Share Sleuth: taking profits from one holding and adding to another

Richard Beddard explains his two latest trades ensure that he is maintaining a diversified portfolio.

3rd June 2021 10:10

by Richard Beddard from interactive investor

Richard Beddard explains his two latest trades ensure that he is maintaining a diversified portfolio.

On Friday 7 May, I reduced the Share Sleuth portfolio’s holding in Solid State (LSE:SOLI) of 1,546 shares by 560. At a share price of £8.90, the actual price quoted by a broker, the transaction raised £4,974 after deducting £10.00 in lieu of fees.

Selling Solid State

Solid State is a manufacturer of rugged computers, communications equipment and batteries. It also distributes electronic components.

My record trading Solid State looks uncharacteristically short-termist.

One of the early additions to the portfolio in 2009, and one of its early successes, I liquidated the entire holding in 2011.

As you can see from the chart, Solid State did very well while I did not own it, between 2012 and 2016 and that experience is one of the reasons I do not completely liquidate holdings in businesses I admire these days even if they are trading on highish profit multiples.

The opportunity to add Solid State back to the portfolio again came in 2016 after the Ministry of Justice cancelled a large contract with a consortium including Solid State before it had even profited from it.

- Richard Beddard: pandemic results feed into Decision Engine

- Share Sleuth: the share I passed up on in 2009, but have now bought

Solid State was part of a consortium contracted to supply bespoke electronic tags used to monitor criminals, but the Ministry of Justice changed its mind and went for an off-the-shelf solution. The rest of the business was in good shape, Solid State received compensation, and I thought the market had overreacted.

In 2019 and last month, I reduced the portfolio’s holding rather than selling all the shares. On both occasions, the portfolio’s holding in Solid State had grown substantially beyond the ideal size as determined by the share’s score.

I last reviewed Solid State in July last year.

The formula that determines the ideal size allocates funds as follows:

Score | % of total value of portfolio |

9 | 10 |

8 | 8 |

7 | 6 |

6 | 4 |

5 | 2 |

below 5 | 0 |

I took profit from a holding in a good business that had realised some of its potential so I could invest in another good business that had more, by my estimation, potential.

This is my way of keeping the portfolio diversified.

Some people uncharitably call this strategy “cutting the flowers and watering the weeds”, but I prefer to think it is “cutting some flowers that are actually flowering, and watering others that might produce more flowers in future”.

I concede my version of the epithet does not trip off the tongue quite so easily, but I find it impossibly tricky to determine which of my favourite shares will do best in relation to current expectations.

Rather than take the risk I might pick the wrong ones, I prefer to own a good spread of decent businesses in the expectation that most of them will perform well and a few will exceed my expectations by a long way.

By using my scores to tilt the portfolio towards high scoring shares I am maintaining a diversified portfolio by reallocating money from those that appear to be highly valued in the market to those that may be under appreciated.

- Richard Beddard: the UK’s Amazon is already in the FTSE 100

- Discover how to be a better investor here

Such is my admiration for Solid State, I reduced the holding by about 2.5% of the portfolio’s total value, which is the minimum size I will trade. Anything less would just be tinkering.

Immediately after the transaction the remaining holding of 986 shares was worth 4.4% of the portfolio. Since its score is 6, it remains slightly above its ideal size of 4%.

I would not have traded Solid State at all if I had not had another flower I wanted to water: Howden Joinery (LSE:HWDN).

Buying Howdens

We published my annual review of fitted kitchen supplier Howdens last month so I will not repeat it except to comment that in last month’s Share Sleuth update I revealed a preference for companies rolling out successful products or services over companies successfully acquiring other businesses.

It is, therefore, satisfying that my first trades since then swapped shares in an acquirer for a company that has grown entirely organically.

When I reviewed Howdens, I gave it a score of eight out of nine, which means it is one of the Decision Engine’s highest ranked shares. I am a big fan of its single minded approach to selling fitted kitchens to small builders.

With a score of 8, it deserved a handsome portfolio allocation (8%, as per the table above).

Yet before the trade, the portfolio’s holding in Howdens was worth only 3% of its total value.

Immediately after liberating nearly £5,000 in cash from Solid State, I added 620 shares in Howdens at a price of almost exactly £8.00. After deducting £10.00 in lieu of broker fees and nearly £25.00 in lieu of stamp duty, the total cost was just over £4,995.

This is the second time I have added shares in Howdens. Because the returns from the portfolio’s investment in the share have been similar to the returns from the portfolio in general, its value compared to the portfolio’s total value has not changed much, and I have never had cause to reduce the size of the holding.

Currently it is worth 5.5% of Share Sleuth’s total value. Technically, I could invest in Howdens one more time without breaching the ideal portfolio size.

However, a rule designed to prevent me getting carried away restricts me from trading the share again for another year.

- Seven ‘buy and forget’ shares for investors with time on their side

- Check out our award-winning stocks and shares ISA

Whether the trade is on then depends on a number of factors: how well the portfolio has done, how well Howdens has done, and whether I have reappraised Howdens as an investment in the interim.

You may well wonder why I have codified so many of my trading decisions. The answer is that the more time I spend thinking about trading, the less time I have for research, and that is where I think I can add the most value.

Share Sleuth performance

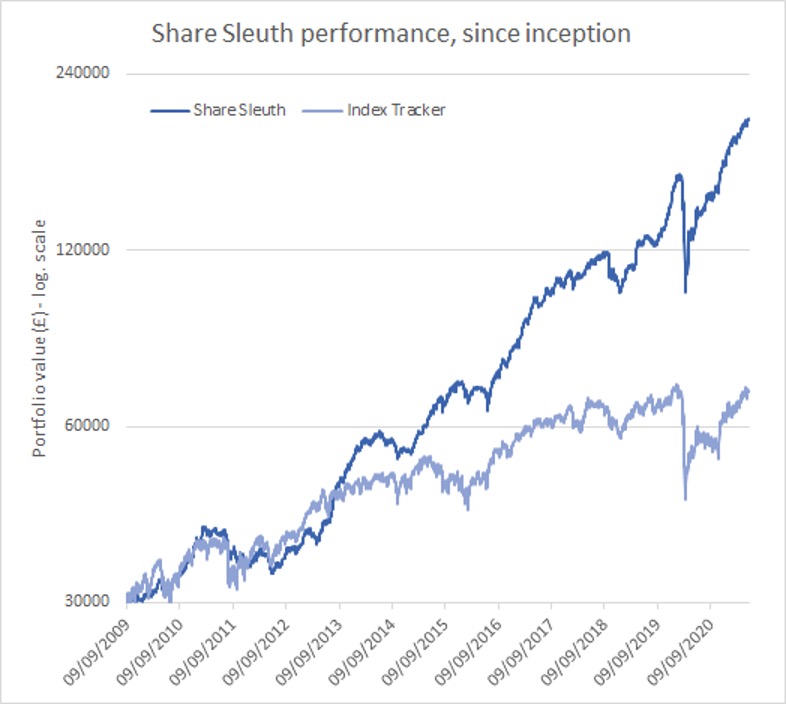

At last Friday’s close (immediately before the bank holiday), the Share Sleuth portfolio was valued at £201,445, 571% more than the notional £30,000 invested over the course of its first year starting in September 2009.

In comparison, the same amount invested in accumulation units of a FTSE All-Share Index tracking fund would be worth £68,929, a return of 130%.

The cash balance of £1,544 is worth less than 2.5% of the portfolio’s total value, so I will need to reduce or eliminate a holding to fund new purchases or wait until dividends accrue to a cash balance of just over £5,000, my minimum trade size.

| Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

|---|---|---|---|---|---|

| Cash | 1,554 | ||||

| Shares | 199,891 | ||||

| Since 9 September 2009 | 30,000 | 201,445 | 571 | ||

| Companies | Shares | Cost (£) | Value (£) | Return (%) | |

| ANP | Anpario | 1,874 | 6,593 | 10,588 | 61 |

| BMY | Bloomsbury | 1,295 | 3,274 | 4,066 | 24 |

| BNZL | Bunzl | 201 | 4,714 | 4,525 | -4 |

| BOWL | Hollywood Bowl | 1,615 | 3,628 | 4,038 | 11 |

| CHH | Churchill China | 341 | 3,751 | 5,797 | 55 |

| CHRT | Cohort | 1,600 | 3,747 | 9,920 | 165 |

| D4T4 | D4t4 | 1,528 | 3,509 | 5,287 | 51 |

| DWHT | Dewhurst | 735 | 2,244 | 15,362 | 585 |

| FOUR | 4Imprint | 190 | 3,688 | 5,349 | 45 |

| GAW | Games Workshop | 76 | 218 | 9,029 | 4,042 |

| GDWN | Goodwin | 266 | 6,646 | 8,432 | 27 |

| HWDN | Howden Joinery | 1,368 | 8,223 | 10,867 | 32 |

| JDG | Judges Scientific | 159 | 3,825 | 9,699 | 154 |

| JET2 | Jet2 | 456 | 250 | 6,135 | 2,354 |

| NXT | Next | 106 | 6,071 | 8,656 | 43 |

| PRV | Porvair | 906 | 4,999 | 5,219 | 4 |

| PZC | PZ Cussons | 1,870 | 3,878 | 4,778 | 23 |

| QTX | Quartix | 1,085 | 2,798 | 5,262 | 88 |

| RM. | RM | 1,275 | 3,038 | 2,754 | -9 |

| RSW | Renishaw | 92 | 1,739 | 5,083 | 192 |

| SOLI | Solid State | 986 | 2,847 | 8,874 | 212 |

| TET | Treatt | 763 | 1,082 | 9,118 | 742 |

| TFW | Thorpe (F W) | 2,000 | 2,207 | 8,200 | 272 |

| TRI | Trifast | 2,261 | 3,357 | 3,550 | 6 |

| TSTL | Tristel | 750 | 268 | 4,388 | 1,536 |

| VCT | Victrex | 534 | 10,812 | 12,773 | 18 |

| XPP | XP Power | 240 | 4,589 | 12,144 | 165 |

Table notes: added more shares in Howden Joinery.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £201,445 today £30,000 invested in FTSE All-Share index tracker. accumulation units would be worth £68,929 today.

Objective: to beat the index tracker handsomely over five-year periods.

Source: SharePad, 27 May 2021.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in Howdens and Solid State.

For more information about my scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.