Share Sleuth review: a financially sound pseudo-conglomerate

Analyst Richard Beddard’s Share Sleuth portfolio replicates a conglomerate capable of funding its own growth from its outsized profits. He thinks the current portfolio, which has beaten an index tracker, is good value.

3rd January 2025 14:37

by Richard Beddard from interactive investor

Happy New Year!

It is a tradition at this time for investors to look back at how well they did in the past year and make intentions for the new one.

This is not a tradition I adhere to strictly. The anniversary of the Share Sleuth portfolio’s inception is in September, and with the help of a reader we publish performance statistics then.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

To recap briefly, Share Sleuth has met its long-term objective, to beat the accumulation units of an index tracker handsomely (after costs), but it has yet to regain the heights it achieved in the summer of 2021.

More fundamentally, I rarely comment on Share Sleuth’s performance because past performance does not tell us much about the future, and that is my focus.

Share Sleuth: a strange and wonderful conglomerate

The shares in the portfolio will deliver future returns, so this portfolio review will examine them through the lens of the Decision Engine.

The Decision Engine is a method of evaluating shares. It scores the qualities of the business and the price of the shares, which results in a single number representing the value of each share relative to all the shares I follow closely.

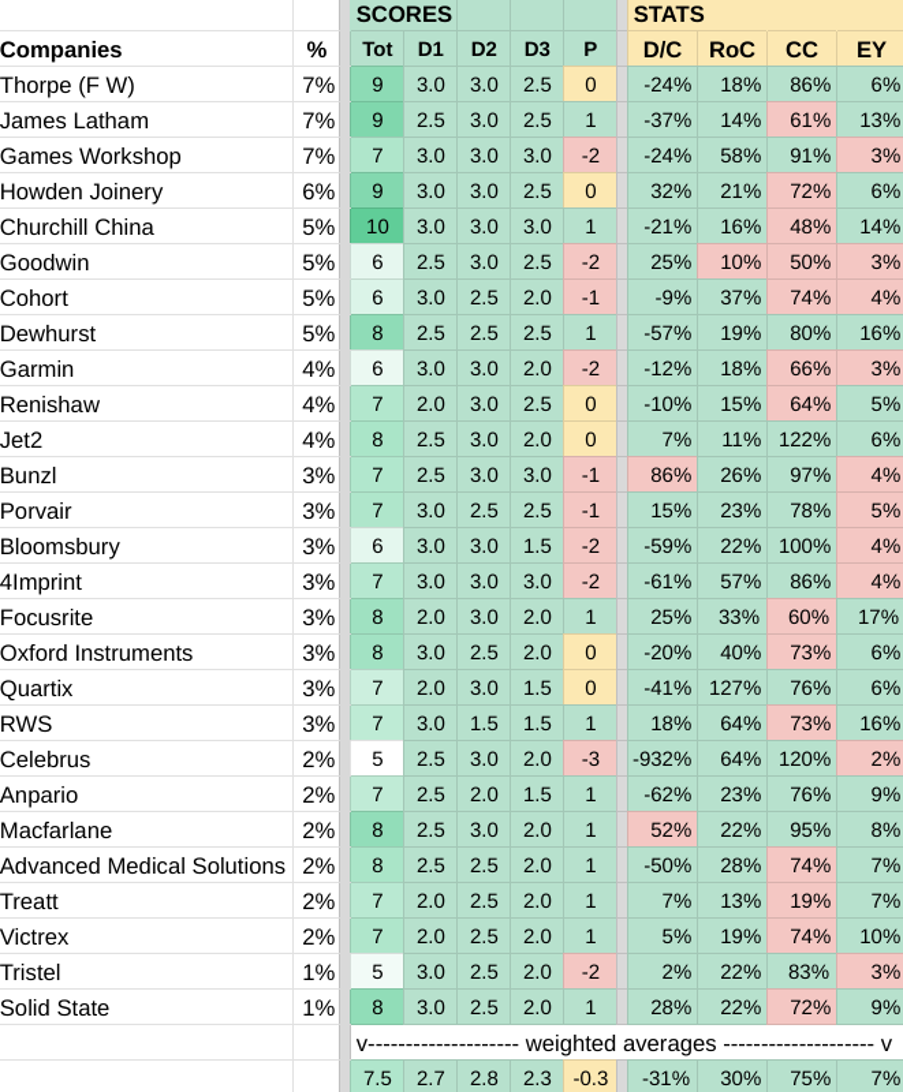

This is what I think Share Sleuth owns. The weighted averages underneath the table describe the portfolio as a whole, as if it were one company, a strange and rather wonderful conglomerate:

The table is ordered by holding size (%). Thorpe (F W) (LSE:TFW) at the top is the biggest holding. It is worth 7% of the portfolio’s total value. The share at the bottom, Solid State (LSE:SOLI), is the portfolio’s smallest holding. It is worth 1% of the portfolio.

Most of the shares are meaningful holdings of 2.5% or more. In the new year I will have to decide whether to liquidate or augment the handful of smaller holdings at the bottom.

SCORES

The next columns show the Decision Engine’s scores. The first column shows a shares’ overall score (Tot). Churchill China (LSE:CHH) is the highest-rated share with a maximum score of 10/10. Its score is coloured deep green. Celebrus Technologies (LSE:CLBS) is the portfolio’s lowest-rated share with a score of 5/10. Its score is coloured white. All of the other shares’ scores are coloured a shade of green. The higher the score, the deeper the shade.

Since the scores represent relative value, my aim is to invest more in high-scoring deep green shares and less in low-scoring shares. I use a simple formula to nudge me to do this (you can read about it in the next section).

As you would expect, Share Sleuth owns more Churchill China (5% of the portfolio’s total value) and less Celebrus (2%). The biggest holding, FW Thorpe, has a score of 9/10. However, the smallest holding Solid State scores 8. That is an anomaly I may well seek to put right in the new year.

Generally, I consider shares with an overall score of 7 or more to be good value and shares of 5 or more to be fair value.

Good news, then. The Share Sleuth conglomerate's weighted average score is 7.5. It is good value. And Celebrus, the lowest-scoring share is fair value. There are no over-valued constituents.

The remaining columns under the SCORES heading relate to the components of the total score. These are described in our guide to the Decision Engine, but briefly they tell us how Dependable (D1), Distinctive (D2), and Directed (D3), the business is, and to what extent the share price (P) is Discounted.

The weighted averages show I am confident in the quality of the businesses (each of the components is scored out of 3), but the slightly negative share price score indicates that, in aggregate, the Share Sleuth conglomerate would be a little pricey if you were to buy it today.

That is not the same as saying Share Sleuth is overvalued, quality comes at a price and as we have already determined Share Sleuth’s weighted average overall score of 7.5 means it is good value.

STATS

The four STATS columns list four financial ratios for each share, the four I spend most time thinking about.

They are: Net Debt to Capital (D/C), Average Return on Capital (RoC), Average Cash Conversion (CC), and the Earnings Yield (EY).

Net Debt to Capital (D/C) tells us how much a company relies on debt and other financial obligations to fund its operations. Happily, in aggregate, the Share Sleuth conglomerate is not dependent. Its debt to capital ratio of -31% means that it has been operating with more cash than debt on its aggregate balance sheet.

Average Return on Capital (RoC) is a measure of profitability. It tells us how efficiently money invested in a company’s operations has been turned into profit on average through good years and bad. Generally, I expect a business to earn a 10% return on capital to justify the investment it has made. The Share Sleuth conglomerate has earned an aggregate 30% return on capital.

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

- The UK stock market outlook for 2025

Average Cash conversion (CC) compares cash flow to profit. There are two main reasons the two might not match. Legitimately a company may be treating expenditure as investment, and it is recognising the cost in profit over time. Alternatively, it may be puffing up profit. In aggregate, I want to see cash conversion of at least 75%, a benchmark the conglomerate has just achieved.

The Earnings Yield (EY) is the basis of the price score. It compares the price of the business (its enterprise value) to the profit it would have earned if it had earned its average return on capital in its last financial year. The higher the Earnings Yield, the cheaper the shares. The weighted average Earnings Yield is 7%, which is not pricey - but the average is skewed by a few large holdings with very high earnings yields.

If your eyes have glazed over by now, apologies. The key point is I think the Share Sleuth conglomerate is good value. That bodes well.

It is also a financially sound pseudo-conglomerate capable of funding its own growth from its outsized profits. That bodes well too.

Converting scores to holdings

I have been running the Share Sleuth portfolio since 2009. Originally published in Money Observer magazine, it moved to interactive investor in 2020.

In its early years, I traded for ad-hoc reasons, but in 2015 I codified my decision-making process in the first version of the Decision Engine.

Codifying decisions, I hoped, would reduce the amount of time it took me to take them, freeing up time for research. That research, I expected, would be more objective, because it was more systematic. Basing trades on objective research, I figured, would lead to better decisions.

Since then, the Decision Engine has guided my trades.

I limit the portfolio to one trade a month, which we call an addition or reduction/liquidation instead of a buy or a sell because they are virtual trades. No actual money changes hands.

The Decision Engine uses a simple formula to calculate the ideal holding size (ihs) of a share.

ihs = score - (10 - score)

The lower the score, the smaller the holding:

Score | Ideal holding size (%) |

10 | 10 |

9 | 8 |

8 | 6 |

7 | 4 |

6 | 2 |

5 | 0 |

Generally, I will only trade a share if its value is sufficiently far from the ideal holding size, a value I call the minimum trade size. The minimum trade size is 2.5% of the portfolio’s total value.

In other words, if a share’s score is 8 and its ideal holding size is 6%, I can add to the holding if it accounts for less than 3.5% of the portfolio’s total value. By doing so I would not breach the ideal holding size.

If the holding were worth more than 8.5% of the portfolio’s total value, then I should reduce it towards its ideal size of 6%.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns many shares in the Decision Engine. He weights his portfolio so it owns bigger holdings in the higher-scoring shares.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.