Share Sleuth: the share I am holding off buying

A potential new holding is on Richard Beddard’s radar, but powder is being kept dry for now.

3rd December 2020 11:23

by Richard Beddard from interactive investor

A potential new holding is on Richard Beddard’s radar, but powder is being kept dry for now.

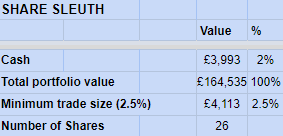

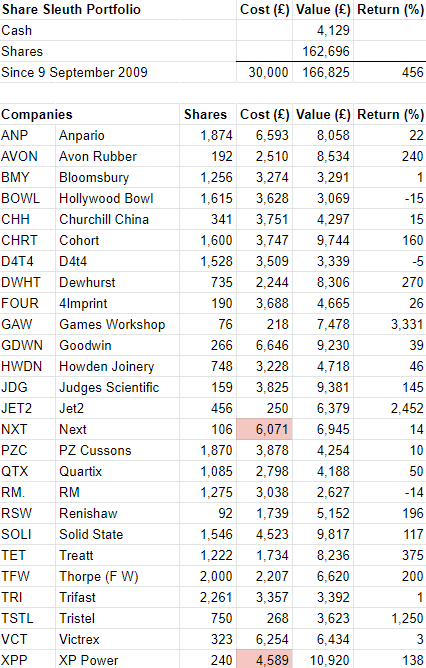

The table below was the position of the Share Sleuth portfolio on 25 November, the day I earmarked for trading in the month.

It was worth £164,535 and almost fully invested in shares. The £3,993 of cash was insufficient to add more shares to the portfolio if I were to stick rigidly to my rule to trade a minimum of 2.5% of the portfolio at a time.

The minimum is there to make sure trades are meaningful, and I also try not to invest more than 5% at a time to stop myself doing anything rash.

The cash balance was only £120 less than 2.5% of the portfolio (£4,113) though, maybe a minor breach of the minimum trade size could have been countenanced.

I abide by these restraints because my aim is to change the portfolio gradually. When I add a share, my intention is to hold it for at least 10 years, and by restricting my trading I am putting in place rules to help me achieve that.

To trade or not to trade...

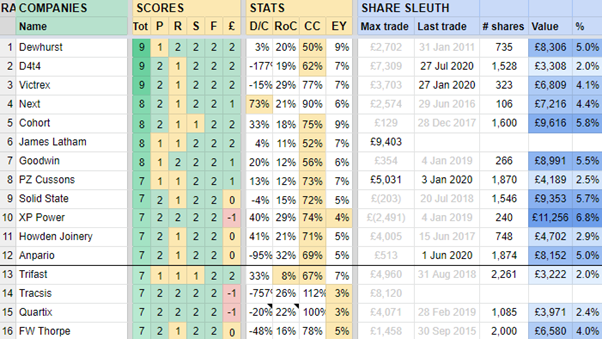

This was the top of the Decision Engine table. The highest ranked of the shares I score.

Scores: Tot: Total, P: Profitability, R: Risks, S: Strategy, F: Fairness: £: Price

Stats:D/C: Debt as a % of operating capital, RoC: Average return on capital, CC: Average cash conversion, EY: Earnings yield (norm.)

Sources:Richard Beddard, SharePad and annual reports

The first column in the blue section (Max trade) shows which shares were available to me to trade. This month, opportunities were thin.

Max trade tells me how much more I would have to increase (or reduce) a holding by to achieve its “ideal size”. The ideal size is a function of the score; the higher a share’s score, the bigger the ideal size of the holding.

If the maximum trade is less than the minimum trade size, I cannot make a meaningful trade, which is one of the reasons why so many of the potential trades are greyed out.

I also discourage myself from trading shares that I have traded in the last six months. Even though second-ranked D4t4’s maximum trade size is £7,309, well over the minimum trade size, the number is greyed out because I traded the share in July 2020.

Finally, I prefer to buy shares that score more than seven out of 10. The numbers in the table are rounded so this limit is indicated by the black horizontal line between Anpario (LSE:ANP) (7.2) and Trifast (LSE:TRI) (6.6).

None of these rules are sacrosanct, they are there to guide me. I have overridden them in the past, and I will do it again in the future but only after considerable thought.

Only two trades were highlighted by the Decision Engine. I could invest in a new share, James Latham (LSE:LTHM), or I could add more PZ Cussons (LSE:PZC) shares to the portfolio.

I am not going to do either this month. PZ Cussons owns popular brands, but the company is going through a slow-motion restructuring of businesses and the board, and before I commit more money I want to hear what the new chief executive has to say about strategy. I imagine in the first few months of his appointment, he has had his hands full with the Covid-19 pandemic.

I am also holding off on James Latham for two reasons. First, it is one of the least profitable and least cash-generative shares I follow closely, which is making me question my own judgement. The second is it imports timber and timber products and distributes them to joiners and builders merchants. Since the construction sector is already well represented in the Share Sleuth portfolio, I need to think carefully before increasing the dependency.

Construction dependency

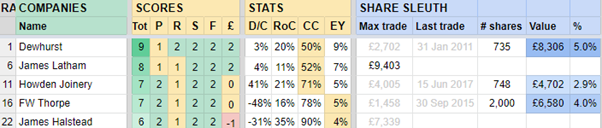

These are the companies I follow that supply construction projects:

Scores: Tot: Total, P: Profitability, R: Risks, S: Strategy, F: Fairness: £: Price

Stats: D/C: Debt as a % of operating capital, RoC: Average return on capital, CC: Average cash conversion, EY: Earnings yield (norm.)

Sources: Richard Beddard, SharePad and annual reports

The James’, James Latham and James Halstead (a manufacturer of vinyl flooring), are not currently members of the Share Sleuth portfolio but they share many of the qualities of the companies that are.

Dewhurst (LSE:DWHT), Howden Joinery (LSE:HWDN) and FW Thorpe (LSE:TFW) are long-standing members of the portfolio. Dewhurst makes and distributes lift components, Howden Joinery supplies fitted kitchens to small builders, and FW Thorpe makes commercial lighting systems.

Together, these three companies comprise almost 12% of the portfolio by value. Last month, I totted up the values of portfolio constituents exposed to the auto and allied sectors, and they too amounted to 12% of the portfolio. Then I reduced Share Sleuth’s exposure and I subsequently removed Castings (LSE:CGS) from the portfolio.

But I am more relaxed about the concentration in construction. The construction cycle is a monstrous thing. The first projects to get axed tend to be builds that have not started. Existing projects often continue, which means it can be many months or even years before the recession hits companies involved in fitting them out and by then it has often become less intense.

Additionally, these companies earn much of their revenue from maintenance and refurbishment projects, which is a steadier source of income than new builds.

I am also more confident in these businesses than I was in Castings, as is evident in their scores for profitability, risks, strategy and price, so I am in no rush to reduce the portfolio’s holdings.

Perhaps, if I can stop dithering about, I might even add to them.

Thank you, Fred

Many thanks to Fred, a reader who has been independently tracking the transactions in the portfolio.

He noticed that I had not updated the cost column of the performance table when I sold shares in XP Power (LSE:XPP) in June and bought more Next (LSE:NXT) shares in October.

This meant the return calculations for those individual shares were wrong, although the overall portfolio return was correct.

I have, of course, made the corrections in the table below (they are highlighted in pink).

As a wrangler of a very large spreadsheet, I am grateful to readers who email me when they see something that might be wrong.

Table notes:

No new holdings

Costs include £10 broker fee, and 0.5% stamp duty where appropriate

Cash earns no interest

Dividends and sale proceeds are credited to the cash balance

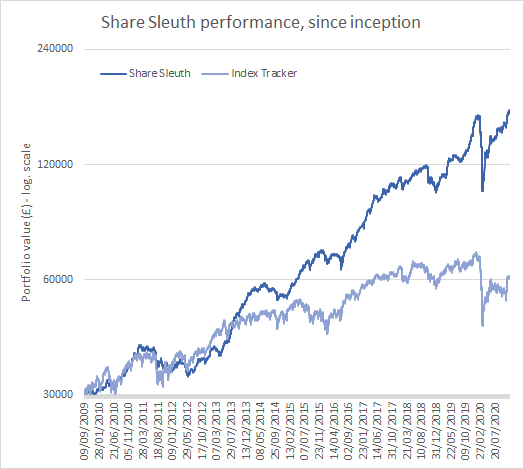

£30,000 invested on 9 September 2009 would be worth £166,825 today

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £61,338 today

Objective: To beat the index tracker handsomely over five-year periods

Source: SharePad, 30 Nov 2020

Richard owns shares all of the Shares in the Share Sleuth portfolio.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.