Share Sleuth: here’s how the portfolio could change in 2022

11th January 2022 10:53

by Richard Beddard from interactive investor

Richard Beddard is considering cutting the portfolio’s number of holdings. Here, he reveals the 19 shares that would win a place if each had its ideal allocation.

Psst! Do you want a glimpse of the future? Would you like to see what the Share Sleuth portfolio might look like in January 2023?

I may be in a position to oblige, because I am thinking about reducing the number of holdings it contains.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

On diversification and decisiveness

In 2009, when I made the portfolio’s first investments, Share Sleuth was called the Thrifty 30, Thrifty because it was invested in good companies at reasonable prices, and 30 because the intention was to hold about 30 shares.

It changed names early on for a technical reason. I also ran a portfolio called the Nifty Thrifty, and we decided the names were too similar. Since 2009 though, the Thrifty 30/Share Sleuth portfolio has comprised nearly 30 constituents. Today it has 28.

- Share Sleuth: the company I cannot bring myself to sell

- Shares for the future: how I’ll find great cheap shares in 2022

- 27 dividend stocks for income seekers in 2022

- Best 39 growth stocks for 2022

It will take courage to reduce that number for two reasons. The first is perhaps the obvious one. The more shares we own, the lower the impact on our returns should one of them fail.

It works the other way too, of course. A holding that does extraordinarily well will have a huge positive impact, if it is one of only a few.

Reducing our potential gains by owning more shares will never be catastrophic, though, while the risk of failure from owning too few could be. Diversification is an insurance policy, and it is probably best to err a little on the safe side.

The second reason that reducing the number of holdings will take courage is it requires me to be more decisive, which does not come easily.

This is why the number and size of holdings in the Share Sleuth portfolio differs from what they would be if I to follow the recommendations of my Decision Engine more closely.

Calculating the ideal size of a holding

The Decision Engine is a ranked list of shares I have researched and scored in the last year. It guides me towards better decisions and gives me a bit more of a spine. Behind the scenes, it also calculates how much of each holding I should own based on its “ideal holding size”.

A share scoring a perfect 9 out of 9 has an ideal holding size of 10% of the total value of the portfolio, while a share scoring 5 out of 9, has an ideal holding size of 2% (where s is a share’s score, the ideal holding size as a percentage of the portfolio’s total value is s+1-(9-s)).

If I were to rebalance the Share Sleuth portfolio so every share had its ideal allocation, it would only contain 19 holdings. They are in the following table along with the actual Share Sleuth (SS) allocations:

The Ideal portfolio

Company | Score | Ideal | SS |

8 | 8% | 4% | |

8 | 8% | 4% | |

8 | 8% | 2% | |

8 | 7% | 4% | |

8 | 7% | 6% | |

7 | 7% | 6% | |

7 | 7% | 6% | |

7 | 7% | 3% | |

7 | 6% | ||

7 | 6% | 5% | |

7 | 5% | 4% | |

7 | 5% | 2% | |

7 | 5% | 6% | |

6 | 5% | 5% | |

6 | 5% | 2% | |

6 | 5% | 4% | |

99% | 61% |

Every share is under-represented in the Share Sleuth portfolio except for Solid State and FW Thorpe.

If I were to follow my research to its logical conclusion, I should increase the holdings that are well below their ideal sizes but I cannot, because the money is already accounted for by lower-ranked holdings, shares that score less:

The rest of Share Sleuth

Company | Score | Ideal | SS |

6 | 5% | 7% | |

6 | 4% | 3% | |

6 | 4% | 3% | |

6 | 4% | 3% | |

6 | 4% | 1% | |

6 | 4% | 2% | |

6 | 4% | ||

6 | 4% | 3% | |

6 | 4% | 2% | |

6 | 3% | ||

6 | 3% | ||

6 | 3% | 3% | |

6 | 3% | ||

5 | 3% | 2% | |

5 | 3% | ||

5 | 3% | 5% | |

5 | 3% | ||

5 | 2% | ||

5 | 2% | ||

5 | 2% | 2% | |

5 | 2% | ||

5 | 2% | ||

5 | 1% | 2% | |

n/a | 37% |

In this table, the ideal holding sizes are not relevant as we have already allocated 100% of the portfolio to the higher ranked shares. While I would invest in these businesses were there not higher scoring ones available, because there are, their ideal size is effectively 0%.

A total of 37% of the Share Sleuth portfolio is invested in these shares, which makes me think there is room for improvement.

There are good reasons for the divergence between the holding sizes of some of the shares in the Ideal portfolio and the Share Sleuth portfolio. PZ Cussons, James Latham and D4T4 are all significantly underrepresented but they are also relatively new holdings and I tend to build holdings up to their ideal sizes in stages.

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

- Shares for the future: my top 40 stocks after dumping this one

- Watch our new year share tips here and subscribe to the ii YouTube channel for free

I am less confident than I would like to be in my analysis of Portmeirion, which is not in the Share Sleuth portfolio, and news that two of Cohort’s subsidiaries are underperforming means I am beginning to question the company’s acquisitive strategy. Until I next review the scores of these shares, I am holding off on trading them.

But there are also holdings in the Ideal portfolio that I would happily add to now, Dewhurst, Goodwin and Quartix, for example, and I hope to find new companies to invest in too.

To add to the portfolio’s higher scoring holdings or make new investments, I will need funds, which barring dividends can only come from reducing or removing lower scoring holdings.

My goal for 2022, therefore, is to dispose of some of the 37% of the portfolio that is less than ideal in order to take the ideal part of the portfolio beyond 61%.

If that happens, by January 2023, Share Sleuth might look a bit more like the ideal portfolio in the table above, and a bit less like the portfolio of January 2022 below.

Share Sleuth performance

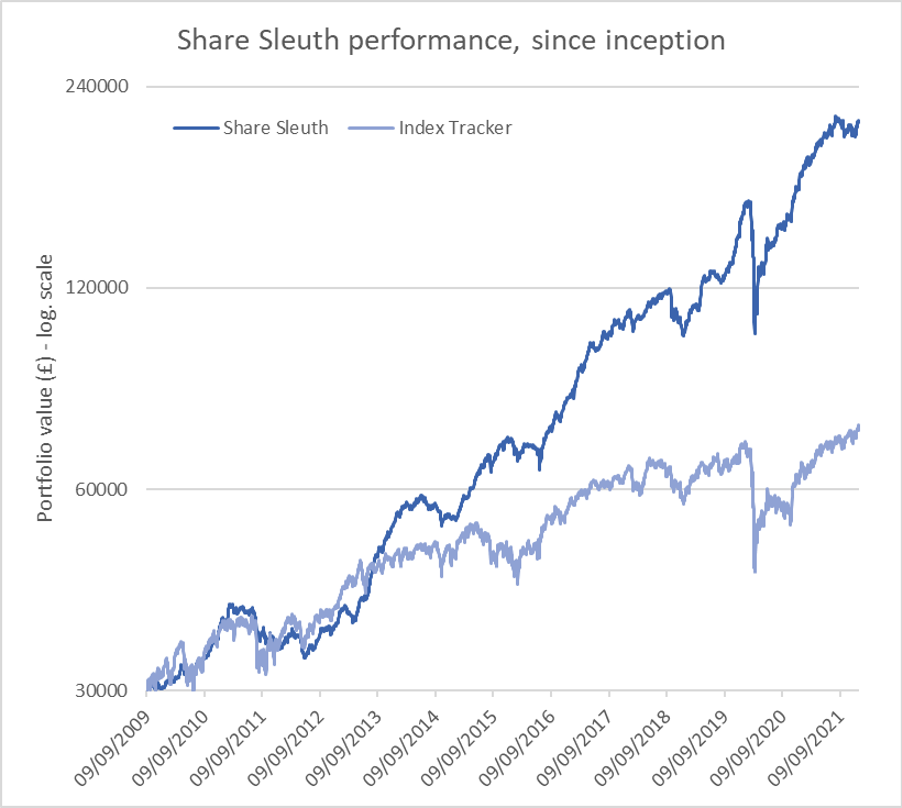

On Wednesday 5 January, the Share Sleuth portfolio was worth £212,395, which is 608% more than the notional £30,000 invested in the portfolio’s first year, from September 2009.

Past performance is not a guide to future performance.

The same amount invested in accumulation units of a FTSE All-Share index tracking fund would have appreciated to £75,118 over the same period.

The portfolio’s cash balance has swelled to £4,043 thanks to dividends from Bunzl, Games Workshop and Tristel.

The cash balance is not insufficient to fund new additions at my minimum trade size of 2.5% of the portfolio’s total value (about £5,300).

Share Sleuth | Cost (£) | Value (£) | Return (%) | ||

Cash | 4,043 | ||||

Shares | 208,352 | ||||

Since 9 September 2009 | 30,000 | 212,395 | 608 | ||

Companies | Shares | Cost (£) | Value (£) | Return (%) | |

ANP | Anpario | 1,124 | 4,057 | 6,901 | 70 |

BMY | Bloomsbury | 2,676 | 8,509 | 9,660 | 14 |

BNZL | Bunzl | 201 | 4,714 | 5,771 | 22 |

BOWL | Hollywood Bowl | 1,615 | 3,628 | 3,819 | 5 |

CHH | Churchill China | 341 | 3,751 | 6,044 | 61 |

CHRT | Cohort | 1,600 | 3,747 | 8,480 | 126 |

D4T4 | D4t4 | 1,528 | 3,509 | 5,348 | 52 |

DWHT | Dewhurst | 532 | 1,754 | 8,645 | 393 |

FOUR | 4Imprint | 190 | 3,688 | 5,415 | 47 |

GAW | Games Workshop | 76 | 218 | 7,661 | 3,414 |

GDWN | Goodwin | 266 | 6,646 | 8,632 | 30 |

HWDN | Howden Joinery | 1,368 | 8,223 | 12,889 | 57 |

JDG | Judges Scientific | 159 | 3,825 | 13,102 | 243 |

JET2 | Jet2 | 456 | 250 | 5,404 | 2,062 |

LTHM | James Latham | 400 | 5,238 | 5,160 | -1 |

NXT | Next | 106 | 6,071 | 8,520 | 40 |

PRV | Porvair | 906 | 4,999 | 6,650 | 33 |

PZC | PZ Cussons | 1,870 | 3,878 | 3,759 | -3 |

QTX | Quartix | 1,085 | 2,798 | 4,177 | 49 |

RM. | RM | 1,275 | 3,038 | 2,627 | -14 |

RSW | Renishaw | 92 | 1,739 | 4,482 | 158 |

SOLI | Solid State | 986 | 2,847 | 13,410 | 371 |

TET | Treatt | 763 | 1,082 | 9,614 | 788 |

TFW | Thorpe (F W) | 2,000 | 2,207 | 9,800 | 344 |

TRI | Trifast | 2,261 | 3,357 | 3,618 | 8 |

TSTL | Tristel | 750 | 268 | 3,375 | 1,158 |

VCT | Victrex | 534 | 10,812 | 13,222 | 22 |

XPP | XP Power | 240 | 4,589 | 12,168 | 165 |

Table notes:

No additions or disposals in the last month.

Costs include £10 broker fee, and 0.5% stamp duty where appropriate.

Cash earns no interest.

Dividends and sale proceeds are credited to the cash balance.

£30,000 invested on 9 September 2009 would be worth £212,395 today.

£30,000 invested in FTSE All-Share index tracker accumulation units would be worth £75,118 today.

Objective: To beat the index tracker handsomely over five-year periods.

Source: SharePad, 5 January 2022.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

Richard owns shares in all of the shares in the Share Sleuth portfolio

For more information about Richard’s scoring and ranking system (the Decision Engine) and the Share Sleuth portfolio powered by this research, please read the FAQ.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.