 | 1,082 | 5,089 | 370 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,100 | 222 |

TSTL | Tristel | 750 | 268 | 2,456 | 816 |

TUNE | Focusrite | 1,050 | 9,123 | 4,778 | -48 |

VCT | Victrex | 292 | 6,432 | 4,894 | -24 |

XPP | XP Power | 240 | 4,589 | 5,316 | 16 |

Notes | |||||

April: Reduced holding in Games Workshop | |||||

Costs include £10 broker fee, and 0.5% stamp duty where appropriate | |||||

Cash earns no interest | |||||

Dividends and sale proceeds are credited to the cash balance | |||||

£30,000 invested on 9 September 2009 would be worth £179,126 today | |||||

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £78,425 today | |||||

Objective: To beat the index tracker handsomely over five-year periods | |||||

Source: SharePad, 28 April 2023 | |||||

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Games Workshop.

More information about Richard’s investment philosophy and how he implements it.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.