Share Sleuth: taking profits boosts cash pile above £10,000

Richard Beddard considers where to invest next, but while he waits for the right opportunity his Decision Engine is urging him to take some profits from his top-performing shares.

4th April 2024 09:34

by Richard Beddard from interactive investor

Having reduced Share Sleuth’s holding in Bloomsbury Publishing last month, the portfolio had enough cash to buy more shares, when I considered my monthly trade at the end of March.

This resulted in more than the usual amount of head-scratching.

- Invest with ii: Open a Low Cost SIPP | What is a SIPP | Interactive investor Offers

Many of the Decision Engine’s top-ranked shares were unavailable to the portfolio because of my trading rules, which were guiding me to reduce holdings rather than enlarge them, or add new ones.

Additions: paucity of opportunity

Top-ranked share, Churchill China (LSE:CHH), was unavailable because it was almost fully represented in the portfolio. Its score was 9.3, which means its ideal holding size was 8.7% of the portfolio (for an explanation of how to calculate this, see the link here). Its actual holding size was 6.6% of the portfolio, which rules it out of further investment because of the portfolio’s minimum trade size, which is 2.5% of its total value. Investing in Churchill China at the minimum trade size would turn it into a 9.1% holding, bigger than the ideal holding size.

There are two other technical reasons not to invest in the manufacturer of tableware, even though I would like to. It is not long until it publishes its next annual report, the cue for me to re-score the business, and I have traded the shares in the last year. I added more Churchill China shares in November.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Shares for the future: analysing a new company for my top 40

These rules stop me concentrating the portfolio too much, overtrading, or buying shares when the score might be about to change.

One or more of these rules also knocked out Focusrite (LSE:TUNE) (score 9.0), RWS Holdings (LSE:RWS) (8.5), Dewhurst Group (LSE:DWHT) (8.5), Howden Joinery Group (LSE:HWDN) (8.5), Macfarlane Group (LSE:MACF) (8.4), Advanced Medical Solutions Group (LSE:AMS) (8.4), Porvair (LSE:PRV) (8.1), Games Workshop Group (LSE:GAW) (7.8), Anpario (LSE:ANP) (7.8), XP Power Ltd (LSE:XPP) (7.8), Latham (James) (LSE:LTHM) (7.8), Thorpe (F W) (LSE:TFW) (7.5), Bunzl (LSE:BNZL) (7.4), Renishaw (LSE:RSW) (7.3), Goodwin (LSE:GDWN) (7.0) and Celebrus Technologies (LSE:CLBS) (7.0).

Oxford Instruments (LSE:OXIG) (score 8.6) and PZ Cussons (LSE:PZC) (7.5) are special cases. Events since I scored them mean I will probably be more critical next time I evaluate them.

When I last scored Oxford Instruments, I rated its internally focused strategy highly. The strategy was fostered by chief executive Ian Berkshire, who retired in October. His replacement, Richard Tyson, was previously chief executive of TT Electronics, a company with an acquisitive history. This makes me wonder whether Oxford Instruments’ strategy will become more acquisitive too, and I want to see what the company says in its first annual report under Mr Tyson.

PZ Cussons has been undone by the collapse in the value of the Nigerian currency, a risk I totally under-appreciated.

Incidentally, soon to be re-scored XP Power is also in this category. It has got itself into financial difficulty, which reduces its ability to deliver its investment-led strategy.

Having knocked out 19 of the 23 shares that score 7 or more out of 10, the Decision Engine was leaving me with just four options, all of them only just in the “buy zone”.

0 | Company | Description | Score | ih% | ah% | Max trade |

16 | Manufactures PEEK, a tough, light and easy to manipulate polymer | 7.4 | 4.9% | 1.9% | £5,642 | |

17 | Sources, processes and develops flavours esp. for soft drinks | 7.4 | 4.7% | 1.7% | £5,768 | |

19 | Online retailer of domestic appliances and TVs | 7.3 | 4.7% | £8,953 | ||

21 | Sells hardware and software to businesses and the public sector | 7.1 | 4.3% | £8,170 |

Note: ih% is ideal holding size, ah% is actual holding size. Max trade is the investment required to take a holding to its ideal size.

One of the reasons for this paucity of opportunity is the annual reporting calendar. We are just entering peak annual reporting season as companies that ended their financial years in time with the calendar year have polished and audited their results.

The log-jam will reduce as I work my way through the reports. Because all this analysis will have a significant impact on the rankings, I am not inclined to invest in shares that only just qualify for investment now.

Better to make my decisions when the analysis is done, and perhaps more choice is available.

Reductions: plenty of opportunity

Although the portfolio’s performance has been pedestrian recently, the same cannot be said for the shares in it. Some have performed very well and others have performed tragically.

Probably some have pootled along too, but my impression is traders are rewarding winners and shunning losers like never before.

As usual, the Decision Engine wanted me to cull many of the top performers because of their high share prices. High share prices work in two ways to reduce the appeal of a share.

- Shares for the future: the best strategy for my pension savings

- Five ways fund investors can get Warren Buffett in their ISA

First they increase the value of the holdings. Second they reduce the shares’ scores, which in turn reduces their ideal holding sizes.

The Decision Engine encourages me to reduce holdings when the holding size exceeds the ideal holding size by more than the minimum trade size of 2.5% of the portfolio’s total value.

Reducing these holdings is psychologically trying because these shares have been very good to the portfolio.

It is particularly trying at the moment because there are four of them:

0 | Company | Description | Score | ih% | ah% | Max trade |

22 | Goodwin | Casts and machines steel. Processes minerals for casting jewellery, tyres | 7.0 | 4.00% | 7.80% | £(7,136) |

25 | Cohort | Manufactures military technology, does research and consultancy | 6.6 | 3.10% | 5.70% | £(4,950) |

32 | 4Imprint | Sells promotional materials like branded mugs and tee shirts direct | 6.0 | 2.10% | 6.30% | £(8,046) |

36 | Garmin | Manufactures sports watches and instrumentation | 5.4 | 0.80% | 4.10% | £(6,386) |

Note: ih% is ideal holding size, ah% is actual holding size. Max trade is the divestment required to take the holding down to its ideal holding size.

The lowest ranked of the four, Garmin Ltd (NYSE:GRMN), and next-to-bottom ranked 4imprint Group (LSE:FOUR) are soon to publish annual reports. There is scope for me to upgrade my Garmin score, so I have given it a stay of execution.

Unlike Garmin, 4Imprint already has the maximum score in every category except price so I cannot improve the score when I re-score it.

It was also the most over-represented share in Share Sleuth. Its ideal holding size was 2.1% but the actual holding is 6.3% of the portfolio.

I think 4Imprint is a great business, so I did not reduce the holding by any more than I had to (the minimum trade size).

Trimming 4Imprint

On Thursday 28 March, I reduced the portfolio’s holding in 4Imprint by 74 shares.

The actual price, quoted by a broker, was a fraction over £64.22, which raised £4,742 after deducting £10 in lieu of fees.

The holding is now 3.8% of the portfolio’s total value. It is still above the ideal holding size, but small enough to get the Decision Engine off my back.

Past performance is not a guide to future performance.

I added 4Imprint during the pandemic at a price of £19.26. The liquidation of considerably less than half the holding has returned about £1,000 more than the whole of the original investment.

Share Sleuth performance

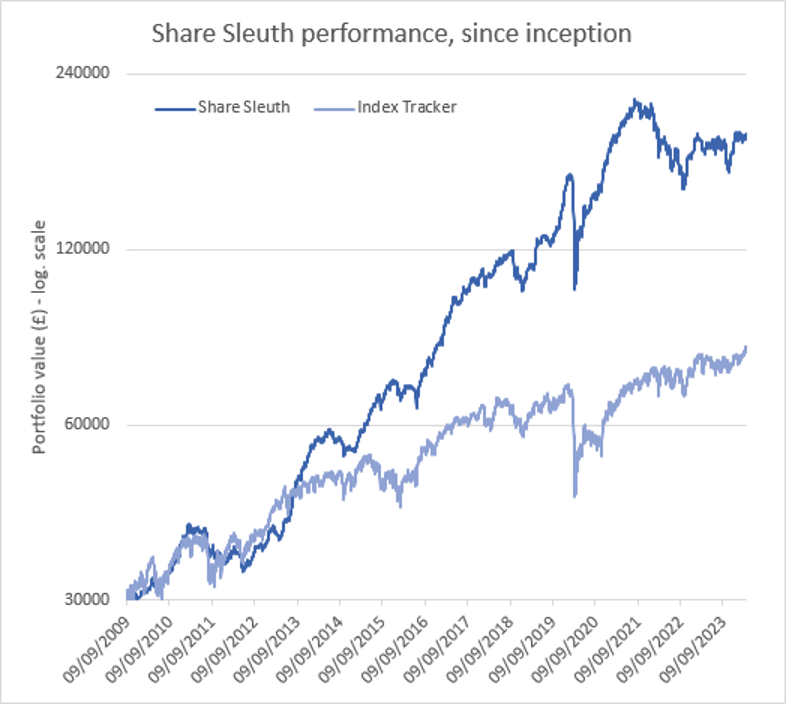

At the close on 28 March, Share Sleuth was worth £189,820, 533% more than the £30,000 of pretend money we started with in September 2009.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would be worth £81,787, an increase of 173%.

Past performance is not a guide to future performance.

After the reduction in 4Imprint and dividends paid during the month from Treatt (LSE:TET), Share Sleuth’s cash pile is £10,164.

The minimum trade size, 2.5% of the portfolio’s value, is £4,786.

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 10,164 | ||||

Shares | 179,656 | ||||

Since 9 September 2009 | 30,000 | 189,820 | 533 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 2,585 | -36 |

BMY | Bloomsbury | 845 | 3,203 | 4,462 | 39 |

AMS | Advanced Medical Solutions | 1,965 | 4,503 | 3,851 | -14 |

BNZL | Bunzl | 201 | 4,714 | 6,126 | 30 |

CHH | Churchill China | 1,058 | 12,223 | 12,326 | 1 |

CHRT | Cohort | 1,600 | 3,747 | 10,720 | 186 |

CLBS | Celebrus | 1,528 | 3,509 | 3,285 | -6 |

DWHT | Dewhurst | 532 | 1,754 | 5,027 | 187 |

FOUR | 4Imprint | 116 | 2,251 | 7,354 | 227 |

GAW | Games Workshop | 100 | 4,571 | 10,040 | 120 |

GDWN | Goodwin | 266 | 6,646 | 14,364 | 116 |

GRMN | Garmin | 53 | 4,413 | 6,210 | 41 |

HWDN | Howden Joinery | 2,020 | 12,718 | 18,317 | 44 |

JET2 | Jet2 | 456 | 250 | 6,576 | 2,530 |

LTHM | James Latham | 750 | 9,235 | 8,400 | -9 |

PRV | Porvair | 906 | 4,999 | 5,635 | 13 |

PZC | PZ Cussons | 1,870 | 3,878 | 1,677 | -57 |

QTX | Quartix | 3,285 | 7,296 | 5,502 | -25 |

RSW | Renishaw | 234 | 6,227 | 9,945 | 60 |

RWS | RWS | 2,790 | 9,199 | 5,234 | -43 |

SOLI | Solid State | 356 | 1,028 | 4,788 | 366 |

TET | Treatt | 763 | 1,082 | 3,250 | 200 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 7,540 | 242 |

TSTL | Tristel | 750 | 268 | 3,263 | 1,116 |

TUNE | Focusrite | 2,020 | 14,128 | 6,767 | -52 |

VCT | Victrex | 292 | 6,432 | 3,793 | -41 |

XPP | XP Power | 240 | 4,589 | 2,616 | -43 |

Notes

28 Mar 2024: Reduced 4Imprint

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

£30,000 invested on 9 September 2009 would be worth £189,820 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £81,787 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, close on Friday 28 March 2024.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all the shares in the Share Sleuth portfolio.

See our guide to the Decision Engine and the Share Sleuth Portfolio for more information.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.